NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

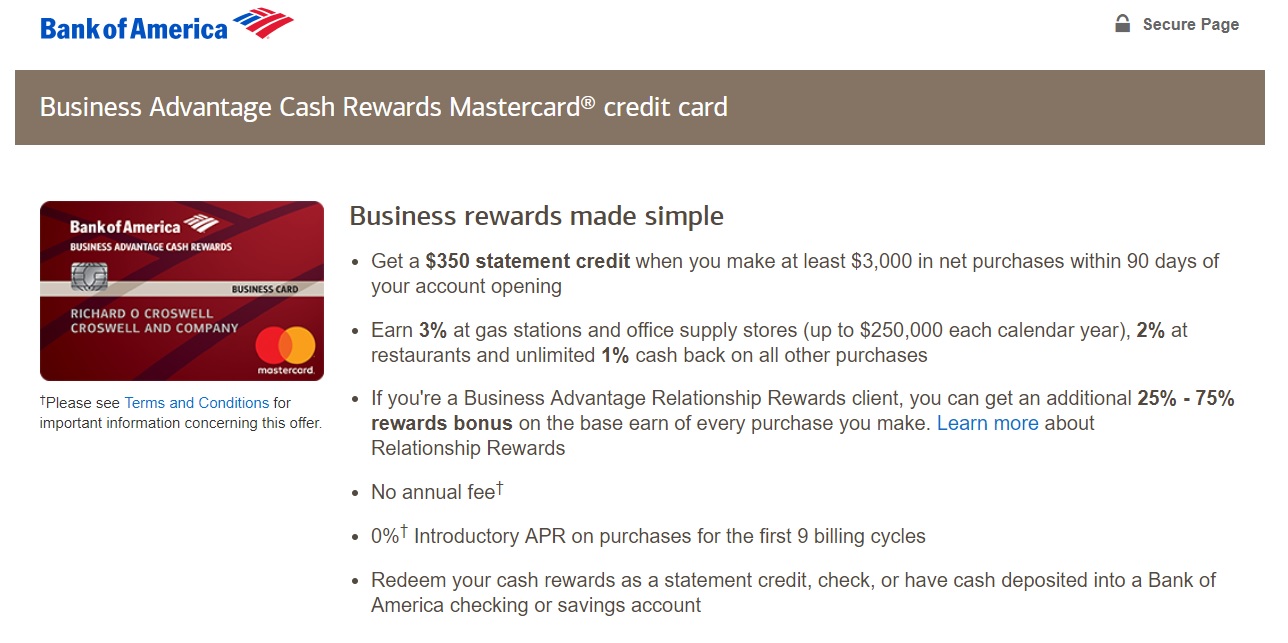

Bank of America has increased the offer on the Business Advantage Cash Rewards Mastercard — you can now get $350 cash back after making $3,000 in net purchases in the first 90 days (versus the previous offer of $200 back after $500 in purchases in sixty days). While the new offer requires a lot more spend, the extra $150 back on an additional $2500 in spend over the standard offer gives you an extra 6% back on that spend on top of your normal earnings, which makes this a reasonable offer. Keep in mind that those will bills to pay via Plastiq can take advantage of the current Masterpass promotion that allows for fee-free payments of up to $250 at a time.

The Offer

- Get $350 cash back after making $3,000 in net purchases in the first 90 days with the Business Advantage Cash Rewards Mastercard

- Find more card information and a link on our Bank of America Business Advantage Cash Rewards Mastercard page

Key Card Details

- No annual fee

- Earn 3% at gas stations and office supply stores (up to $250,000 each calendar year)

- Earn 2% at restaurants

- Earn 1% everywhere else

- You can get an additional 25% – 75% rewards bonus on base earn via Relationship Rewards (similar as the program for personal accounts). Click here for more information about Business Relationship Rewards

Quick Thoughts

This business card might be particularly attractive to some readers as it will not add to your 5/24 count and it earns a decent cash bonus for new card members. Furthermore, the fact that it is a Mastercard means it is compatible with the current Plastiq Masterpass promotions — so if you have bills that can be paid $250 at a time, it would be easy to make the minimum spend without incurring fees.

Those with a lot of money on deposit or invested with Bank of America / Merrill Lynch business accounts can qualify for slightly better bonus categories. Note that the business relationship bonuses only apply to base earnings (1%) rather than the category bonuses. This means you can earn an extra 0.25% to 0.75% across the board. See this post for more details.

The Bank of American Business Advantage Cash Rewards card doesn’t offer compelling spend bonuses in its bonus categories, but it offers a decent return for new cardholders with this newly increased bonus and it has no annual fee, making it an easy win for those looking for a business card with a cash rewards intro bonus.

H/T: Doctor of Credit