NOTICE: This post references card features that have changed, expired, or are not currently available

My wife and I each have Chase Sapphire Reserve cards, and our new annual fees just came due. My previous plan was for my wife to downgrade her card to a no-fee Freedom card, and then I’d pay $75 to add her as an authorized user to my card. Now, though, a new card has made me rethink my plans. Now, I’m wondering: should I keep the Sapphire Reserve card at all?

Last week Amex unveiled their new Gold card which offers eye-catching perks in exchange for its $250 annual fee:

- 4X Membership Rewards at US Restaurants

- 4x Membership Rewards at US Supermarkets on up to $25K per calendar year in purchases (then 1x)

- 3x Membership Rewards for flights booked directly with airlines or on Amextravel.com

- $120 dining credit: $10 per month credit for spend at GrubHub, Seamless, The Cheesecake Factory, Ruth’s Chris Steakhouse, and Participating Shake Shack locations

- $100 Airline Fee Credit

Whether those perks are worth the $250 annual fee depends upon your spend habits. I created an easy way to answer that question for yourself, here: Is 4X worth $250 per year? How much are those Amex Gold 4X categories (grocery & dining) worth?

What if your answer, like mine, to whether the Gold card is worth the $250 annual fee was a resounding “YES“? Does this mean that the Chase Sapphire Reserve card is no longer worth keeping? After all, a big part of the Sapphire Reserve’s value is with its 3X dining benefit. Let’s break down the numbers…

Chase Sapphire Reserve’s valuable benefits

The Sapphire Reserve’s benefits can be found in my Google Doc spreadsheet: Ultra Premium Credit Card Value Worksheet. As a reminder, this worksheet was designed to help you analyze which ultra-premium cards ($400+ per year) are worth the annual fee. Read more about the spreadsheet here: Your turn: Which Ultra Premium Cards are Keepers?

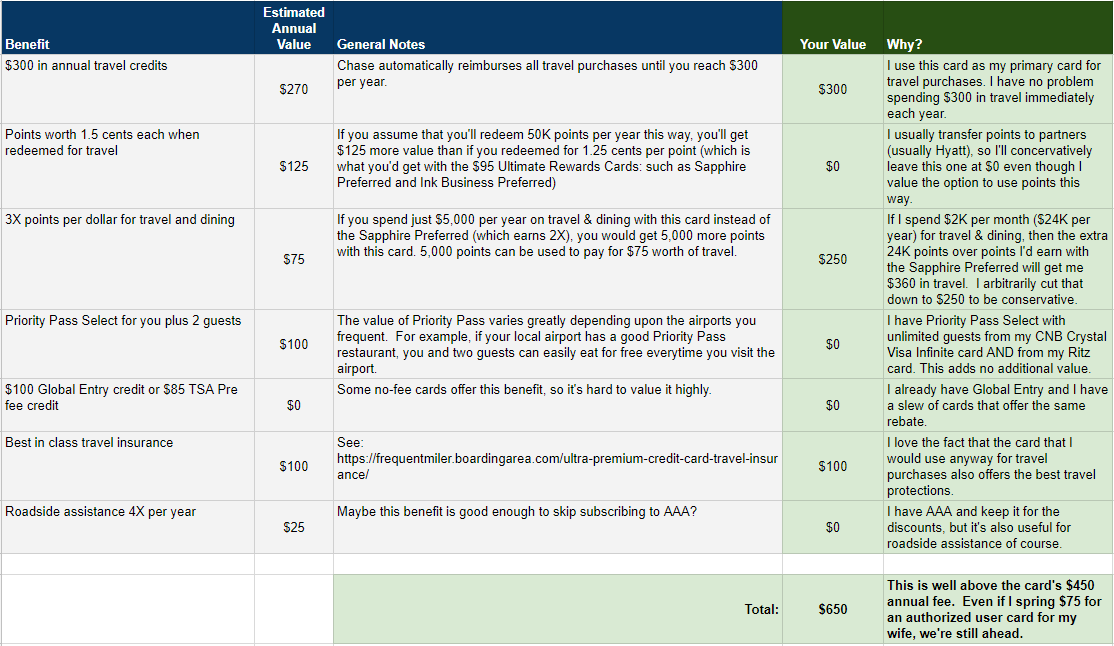

Before the old Premier Rewards Gold card was turned into a gem and renamed to “American Express® Gold Card,” my personal valuation of the Sapphire Reserve card was as follows:

In total, my personal valuation of the card’s benefits came to $650. That’s enough above the card’s $550 annual fee to make the card worth keeping.

Now, though, the Gold card has me rethinking things. While in the United States, my wife and I will no longer use my Sapphire Reserve card at restaurants. Even though I have a slight preference for Ultimate Rewards points over Membership Rewards points, I’ll take 4X Membership Rewards over 3X any day. Still, I would continue to use the Sapphire Reserve card for dining when traveling outside of the US. I’d also use it at hotel restaurants within the US since there’s no guarantee that they’ll code as dining (they may code as lodging). And, I’d want to continue to use the Sapphire Reserve for all travel spend for its 3X rewards, best in class travel insurance, and $300 in annual travel credits.

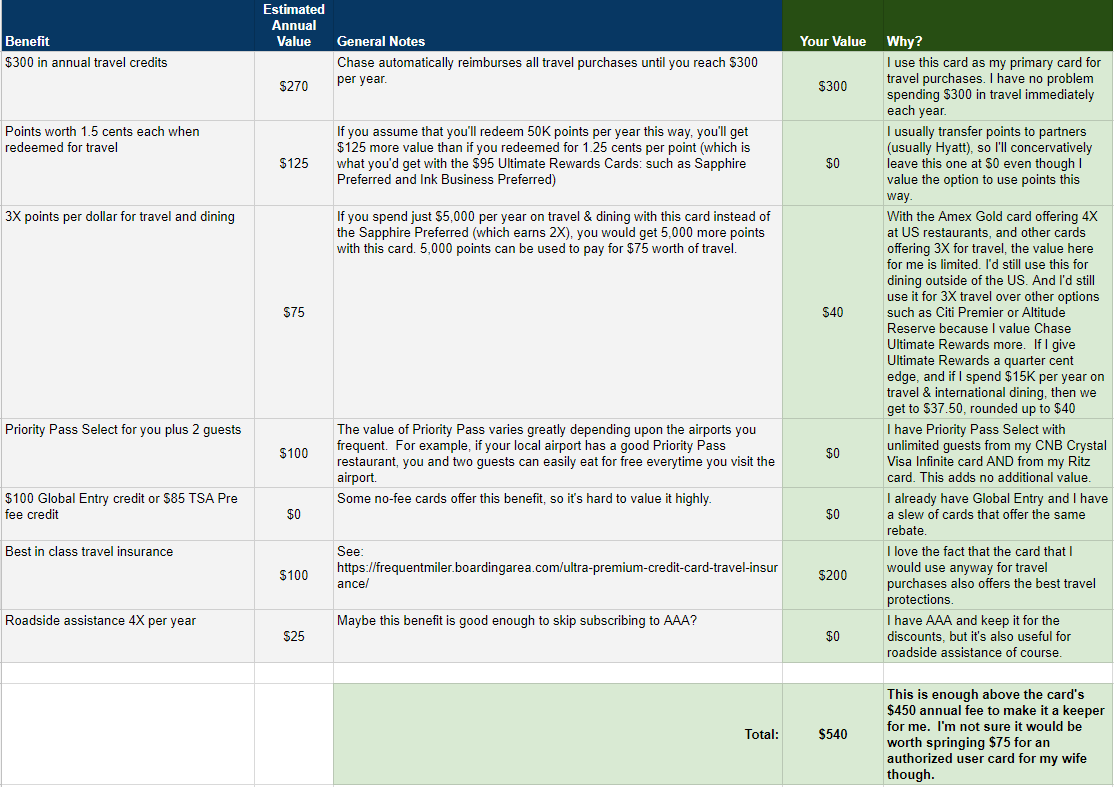

After accounting for the Amex Gold card, my valuations of the Sapphire Reserve’s benefits changed. The biggest change is that I dropped my valuation of “3X points per dollar for travel and dining” to just $40. Here’s how I came to that number:

- Dining: Going forward I won’t use the Sapphire Reserve for dining within the US at all, but would like to continue using it when outside of the country.

- Travel: I have other cards that offer 3X for all travel purchases (Citi ThankYou Premier and US Bank Altitude Reserve), but I do personally prefer Ultimate Rewards points over ThankYou points or Altitude Reserve points (which are worth 1.5 cents each towards travel).

- Overall, I’d estimate that I spend $15K per year on travel & international dining.

- I arbitrarily assigned a quarter cent value of Ultimate Rewards points over competing points (ThankYou Rewards, for example)

- Taken together: $15K spend x $0.0025 = $37.50. I rounded up to $40.

- This is, admittedly, a conservative valuation. I’m likely to get plenty of additional value through earning 3X rather than 2X when dining outside of the US, but I’d rather error towards a lower value.

The other change I made was to increase my valuation of the Sapphire Reserve card’s travel protections. The Sapphire Reserve really does have the best automatic travel protections available (see: Ultra-Premium Credit Card Travel Insurance). As I considered this, I realized that I have a real world datapoint showing how much I value this: Even though I currently have a consumer Amex Platinum card which offers 5X for airfare, I’ve continued to earn just 3X with my Sapphire Reserve card for airfare in order to ensure that I’d have protection for trip delays, trip cancellation, emergency medical, etc. With Membership Rewards points worth a minimum of 1.25 cents each (see previous post for details about that), this implies that I value the Sapphire Reserve card’s travel protections at at least 2.5 cents per dollar spent on airfare. If I spend $750 per month / $9,000 per year on airfare*, then we can back into how much I value Chase’s travel protections: $9,000 * .025 = $225. Rounded down, that comes to $200.

* With the Sapphire Reserve, you’re covered even if you book award flights as long as you pay taxes and fees with the card. So, the $9,000 per year on flights in my analysis includes the value of award flights.

In total, my new personal valuation of the Sapphire Reserve comes to $540 per year. That’s enough over the card’s annual fee for me to keep the card (especially since I was very conservative in my value estimates). But, it’s not enough to justify paying $75 more per year to get my wife an authorized user card. Instead, she can use my card to pay for travel booked online. And she can use her Citi Premier card when she needs to pay for travel in person (that’s a great option, too, for 3X gas purchases). For dining, she can use her Amex Gold card within the US (4X), and her Citi Premier elsewhere (2X).

Your turn

Use the spreadsheet I created to estimate how much you value the Sapphire Reserve card, assuming you have the Amex Gold card too.

Click here to open the spreadsheet.

To use the spreadsheet, create a copy of it and then overwrite the values in columns D and E on the Sapphire Reserve tab with your own value estimates.

Tips for using the spreadsheet effectively

- Be conservative with your estimates. Enter values that you would pay for a subscription for that benefit rather than the amount you expect to save.

- Consider other factors not listed. Most of the benefits of my Sapphire Reserve card are available through other cards, but I love the fact that this single card gives me best in class earnings on travel, best in class travel insurance, and increases the value of my Chase points earned on other cards. There’s something great (to me) about having a single card to turn to for all travel spend.

- Once you identify cards that you know that you’ll keep year after year (such as the Amex Gold card), make sure to consider that when evaluating overlapping benefits on other cards. For example, the Amex Gold card offers 4X for US dining, so you shouldn’t assign any value to the Sapphire Reserve card’s 3X dining benefit unless you dine out a lot outside of the US.

Once you’ve come up with an honest estimate of the card’s value, compare it to the annual fee. If your estimated value is less than the annual fee, consider downgrading it to a cheaper card or to a fee-free card.

Summary

I have no doubt that some readers will find that the new Amex Gold Card did indeed kill the Chase Sapphire Reserve, for them. In my case, it’s clear that both cards provide value that exceed their annual fees, so I’ll keep both. That said, I no longer plan to add my wife as an authorized user to my Sapphire Reserve card. The main reason I wanted to do that was so that she would have her own card that earns 3X for dining. Now, with the Amex Gold Card, she gets 4X within the US. And, with the Gold card, authorized users are free.

What about subbing out the USBank Altitude Reserve for your CSR. It has all the travel protections of the CSR, doesn’t have Dining, but adds mobile pay. Only thing you miss out on is the transfer option, but you get easy mobile redemption and a lower annual fee/more travel credit, so I think that is a wash

I would love to do that but the Altitude Reserve’s travel protections aren’t nearly as good. See this post for a comparison: https://frequentmiler.com/ultra-premium-credit-card-travel-insurance/

Thanks for the link, seems like protections are pretty close, only meaningful difference for me is having to pay in full(roadside is redundant with several other cards and baggage delay is super rare compared to trip delay in my experience).

CNB Crystal Visa Infinite and has up to $1000 in travel credits with all 4 cards at a total annual fee of $400. Priority Pass with unlimited guests (remember chase USED to do that), global entry, multiples on restaurants, even the $100 discount from Visa Infinite for pairs of plane ticket from their site. No junk 5/24 and they have a 9% interest rate if you do have a reason to carry a short term balance. CNB puts Chase to shame.

both cards could be compliments to one another (or the CSP) if you run the numbers. 4% on groceries, plus the $220 in credits can make the gold positive , while pushing all other spend on the CSR makes that a very lucrative card (reason I push the rest on CSR is because traveling internationally the CSR makes more sense than the gold).

Good write up overall but I can’t shake the fact you are bias towards the AMEX Gold. One thing we have to address here is – the AMEX Plat is the direct competitor to the CSR, not the AMEX Gold. I see the AMEX gold as a slightly more luxurious competitor to the CSP.

The thing here is – the CSR offers more luxurious perks, more travel insurances, and etc… While the AMEX Gold does have 4X dining and groceries, the CSR has a more flexible 3X travel. Chase’s travel term is broad, which makes it very good to stack points. If you look past the fact you get 1 less points for dining, you can actually get more from a more flexible 3X travel system.

[…] However, when the luster of new account bonuses is gone, whether because you’re locked out of the bonuses you may want or you just don’t want to open five or ten or thirty new cards per year, you next have to consider your return on everyday spend. For a lot of people, food makes up a big part of the budget. That’s one of the reasons I was so pumped for the new benefits on the Amex Gold card: US Supermarkets and US Restaurants make up a healthy portion of our personal spending each year. The card created such buzz that Greg had to ask: Did Amex’s new Gold card kill Chase’s Sapphire Reserve?. […]

I’d love to see one of these comparisons include the Uber card from BarclayCard.

No Annual Fee

4% cash-back on dining

3% cash-back on hotel & airfare (including travel agencies)

2% cash-back for online purchases

1% for everything else

You get this cash-back for purchases outside the US, too, not just US restaurants like the Gold card. Plus, you get phone coverage if you pay your phone bill on it… up to $600 for damage/theft. While it is not a transferable currency, I am having a hard time arguing with these numbers from an ease of use perspective.

That’s certainly on my radar to do. Thanks!

Thanks, Greg! I loved hearing Nick’s thoughts ( https://frequentmiler.com/are-cash-back-cards-the-new-airline-cards/ ), and would really appreciate your views as well! Nick proposed a few ideas that I hadn’t considered before which is one of the reasons I love your blog. 🙂

I think before people start calling this new card a CSR killer, perhaps they take notice of all the restaurants where the new card does NOT earn 4x on restaurant spend. Reports are now trickling in and folks aren’t happy.

I think you need to consider the personal valuation for the $300 credit to be no more than $286.50. You earn no points on that $300 spend and that means you’re losing 900 UR/$13.50 in rewards.

Good point!

Awesome post and really useful spreadsheet, Greg! I not only agree with your methodology, most of my estimated values are close to yours and for the same reasons (e.g. zero value attached to Priority Pass).

Minor nit – if you are comparing a couple of benefits (e.g. 3x travel & dining points value & 1.5x travel redemption value) as the incremental value OVER the CSP and Ink Business Preferred, both of which have a $100-ish annual fee, your total value for justifying the CSR needs to also be compared to the incremental difference in annual fees. I mean either take the total value of the expected benefit and justify the total annual fee against it, or take the extra value over a CSP/IBP and justify the extra annual fee to be paid (about $350).

Shouldn’t change the conclusion for most people, but would be more consistent.

Thanks. Which specific valuations are you thinking of regarding the minor nit? I don’t think I compared to IBP?

I was referring to the 2nd and 3rd rows in the graphic above (both old and new post- “new Gold card” ones). You were comparing the valuation (from the perspective of both earning for travel & dining, and redemption for travel) of other UR cards, specifically the $95 CSP and IBP. My logic was that to be fair justification, the annual fee of those should then also be factored in. Again, only an academic difference that would not change the conclusion for most.

[…] 消息來源 FrequentMiler […]

If memory serves me correctly, Amex’s dining category is vague no? ie – Starbucks or fast food, bars, cafes etc do not count as restaurants vs CSR’s almost every place counts as restaurants/dining? The Gold card almost seems good to me because I do use grubhub often though was thinking it might replace my EDP instead. Also to mention CSR does work with MPX at starbucks btw. Not sure you can this with Amex.

Another great post Greg .. I hadn’t considered using CSR over my Amex Plat for airline tickets, but I will now.

Thanks,

David

For me, I don’t MS, and as a family of 5 our grocery costs are one of our highest monthly expenses. In our situation, Gold wins out over something like EDP with the $6k annual cap. And I appreciate not having to worry about swiping 20-30x a month depending on the card.

For us, we will keep CSR for travel and primary rental car insurance, with points boosted by Freedom and Freedom Unlimited purchases too.

Amex will get our dining and grocery. Amex is not accepted at our doctor’s office, tire place, some insurances. And freaking Costco.

It is worth it to me right now to collect MR, UR, and cash back depending on the purchase.

It’s a good card but the AMEX transfer partners are underwhelming in my opinion.

For people who don’t MS that much, something to be mentioned is a lot of the time (not all), purchases have a higher ROI working on a signup bonus. Even better if your signup bonus card has travel / dining categories :).

That’s also true for people who MS in any quantity. Your best ROI will always be working on a good welcome bonus. But if you’re able to hit minimum spend with purchases that generally go unbonused, you’d be better off taking advantage of bonus categories on the cards you intend to keep, which is what this is about.

Most of my flights are award flights and if I use Ritz card which give the same travel protection, then I think the CSR is dead to me.