NOTICE: This post references card features that have changed, expired, or are not currently available

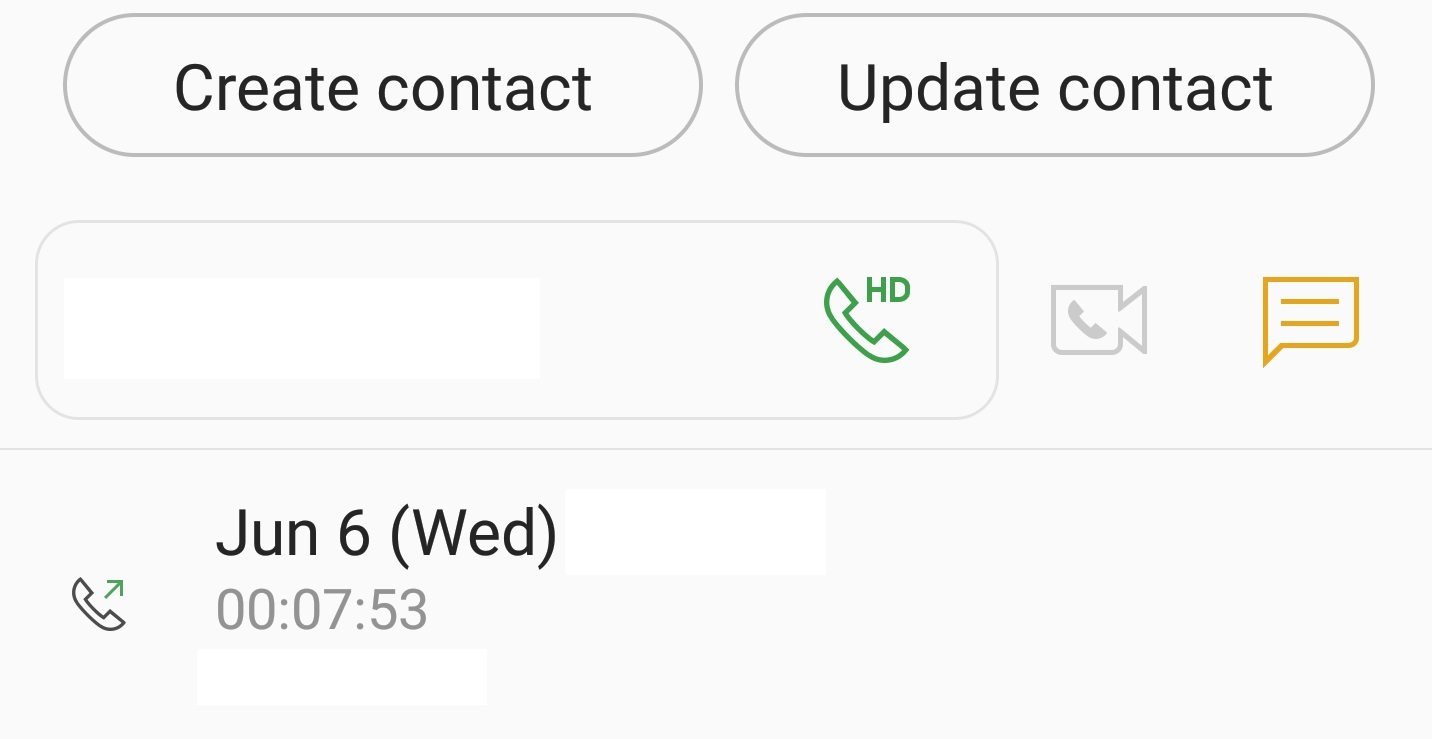

Without a doubt, the easiest way to earn miles and points is through credit card bonuses. The welcome offers on many cards are huge and often represent multiples in the 10-20 points per dollar range compared to the minimum spend required. After sign up bonuses are earned, many people skip right to category bonuses as the next means of maximizing their mileage. However, there is another option in between: retention bonuses. Yesterday, an eight minute call scored me (what will eventually be) 36,000 miles (no, I didn’t earn those points in eight minutes — but I will earn them thanks to a short call). And I learned a couple of things in the process.

Citi Prestige Retention Call

The annual fee recently hit on my Citi Prestige card. I got grandfathered in to a $350 annual fee on that card several years back. The Prestige card has an annual $250 airline credit, which I’ve never struggled to hit. So long as I would otherwise spend $250 a year on airline tickets, and I certainly have for as many years as I’ve had the card, it’s really like a net $100 annual fee.

While I don’t use the 4th night free benefit often, I have used it a handful of times. I also had one big trip delay reimbursement that paid out $500 for my expenses on an overnight delay. Citi hasn’t been covering missed connections like mine for quite some time now, but the fact is that between that reimbursement, the occasional 4th night free, some Citi Price rewinds, and the ability to transfer points earned from my AT&T Access More card to airline partners (since I pool my points), it would probably be foolish to cancel it.

But maybe the retention team doesn’t know that.

And so a few days ago, I called the number on the back of my Prestige card. A friendly agent (“Mary”) answered and I let her know that I think I’d like to cancel my Prestige card because they keep trimming benefits and I’m only earning 1 point per dollar on most of my purchases. “Unless there is some sort of special offer to entice me to keep the card,” I told Mary that I’m leaning towards cancelling it.

Mary said that she could take a look and see if there are any offers and then maybe get a specialist on the phone who could work some magic. She put me on hold for a couple of minutes and then came back with what she had found: there were no offers on my account. Surely, Mary had to be wrong. I asked if I could speak with one of those magical retention specialists she mentioned a few minutes ago. She told me that there were no offers on my account, so they wouldn’t have anything to offer…She offered to go ahead and close the account for me.

Noooooo!

I stopped her there and said that since the fee had just posted, I’d mull it over for a bit longer. I hung up the phone a bit deflated. I never seem to do as well on retention offers as others report despite the fact that I consider myself a fairly charismatic guy on the phone. Part of me wondered whether the rep I’d spoken with knew what she was talking about. In other past calls, I’ve always had to get the retention specialist on the phone to hear about offers (with any issuer). I thought that perhaps Mary didn’t know what she was talking about. I figured I’d give it another shot in a day or two.

Then, I saw this Milenomics post in the interim. It’s worth a read, but the gist of it is this: Robert (and several others) reported a similar experience – Citi’s front line reps seem to be able to see if you have any retention offers available. You still need to get transferred to a retention specialist in order to get the offers, but the front line rep can see whether or not they exist. This actually makes a lot of sense; it probably saves the retention specialists hours of time in not having to deal with the customers who have no offers. Retention offers themselves usually aren’t determined by the rep — the computer populates the offers. The rep can choose which one to offer you first (if the computer populates more than one), but they can’t make up an offer if one doesn’t exist. And so it makes total sense to let the front line rep know whether transferring your call is worth the time.

But of course that meant that I was disappointed to know that Mary probably did know what she was talking about after all. That said, Robert at Milenomics reported on an awesome retention offer I’d seen mentioned elsewhere recently, so I figured it was worth one more call.

AT&T Access More Retention Offer

You’ll note that one of the reasons mentioned above for keeping my Prestige card is that I pool with it the points that I earn from my AT&T Access More card. The AT&T Access More card is no longer available for new applications. For a long time now, it has only been available via product change. However, this past week I’ve received at least one report from someone who said he was told by a rep that product changes to the Access More card are no longer allowed. Whether that was a rep making up a story to explain something they didn’t know how to answer or it’s a true lockout on getting this card, I don’t know. Either way, I kinda felt like a fraud when I called the number on the back of my card and told the human who answered that I wanted to cancel my AT&T Access More Card.

I felt like she could see through my ploy. Who cancels the Access More Card? It earns 3x for online purchases. Sure, it’s a bit of a pain since not all online merchants code at 3x. But I think most people would be happy with 3x Amazon or eBay (even though you could probably buy gift cards for those merchants and earn a better category bonus).

Still, I explained that not all of my purchases are coding at 3x and as such I’m just not earning enough points on the card to keep it.

The rep put me on hold. This time, when she came back, she had a retention specialist on the line. Bingo! “George”, my retention specialist, saw me coming from a mile away. I told him I just wasn’t earning enough points and he said he’d take a look and see if there was anything he could do. He immediately sounded happy and said, “Oh, that’s a good one.” He went on to tell me that I had an offer to earn 2 additional Thank You points on all purchases (aside from cash advances/balance transfers/etc) for the next 6 months, up to 35,000 bonus points. Ding, ding, ding! Looks like a winner to me! That offer was the reason for my call, so I had half a mind to end it right then and there. But for the benefit of Frequent Miler readers, I pushed onward: “Are there any other offers available?” I kind of felt like a slimeball for asking, but wouldn’t I be thrilled if he came back with a 4x everywhere offer? Alas, he didn’t. He said that yes, there were other offers, but they weren’t nearly as good. He then gave me all three offers:

- 2 extra points on all purchases for 6 months, up to 35K bonus points (more simply: Spend $17.5K, get 35K bonus)

- Spend $3K in 6 months, get 10K bonus

- Spend $1K in 3 months, get 7.5K bonus

Mmmmmmmmmmmmmmnumber 1, please. He said, “Yeah, I knew that was obviously the best offer, that’s why I didn’t even bother with the other two.” I like the cut of George’s jib.

But he wasn’t done. After I said #1 was good and I’d keep the account open for that, George said he could do one better: he told me that they give him a bank of points to use and he hasn’t been using any of them today, so he could give me 1,000 points just for my “inconvenience or whatever”. I expressed my appreciation for George’s fine work, listened to him read the required disclosures, and wished him a great day….hanging up the phone in less than eight total minutes.

The truth is, I was already going to spend on this card. Getting two more points per dollar on top of the 3x online or just getting 2 extra points to once again earn 3x total on gift cards or Plastiq payments — it’s gravy. Just this week, I redeemed 15K Avianca LifeMiles (transferred from Citi) for a domestic United business class ticket with a (ridiculous) cash price of $500. With this bonus offer, spending just $3K online would replenish those points (3x online purchases + 2x through the retention offer). And it makes it nearly impossible to get rid of the Prestige card since I wouldn’t be able to transfer my points to partners without it. Basically, this is just an extra 36K points that materialized from picking up the phone. If I do the entire $17.5K spend at online merchants for 5x total, I’ll earn 87,500 points from that spend…which I’ll put to good use.

One more lesson: you don’t need a zero balance to get an offer

When I’ve made retention calls in the past, I’ve always figured that I needed to have a $0 balance (or just the annual fee unpaid if it just posted) in order to seem like a serious threat to cancel. I logged in to make sure my balance was $0 before making my call yesterday, but when I logged in I saw that I actually had a balance of nearly a thousand dollars for a bill that had been automatically charged to the card. I almost paid it right away — but then I wondered to myself whether or not it mattered (mostly because I figured I wouldn’t get a juicy offer anyway).

As it turns out, neither Mary nor George said a word about my current balance. Nobody attempted to call my bluff. Apparently, you don’t need a $0 balance to get a retention offer — which was news to me since I haven’t noticed that mentioned previously.

Bottom line

There’s a great (targeted) retention offer out there on the AT&T Access More card (+2X on all purchases for 6 months / up to $17,500 in purchases), and it’s an excellent reminder that it’s worth calling now and then to see how highly the bank values your continued business. It never hurts to be nice on the phone: my retention specialist even kicked in an extra thousand points for the heck of it. It just so happens that front line Citi reps can now tell whether or not there will be any offers for the retention team to offer you, saving you at least a little time (but remember that you should not tell the automated system that you want to cancel, but rather tell the computer that you’d like to speak to a representative about your account until you get a human on the line, lest the automated system close your account immmediately). Finally, I learned that you don’t need to have a $0 balance to get a retention offer, which saves me a step in logging in and paying the bill before my next call — and you’d better believe that after 36K easy points, there will be more calls to come…

[…] the card offers an extra 10K points when you spend $10K or more in your cardmember year. The great retention bonus I got on this card this year meant that I easily hit that requirement for my 2018-2019 cardmember year, but even without that […]

[…] will code that way). I’ll use mine to pay for my wife’s treatment(s) as I also have a good retention offer for an extra 2x, which means I might earn 5x. Together with 10% back, I’ll be happy with […]

perfect timing for this post – I’m in the same exact boat as you – just tried for Citi Prestige retention offer and got nothing – let me try on my AT&T Access More card – Thanks so much!

nick. nice post, but let me clarify a few things.

1) citi has always had a front line retention flagging/referral system. knowing this, i spend NO TIME speaking with the front line agent. even south dakota prestige. the computer handles everything. you must be “eligible” for retention dept transfer. so you ask for exactly that. its not about being a “fairly charismatic guy on the phone”. if the system does NOT flag you, you dont get transferred. front line dont see jack shit. they have no idea what offers are available. sometimes you get a very high level manager that can see the retention screen and may even bust it out on the spot. that is very rare. its all algo based. so u say “Im thinking about canceling my card, but first, please check if i am eligible for retention as that will further solidify my decision”. thats it.

2) do NOT ever think ur strategy of retention w/ “$0 balance (or just the annual fee unpaid if it just posted)” is wrong. its YMMV. it depends on who you speak with, their level/experience and wat bank. this is where your “fairly charismatic guy on the phone” will play here. let me tell you that so MANY damn abusers play the game now that Amex RAT retention team or “amex membership consulting services” as they are called now, got super smart. they have screens that call your bluff. so u call retention and “pretend” like you want to cancel, but its clear from your CC use behavior that you are just loving that shit and having a shitload of good steamy sex with your CC and licking the plastic every night. Retention will ask WTF is this shit. especially if you keep using your airline credits and uber credits and FHR and etc etc. “so you want to cancel a CC that you love using????? umm….” yea thats not a good look. in the case of Citi, their IT is shit. their screens probably have pr0n on it. they cant tell jack.

there is much much more i could say, but will just leave it here.

Say more I always take 50 opinions then do what I’m willing to pay for.

CHEERs

The Access More being unavailable by product conversion is real, based on my experience dating as far back as Oct 2016. I tried six times over six months (the first time was only a week after Stefan at Rapid Travel Chai told me he successfully converted his), from different kinds of cards (AA Bronze, Double Cash, Thank You Preferred). I was eligible for conversion to plenty of other cards, but never the Access More, and one rep told me explicitly that they no longer perform conversions to that card.

Odd. Here’s a post from someone who did it in March 2017:

http://www.milesfortwo.com/2017/03/30/converting-citi-ty-premier-att-access/

And here’s one from when Grant did it in January 2018 — which might include the workaround you need:

https://travelwithgrant.boardingarea.com/2018/01/25/convert-any-citi-card-to-the-citi-att-access-more-credit-card/

I know I’ve talked to others who have PC’d more recently than Oct 2016.

Those are great contra DP though, good to know. Thanks. Will look at Grant.

IvanX. its YMMV and its system generated. no idea whats specifically stopping u but its still possible. too many people are doing it. matter of fact, i feel citi may devalue the AM CC soon. but i have no idea what is up with ur situation dating back to 2016.

Thanks NinjaX. Are you my cousin?

probably. most likely.

I was told I had to convert to the Access card before converting that to the Access More card. I was able to convert my AA card to the Access card, but I decided to hold off converting to the Access More card due to its $100 year #1 AF. I would need to spend quite a lot to make up $100 on the 3x hit-and-miss online category vs. 2% CB. Plus I already get 5% CB from Amazon and Gap (our biggest online purchases) via their store cards. I guess I just don’t get the excitement over the ATT AM card.

“(but remember that you should not tell the automated system that you want to cancel, but rather tell the computer that you’d like to speak to a representative about your account until you get a human on the line, lest the automated system close your account immediately)”

Um, yeah, that’s what I did before and then had to call back and have my Citi card reinstated, LOL. Pain in the butt, but at least I saved it.

Thanks for the post, just got the same 35,000 points offer on my AT&T Access More card 🙂 My annual fee posted over 3 months ago, so you can call anytime, really 🙂

Thanks for the post, Nick. I’ve also never been successful at a retention call myself, either on cards where I put an enormous amount of spend and where I put none at all. I really can’t figure out why – is it because I”m sometimes carrying a balance? I really wish we had some data points on how they do the math of who is a valuable customer they want to retain.

Also re: the other comments, these banks are huge, profitable enterprises. They’re making money off of you; I recall frequent miler posting a link to an article about Amex charging someone an annual fee for 18 years for absolutely no miles, points, or perks whatsoever, and then not even offering a retention bonus. The only reason they offer miles, points, and other perks is if it makes sense for them to do so financially. They’ll do anything to increase their bottom line, so playing within their rules is just doing what they do. As long as I’m not violating their T&Cs, I have no qualms myself.

Can you please mention what your annual spend was on each card? (I assume it is a factor in whether or not you get a retention offer…If not, what do you think the reason might be you get or do not get a good offer?)

I can’t answer for Nick, but I will point out that I have several no-fee Citi ThankYou cards and I frequently get retention offers for them even though I never use them for spend.

My approach is to call (about once per year) about one card and then say something like “I have a few other Citi cards, can you check whether they have retention offers?” Then we go through them one by one.

Just saw the Doc 10 mins ago he’s going to drop his Delta Amex I think $500 card for the Prestige card. He had to go to a Medical Convention and Delta Really jacked him around AT the airport and the NEXT day AT the airport . So he canceled the flt and got cash back and took SW last min $330 .Delta hater like me now make it simple airlines we need EU rules here …I’m sure he could’ve gotten something from Citi ..

CHEERs

I called yesterday and got offers #2 & #3 and another, smaller, offer. I was looking for a reason not to cancel the card since I value the price protection and 2 year warranty, and since I already have 0% Plastiq payments scheduled for over $3k, decided to keep it and accept offer #2. I spent probably $15k on it last year.

I always Feel like a Slime too ball when I got a great deal and wanted more . But thanks for ur post my reup is in Aug I’m keeping the card but I’ll do what u did ..A retention person keep me @ Citi and I really was going to cancel the AA personal card but she gave me 5K points for the $95 reup fee so = …10 months from now I’ll cancel the AA Biz card and keep the AA personal .

CHEERs

Good for you. I called Barclay yesterday because my Aviator annual fee posted. The last couple of years, they’ve mailed flyers with retention offers. Nothing this year. The first rep sent me to a retention specialist who said the only offer is to be entered into a sweepstakes for trips to New York or somewhere else I don’t remember. Both destinations include coach airfare, hotel and a gift card for spending $. The NYC trip includes $2K.

My Chase Sapphire Reserve posted the other day. After being shut down and reinstated, I’ll skip any retention calls this year.

background story on the shut down please.

I was way past 5/24, already had 2 Ink Cash, Hyatt, IHG, Freedom, Freedom Unlimited, and Sapphire Reserve… and applied for an Iberia card. Got instantly approved for >$20K credit limit.

Two days later, all of my accounts are shut down. I called and was told too many new accounts. They sent my case for review. Seven days later, all accounts are reinstated, including the new Iberia card.

I haven’t MSed in about 2 years and just do regular spend. I really do try to do some spend on even my sock-drawer cards. I think that helped get me reinstated.

really glad u got reinstated. its highly likely that u didnt look like an abuser and they had no reason keep u shut down. dont bother with CSR retention. nobody is getting anything. maybe a few points only. thanks for the info.

“I kind of felt like a slimeball”…. You said it yourself. While I value tips and legitimate points earning opportunities, I am disgusted by this post. Blatantly bragging about one’s deceit is loathsome enough but instructing it??? You deserve the walk of shame, shame, shame.

An unnecessarily harsh assessment.

You should never feel bad taking advantage of an offer any of these card issuing banks is making you.

I know its been about 10 years, but never forget the messed up stuff the slimeballs at these banks were doing.

If they’re making you an offer, its because they believe they will come out ahead in the end. As long as you’re not lying (saying “I’m considering cancelling” is not lying) then you’re fine.

useless, should keep to yourself

Ohhh my God!!! Ebg is so disgusted. Now get the F outta here.

Ah yes, asking if there are any other offers available is “deceit” and shameful. One should politely pay the bank the annual fee on all cards, year after year until one becomes impoverished! Such is the honorable way!

Glad to hear you got the offer too. My wife got it as well.

One thing I noticed along the way was that you can use Citi’s Chat feature to ask them whether you’re eligible for offers. I thought this might be a short-cut to decide whether it was worth *our* while to get on the phone. However, the chat agent dutifully told us that no offers were available when in reality they were avaliable. I think they were wrongly checking whether spend bonuses were already applied to the card(s) rather than whether we were eligible for retention bonuses.

Also, although I’ve heard datapoints that some Preferred cards are getting the same 35,000 offers I was 0 for 2 on that one.

So no love for Citi Prestige? Did you keep it?

I did keep it for now. Two problems with cancelling the Prestige card: #1) I wouldn’t be able to transfer to partners (Avianca has fit my needs terrificly as of late). #2) I would lock myself out of a signup bonus on either the Prestige or Thank You Premier for 2 years if I cancelled my Prestige without first opening a new account. (A third problem would be the points earned from my Prestige expiring 60 days after closing and having no way to separate those points from points earned on the Access More…though for that reason, I’d downgrade the Prestige rather than cancel probably).

Truth be told, I have considered closing the Prestige since they aren’t paying out on missed connections (for trip delay) and so many benefits have been trimmed. While I have used the 4th night free a handful of times and I feel like I’m ahead on the card overall at this point, I haven’t used it this year and have no plans to do so in the next year. Part of me has considered opening a Premier and dumping the Prestige. I assumed they would give me a retention offer that would tip the balance in favor of keeping the Prestige. I was surprised when they didn’t. This offer on the Access More certainly helps.

I’m very much in the same boat. $350 AF, rarely use the 4th night. Aside from the travel credit I’d never put real spend on the card since I value the CSR’s rewards more.

However, like you, I do use the AT&T Access More A LOT and value the transfer partners, especially the periodic bonus on JetBlue that’s 1:1 or greater (stacks amazingly well with the JetBlue plus card’s unlimited 10% points back redemption bonus to give a floor of ~1.6 CPP on basically all flights).

Prestige AF posts in a couple weeks, disappointed to hear they weren’t offering retention offers even after the cuts.

You can downgrade to the $0 AF ThankYou Preferred without resetting the 24 month clock (keeps the same card #) and does not start a 60-day expiration of your ThankYou points. Of course, you lose the 1.25 multiplier on any bookings through their OTA

If you downgrade to the Premier you keep your same account number and points, and still maintain your points. It is an option I am considering with the recent Prestige fee increase and fourth night free devaluation.