NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Those who like to pick low-hanging fruit will be happy to see the return of a great offer on the AAdvantage® Aviator Red World Elite MasterCard®: now get 60,000 American Airlines miles after first purchase and payment of the $95 annual fee. That’s a great trade if you’re after AA miles.

The Offer

- 60,000 American Airlines miles on first purchase and payment of the annual fee

- See more information and get a link on our AAdvantage® Aviator Red World Elite MasterCard® page

Card Details

- $95 Annual fee charged on 1st statement

- Earn 2X on American Airlines

- Earn 1X everywhere else

- First checked bag free

- Preferred boarding for the primary cardmember and up to 4 companions traveling on the same reservation

- 10% rebate on AA awards (up to 10K per year)

- Reduced mileage awards

- 25% off in-flight purchases

- From the terms: This one-time offer is valid for eligible cardmembers. You may not be eligible for this offer if you currently have or previously had an account with us in this program. In addition, you may not be eligible for this offer if, at any time during our relationship with you, we have cause, as determined by us in our sole discretion, to suspect that the account is being obtained or will be used for abusive or gaming activity (such as, but not limited to, obtaining or using the account to maximize rewards earned in a manner that is not consistent with typical consumer activity and/or multiple credit card account applications/openings).

Quick Thoughts

This is a very solid offer if you have a good use for American Airlines miles. Keep in mind that AA miles are not terribly useful for domestic travel unless you plan at the last minute.

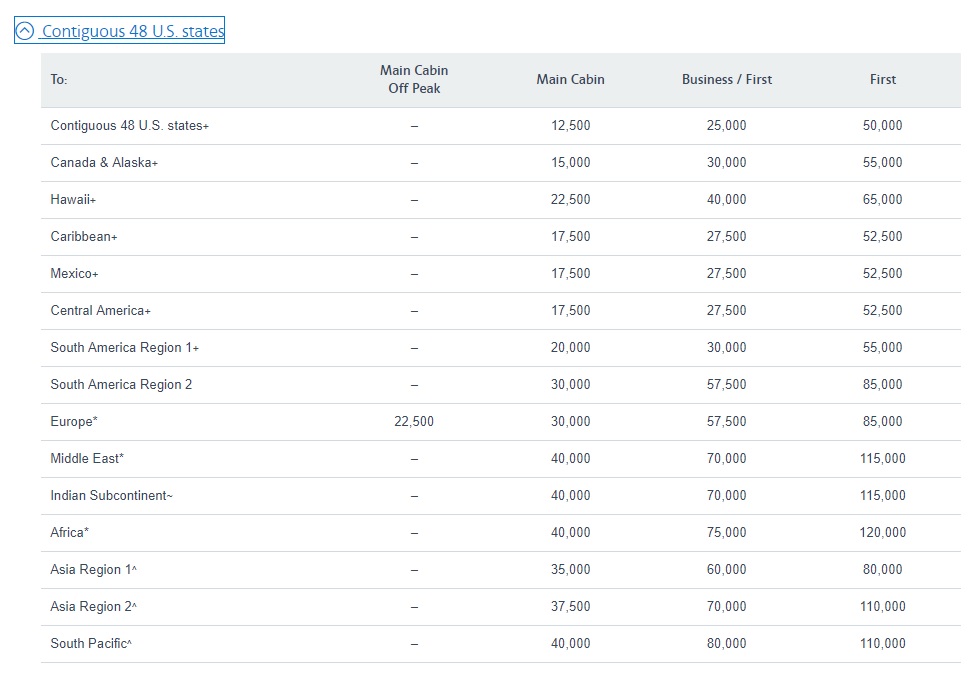

However, AA miles can be very useful for some partner redemptions. Sixty thousand miles is enough for one-way business class to South America, Japan, or Europe (though watch out for exorbitant fees on British Airways). It’s not far off of from enough to fly to the Middle East or Indian subcontinent in business class either. Getting that many miles with just a single purchase is a pretty tough deal to beat if you can find availability on AA partners.

I recently flew Cathay Pacific business class from New York to Shanghai for 70K miles. It would have been 60K to connect from Hong Kong to Japan instead of Shanghai. I imagine Japan Airlines is probably a better experience (I haven’t yet flown their long-haul business class), but Cathay wasn’t bad when you consider the ability to pick up that one-way for the cost of a single purchase an one annual fee.

One thing that is a little unclear to me from the terms is where it states that “you may not be eligible for this offer if you currently have or previously had an account with us in this program”. I would take that to mean that you may not be eligible if you already have a personal Aviator card open. Or do they mean one AAdvantage account per person? The business version is currently offering 50K after first purchase. Can you have both cards? I’m not sure. If anyone has recently opened the business version and already had the personal, let us know in the comments.

As always, we have added this offer to our Best Credit Card Offers page.

H/T: Doctor of Credit

I HAD THE RED PERSONAL CARD AND GOT THE BUSINESS CARD WITH THE BONUS. would LIKE TO GET ANOTHER PERSONAL CARD. iS THAT POSSIBLE SINCE I ALREADY HAVE ONE?

You MAY HAVE ALREADY RESOLVED THIS QUESTION BUT I CALLED AA ABOUT WHETHER AS A PRIOR ADVANTAGE CARD HOLDER WOULD I BE ELIGIBLE FOR THE NEW AVIATOR CARD. ANSWER YES.

Hello, how long before people have seen the 60k reflect in their AA accounts after qualified purchase and paid AF? Thanks!

looking for DP.

i have 2 old Aviator Red World MasterCard that were converted from US Air cards owned by barclay. am i eligible for this card as it should be a different product? i’ve never applied to any of the new Barclay Aviator Red cards before. anyone in similar situation and successfully got approved for this card? thanks in advance!

Similar situation – I have an old legacy US card that converted, and downgraded to the no AF white card. I applied yesterday and went pending, will report back with the result.

However – I have read many places that getting a 3rd card is nearly impossible, regardless of how they originated.

how many old Aviator Red do u have? i have 2 red that i have kept open the whole time cuz of the amazing 10k anniversary miles. i will never close them for that.

trying to see if its possible to get 3rd since this is “diff” product as mine is World mastercard and this is world elite.

Have one old Red, but it downgraded to white some time ago. Was recently approved for a new Red, so currently one open red.

@NickReyes so I had the USair card that converted to the Aviator Red card years ago. I never used the aviator card (I’m not even sure if I ever even activated it). I closed it mid year in 2016. Do you think I would qualify for this welcome offer if I applied for the Aviator red card?

I think you probably would.

If After you close the account, do you keep the miles? Or the miles are only available while the account is open?

They stay in your AA account, but you’ll need to keep an eye on them to keep from expiring.

I have too many letters from Barclays saying:

We have reviewed your application and determined that we are unable to approve you for a (EVERY CARD) credit card account for the following reason:

THE NUMBER OF BANKCARDS OPENED WITHIN THE LAST 24 MONTHS

Question about required interval between applying for Barclay cards…

Me and my spouse just recently (a few days ago) applied for the BUSINESS version of the Barclays AAviator Red card. We both got instant approval.

I already have this card (personal Barclays AAviator Red). My spouse once had this card, but she dumped it more than a year ago.

This 60K offer for the personal card is tempting (for her). Since she closed the same card a long time ago (more than a year) I’m sure she’s OK there. BUt it was just a few days ago that she applied for the Business card.

What’s the current thinking on best practices for waiting between two Barclays applications?

What I’ve always done is go to Barclay’s Check Application Status page and when my most recent app has fallen off I apply and have never been denied. Unfortunately I think it takes about 6 months to fall off that page after you are approved. Did you and your wife apply with existing businesses or new ones?

I just checked looks like it takes 90 days to fall off.

Do Barclay business cards (such as the AAdvantage business) count towards Chase 5/24?

Hi Nick,

Any help on this question would be greatly appreciated. Thanks!

Sorry for the slow response. Unfortunately, there isn’t a clear answer. There are mixed reports on Barclays business cards reporting to the personal credit bureaus — it seems they do for some people and not for others. If it gets reported to the personal credit bureaus, it will count against 5/24 – unfortunately, reports are not consistent enough to know.

My wife with 800+ credit got an instant denial for this card. The recon rep specifically said that the reason is 6/24 and that authorized user cards count.

I have the personal Aviator Red card and recently opened the business card with no problem. But, the personal card is the one that was converted from USAir. I’ve kept it because it pays a 10k mile bonus on each anniversary. I’m tempted to try for the current personal card. Any thoughts on the chance of approval?

You can try, but I don’t think it’s likely from all accounts I’ve heard.

I closed my personal Aviator Red a couple weeks ago. How long should I wait before applying? I should note that I have an Aviator (white) personal that was originally a US air card that converted to Aviator Red, then upgraded to Silver, then downgraded to white (no fee). I plan to keep that account open because it’s one of my oldest credit lines. Will that prevent me from getting a new Aviator Red with this new language?

I have heard some stories from people who were unable to get a new Aviator Red for quite some time even after closing one, so I’m not sure what the timeline is on those right now. Also not sure if you can keep the White and get a new Red. Sorry — if you try, let us know your results.

+1 for this question, I’m in the same boat with an old legacy US card, converted to Red, then downgraded to white, and want to try a new Red app.

Update: Auto-approved (after a few days) for Red with an existing downgraded/white old US Airways account.

I recently had both, a personal and a business card, open at the same time. From what I understand, you can only have one personal at a time and one biz at a time. I’m thinking I saw some posts somewhere of folks saying they got denied when they tried for a second. There was one exception but that was when there were (are?) people who had the USAir card converted to AA.

Yeah, back in the day they used to allow multiple US Air cards. I had a couple that I still have as Aviators because they waive the annual fee when I call in and/or offer spending bonuses.

Hi Nick, Do Barclay business cards (such as the AAdvantage business) count towards Chase 5/24?