NOTICE: This post references card features that have changed, expired, or are not currently available

Good news on the MS front — it appears that the opportunity to earn cash back on Visa Gift Card purchases is back through some portals at GiftCardMall and GiftCards.com. You can earn 1% back on the face value of Visa gift cards (not including activation fee), which can help reduce the cost of purchase significantly.

Greg reports having received the following email from SimplyBestCoupons:

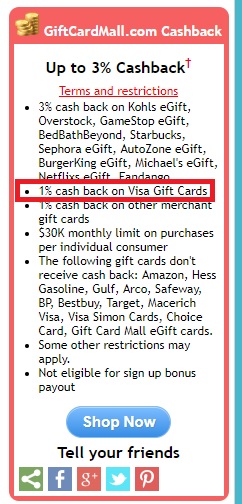

Great news!Visa Gift Cards cashback on is now available again from GiftCards.com and GiftCardMall.com Both of these sites offer 1% cash back on Visa Gift Cards.GiftCards.com offers 1.25% cash back on Mastercard Gift Cards.Please review the terms!Also, monthly limit is $30K now.Gift Card Mall cashback:GiftCards.com cash back:

TopCash now showing 0.75% on visas (and down from 4.5% to 2% on other gift cards). Anyone tried a personalized visa yet to see how it tracks?

Please can someone clarify if the offer buying visa cards still available? I am not be able to find it. Thanks

Cashbackhouse is currently offering 1.4% cash back on Visa Gc.

Do you have a write-up on the best ways to liquidate VGCs nowadays? (Now that MOs at WM are dead)

MOs at WM are not dead. You may have more difficulty in some areas than others, but not dead as of last week anyway and I see no reports to the contrary.

As for your best options, you might want to check out these:

https://frequentmiler.com/2016/01/08/liquidate-visa-and-mastercard-gift-cards/

https://frequentmiler.com/manufactured-spending-complete-guide/#VisaMC

And try other places in your area that sell MOs (typically grocery stores).

Thanks for the quick reply and great suggestions. I thought I read that MOs at WM were dead, but glad to hear it may still be working. I’ll try it and report back. Thank you again!

With an activation fee of 6.95 and a shipping charge of $7.45, even after cash back of 1% from the portal it comes out to cost more than the $3.95 fee at Simon. I guess the only play here is you don’t have a simon mall or want to leave the house?

The fee is $5.95 and if you buy enough of them shipping is a flat $10.95. If you’re only buying 1 or 2 cards, you’re right that it doesn’t work out. Run the math. You don’t need to buy very many in a single order to come out ahead of the mall. Just keep in mind that they can be ban-happy, so work your way up slowly.

I went thru giftcards.com, which the fees are 6.95 and won’t allow an order over $2500 ( therefore not enough cards can be bought to compensate for shipping). I will have to try giftcardmall next. Thanks

Are these actually META gift cards? SOme past reports of giftcardmall shipping out non meta gift cards.

1% is available on Yazing too.

[…] Hat tip to Frequentmiler […]

can’t you just stop posting about this before you kill the cashback?

which card would you use after spg/Marriott merger except hitting welcome bonus? Thanks Nick.

That’s the million dollar question isn’t it. Since some card issuers close accounts when they see gift card purchases even at Christmastime, they seem to rather want decreasing customers whom many are actually business owners or other high net worth people. Meanwhile, other smarter institutions are capitalizing on the self inflecting harm the other issuers are doing and swaying great business over to their products and financial services.

First choice: Meeting min spend (on something other than Amex).

Second choice: Retention bonuses (i.e. I have one right now for an extra 2x on up to $17.5K in purchases in 6 mo on my AT&T Access More card, so 3x total).

Third choice: Discover IT Miles during 1st year (effective 3% back)

Fourth choice: BOA Premium Rewards if you have Platinum Honors ($100K on deposit / invested) as it’s 2.625% back everywhere in that case

Fifth choice (tie): Freedom Unlimited / Ink Business Unlimited. Actually, this would be *my* 4th choice as I would rather have 1.5x URs than 2.625% cash back. But objectively, points can be used for 1.5c each through UR portal with CSR, so this has a “value” of an effective 2.25% back.

Heck, even a Citi Double Cash would come out well ahead here.

Note: I left Amex out here due to the chance that they could deem these ineligible for rewards as a “cash equivalent”. There are good Amex options also, but the above should give you some options. I also left off the Alliant Cashback Visa (3% back in year 1, 2.5% back thereafter) because they had zeroed out cash back on gift card purchases in the past.

Also keep in mind that some big spend bonuses might also be worth considering. For exampe, the aforementioned AT&T Access More card earns 10K bonus points each year if you spend $10K or more. So that’s an effective 2x on your first $10K spend each year, which might make that card a good choice. It certainly depends somewhat on your situation.

Would you be concerned using this to meet min spend on chase?

Chase doesn’t care.

Why would one buy visa gc from them instead of from grocery stores where you can get better cashback?

Lower activation fees to begin with that are then mitigated even further by cash back. Run the math on your costs.

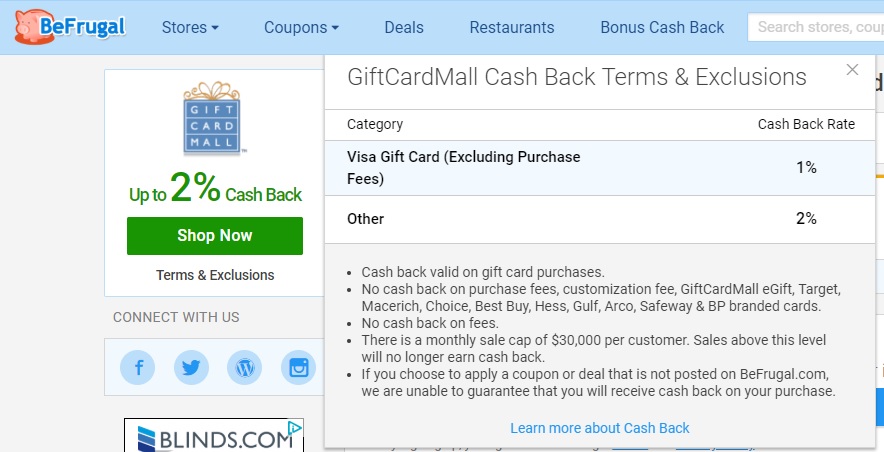

BeFrugal never stopped CB on VGC’s. Been getting CB since all the other portals stopped.

Ditto. Was surprised to hear CB from Befrugal considered news on some channels

I started with them not too long ago. Are they good with payments on time?