NOTICE: This post references card features that have changed, expired, or are not currently available

Among many other bits of Marriott news lately (NOW LIVE: New Marriott SPG Award Category Assignments) was the publication of the new Cash + Points award chart that will be in effect when the Marriott, SPG, and Ritz programs merge in August. At first look, I wasn’t impressed. After running the numbers, I’m still not impressed, but I do see a few nuggets of value…

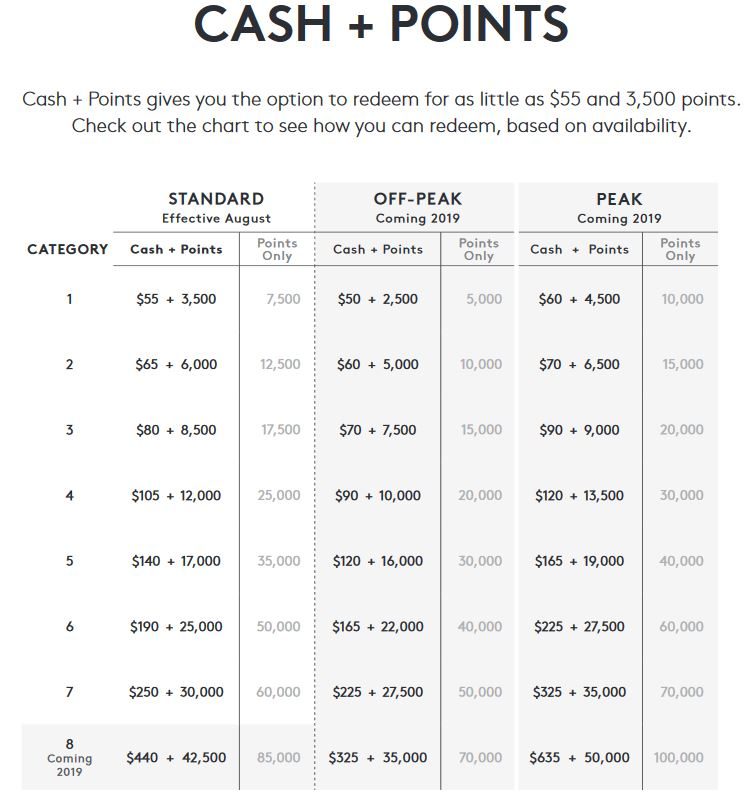

Several hotel programs offer the option to pay for awards partially with cash and partially with points. The chart, above, shows the regular award prices (Points Only) and the Cash + Points prices.

The idea behind Cash + Points rates is that you might not have enough points to book your desired stay, so you can instead pay partially with cash. You can think of it as buying the points needed for the award. Take, for example, a category 4 hotel that would normally cost 25,000 points. If you didn’t have the full 25,000 points and Cash + Points rates were available, you could use 12,000 points plus $105 in cash to book the room. This is like buying the extra 13,000 points for $105.

Is that a good deal? Let’s crunch the numbers:

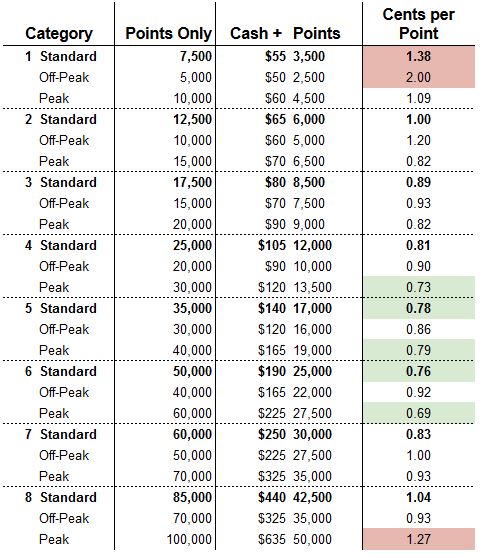

As I said above, booking a Cash + Points award is similar to buying the difference in points between the points portion of the Cash + Points award and the full points price of the award. The table above shows the point “purchase price” for each award.

I highlighted the chart in green where I think the “purchase price” is a good deal, and in red where I think it’s a bad deal. Green means that the purchase price is similar or less than the Reasonable Redemption Value for Marriott points, which is currently 0.72 cents per point. In other words, the cells in green show where it’s possible to buy points for what they are worth, on average. Keep in mind that the RRV for Marriott points is likely to change with the new program, but since I found that the average award price is about the same in the new program as the current program, it probably won’t change much.

The red “bad deals” indicate places where it’s possible to buy points directly from Marriott for less. Currently it is possible to indirectly buy Marriott points through SPG for about .75 cents each (35% off Starpoints is back), but the usual price Marriott charges is 1.25 cents per point. There’s little reason to pay a higher Cash + Points rate when you could buy the points for less and then book a points-only award. Of course we don’t know if Marriott will continue to sell points for 1.25 cents each in the new program, but I think it’s a safe bet.

The rest of the cells, the one’s not shaded red or green, could make sense under certain circumstances. When there’s no sale on points, and when you don’t have enough points for your award, it can absolutely make sense to book these. See the next section for details.

Comparing to all-cash

Another way of looking at Cash + Points awards is as a way of saving money over all-cash rates. When all-cash rates are very high, a points-only booking usually makes the most sense, but Cash + Points can make sense too if you don’t have the points to spare.

Let’s take a simple example: A category 3 hotel costs 17,500 points, or $80 + 8,500 points. And let’s imagine that the all-cash price for the same hotel room is $150 all-in.

If you had the 17,500 points available, a points-only booking makes sense. You would get $150 / 17,500 = 0.86 cents per point value. That’s not amazing, but it’s more than the current Reasonable Redemption Value.

Now suppose you started with zero points and simply bought 17,500 points for 1.25 cents each. That would cost you $218.75. That would be a very bad deal.

Cash + Points, though, is less obvious as to whether or not it’s a good deal. If the room rate was only $80 it would obviously be stupid to spend $80 + 8,500 points instead. In this case, though, the 8,500 points saves you $150 – $80 = $70. Is that a good deal? Actually, yeah, it’s not bad. In this example you would get $70 / 8,500 = 0.82 cents per point value. Since 0.82 cents per point is more than the Reasonable Redemption Value, it may be worth doing.

The above example glossed over the fact that you can earn points on your all-cash booking, but it should give you a general idea of how to evaluate when to go with Cash + Points.

Summary

Marriott’s new Cash + Points scheme is sometimes a really bad deal, sometimes a good deal, but often a deal that depends upon circumstance. If a points-only booking makes sense (e.g. the cash-only price is high), then there’s a good chance that Cash + Points makes sense too if you don’t have enough points for a points-only award. Keep in mind, though, that Cash + Points awards have historically been much harder to find than points-only awards.

Agree with Stvr below. You’re not taking tax on the cash portion into account. That can dramatically change your calculations.

For a high category hotel, it seems the math doesn’t make sense. 2 night stay, first night costs $569, second night costs $398 or 45,000 points/night. Would it not obviously make more sense to use the points on the expensive night? The math suggests the cost of using the miles for the higher cost night is more than the lower cost night. (sorry but i’ve been looking at this for hours and maybe I’m the one that’s lost!)

[…] C+P 新增===== 後來我讀到frequentmiler關於萬豪的C+P分析時,它有將Standard […]

Often I find if there is Cash & Points availability then they have excess capacity and are usually selling rooms cheaply on a third party website and hence a BRG claim is never difficult to find, So while the SPG/Marriott rack rate might seem a decent deal the actual cash rate you can get makes the Cash & Points a poor deal.

Unrelated question to this topic, but hopefully there’s an answer to this out there!

I’m currently in line to hit night #50 on SPG on July 31st, checking out of the hotel on August 1st.

Do we expect that I’ll get 10 Suite Nights for qualifying for Platinum Status under the old program, or because it’ll hit the system in August, will I have missed my shot?

Hey Greg, For the ~10% of us males who are colorblind (mostly the red-green variety!) it would be helpful if you found another way to highlight the differences. 🙂

This analysis ignores whether you pay sales tax on the cash component.

If we’re just looking at the averages, and not individual properties/dates (which, of course, is how to measure a deal) this looks…not good. I mean, the best options are like buying points on sale. Yay? I buy SPG points at 2.3 cents because I want a *better* deal than cost. If all I can get on cash+points is what I would have gotten if I bought the points speculatively, it’s a waste of time IMHO.

I tend to look at it differently when deciding whether to use all points or a combination of points and cash. At the time of booking I look at the actual price for the dates i intend to stay at a given property and divide it by the number of points required to compute the cost of each point. The i compute the cost / point in the cash and points situation and if the value is substantially greater then I go with the points and cash option otherwise I choose the all points option. I have not done this with Marriott or SPG but have used this technique with Hyatt and Hilton. e.g. If the going room rate is $200 and the number of points required is 20,000. and the points + cash option is $80 + 10,000 points then I have increased the redemption value of my points from 1 cent to 1.2 cents when going with cash + points option. If on the other hand the cash + points option is $100 + 10,000 points then I am getting the same 1 cent value and hence I prefer to go with the all points option. The absolute redemption value is not as relevant in this scenario however if the hotel is too cheap and it drops the redemption value below the fair trading value in your chart then i will just make an all cash booking.

This is my thinking, too. Because of it, at Hyatt at least, it causes me to concentrate C+P at highest end properties and/or when the cash price is high at a Cat 2 (i.e., $62ai + 4000 points for any room $144 or above, since I want 2 cents or more per point spent).

This said, it has been pointed out to me on FT that there is another way to look at this, which is related to what Greg is saying. Your way of thinking — which, as I say, is also my way of thinking — assumes that the points are “just there,” presumably as a result of some sort of points acquisition behavior that is valuing them (to take my Hyatt example) at 2 cents a point. Some folks look at the cash portion of C+P and ask, “Could I purchase those points right now for less than 2 cents per point?” If so, they either do that, or, mentally, do the purchase, which makes them shift in either instance to an all points redemption.

Also, I realize in retrospect that my preference for the calculation you describe hinged a lot on the fact that C+P stays at Hyatt counted toward status and were eligible for suite upgrades, whereas all Points stays were not — a fact that is no longer a fact.

Greg crunching ma numbers !! Keep it goin man