NOTICE: This post references card features that have changed, expired, or are not currently available

Bank of America has announced a rewards program for business customers that is similar to their consumer Preferred Rewards program (the program that makes it possible to earn up to 2.625% in rewards for all spend). I wrote about this program earlier today based on some inside info I had learned and a bunch of my guesses, but we now have actual facts from a website: promo.bankofamerica.com/RelationshipRewards (thanks Mike!).

Basic details

- Program Name: Business Advantage Relationship Rewards (BARR)

- Expected Launch Date: Early 2018 (My source says March 2018)

- Types of Rewards: Tiered business credit card bonuses, and more

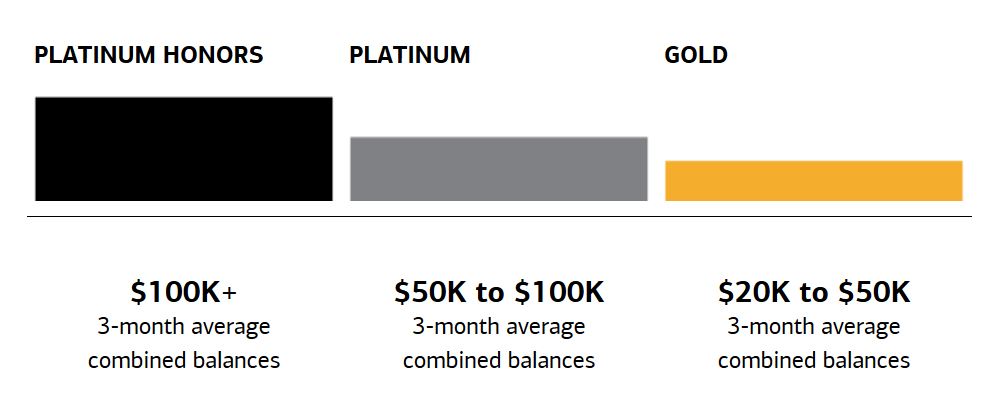

- Tier Names: Gold, Platinum, and Platinum Honors (same names as with the consumer program)

- Program qualification requirements: You must have an eligible Bank of America business checking account and 3-month average combined business balances of $20,000 or more in qualifying BOA business deposit account and Merrill Edge business investment accounts.

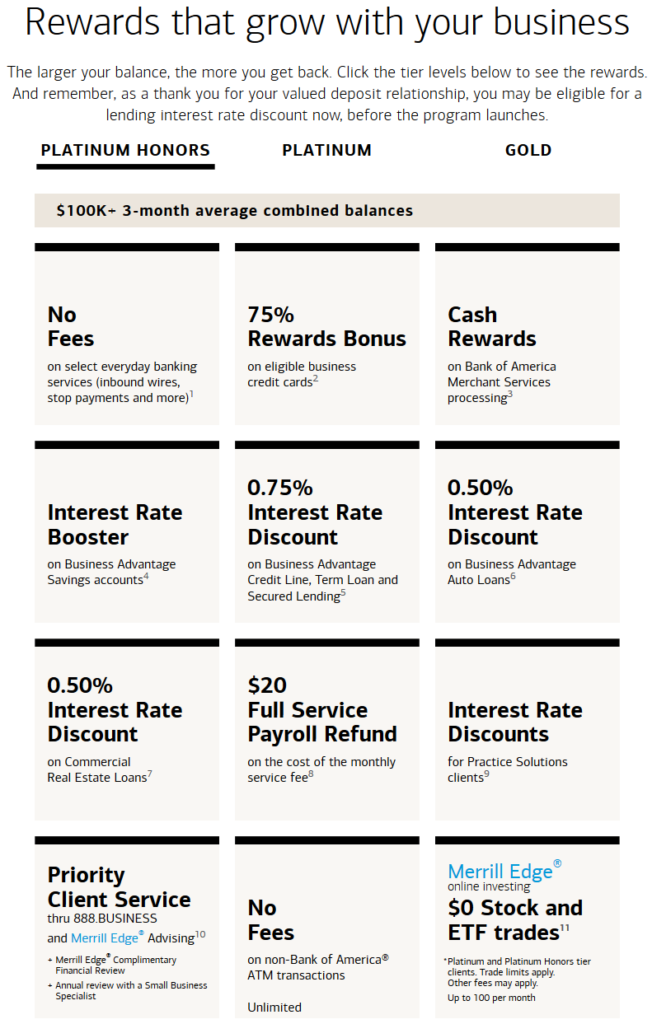

Rewards

Like BOA’s consumer program, the business program offers up to a 75% rewards bonus on eligible credit cards:

Eligible Credit Cards

The following cards are eligible for the rewards bonus:

- Business Advantage Cash Rewards

- Business Advantage Travel Rewards

- WorldPoints Rewards for Business credit cards (I can’t find these on the BOA website, so maybe they’re no longer available)?

Cards not eligible for the rewards bonus:

- Non-rewards credit cards (Bank of America Platinum and Platinum Plus for Business cards)

- Personal or consumer purpose credit cards

- Business Advantage Cash Rewards 123 w/50% Bonus

- Business Advantage Travel Rewards w/50% Bonus

- Merrill Lynch branded Merrill Rewards for Business Card

- Alaska Airlines®

- Asiana Airlines®

- Spirit Airlines®

- Business Banking, Global Commercial Banking, Global Corporate Investment Banking or Institutional clients are not eligible to participate in the program.

How useful is this?

Given the 75% bonus on the two business credit cards identified above (the one’s I can find info on!), they would then earn the following rewards:

Business Advantage Cash Rewards Mastercard

Usual rewards: Earn 1% cash back on every purchase, 2% on purchases at restaurants, and 3% on purchases at gas stations and office supply stores (up to $250,000 each calendar year, 1% after that)

With a 75% bonus: Earn 1.75% cash back on every purchase, 3.5% on purchases at restaurants, and 5.25% on purchases at gas stations and office supply stores (up to $250,000 each calendar year, 1.75% after that).

All of the above are strong earnings for a no-fee business credit card. 5.25% for gas stations, though, is terrific. No other business card comes close to that.

UPDATE: The fine print now shows that the 75% bonus is only on the base 1%, so at most it will earn 1.75% on every purchase, 2.75% on purchases at restaurants, and 3.75% on purchases at gas stations and office supply stores (up to $250,000 each calendar year, 1% after that)

Business Advantage Travel Rewards World Mastercard

Usual rewards:

- Earn unlimited 1.5 points for every $1 you spend on all purchases

- Earn 3 points per every dollar spent on travel purchases (car, hotel, airline) booked through the Bank of America® Travel Center – powered by Orbitz®

With a 75% bonus:

- Earn unlimited 2.625 points for every $1 you spend on all purchases

- Earn 5.25 points per every dollar spent on travel purchases (car, hotel, airline) booked through the Bank of America® Travel Center – powered by Orbitz®

The rewards for this card are identical to the consumer Travel Rewards card. Both offer great value for everyday spend for those with Platinum Honors status.

How good were my guesses?

I’d say I did fairly well! Earlier today, I made the following guesses:

- Given that the top tier of the new program has the same name as the top tier of the consumer program, it seems a safe bet that the business program will also have Gold and Platinum tiers. Correct!

- Each tier will probably offer the same credit card bonuses as corresponding tiers in the consumer program, but the bonuses will apply only to select business credit cards:

- Gold: 25% bonus Correct!

- Platinum: 50% bonus Correct!

- Platinum Honors: 75% bonus Correct!

- The following business credit cards should qualify for increased rewards with the new BARR program:

- Business Advantage Cash Rewards Mastercard Correct!

- Business Advantage Travel Rewards World Mastercard Correct!

- The only cards I missed were the elusive WorldPoints Rewards for Business credit cards.

- Bank of America will introduce a new business credit card similar to their consumer Premium Rewards card. Most likely it will be called Business Advantage Premium Rewards and it too will qualify for increased rewards with the business rewards program. Correct? We don’t know yet!

[…] BOA Business Advantage Relationship Rewards […]

Thanks Cary and Chris. I’ve updated the post to indicate the max 3.75% rate for gas purchases. Bummer!

@Greg- Could applying for the Business Travel Rewards card as a Sole Propreitor with SS number allow existing Personal bank accounts to get to Platinum Honors? Or do you think one must open up “NEW” Business checking accounts and wait for the $100,000 average? Thanks!

Sam, no I don’t think there’s any way to get your personal bank accounts to count towards the business advantage program.

The fine print shows the business version of the cash rewards card can only earn up to 3.75% on gas, not 5.25% as you have stated. The relationship bonus is only applied to the 1% base earnings: “your gasoline purchase will earn the base earn of 1%, + the Relationship Rewards bonus of .25%, + the Category Bonus for Gas purchases of 2% = a total of 3.25% per $1 in net purchases”

Your calculations for the Travel Rewards card are correct.

Fine Print after the guesswork

2 Business Credit Cards:

Only certain credit cards are eligible to receive the program bonus. Enrolled clients with eligible cards will receive the program bonus based on program tier and type of card. All eligible card types receive the program bonus with each net purchase on the base earn only. That means a purchase that earns 100 base points will actually earn 125, 150, or 175 points, based on your tier when the purchase posts to your account less any credits, returns and adjustments. For example, a Gold tier client with a Business Advantage Travel Rewards credit card earns: 1.50 Base Points + a Relationship Rewards Bonus of .37 Points = a total of 1.87 points per $1 in net purchases. For Business Advantage Cash Rewards, the Relationship Rewards Bonus will be added as Bonus Cash Rewards to the Base Cash Rewards you earn with each $1 spent in net purchases. That means a client enrolled in Business Advantage Relationship Rewards in the Gold tier will actually get 3.25% on gas and office supplies, 2.25% on restaurants, and 1.25% on all other purchases. Calculation example: your gasoline purchase will earn the base earn of 1%, + the Relationship Rewards bonus of .25%, + the Category Bonus for Gas purchases of 2% = a total of 3.25% per $1 in net purchases (up to $250,000 in gas station and office supply store purchases annually, 1.25% base earn after that). Calculation examples above will vary based on your enrollment tier, Platinum and Platinum Honors calculations will be higher. Other terms and conditions apply. If you have an eligible card, please refer to your card’s Program Rules for details about how you will receive the Relationship Rewards bonus on your business card. Program Rules are mailed upon account opening and are accessible through the rewards redemption site via Online Banking or by calling the number on the back of your card. Most Bank of America® branded business credit cards (such as the Business Advantage Cash Rewards, Business Advantage Travel Rewards and WorldPoints Rewards for Business credit cards) are eligible to receive the program bonus as long as the card account is open and in good standing. View a complete list of ineligible cards.

[…] Bank of America has announced a relationship rewards program for business customers coming in 2018, similar to their existing relationship bonus for personal checking and credit card customers. The existing personal program is called Preferred Rewards and the upcoming business program will be called Business Advantage Relationships Rewards. Business Rewards will launch in March 2018 according to a source at Frequentmiler. […]

Pretty cool but just about every business I know it’s moving to electric vehicles….I guess if you are a trucking it taxi company it is nice

Less than 10% of vehicles are electric. Kind of a strange comment.

Need to update if BOA reports business cards to bureaus.

BOA does not report business cards to bureaus. That’s a key reason that some may prefer the business travel rewards card over the personal one.