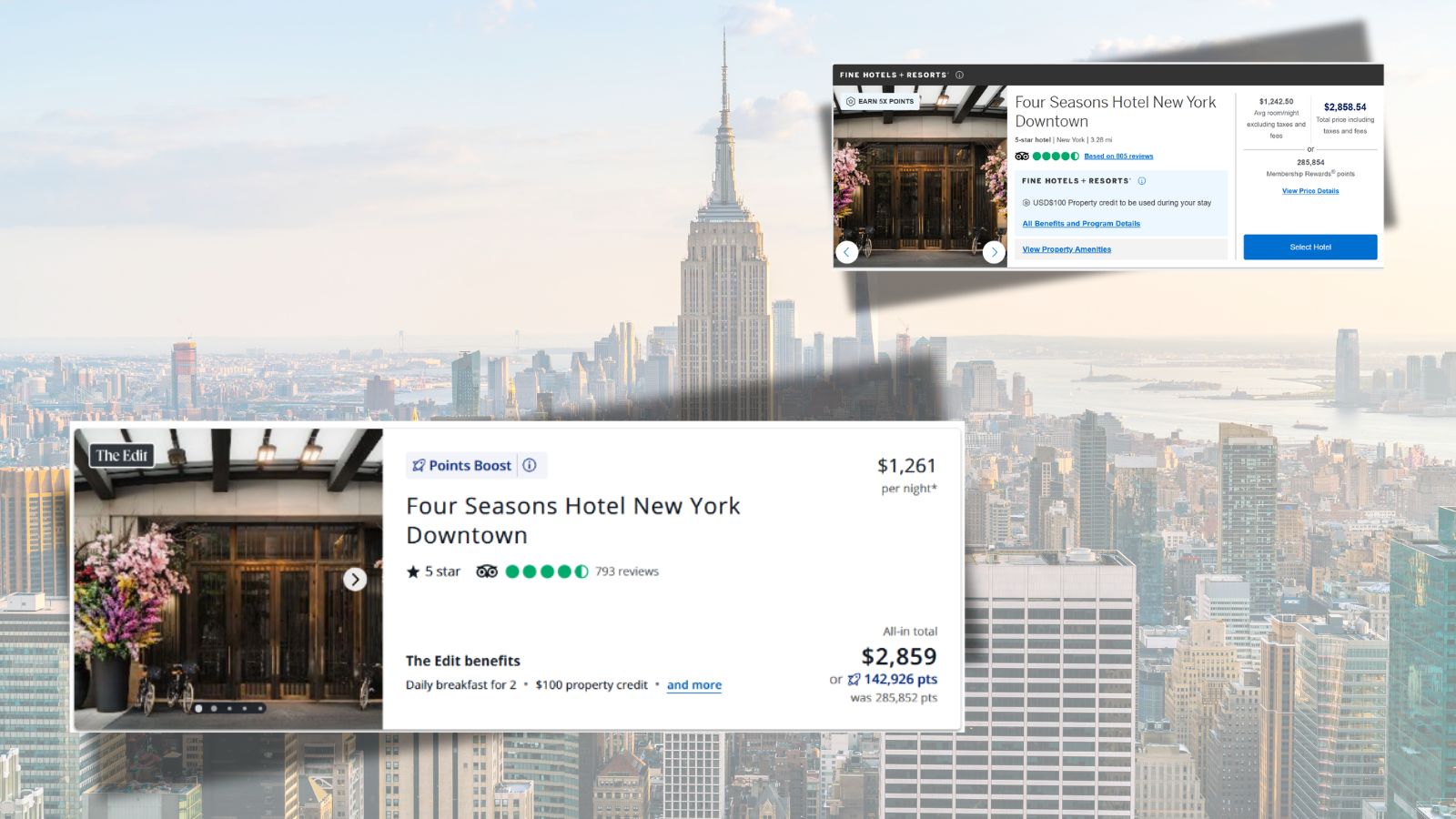

Chase recently made a significant negative change to The Edit by Chase Travel℠, Chase’s luxury hotel program for Sapphire Reserve® customers. Instead of offering a 2x “boost” for all of The Edit hotels, they now offer “up to 2x”. When paying with points, you’re no longer guaranteed to get 2 cents per point value with The Edit. Instead, many hotels are showing 1.65x boosts. In light of that change, I wondered if something good might have come from it. For example, maybe they lowered prices or added more hotels to their program. I don’t have much data from before the change, so I couldn’t do a direct before-and-after comparison. Instead, I matched The Edit against Amex’s hotel collections to see how it now looks in a head-to-head comparison…

Overview

To answer several questions I had about The Edit and how it compares to Amex’s Fine Hotels + Resorts® (FHR) and The Hotel Collection (THC), I searched for hotels in both programs for a specific weekend (May 15-17, 2026) and across two cities: New York and London. Results can be found in the answers to each question below. First, though, here’s a quick comparison of the programs:

| Perk | The Edit | FHR | THC |

|---|---|---|---|

| Room upgrade | When available | When available | When available |

| Daily breakfast for 2 | Yes, at many but not all properties | Yes | Yes, at some but not all properties |

| Property credit per stay | $100 | $100 | $100 |

| Early check-in | When available | When available | When available |

| Late check-out | When available | 4 PM guaranteed | When available |

| Premium card rebate | $250 twice per year | $300 every six months | |

| Rebate minimum stay requirement | 2 nights | 1 night | 2 nights |

| Point value towards stays | 1.65 to 2 cents per point | 1 cent per point | 1 cent per point |

Did Chase add many more hotels to The Edit?

One of my biggest criticisms of The Edit has been that it has a much smaller collection of hotels than Amex does. In many medium-sized cities, I haven’t found any qualifying hotels. My hope with the Points Boost change was that it was driven by the realities of adding many new hotels, some of which would be less profitable for Chase. So, did Chase add many more hotels?

Answer: Not really, no.

At the time of this writing, Chase’s website shows that The Edit includes 1,402 properties. When we wrote about how to find that information and a list of eligible hotels (here) on November 14th, there were 1,371 eligible properties. Since then, the list has grown by 2.2%. That’s better than nothing, but it’s not enough to justify lowering the Points Boost on many properties.

Are many hotels boosted less than 2x?

I wouldn’t worry too much about the new 1.65x boosts if they only affected a small percentage of Chase’s catalog. Unfortunately, I found that around half of the results across New York and London were boosted at only 1.65x.

- Across New York and London: 73 hotels

- 1.65x boost: 39

- 2x boost: 34

- New York City: 44 hotels

- 1.65x boost: 25

- 2x boost: 19

- London: 29 hotels

- 1.65x boost: 14

- 2x boost: 15

Answer: Yes, approximately half of the hotels I looked at were boosted at only 1.65x.

Did The Edit gain ground compared to Amex’s hotel collections?

Chase may not have added many hotels overall, but they may have rebalanced their portfolio to look better in head-to-head comparisons with Amex.

Answer: Nope (at least not in New York or London).

Here are the number of eligible and available hotels that I found for the weekend of May 15-17, 2026:

- New York City

- Chase’s The Edit: 44 hotels (19 with 2x boost, and 25 with 1.65x boost)

- Amex: 73 hotels (34 Fine Hotels + Resorts, and 39 The Hotel Collection)

- London

- Chase’s The Edit: 29 hotels (15 with 2x boost, and 14 with 1.65x boost)

- Amex: 84 hotels (39 Fine Hotels + Resorts, and 45 The Hotel Collection)

In both cities, Amex offers far more available hotels than Chase. When looking only at Fine Hotels + Resorts, though, Chase has more eligible properties in New York (this was true in June 2025, too). However, In London, Amex’s Fine Hotels + Resorts alone includes more than twice as many hotels as The Edit

Are Chase’s prices competitive with Amex’s prices?

Maybe the reduced Points Boosts were introduced to make room for lower prices? If so, I’d expect Chase’s prices to be competitive with Amex’s…

Across the 73 hotels available through The Edit in New York and London, 47 were also available via Amex’s Fine Hotels + Resorts (FHR) or The Hotel Collection (THC). I did head-to-head price comparisons with those 47 matching hotels:

| Same Price | Amex Cheaper | Chase Cheaper | |

|---|---|---|---|

| Total | 25 (53%) | 18 (38%) | 4 (9%) |

| FHR | 14 (47%) | 13 (43%) | 3 (10%) |

| THC | 11 (65%) | 5 (29%) | 1 (6%) |

| New York | 19 | 8 | 3 |

| FHR | 10 | 4 | 2 |

| THC | 9 | 4 | 1 |

| London | 6 | 10 | 1 |

| FHR | 4 | 9 | 1 |

| THC | 2 | 1 | 0 |

The data shown above made it possible to answer the following questions:

How do prices compare overall?

About half of the time, prices matched either exactly or within $15. That’s better than I expected for Chase. However, when prices were different, Amex was much more likely to have the lower price. Amex’s prices were lower 38% of the time, whereas Chase’s prices were lower only 9% of the time.

Does the answer differ whether the hotels are part of Fine Hotels + Resorts or The Hotel Collection?

Given that Fine Hotels + Resorts (FHR) includes many more perks than The Hotel Collection (THC), it seemed to me likely that Chase’s prices would be more competitive with FHR than with THC. The actual result, though, was the opposite. In 3 out of the 4 times where Chase was cheaper than Amex, the hotel was part of FHR. Of course, with numbers this low, the difference is just as likely to be a fluke.

Answer: No.

Are Chase’s prices better when the Points Boost is lower?

It would be reasonable to expect that hotels with lower Points Boosts would be more competitively priced than those with 2x boosts. Surprisingly, the opposite seems to be true. With 2x Points Boosts, I found that Chase had the same or better prices than Amex 70% of the time. With 1.65x Points Boosts, though, Chase had the same or better prices than Amex only half (52%) of the time.

Answer: No. In fact, prices seem to be better with 2x boosts!

| Same Price | Amex Cheaper | Chase Cheaper | |

|---|---|---|---|

| Total | 25 (53%) | 18 (38%) | 4 (9%) |

| 1.65x Boost | 9 (43%) | 10 (48%) | 2 (10%) |

| 2x Boost | 16 (62%) | 8 (31%) | 2 (8%) |

| New York | 19 | 8 | 3 |

| 1.65x Boost | 6 | 6 | 1 |

| 2x Boost | 13 | 2 | 2 |

| London | 6 | 10 | 1 |

| 1.65x Boost | 3 | 4 | 1 |

| 2x Boost | 3 | 6 | 0 |

How significant were the price differences?

| % Savings | When Amex was cheaper | When Chase was cheaper |

|---|---|---|

| 1% – 5% | 4 | 3 |

| 6% – 10% | 4 | 0 |

| 11% – 15% | 5 | 0 |

| 16% – 20% | 5 | 0 |

| >20% | 0 | 1 |

When Amex was cheaper than Chase, there was no strong pattern in the extent of the savings. Approximately the same number of “winners” fell in each of the savings categories (1 to 5%, 6 to 10%, 11 to 15%, and 16 to 20%), but the savings never exceeded 20%. Meanwhile, when Chase was cheaper, the savings were only 1% or 2%, except for one outlier in which Chase was 23% cheaper than Amex (this was at The Mark in New York City).

Conclusion

Sadly, even after Chase introduced 1.65x boosts, The Edit compares poorly to Amex’s hotel collections. Amex has far more properties in its collection, and you’re more likely to get a better price through Amex than through Chase. On the other hand, with The Edit, you do have a very good chance (around 60%) of finding prices that are equal to or (rarely) better than Amex’s. And, if you want to use points to pay for your stay, you’ll do much better with Chase than with Amex since Amex doesn’t offer Points Boosts at all.

What does it all mean? It is possible to get reasonable prices through The Edit, and it is still possible to get 2x boosts about 50% of the time. The value that I wrote about last week (Rethinking The Edit by Chase Travel℠) is still there, but it’s now harder to find.

Struggling to find a use for The Edit. 2 night min, inflated prices, limited scope. Can’t wait til I can PC this card.

Today I’m seeing “The Edit” hotels (with the benefits) showing up in searches for one night. Did they change the two nights to one?

The Edit has always been available for 1 night but the $250 credit is only for multi-night stays.

The guaranteed breakfast is an important part of FHR that is sad to see Edit doesn’t actually have.

FWIW your chat says free breakfast is not a part of THC, whereas I’ve seen it offered at some THC hotels.

Thanks for the comparing Edit vs FHR. I have been looking at several hotels and the edit collection is always more money. Only time I can see it better for me is hopefully stacking the 2026 IHG/Omni credit/

Amex FHR wins for allowing 1 night stays. This nerf to CSR is the nail on the coffin, and I will be cancelling at next renewal, not worth $900!!! annual fee.

I believe Chase Saphire Annual fee is $795?

Yeah, looks like they combined them in their mind. $895 is for the Amex Platinum.

One thing to keep in mind with the Edit bookings is that if you do accept 1.65 cpp (which I personally recommend against), you’ll need to remember to check the math. I suspect Chase’s next devaluation will be similarly unannounced, so you may be getting even worse value if you assume it’s always at least 1.65 cpp.

The same goes for 2 cpp bookings, but it’s easier to check that math without a calculator.

Thank you for the analysis. Just another DP. I’m curious about Edit hotels in California, and more specifically Hyatts. I’ve been keeping 2 Hyatt hotels in Oceanside (Seabird and Mission Pacific) as last minute “staycations” to use the 2025 Edit credit on CSR Biz. After eyeing them for months, they appear to have vanished for me as Edit properties. Both hotels are available via Chase travel if I search using my CIBP as the selected card, but are not available any longer using the CSR Biz. (I also searched using my CSR Biz with the filter “Hyatt” and they both come up as “Sold Out” Edit properties. These 2 hotels are available using AMEX FHR, and the Hyatt website. I chose two 2-day date ranges for the comparisons with AMEX. Then I searched midweek, randomly, over 10 months using CSR Biz and CBIP and came up with same results. “Sold out” using CSR Biz and available using CBIP. Monterey, CA is another example where a search using CSR Biz no longer shows Edit properties. What do you think?

I’ve had this same thing happen multiple times for properties I was watching in multiple countries/locations. I posted it to the frequent miler insiders group on FB on Nov 16 – which was when I first noticed it. It’s annoying that it’s still happening.

They are playing games with their availability with Edit. I was eyeing those properties too and they have wide open availability everywhere else except through Edit. Edit bookings are probably not profitable for them

Noticed the same

Looking at property and there was no availability for all of 2026

Chase, what the duck?

Greg, another factor is that the $250 CSR credit requires stays to be prepaid. In my searching this month, only the most expensive properties have prepaid rates, and those are often inflated. More affordable The Edit stays do not have a prepaid rate on the Chase Travel platform, and thus the credit could not apply. Any 2x points “boost” is far less valuable than the $250 credit. Chase is effectively neutering the hotel credit, which makes the fee increase more onerous.

One minor correction for the comparison chart: points redemptions for THC are actually .7 cents per point. While the Edit changes are disappointing, just a further reminder that AMEX redemptions for anything other than partner transfers are insulting.

I’ll use my new and old credits (because I ain’t no chump), but, for real, only Amex (not Chase, not Citi) has been making improvements to their premium cards that I can readily and pleasantly use. FHR increased $300 1-night 2x/year credits are so much better than The Edit $250, 2-nights, less properties included, no guaranteed 4PM late checkout. Citi is total trash (whoever’s in-charge of their online travel portal needs to wake the F up.)

I actually find the Strata Elite to be the best high end card, just barely edging out the BoA PRE. Travel portal is solid, priced competitively, and dead easy to use the $300 credit. Splurge is simple to effectively cash out near cash rates, and the 4 AAdmirals club passes are a steal and a half for anyone with kids. Plus I value their transfer partners highest. In a 2P household, combining 2 Strata Elites with a Doublecash and the 0 AF Strata for 3x grocery / gas / self-select is just so silly good. Sprinkle in a few Custom Cashes and baby you got a stew going.

People were pretty lukewarm on the Elite, but it is proving to be a pretty solid alternative. It is a pretty inexpensive path to lounge access (especially with the $75 AU), though the lack of any Citi lounges limits the upside a bit. The Ritz card is probably the best deal on the market, but for families, I think Citi is #2. If you are single or a couple, I still think the VX is the better bargain overall. I still can’t quite get there for myself, but if the VX didn’t exist, my household would be using the CSE.

If they’d have launched with more competitive earning rates, it wouldve been the best card on the market by a country mile. The weird dining gimmick with effectively no bonus travel categories really hobbled it out the gate. If they’d have gone 4/4/4 (dining/hotel/air) and 1x on all other spend it would’ve been an absolute homerun.

VX probably is a better bargain, but I anecdotally notice higher portal costs there relative to Citi and, at least for me personally, C1 miles have lower value than TYP, which gives the Elite the edge for me. I also mostly fly out of ORD so any AU lounge is kind of a non factor here given the absolute dearth of any non-airline lounge. So the Elite’s AAdmirals club passes are a big deal for our family! Ritz is also super solid (we have 2!) but I think the path to get there limits mass appeal.

Amex is the best high end card. As for Citi’s offerings, it’s the right analysis – clearly they have the best combos for spending right now – I just don’t see the need for the Elite in it, I would just get a Premier. But I have an AA Exec card, mostly because I value AA Hotels and the 10x miles on spend, but it makes the 4 AA passes irrelevant (and really for a family, it’s only good for 1 round trip, so if you fly AA with the family with any frequency, you either need 2 Elite’s and/or a Globe… it’s not a lot).

You conclude that AmEx is better and repeatedly harp on Chase sometimes reducing point boost from double to 1.65. AmEx doesn’t offer point boost. If you’re going to compare prices between them, maybe you should factor in the point boost benefits to the prices too? Using points cuts the prices in half, or pretty close, compared to AmEx. It feels like you’re trying to favor AmEx in this article.

The point is that for Chase, you’re using points, which can be use elsewhere for better value. And 1.65 is already pretty close to Chase UR value.

I don’t follow the logic of your comparison. Using points doesn’t cut the prices in half because the points have value to transfer to partners (as Phil notes). And comparing points redemptions between Chase and Amex makes no sense because Amex doesn’t have points boost, so paying with points doesn’t make much sense with Amex anyway.

Remember this discussion started with comparing the overall hotel benefits of the two cards. Amex has a credit that most people have a relatively easy time using. But The Edit credit was not doing well by comparison because it is a much smaller footprint, it requires a two night stay, the hotels tended to be very expensive, and in many cases the prices through Chase were higher. So if you compare the two hotel credits, Chase clearly loses.

Greg was trying to see if perhaps the silver lining in all this for Chase was that Chase offers points boost and Amex does not, and his speculation was that perhaps it would provide enough better value to help make up the fact that The Edit credit was very difficult to use. For Chase to compare well against Amex the points boost would have to provide a lot of value because Chase is in the hole when comparing hotel credits otherwise. It was a tenuous argument anyway, but with the further devaluation of points boost and the other issues Greg points out above, the Chase hotel benefits are of extremely limited value compared to Amex and Amex clearly smokes Chase on hotel benefits.

Contrary to being biased against Chase, Greg went out of his way to try to find value, only for Chase to promptly devalue it. It isn’t the article that is biased against Chase. It is the data.

I see where you’re coming from to some degree. That said, this phrase “comparing points redemptions between Chase and Amex makes no sense because Amex doesn’t have points boost,” i disagree, Chase offers a benefit that Amex doesn’t which is the point of comparing two different things. If you have use for the points at better value redemption, that may be better for you, but not everyone does. For my use case, the double points for hotel redemption is ideal. Clearly, AmEx allowing redemptions for 1 night instead of 2 is much better. But Chase is changing it from once/6 months to twice/year (any time), which also helps improve its utility.

It also makes no sense to compare only the hotel benefits of the card, in an envelope. They’re adding another $150 IHG freebie, on top of the $300 travel freebie, $300 stubhub, $300 dining (plenty of places you can buy gift cards from, some online, if you don’t live in a big city- there are posts on Reddit with options), $500 Edit, free Apple music/Apple TV, etc. It adds up. AmEx also has solid value with Resy.

I also wish there were a better selection of Edit holds, particularly on the lower end. Chase requires a hair more effort to obtain the value, but for those who don’t mind, it’s worthwhile.

Yes, I agree that comparing a benefit Chase offer to one that Amex does not offer makes sense. That is what Greg was doing in his posts, but you thought he was favoring Amex. Where you lost me was when you said that points boost cuts the prices in half compared to Amex. I can’t think of any way this is true. The value of points boost is relative to whatever you think is RRV for Chase UR, not compared to Amex points redemption value. (I value UR at about 1.7 cents, so at 1.65 points boost is worthless to me.) Amex points redemption for hotels is even worse, but it doesn’t matter because when you get below zero value it doesn’t matter how much worse it gets; it is still zero.

I also agree you have to factor in all the benefits of each card, but when you do Amex has a much longer and more robust list of credits with quite a few that are pretty easy to use. So I don’t think that helps CSR any and in fact I think they fall further behind.

Look, the author’s data demonstrates that Chase is adding ~25% more hotels to the edit, annualized, yet he concludes “Did Chase add many more hotels to The Edit? Not really, no.” This isn’t letting the data speak for itself. It’s coming up with a narrative and trying to mold the data to support it, even when it doesn’t. Don’t get me wrong, I appreciate the analysis and find the information useful. But if you ignore this bias, it raises questions about your critical thinking skills.

You should check out VFTW.

Guessing they’re much more biased? At least they open with “I receive compensation for content and many links on this blog,” haven’t seen that on this site lol

I should also add- you’re picking apart a benefit that’s been in place for less than 6 months. While the article suggests that adding over 2% more hotel options in a single month equates to “no, Chase is not effectively adding hotels,” I disagree. Extrapolating, 25% more hotels in a year is a lot. The program is new and improving.

I’m just comparing the benefits on two cards as they exist now, which is all I can do. And the current CSR is weak. Chase has added properties and restaurants, but has also devalued with no notice and been notably incompetent in how they have implemented some of the new features. So I can’t predict what they will do in the future and whether it will be better or worse. If they improve the card enough then I will apply again. But if Chase can’t come out with a strong product from the start then they shouldn’t be surprised if people cancel.

The revised CSR coupon book is bad. Making you search for a needle in a haystack on top of it is worse. Amex won 2025 and Chase lost. And Citi was – amusing?

100%

Considering everything that’s being reported and commented upon, I would not be a user of Chase’s travel portal or The Edit. And, without that, one basically earns 4X airfare/hotel, 1X other travel, 3X dining, 1X all other spending. With Priority Pass. And, the hassle of coupon-clipping. What’s the point? Is there not a better/easier alternative out there?

You did a comparison, but only used two cities?

London and NYC? The two cities that probably have the largest number of luxury hotels, if not just hotels in general, in the Western world? I think that they would give a pretty good idea of the comparison of the two programs, especially considering how in depth Greg went with his analysis.

If you are upset about this free analysis provided for you, than do your own.

I mean, it’s definitely data points and it’s better than nothing. But I do think it’s reasonable to point out that looking at just the two most expensive hotel markets in the world for bookings on a single weekend might not be representative of the whole program?

I’d want to at least see some smaller/cheaper markets (and preferably mid-week vs weekend, and booking far out vs close in) before assuming that these conclusions hold across the board.

Lets hope they don’t followthrough with the updates to the Sapphire Preferred. If they screw up the preferred it will make it harder to justify chasing UR points.

For me it’s looking like the Reserve is going to get get downgraded when the AF comes due.

Target customer is big city/road warrior who values the lounge access and likely to use resturant credits.

Stubhub is cheaper than Ticketmaster. It takes 15 minutes to buy any tickets (needn’t be local) and resell them, if you don’t like doing stuff.

I’d love to hear more details about your buying/selling experience because I just tried doing this today and so far it’s a pretty big PITA. I bought 2 tickets totaling ~$150 including tax, which got transferred to me from the venue after I created a logic with the venue (after creating a login with StubHub). SH then requested that I transfer the tickets to SH, which I’ve tried unsuccessfully about 4 times. I never would have guessed that the tickets wouldn’t just “live” on StubHub allowing me to more easily sell them.

Bottom line – it’s going to take me 1-2 hours of work for maybe $75-100 back.

I love concerts and college sports, and tickets make great gifts. So using the credit is never an issue for me. That said, if you’d like to resell, you need to buy tickets that offer “Instant Download” (a filterable option). Those can be obtained and relisted instantly, with very little effort.

Yep, I lucked into getting an Instant Download set of tickets yesterday. If I did this regularly, it might go smoother, but of course I’ll only buy/sell once every 6 months. I get the reasons for it, it’s just super annoying that SH doesn’t hold/control the tickets, so I have to download them from a third party, then either upload them to SH (PITA so far) or eventually transfer them directly to the buyer myself.

This is logical and others have pointed it out, but between the spread SH charges, taxes, and the need to discount your tickets to guarantee a sale, it looks like I’ll only get $100 at absolute best from my ‘$150’ tickets. When I went to sell, I was shocked that SH suggested I list them between $28-$36/each (reminds me of the spread in the diamond industry!). Instead, I listed them for $50/ea, I’ll discount them as Xmas approaches.