NOTICE: This post references card features that have changed, expired, or are not currently available

This week at Frequent Miler, we looked at how you can pay the tax man while getting the best return for your spend, how to get top-tier status without many stays, and unexpected discoveries form Chase — both in terms of how many points you can earn for referrals and in the weird and scary glitch that might have compromised your account. Read on for our weekly recap.

Pay taxes via credit card, 2018 edition

We all know the saying: In this world there are 3 certainties — life, death, and taxes. Or there’s the defiant ode to our freedom: I don’t have to do anything but die and pay taxes! This time of year means we need to face the music, but we don’t have to do it without bringing in a nice haul of miles. Here’s this year’s tips and tricks.

Hyatt extends wife’s elite status by 3 months but I’m not thrilled & Match M life to Hyatt Explorist NOW, skip extension and get club upgrades!

Hyatt “generously” offered to extend elite status by 3 months for some people. Why is that a bummer? Read on to find out — then check out the second article to find out how to extend your Explorist status until 2019 AND grab yourself four shiny new club upgrades in the process.

An unexpected path to the Companion Pass…

Some of the world’s finest discoveries have happened by accident. Newton’s Law of Gravity. Ivory’s floating soap. The fact that you can almost earn a Companion Pass based on the referrals for a single Southwest credit card if you timed them right. Ok, so one of those things is not like the others…but if you want to know more, see the post.

Top 4 Ways to Manufacture Marriott Platinum status

I came into 2018 pretty convinced that I was going to manufacture Marriott Platinum status. Part of my rationale for doing so was for a stay this summer at Convento do Espinheiro, part of an SPG nights & Flights package I booked last January. As you may have heard, that property recently left SPG. While my reservation is still being honored, SPG benefits will not be. With the Hilton Aspire card offering Diamond status in that chain, I’m less fixated on Marriott/SPG status. But for those who frequently stay with Marriott/SPG and/or use United silver status, this post includes 4 ways to get to the top tier without spending 75 nights in Marriott beds.

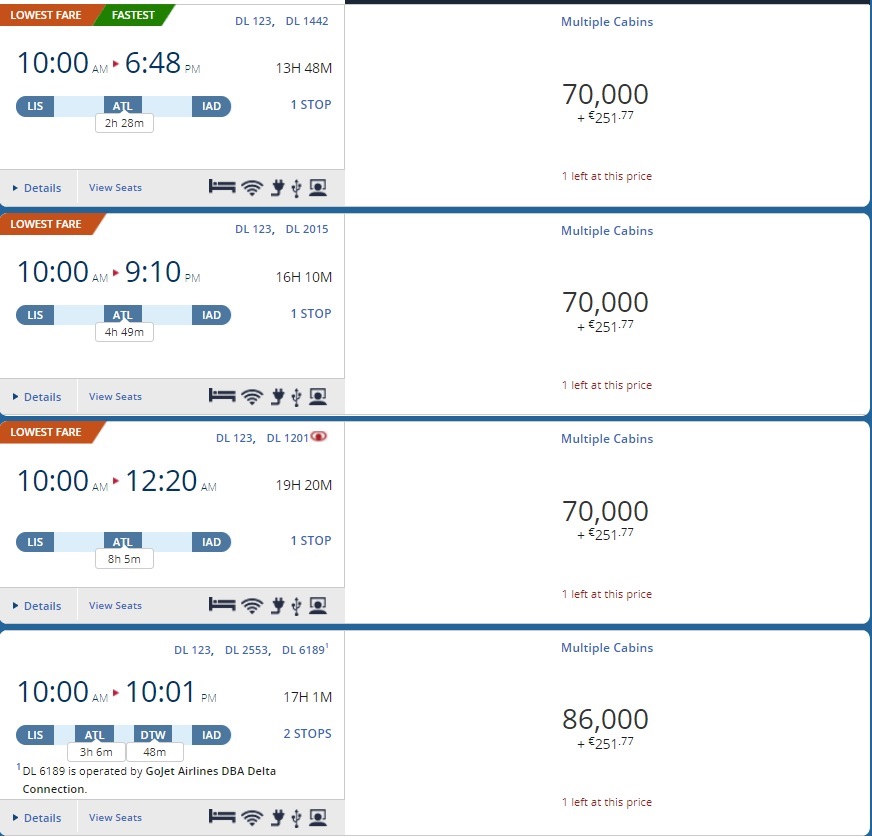

Searching for awards, 1 seat at a time

The economics of traveling with more than one person in your party can be difficult on their own; this is only exacerbated by the fact that airline and hotel computer systems don’t work like your grocery store cash register, where each item is priced independently and items are added cumulatively. For travel reservations, you may have to get in the habit of booking separately….though as noted in the comments, that isn’t without its own set of potential troubles.

Potential Chase security breach: Don’t log in? & Update: Chase says breach is fixed

In scary news this week, Chase had a major security scare that they say only affected a small number of customers. I’m not sure which of the following is hardest to believe: A) That people were logging in only to see a complete stranger’s account information (i.e. that this happened at all); B) That it only affected a small number of customers or C) That they are “not aware” of any fraudulent activity as a result.

Has Chase stopped allowing product changes via secure message?

Funny enough, I tried to product change via secure message a few times last year with no dice. Now, it seems there is a definitive policy that has taken root on product changes. Hint: If you don’t like phone calls, you’d better learn to love the cards you’ve got.

Showdown: Sapphire Reserve vs Preferred First Year Value

Which card would win in a fight for better first-year value — the Sapphire Reserve or Sapphire Preferred? Hint: It’s a closer battle than you might expect. It will come down to which benefits you use and how much you use them, but this thoughtful analysis will give you a look that should help you make the decision if you’re weighing these two cards.

That’s it for this week at Frequent Miler! Check back soon for our week in review around the web and this week’s last chance deals.