NOTICE: This post references card features that have changed, expired, or are not currently available

Doctor of Credit is reporting a great targeted offer that some people are seeing in their Chase accounts for the Chase Sapphire Preferred card: Get 60,000 Ultimate Rewards points after spending $4,000 in the first 3 months plus 5,000 points for adding an authorized user. Best of all, this offer (found under “Your Offers” in your online account) bypasses 5/24 and this particular offer maintains 24-month language despite the recent change to 48-month language on the Sapphire cards.

The Deal

- Chase has a targeted offer for some users found under “Your Offers” in your online login to open a Chase Sapphire Preferred card and earn 60,000 Ultimate Rewards points after $4,000 in purchases in the first 3 months plus get 5,000 points for adding an authorized user in the first 3 months

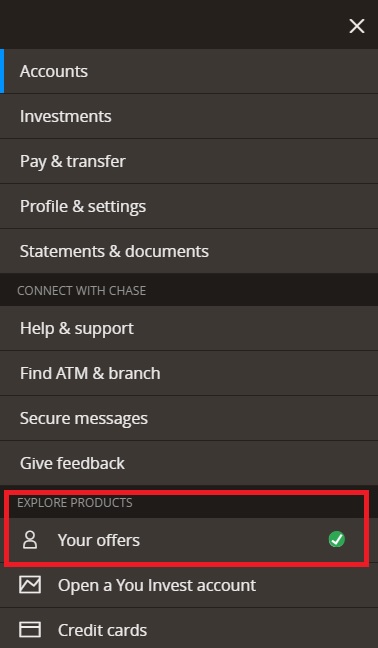

- There is no direct link as this is a targeted offer. To see if you are targeted, log into your Chase account, click the menu, and click “Your Offers”. If you see an offer for 60,000 points with the Sapphire Preferred and a green check mark, you have been targeted.

Key card details

- Card Type: Visa Signature

- Earning rate: 2X Travel and Dining

- Noteworthy perks: Primary auto rental collision damage waiver

- Annual fee: $95, waived the first year

- Can transfer points to partners with this card

Quick Thoughts

This is a terrific offer if you are targeted as 60,000 points is an excellent welcome bonus on this card and the ability to bypass 5/24 and apply with 24-month language will be extremely valuable for some readers. To see if you are targeted, log into your account and click the menu. If you see a green check next to Your Offers, click there to see your targeted offers from Chase.

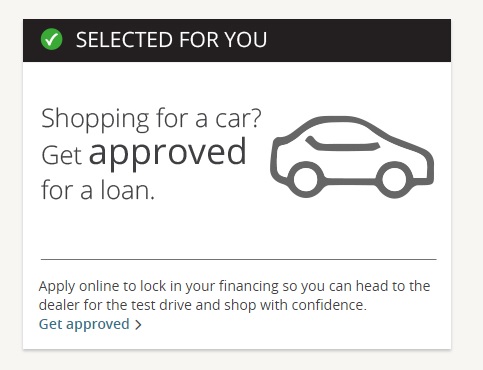

You’ll then see your pre-approved offers with a green check. Unfortunately, I do not have this offer for the CSP. I have a couple of offers like this one for a car loan:

If you see an offer with a green check for 60K points with the Sapphire Preferred, that would mean you are targeted. If you have this offer available, and you qualify in terms of it having been at least 24 months since you last received a new cardmember bonus on any Sapphire card / you do not currently have a Sapphire card open, it is definitely worth your consideration as the new 48-month language will likely make its way to offers like this eventually. While some will argue that the Sapphire Reserve is a better long-term value for those who spend at least $300 per year on travel, I think the additional points here make it worth starting with a Sapphire Preferred and upgrading to a Sapphire Reserve down the road if you do not have an immediate need for the CSR’s anciliary benefits. Also note that Chase recently removed the authorized user bonus from the public offers (5K for adding an AU and making a purchase in the first 3 months), but that bonus remains in this offer.

H/T: Doctor of Credit

Been going back and forth between Preferred and Reserve. Was going to go for the Reserve but friends saying go with Preferred IF I’m not using the points immediately. Getting this offer would make me go with Preferred. Does this offer make it seem like new offer for Reserve is possible?

I see the CSP 50k offer with 48 month restriction (green check) in my chase account. I cancelled my last CSP in 2013; therefore I should be fine with the 48 months restriction. do you know if they will still pull a credit check and look for 5/24 after sending me a targeted offer?

[…] Doctor of Credit is reporting a great targeted offer that some people are seeing in their Chase accounts for the Chase Sapphire Preferred card: Get 60,000 Ultimate Rewards points after spending $4,000 in the first 3 months plus 5,000 points for adding an authorized user. Best of all, this offer (found under “Your Offers” in your online account) bypasses 5/24 and this particular offer maintains 24-month language despite the recent change to 48-month language on the Sapphire cards.LEARN MORE! […]

Do these not show if you have a business profile?

I dont know if this is because i keep my Chase app on iOS updated but I cannot get to “Your offers” as shown in the screenshot above. My app now has an option in the menu under ‘Connect with Chase” called ‘Open an Account’. When you tap that you enter a new menu with the first on the list being “Your offers”. It makes seeing your offers much more convoluted

The screen shot in the post is from the desktop version of the site. Have you tried the desktop version also?

I didn’t get the CSP offer, but I do see a CFU 25k offer. Tempting, but at 20/24 I’d still probably be denied and could open myself up to a shutdown.

EDIT: NM, was actually home financing 25k offer as a CFU cardholder…looked confusing on mobile site. No dice on any card offers for me, but no big loss.

Probably a good call with those numbers.

I’ve been wanting to get a CSP for my wife. She only has one Chase card – the Freedom card – so I checked her account. No offers. Checked her Chase Credit Journey and it shows she is at 6/24! Uh, no! Checked TransUnion and Equifax through Credit Karma and she is only 4/24 INCLUDING closed and AU accounts. Experian shows the same.

What gives with Chase Credit Journey? If their info is so wrong, what good is it?

Sorry for getting off topic.

Ugh, no dice for me, have never had the CSR/CSP unfortunately over 5/24.