Bank of America tends to fly under the radar when it comes to travel credit cards despite issuing cards for Alaska Airlines/Atmos Rewards, Air France/KLM Flying Blue, Spirit Airlines, and more. A key reason for that is the lack of a transferable points program.

Where it has often drawn people’s attention is when it comes to cashback earnings, particularly due to the way it’s been possible to juice your earning rate by having status in its Preferred Rewards program. If you had high enough status in that program, you could earn 2.625% cashback on all spend on some cards which, historically, had been a very good return.

A few weeks ago Bank of America started sending out notices to existing Preferred Rewards customer to advise them that changes to the program would be coming soon. Details were vague at the time, but they’ve now provided more details and some people are going to be disappointed.

Program name change

From May 2026, the rewards program will be rebranding from ‘Bank of America Preferred Rewards’ to ‘BofA Rewards’. That BofA branding decision is a bit of a curious choice. Some might say it’s nuts given its context in modern popular culture (I apologize in advance if you were previously unaware of this context).

Branding aside though, what truly matters is how this will affect eligibility in the program and its associated benefits.

Current Preferred Rewards eligibility requirements

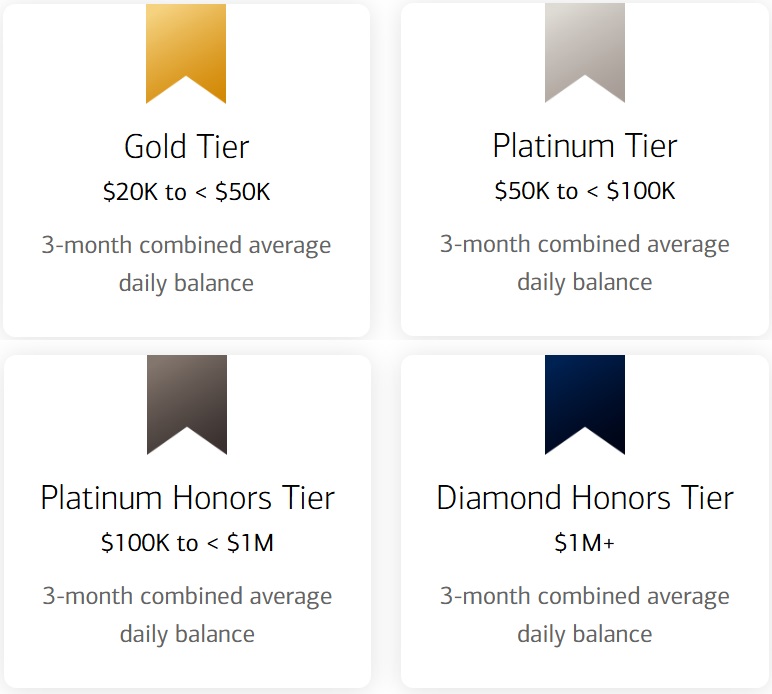

At present, you need to have enough money on deposit in Bank of America accounts and/or Merrill investing balances to earn Preferred Rewards status. The current status tiers and eligibility requirements for the Preferred Rewards program are as follows:

- Member – <$20K

- Gold – $20K to <$50K

- Platinum – $50K to <$100K

- Platinum Honors – $100K to <$1 million

- Diamond Honors – $1 million+

Each tier has a range of benefits that might be of interest for people, such as waived monthly fees on select checking accounts, discounted origination fees on mortgages, discounts on HELOC interest rates, etc.

For many people though, it was the bonus earnings available on credit cards that made Preferred Rewards status more worthwhile. Here’s the bonus you’ve historically received at each status level:

- Gold – 25% bonus

- Platinum – 50% bonus

- Platinum Honors – 75% bonus

- Diamond Honors – 75% bonus

It’s that 75% bonus tier for Platinum Honors status that’s been most appealing for people with large enough deposits with Bank of America and/or Merrill. That’s because it’s turned cards that earn 1.5% cashback into cards that earn 2.625% cashback. (n.b. there are some Bank of America credit cards that can earn more than 1.5% cashback, but those all have relatively low caps.)

New BofA Rewards eligibility requirements

Under the new BofA Rewards program, the number of status tiers above member level will be reduced from four to three. Deposit requirements will be set higher in order to access the rewards program in the first place, while the bonus earning rates will be slashed for those who currently have Platinum or Platinum Honors status.

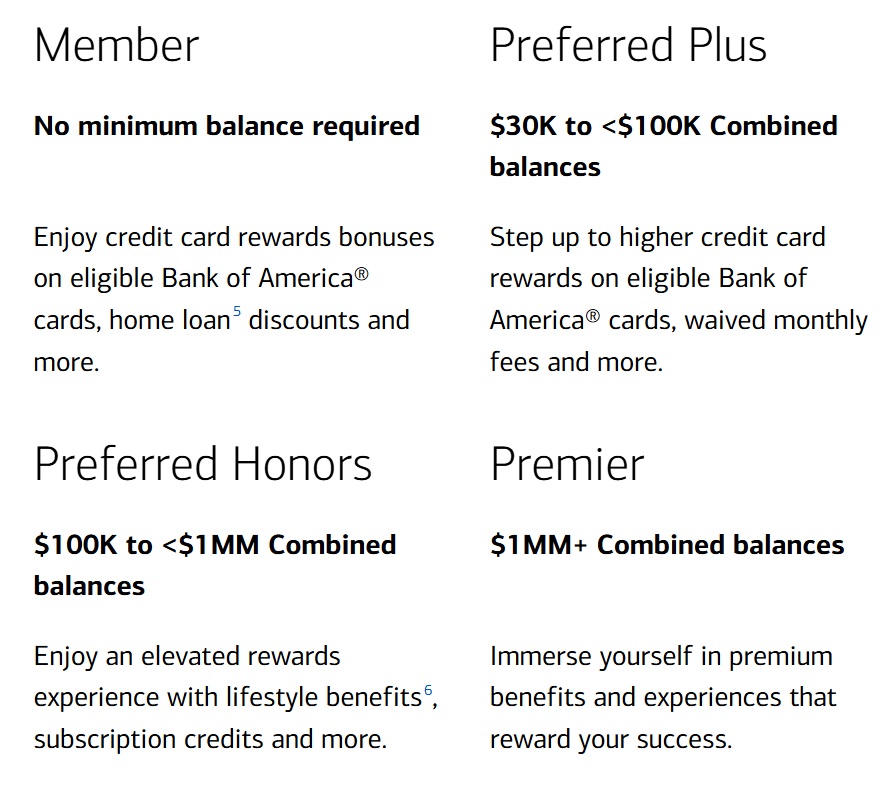

Here are the new eligibility requirements:

- Member – <$30K

- Preferred Plus – $30K to <$100K

- Preferred Honors – $100K to <$1 million

- Premier – $1 million+

Existing Gold and Platinum members will be mapped to the new Preferred Plus status, Platinum Honors members will become Preferred Honors members, while Diamond Honors members will become Premier members. For existing Gold members, it’s worth being aware that the required minimum balance on deposit with the bank will be increasing from $20,000 to $30,000.

For existing Gold members, the new Preferred Plus status won’t be a downgrade when it comes to credit card earnings as you’ll still get a 25% bonus. It’s the next two status levels where these changes will sting.

Existing Platinum members will also be getting swept into the Preferred Plus status tier. As a result, you’ll also only earn a 25% bonus from May 2026, rather than the 50% bonus that you currently receive. At present, a 1.5% cashback earning card earns you 2.25% cashback; in the future, that’ll drop to 1.875% – a significant difference.

Platinum Honors members will likely feel even more aggrieved. The credit card bonus rate will be slashed from 75% to 50%. That means your 1.5% cashback card that currently gets boosted to 2.625% everywhere thanks to your Preferred Rewards status will only earn 2.25% cashback under the revamped BofA Rewards program. That reduced earning rate could make a material difference in people’s willingness to put spend on their Bank of America cards rather than a card that earns two transferable points per dollar with select American Express, Citi, Capital One, or Bilt cards.

Although the new status tiers will come into play from May, some of your existing benefits won’t change immediately. For example, in the FAQs it states the following:

Some benefits, like the credit card rewards bonus and no-fee safe deposit boxes, may be subject to change. If this applies to you, you’ll keep your Preferred Rewards benefits for at least 6 months (after May 2026).

That means Platinum and Platinum Honors members will still get the 50% and 75% bonuses respectively through November 2026. That gives you nine months from now to plot your course forward.

New BofA Rewards benefits

There’ll apparently be select new benefits for some BofA Rewards status tiers. For example, there’ll be a subscription credit for Preferred Honors and Premier members which is described as follows:

In order to be eligible for the subscription credit benefit, you must: (1) Be enrolled in the BofA Rewards program’s Preferred Honors or Premier tiers (2) Agree to the full terms of the Subscription Credit Benefit via the Subscription Credit Benefit page within BofA Rewards and (3) Make payments directly to eligible merchants using your Bank of America debit card linked to a checking account that you designate via the subscription credit benefit page. Customers may receive statement credits up to $8 per month for Preferred Honors members and $15 per month for Premier members. Eligible merchants are subject to change without notice. Currently eligible merchants can be found on the subscription credit benefit page.

It remains to be seen as to what type of subscriptions will be eligible for these credits.

Preferred Rewards for Business – no changes, so a good workaround?

At present, there’s nothing indicating that Bank of America will be making imminent changes to the business version of the Preferred Rewards program, appropriately called Preferred Rewards for Business.

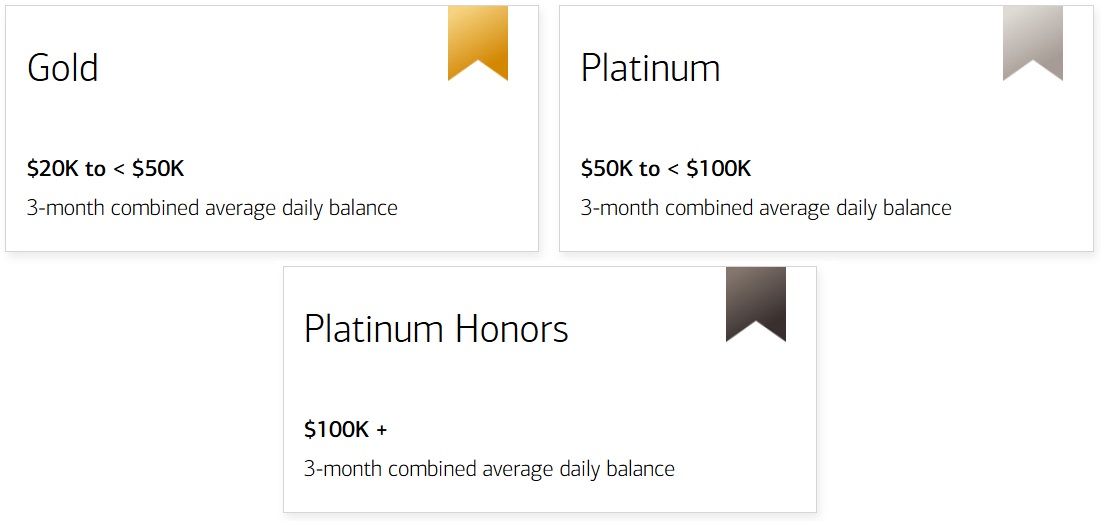

As a reminder, here are the Preferred Rewards for Business requirements:

As you can see, the existing requirements on the personal side map across to the business side identically, albeit without a Diamond Honors level on the business side. If you’re currently a Platinum or Platinum Honors member with your personal accounts and could shift those deposits to business accounts instead, this would be a (somewhat) easy workaround to maintain your existing credit card bonus rates of 50% and 75% respectively.

If you did proceed in this manner, you’d also need to get a business credit card that earns 1.5% cashback everywhere if you want to continue earning 2.625% on all unbonused spend as a result of your status.

Your Thoughts?

Will these Bank of America Preferred Rewards/BofA Rewards changes affect you? Will you be changing your approach as a result, whether that means depositing more money with Bank of America/Merrill, shifting to Preferred Rewards for Business, or putting your everyday spend on a different card? Let us know in the comments below.

The biggest question for me is will the UA TravelBank continue to work for there premium rewards travel card. By making it “free” a card that can to 3% dining/travel and 2.25 catch all is great for simplicity. If that goes away then that plus the rewards nerf is tough to take…

Some recent reports have indicated success and others have indicated failure. Wait for more data points.

To get 4.5% on “online purchases” which is a wide swath of anything bought through a computer or a mobile wallet is still tremendous, even if it is limited to $2500 per quarter per card. Many people have three, four, or more CCRs so that accounts for a majority of regular spending. I will still move some assets in to qualify for 2026 and into the first part of 2027 to the $100k level, but after status runs out in 2027 I will evaluate what is out there then. Maybe it will be a combination of Robinhood 3%, category cards, and whatever sign up bonus I am trying to hit.

where to move for cashback? the sketchy Robinhood 3% card?

See link below

BofA will absolutely nerf preferred rewards for business. No one said they were required to do it all at same time. Besides, the business version is already to easy/generous.

Definitely no reason to bank with BofA now.

Yet another reason to bail on Bank Of America. 2.25% is better than 2% cash at Citibank but is it better than 2 pts /dollar at Cap One?

You’re talking about an extra 0.25% on how much spending? Whatever that number is, is it worth the effort of maintaining the relationship? Only you can answer that.

As a small business owner I have seen BofA seemingly do anything they could to alienate customers, but I have stuck with them. This will cause me to end my business and personal relationship with them.

https://www.reddit.com/r/CreditCards/wiki/list_of_flat_cashback_cards_with_benefits/

For those looking for pure cash back.

Stephen, you mention an easy work around changing the personal100k account to a business account to keep the 2.6% but wouldn’t there be tax issues involved?

I am not an accountant, but I believe earnings on business accounts can be included on one’s personal return. I treat my BoA business account as a personal account for tax purposes.

On the up side, maybe commenters will stop advising people to “just get the 2.65% card.”

This was my main method for cashback. Holding 1m in Merrill funds makes no sense long term with current brokerage transfer bonuses.

In reality though, the 5.25% on all online spending was the only mega deal for this… Boa platinum cards were great everyday spend as well, btu the 2.62% cash back wasnt that big gain over normal 2% point cards (if you can spend the points well).

BOA should have made a 250k tier at 75%, and the 1m tier could have had 75% as well with a whole buncha other goodies attached.

Welp. Was thinking of giving up points to just go cash back with BOFA and now I don’t think I will. Just in time!

The Robinhood gold card is better than even the old platinum honors earning rate for everywhere else spend.

The waitlist is annoying though, especially if you’re trying to stay at 4/24 because you don’t know how long the waitlist take and you only get like 10 days to apply after you get off it.

And the $50 annual RH fee really eats into the difference. You would have to put over $13,333 spend on the card before RH was the better choice.

If you take advantage of the Robinhood gold benefits (extra 2% match on Ira contributions, $1000 of interest free margin to invest in something safe) then you come out ahead on the annual fee. But if you don’t then yes.

Robinhood has been quick with denials on large dollar purchases that they don’t want to give the 3% to. They have been cracking down on people purchasing in game credits in Steam, for instance, and have questioned gold purchases at Costco. Taxes and bank account deposits are rejected before you can even make the charge. Bank of America has been very open in this regard to allowing charges. I am still in the first year 3.125% period on a new UCR and will be doing another credit limit reallocation in the coming months to charge estimated taxes for 2026 on the card.