NOTICE: This post references card features that have changed, expired, or are not currently available

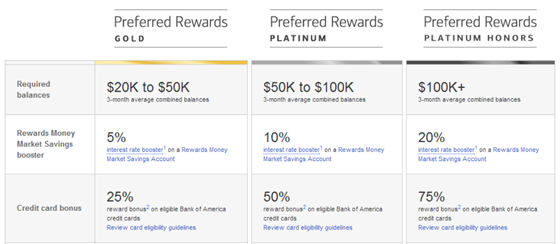

Bank of America’s new Premium Rewards Card (details here) is expected to be released any day now. The card is most interesting to those who have enough money managed by Bank of America / Merrill Lynch / Merrill Edge to qualify for Preferred Rewards Platinum Honors. Those with $100K or more in investments and deposits earn 75% more points with select Bank of America credit cards (including this new one). That means that those $100K+ customers with the new card will earn 3.5% cash back for travel & dining and 2.6% back everywhere else. That’s a remarkably good “everywhere else” category.

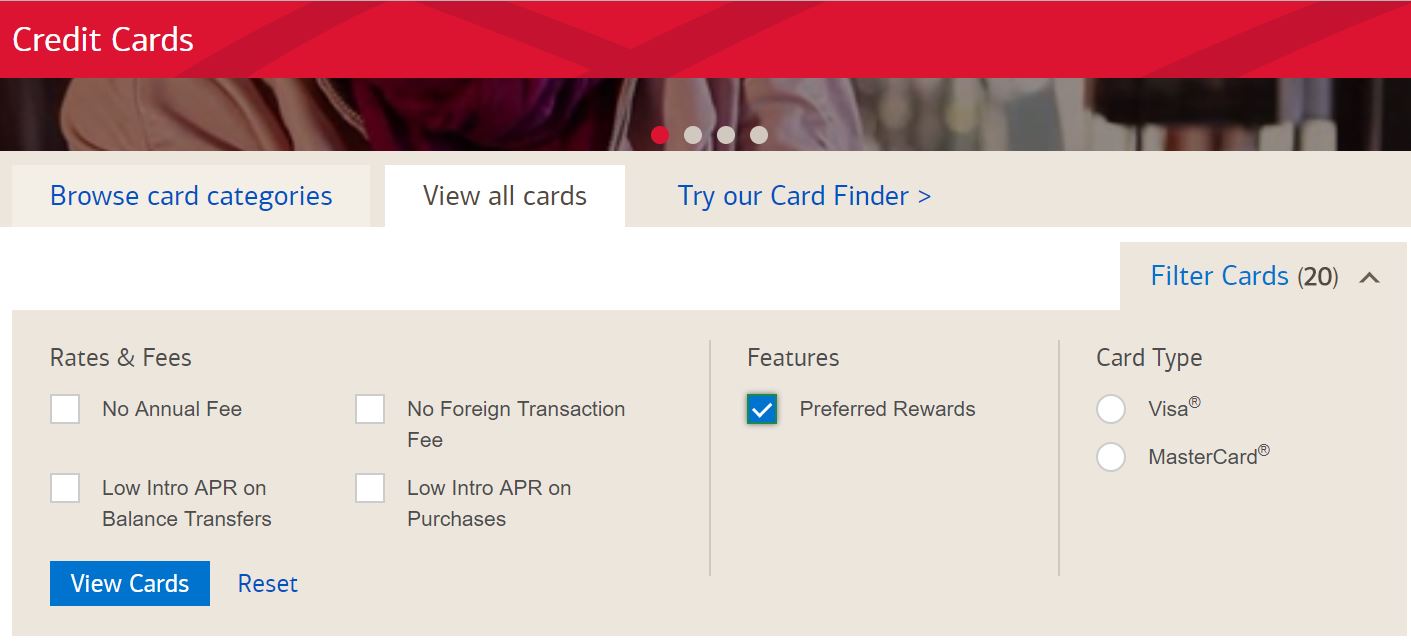

This got me wondering about other cards that are eligible for Preferred Rewards. Bank of America doesn’t make it particularly easy to find them. If you lookup Preferred Rewards, you can find a list of cards that are not eligible, but finding eligible cards is less intuitive. A solution is to go to Bank of America’s Credit Cards page, select the View All Cards tab, then filter to Preferred Rewards.

Cards that are eligible for Preferred Rewards

Bank of America® Premium Rewards

- $95 annual fee

- Earn 2% for travel and dining, 1.5% everywhere else

- With Preferred Rewards Platinum Honors: Earn 3.5% travel & dining, 2.625% everywhere else

Click here for more info about the Bank of America Premium Rewards card.

Bank of America® Travel Rewards

- Earn unlimited 1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

- With Preferred Rewards Platinum Honors: 2.625 points (worth 2.625% towards travel) for every $1 you spend on all purchases everywhere

Click here for more info about the Bank of America Travel Rewards card.

Bank of America® Travel Rewards for Students

The earning structure for this card appears to be identical to the regular Bank of America® Travel Rewards card, above.

Bank of America® Cash Rewards

- 1% cash back on every purchase, 2% at grocery stores and wholesale clubs and 3% on gas for the first $2,500 in combined grocery/wholesale club/gas purchases each quarter

- With Preferred Rewards Platinum Honors: 1.75% cash back on every purchase, 3.5% at grocery stores and wholesale clubs and 5.25% on gas for the first $2,500 in combined grocery/wholesale club/gas purchases each quarter

Click here for more info about the Bank of America Cash Rewards card.

A number of Bank America cards offer the same earning structure as this card (including the Preferred Rewards bonuses). They are:

- Bank of America® Cash Rewards for Students

- Pink Ribbon BankAmericard Cash Rewards™ Credit Card

- MLB®

- World Wildlife Fund

- U.S. Pride®

Norwegian Cruise Line®

- Earn 3 WorldPoints® points for every $1 spent on Norwegian purchases. Earn 1 WorldPoints® point for every $1 spent on all other purchases.

- With Preferred Rewards Platinum Honors: Earn 5.25 WorldPoints® points for every $1 spent on Norwegian purchases. Earn 1.75 WorldPoints® point for every $1 spent on all other purchases.

This one seems extremely odd since other cruise line credit cards are not eligible (see “Cards not eligible for Preferred Rewards”, below), but the Learn More page for this credit card specifically states:

Get even more rewards

Bank of America Preferred Rewards clients get an additional 25% – 75% points bonus on every purchase, applied to the base earn of 1 point per $1.

AAA Member Rewards Visa Credit Card

This card is not on Bank of America’s list of cards that are included in the program, but Doctor of Credit says that it does offer a Preferred Rewards bonus. Doctor of Credit notes the following earning rates:

- 3x (3% cash back) on travel and on AAA purchases; 2x (2% cash back) on gas, grocery, and drugstores; and 1x (1% cash back) on everything else.

- With Preferred Rewards Platinum Honors: Earn 3.75% on travel and AAA purchases; 2.75% on gas, grocery, and drugstores; and 1.75% everywhere else.

Note that this card appears to be available only in certain locations, but you can try browsing to this link to see if the card is available to you. If you see a AAA Dollars Mastercard, that’s not the same card, it is not issued by BOA, and it does not participate in Preferred Rewards.

Cards explicitly not eligible for Preferred Rewards

Non-rewards credit cards, Business purpose credit cards, Bank of America Accolades®, BankAmericard Better Balance Rewards®, Merrill Lynch branded (including Merrill Accolades®, MERRILL+®, Merrill Lynch® Octave® and Private Banking and Investment Group Octave®), U.S. Trust branded (including Bank of America Accolades® and U.S. Trust® Octave®), AAA® Gas Rebate, Alaska Airlines®, Allegiant World MasterCard®, Amtrak Guest Rewards®, Amway™, Asiana Airlines®, Azamara Club Cruises®, Bass Pro Shops®, Celebrity Cruises®, MelaleucaSM, Royal Caribbean International®, Spirit Airlines®, Virgin Atlantic Airways®

Old Post I know, hopefully someone sees this and is able to chime in, any input is appreciated — I opened a BofA checking/savings combo today for a $500 mailer bonus, the savings end required 20k, had to close some other accounts anyway so I just moved 30k or so there to hold for the time being. I am considering moving my brokerage account to ‘somewhere’ soon. My question is: I can maintain that 30K in BofA for a few months, so i’ll soon enough hit 3-month average of 20k+ Rewards Gold. In the future, if I move my Brokerage to Merrill, would I need to re-qualify for another 3 months average at 100k+ for Rewards Honors? Thank you!

As I re-read that; kinda felt like a stupid question when all the material clearly states ‘average 3 month of 100k+’ thus would likely have to re-qualify starting around the time the combined accounts reached 100k+. I’ll have to look into the Merrill bonuses soon I suppose. 🙂

Posted on reddit and DOC but wanted to see if you or Nick or any idea:

Regarding BOA Preferred Rewards 3-month period: Does anyone know if it starts on the first day of account opening and goes by statement cycle or is it based on calendar month starting with your first full month. i.e. If I opened the account on 1/25, when will I first be eligible for Preferred Rewards? 4/25? 5/1? A few weeks later?

No, I don’t know

Thanks for this, Greg. I was just looking at opening a Merrill Edge brokerage acct for the sign-up bonus – https://www.merrilledge.com/cmaoffer

I have some stocks that I’ve used the last few years to get the Fidelity mileage bonuses. It is time to move them out just in case Fidelity brings the mileage program back. (They have to be in for 9 months, out for 3 months before you can get another bonus.)

This could sweeten the deal.

Good idea! Watch for an even better Merrill deal, though. Last year I got in on a $1K offer that was available (I think) in Nov and December. Maybe that will come back?