NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

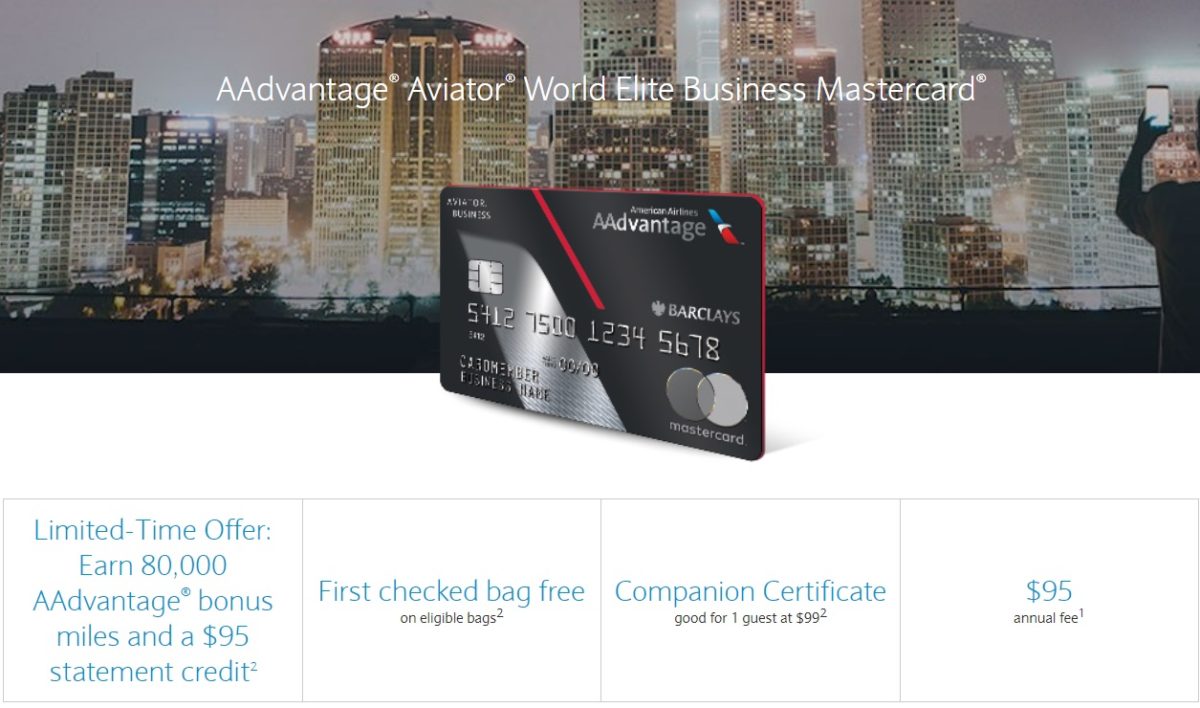

Earlier this year the AAdvantage Aviator Business MasterCard disappeared from the Barclays website. That initially didn’t bode well for the future of the card, but it returned with a solid welcome offer a couple of months ago giving up to 70,000 miles.

That offer has now not only been bumped up in terms of how many miles you can earn, but you get a $95 statement credit too.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $-95 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available to new applicants$95 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 2/6/23: 80K miles + a $95 statement credit after $2K spend in first 90 days. Earning rate: ✦ 2X AA, office supply, telecommunications services, and at car rental agencies ✦ 1X everywhere else Card Info: Mastercard issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: $99 companion certificate with $30K account year spend Noteworthy perks: ✦ First checked bag free ✦ Preferred boarding ✦ 5% bonus on miles earned the previous year after AF is paid ✦ 25% statement credit on in-flight purchases |

Quick Thoughts

The most recent welcome offer on this card gave up to 70,000 bonus AAdvantage miles – 60,000 when spending $1,000 within the first 90 days and an additional 10,000 miles by adding an employee card and making a purchase on it.

This new offer is better on a few counts. Not only does it award more bonus miles overall, but it doesn’t require that you add an employee card and make a purchase on it. This new offer also comes with a $95 statement credit which effectively waives the annual fee for the first year.

A key difference with this new offer is that you have to spend $2,000 within 90 days rather than only $1,000 with the previous offer. $2,000 is still a fairly low minimum spend requirement compared to other welcome offers though.

Another benefit of this card is that it’s a business card which means it won’t add to your 5/24 count with Chase. I’m currently 4/24, so it’s tempting to pick up one of these to earn some easy AAdvantage miles as I recently redeemed a bunch of them for a trip early next year.

Be aware that the bonus miles you earn don’t earn a corresponding number of Loyalty Points, so meeting the minimum spend requirement sadly won’t also earn you 80,000 Loyalty Points which would otherwise be more than enough to get you Platinum status with American Airlines. However, your base spend on the card does earn you 1 Loyalty Point per dollar and so cards like these can still help you earn AAdvantage status.

Hi, the application gives me an error for not entering a “Trading Name” is this a ticker symbol? I’ve never seen this asked before.

I called the direct number Barclays c/s gave me, along with the app # they provided: 866.383.7495.

The rep told me to fax in some info, & I s/b good to go! I have 3 other Barclays Wyndham cards (2 personal & 1 biz). I make sure & put some spend on all. My prev Aviator account has been closed only just over a year so very good news!

Just said No after about 3 calls and an hr on ph. I have the personal card to close to bus card to give it to me. I’m a SP so same name but did offer to raise credit line as in No Thanks..

I love AA points great for ATH and SYD, Cheap non-stops..

Good Luck the first time in 10 years they said No !!

Am I eligible for this card’s bonus if I still own a personal Barclays Aviator and my business is under the same SSN?

Any idea how long this offer is valid until?

Is there a retrial bonus if I already have the card and want to refer P2?

Sorry that’s supposed to be referral bonus.

I’m not aware of one being available.

Just picked this up and the application was so easy. thank you!

Got an invite but, only allows me to put in revenue numbers less than $10M – tried different browsers – anyone else have the same issue?

I closed this same card 4.21 & just applied again thru FF’s link. It says my app is under review so we’ll see but not an immediate denial, either.

Let us know if they give you the bonus!

is a shame that Barclays has recently been cracking down and not approving apps within 24 months of same card closure.

FYI: if you had this card and closed it within the past 24 months, you’re ineligible for the bonus. I just realized I got this card in 2019, closed late 2020, so not eligible for the bonus.

I have an email from 2019-March-04 saying I am approved for this card, so I am fairly certain it has been just past 2 years for me. I did not keep good records of when I cancelled, but I can probably find that info somewhere. Not a bad offer at all with the $95 back, but I am going to wait a month or so to give myself a bit more cushion (and I am currently working on a different SUB).

You should probably start using a churning tracker spreadsheet. This is a good template: https://www.reddit.com/r/churning/comments/9430cv/churning_tracker_spreadsheet_template/

I actually have a sheet where I keep track of this kind of stuff, but obviously it is only as good as the info entered. I tend to pay more attention to bonus spending categories and opening dates than I do closing dates, but I do have a column for close date and just did not bother to populate it. I will blame Mar/Apr 2020 on having my mind elsewhere given the state of the world.

Thanks for this link, that appears to be a much more well thought out and comprehensive option than mine.

Does Barclays match to a better offer , just applied for this card a few weeks ago

It’s always worth contacting banks in circumstances like yours – the worst that can happen is that they’ll say no.

I tried calling and securing messaging and was denied a match. Was anyone else able to secure a match to the new offer? Doctorofcredit has a few DPs from 2018 with Barclays matching better offers but nothing since then

Same here I was denied 🙁

How often can you get this card? Can you hold two at once? Thanks!

Have to wait 2 years after closing the last one. Not sure about multiples.

The terms state “Existing accounts and previous cardmembers with accounts closed in the past 24 months may not be eligible for this offer.” It’s therefore unlikely that you’ll get approved, but a strict interpretation of those terms suggests that it might be possible.