The new Sapphire Reserve for Business℠ Card is out with a huge welcome offer which requires a huge amount of spend. In this post I’ll help you understand why you may be eligible even if you don’t think you have a business, plus I’ll show step by step how to apply. Finally, I’ll add some thoughts about how to meet the card’s huge spend requirement.

Current Offer

This display is kept up to date with the most current offer and basic info about the Sapphire Reserve for Business card:

| Card Offer and Details |

|---|

ⓘ $1595 1st Yr Value Estimate$300 travel credit valued at $285, $500 Chase The Edit credit (2x per calendar year) valued at $125, $100 GiftCards.com credit ($50 Jan-Jun and again Jul-Dec for cards purchased from https://reservebusiness.giftcards.com/) valued at $50 Click to learn about first year value estimates 150K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 150K points after $20K spend in first 3 months.$795 Annual Fee Recent better offer: 200K points after $30K spend in first 6 months. (Expired 1/22/26) FM Mini Review: Could be very appealing for a business that books a lot of travel, as it earns 8x through Chase Travel℠ or 4x when booking direct through airline and hotels. It has decent perks, best-in-class travel protections, and earns valuable Chase Ultimate Rewards points. Best when paired with no annual fee Chase Freedom Flex, Freedom Unlimited & Chase Ink Cash cards Earning rate: 8X Chase Travel℠ ✦ 4X flights and hotels booked direct ✦ 3X social media and search engine advertising ✦ 5X Lyft (through September 2027) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: After spending $120,000 each calendar year, get the following benefits: IHG One Rewards Diamond Elite Status ✦ Southwest Airlines A-List Status ✦ $500 Southwest Airlines credit when booked through Chase Travel ✦ $500 credit to The Shops at Chase Noteworthy perks: $300 Annual Travel Credit ✦ Up to $500 The Edit credit ($250 twice per calendar year) ✦ Up to $400 ZipRecruiter credit ($200 January to June and again July to December) ✦ $200 Google Workspace credit ✦ $100 Giftcards.com ($50 January to June and again July to December for purchases at giftcards.com/reservebusiness) ✦ Points worth 2 cents each towards qualified bookings through Chase Travel(SM) ✦ Transfer points to airline & hotel partners ✦ Primary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft credit See also: Chase Ultimate Rewards Complete Guide |

Are you eligible if you don’t have a business?

The Sapphire Reserve for Business is a small business credit card. You must have a business to apply. That said, almost everyone does something that can be legitimately considered a business. Legitimate businesses include selling things on eBay or at yard sales, business consulting, being an aspiring musician or author, owning rental property, driving for Uber or Lyft, etc. The list is endless.

How to apply as an individual

If you don’t have a formal business, but you do have some kind of business activity as described in the previous section, you can apply for a business card as a sole proprietor. There are no legal or tax repercussions to declaring yourself as a sole proprietor.

How to apply step-by-step

1. Click through to the application page

If you are being referred by a friend or family member, they’ll send you an application link. Otherwise, you can find the application link near the top of our Sapphire Reserve for Business page. At the time of this writing, we have an affiliate relationship with Chase and so using our link will help us out, and we appreciate that! The link is titled “Click here to learn how to apply” and, after clicking it, you’ll still need to make your way through a couple “Apply Now” buttons to finally get to the actual application page which says “Let’s get started”. Visit our Sapphire Reserve for Business page to find that link.

2. Authorizing info = owner

The first question asks for your “Authorizing info.” They want to know your role in your business. If you are a sole proprietor, select “owner.”

3. Personal details

You should be able to fill out the personal details, identification, home address and contact info sections without any help from me. These are the same answers you would put on any personal credit card application…

4. Financial info

This is asking for your total income, not just your business income. For example, if you earn $50,000 from a full time job, and you expect to also bring in $10,000 income from your side business, you would enter $60,000.

5. Business structure = “sole proprietorship”

If you are a sole proprietor (an individual without a formal business), select “sole proprietorship.”

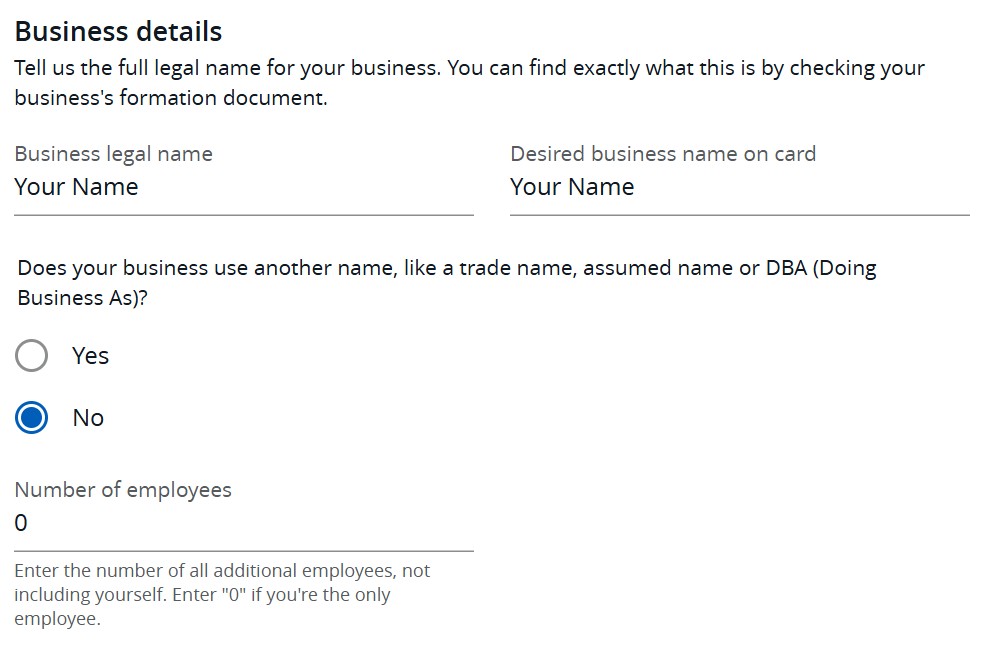

6. Business details = your name, zero employees

If you don’t have a formal business, I recommend using your own name as your business name. If you don’t use your name as the business name, you may be asked to provide evidence that you own the business or that you’ve registered the business. Enter “0” for the number of employees, not including yourself.

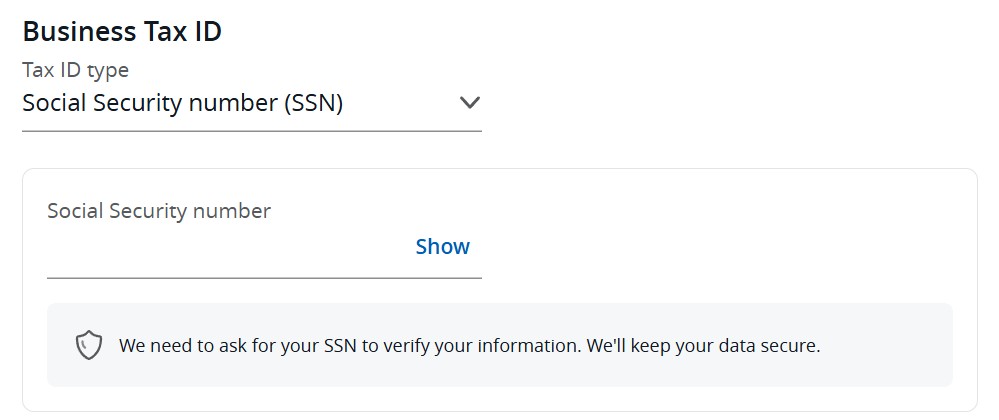

7. Business tax ID

You can use your personal social security number (or ITIN if you don’t have an SSN); or you can get a business tax ID (EIN) from the IRS. For most sole proprietors, the easiest option is to use your personal SSN or ITIN.

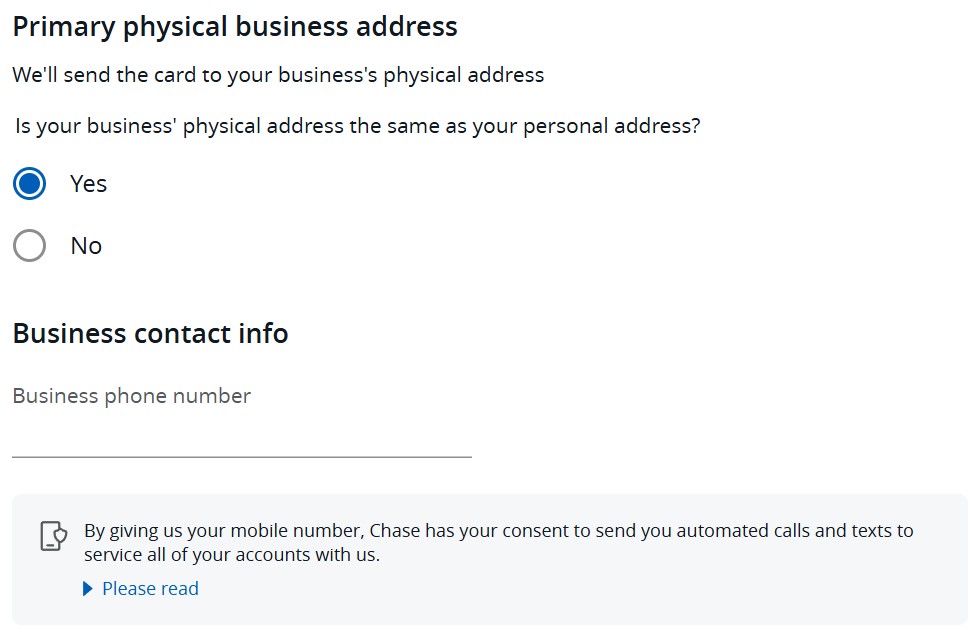

8. Business contact info

For your business contact info you can use your home address and you personal phone number. Chase makes using your home address really easy because you can simply select “Yes” to say that your business is at the same address:

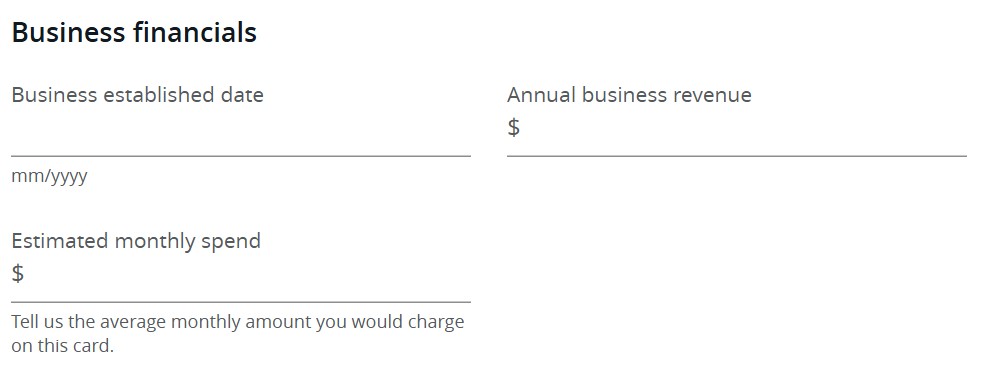

9. Business financials

Here’s how to answer this section:

- Business established date: When did your business start? If you’ve been doing your business for years (selling stuff at yard sales, for example), it’s fine to estimate the starting date. While having a long established business is helpful, it’s also fine to enter a very recent date if you just started your business last week.

- Annual business revenue: $0 (or project an amount based on expected revenue)

- Estimated monthly spend: $3,000 (Use your judgement here. A higher number might lead to a larger credit line, but if it’s too high it might negatively affect approval).

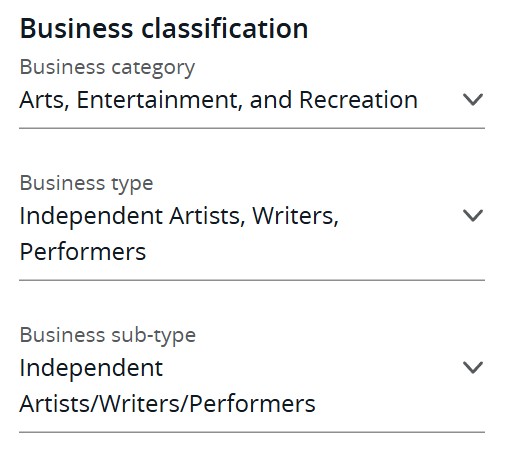

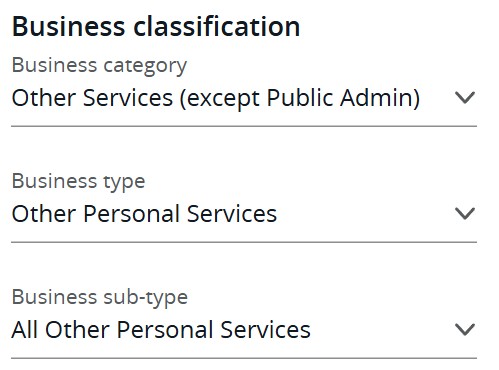

10. Business classification

Try your best to find a classification that makes sense for your business. Here’s an example of what you might select if you’re an aspiring author or artist:

And here’s what you can select if none of the drop-down options are remotely close to what you do:

How to improve your chances of success

The following tips may help with approval, but none are required:

- Apply for a Chase business checking account

- Use an EIN instead of your SSN when entering your Business Tax ID on the application

- Do not call if your application goes to pending

- Call if your application is denied

Below you’ll find more info about each of the above suggestions:

Apply for a Chase business checking account

After opening a business checking account, you are likely to receive pre-approved offers for business cards. Go for it. While pre-approval doesn’t ensure final approval, in this case it does make it very likely.

Make sure to be prepared with necessary documentation and identification. Chase has a checklist here for sole proprietorships. You’ll see that you may need an Assumed Name Certificate, often referred to as a DBA (Doing Business As). Usually, you can get the certificate by registering your business name with either your local or state government for a small fee.

Use an EIN instead of your SSN as the business Tax Identification Number

To apply for a business credit card, you’ll need a business Tax Identification Number. Sole Proprietors can use their own social security number as the business Tax ID or they can use their company’s EIN. While either will work, it can’t hurt to have an EIN and may help give your business more credibility. You can sign up for an EIN, for free, from the IRS: Apply-for-an-Employer-Identification-Number-(EIN)-Online.

Do not call if your application goes to pending

When applications go to pending, people frequently find that they get approved without calling. When people do call, they may get tough analysts who deny the application.

The approval process goes through up to 3 “gates”:

- Instant Approval (this is rare with Chase business cards)

- Automatic Approval, sent by mail and/or email (may take several weeks)

- Analyst Phone Approval

If you’re not instantly approved, then calling bypasses gate 2 and may reduce your overall chance of approval. Instead, I recommend waiting to get an approval letter. Hopefully it will say “congratulations”.

Of course, if Chase contacts you asking for more information, you absolutely should talk to them on the phone. In some cases they’ll simply need more information about you or your business before your application can go through the next review stage.

Call if you are denied (and call again)

If your application is outright denied (either instantly or by mail), then call Chase’s business reconsideration number (800-453-9719), which is open Monday through Friday during business hours. There are many cases where analysts have overturned denials over the phone.

The analyst will likely ask a lot of questions. Make sure your answers match your application. Also, if you have multiple Chase business cards, make sure to let the analyst know that you don’t need Chase to extend you more credit. Tell them that you are willing to move available credit from another card or to cancel another card if necessary. Be prepared to answer financial questions about your business. Be prepared to answer questions about why you want the card and how you expect to use it. There is absolutely nothing wrong with saying that you were attracted by the welcome bonus.

If the analyst doesn’t approve your application, call again. Many people have had luck simply calling a few times until the reached an analyst willing to take a chance on their business.

How to meet spend requirements

Is personal spend allowed?

At the bottom of the application, you are asked to check the box that says that you’ve read and agree to the terms. One of those terms is “This is a business account which shall be used only for business purposes and not personal, family or household purposes.” For many/most sole proprietorships, though, there’s no clear line between business and personal expenses. If you’re an aspiring writer, for example, you may need to travel, eat, or in myriad other ways experience life in order to gain inspiration, ideas, and information for your writings. Further, if you accidentally put personal charges on your business credit card, there are unlikely to be any negative repercussions: There are no laws against using business cards for personal expenses and there are no tax repercussions for doing so.

How to meet minimum spend

At the time of this writing, the welcome offer for the Sapphire Reserve for Business card has a huge spend requirement. Obviously it can help to put all of your expenses on the card. For things that can’t usually be paid by credit card (taxes, utilities, tuition, pet sitters, etc.), it’s often possible to use a service to make the payment by credit card for a fee of up to 3%. While I wouldn’t normally advise paying 3% fees to use credit cards, it absolutely makes sense when you need to complete large minimum spend for a welcome offer.

Check out these posts for more details:

- How to pay taxes via credit card

- Melio: Pay business bills by credit card

- Plastiq Guide: Pay Bills via Credit Card

- Guide to increasing credit card spend

You can also make charitable contributions or charitable micro-loans via credit card. See these posts for details:

Applied for CSR Business card on June 23. Received a rejection letter via Secure Message on June 24. Called Chase Business Reconsideration Line on June 25, and was told the application had not been rejected but was pending. While I was on the phone with them, received an email from Chase requesting additional information/documents for reviewing my application. Specifically, driver’s license (proof of physical address) and social security card. Provided those via Upload link on June 25. Have not received anything back from Chase since. When I call Chase, I’m told the application is still “under review.” I have not yet pushed to speak with someone on the team reviewing it. (Have hesitated to do so, given Greg’s counsel to be careful not bypass a potential automatic approval but to instead wait to get an approval or denial). It’s now July 28. Should I continue to wait? Or is it time to push to speak with someone reviewing the application?

Thanks Greg. Just used your links. And I was instantly approved for the New CSR Business card following your exact steps. I made sure to match business details used in last year’s application and approval of the Ink Bus Preferred (Freedom Unlimited was opened at the same time). I did ensure to be well under 5/24 and waited 3 months after earning the recent CSP bonus earlier to have a greater likelihood of approval. Thanks Again, Nick & Greg!

Congrats!

Anyone have datapoints for applying while having multiple Chase Business cards?

Recently got under 5/24 and I have three inks, got denied for #4 last year (“applying too quickly”) and debating if closing one will help or hurt my odds at a CRB.

I applied for the new CSR bus, received the under review message, then received the denial letter, called reconsideration and denied again. I have 5 chase business cards – 3 Ink, the Hyatt and IGC. Reason for denial was recent chase bus card opened, too many active accounts / available credit on consumer report and too many recent requests for credit. I’m considering closing two of the Ink cards and calling reconsideration again before the 30 days is up. (I’m 3/24)

Oh damn, I only have 2 chase biz, (also 4/24), should be fine, right?!

I am 5/24 and was approved. This is my 4th case business card and the second chase card I got from chase since April. The put the application under review, then called and me moved some credit from one card to this one and it was approved.

I heard on a different points podcast recently that if you have an LLC and put personal expenses on a business card those can be considered part of the business and “gone after” in the event you get sued. Do you know if this is true? It sounded questionable to me but made me a little nervous about putting house taxes on a biz card (even though I run my LLC from home).

Sorry I don’t know one way or the other about that.

What’s everyone’s experience been applying while above 5/24?

I got denied after getting “pending” at 7/24 and didn’t bother doing recon… yet.

I got approved while over 5/24

I was denied at 7/24 (with two of them only a month and two months from 24). Called reconsideration and told 5/24 was a firm policy and disqualifying, even for the new card issuance. I mentioned that there were several reports of people being approved at greater than 5/24 and representative insisted this was a non-waivable policy. Is it worth HUCA or hopeless at this point?

I haven’t heard one way or the other whether recon will help in this situation. It can’t hurt to call (except for your blood pressure, I guess)

Doc found out cff no longer accepting applications but select referrals still work

I chose to apply for the Ink Preferred card last week. I have a person CSR and may cancel that in Oct 2026 when the AF balloons to $800. The Preferred card, if it doesn’t get nerfed by then will give me partner transfers for $95 a year and in the short term 90k UR for “only” $8000 in spend.