NOTICE: This post references card features that have changed, expired, or are not currently available

Up to 30,000 Membership Rewards points for small businesses!

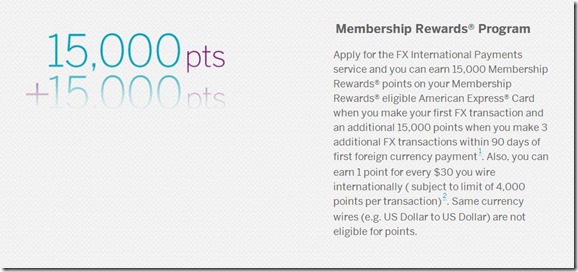

A reader identifying himself as “farbster” recently pointed out to me an opportunity to earn up to 30,000 Membership Rewards points (Thanks farbster!). American Express offers a small-business service called “FX International Payments” which facilitates, you guessed it, international payments. Currently, the site is running a promotion in which it is possible for new enrollees to get up to 30,000 bonus Membership Rewards points:

According to the offer, once you signup and make one foreign transaction you’ll receive 15,000 points. Then, once you complete 3 more transactions within 90 days of the first one, you’ll receive another 15,000 points. As a standard benefit, they also offer 1 point for every $30 wired internationally.

For those interested, here is the fine print of the offer:

1. To earn 15,000 Membership Rewards bonus for activation of your FXIP account, you must satisfy the following conditions: (i) you must complete an FXIP application form and a Membership Rewards registration form and submit them to us (ii) your FXIP application and Membership Rewards registration must have been processed and approved by us; and (iii) you must complete at least one foreign currency payment through your new FXIP account no later than January 1, 2015. In order to earn an additional 15,000 Membership Rewards points, you must meet the conditions in the preceding sentence and you must also initiate at least three (3) additional foreign currency wire transactions within ninety (90) days of your first foreign currency payment. Same currency transactions (USD to USD) are not eligible for this offer. The value of the points received may be taxable income to you. Please consult your tax advisor if there are any questions about the tax treatment of points. Bonus ID 7786.

Pricing

As you can see below, American Express usually charges $15 per transaction with this service. With a Business Platinum card, however, fees are waived as long as you are a card member. And, with any American Express OPEN card, fees are waived for the first six months. After that, they charge $10 per transaction:

I haven’t had the chance to evaluate whether Amex’s exchange rates are fair (I would guess so), but If you have a business that does a lot of foreign transactions it seems to me that combining this service with an Amex Business Platinum card is the way to go.

Really meant for businesses

I clicked through to signup for this offer only to find that the signup process is a bit more arduous than I expected. The application requires all of these bits of info:

- Name

- Business title

- Business phone & email

- Legal name of business

- Business type (S-corp, Nonprofit, etc.)

- Federal Tax ID

- Year of Incorporation

- Business address

- Goods and services for which the business makes international payments

- Staff size

- Asset size

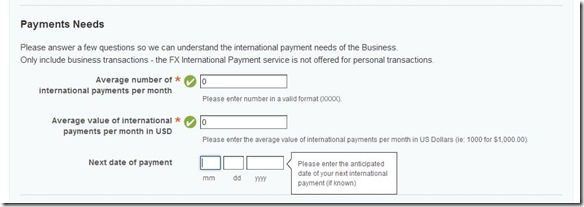

- Average # of international payments per month

- Average value of international payments per month

- Countries in which business makes payments

- Bank details: account #, routing #, etc.

- Payment needs

- And more.

I plowed through the application and answered everything as truthfully as possible. Under Payment Needs, I honestly answered that the average number of international payments per month for my business is zero:

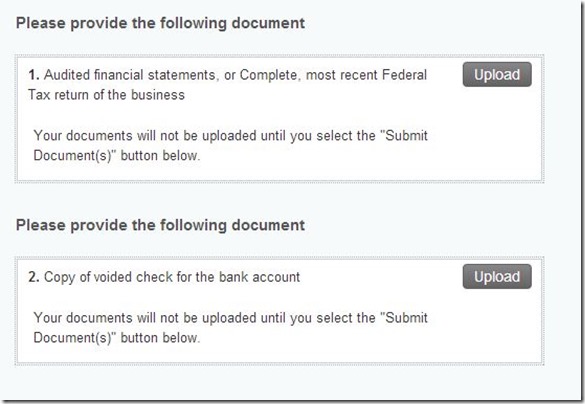

At the end, they asked for even more. They wanted my business financial statements and a voided check:

After uploading these things, I found out that it was actually optional to do so (I should have read the on-screen directions more carefully!). I then received an email with this content:

Thank you for your application to American Express FX International Payments. We will be in touch over the next few days to discuss the status of your application.

In the interim, we recommend that you provide us with the following additional documentation if you have not already done so:

1. Audited financial statements or Complete most recent Federal Tax return of the business

2. Copy of voided check for the bank account

This is not mandatory, but providing this documentation will help us to process your application.

I applied last week, but have not yet heard if my application was approved.

Should you apply?

If you have a business with real foreign transaction needs, I don’t see any reason not to go for it. 30,000 Membership Rewards points is a nice benefit! Plus, you can earn an additional point for every $30 wired internationally.

If your business does not do foreign transactions, it can’t hurt to apply, but you might want to wait to hear what happens with my application.

If you don’t have a business at all, I don’t recommend applying.

Reader experiences

Has anyone already applied for this? If so, what has your experience been? Were you approved? What kind of transactions did you make? Have you received the signup bonus?

[…] has written about this offer in the past (See: A different kind of signup bonus). See that post for full details, but the synopsis is that a lot of detailed business information […]

I wish to provide a succinct analysis of this offer:

MEH!

hey FM readers,

just applied for my first chaa$e iink bo1d card. i got a “we’ll let you know message” from them. does this mean i need to call their recon number and persuade them?

thx

Absolutely!!! Don’t wait for the pain of rejection…….preempt them and say I called as it seems you may need more information…….How can I help you?

We all know that AMEX can be a true pain in the butt and it is no secret that they design things using obfuscation to the max to create more fees than the value they provide……this one seems to be one of their true art forms………..I personally will opt for another Bluebird in the family before drinking this koolaide……..but FM it shows you are the master of the nuances………….

typo, I meant my own social security number

Let’s say I apply as a start-up and a sole proprietorship; I write my own name as the business name, and the business has 1 employee, $0 annual revenue, and 0 years in business. Let’s also say I write your own social security number as the business tax ID number. Would there be a good chance of getting approved?

Another question: to receive the 30,000 bonus points for the 4 transactions, what is the minimum amount for each transaction? Also, how would I wire transfer to a friend or relative who lives in a foreign country?

Unfortunately, “I don’t know” is my answer to both questions. To the second one, though, I can elaborate and say that I do see any minimum requirements listed in the T&C so I would guess that even a $1 payment would work.

I applied and they ask for alot more info in the next week or so. Invoices from foreign clients, certificate of good standing, audited financial statements, etc. I just stopped with the application after a while because they were asking for way too much.

You’re right – those are some crazy requirements just to make payments. This new joint seems shady.

“…The value of the points received may be taxable income to you…”. New standard language on all AMEX offers or is this a one-off?

My assumption is that the warning is there to protect themselves, not that they send out tax forms. I don’t know this for sure though.

I did this a year or two ago, had a genuine need. The foreign funds part means that you are in their exchange system and they fix the price to cover the points earned, but it is only a profit to them on a regular transaction, not when there are the large bonuses involved.

I used it for legit business transactions in Asia, not sure if you can just make up a friend in some other country and it would work or not.

If you don’t know any recipients who take wire transfers probably there’s no need to make a friend up. Maybe find a charity that does? Sitting this one out.

I have been using FX payments for a little over 2 years. I got the 30k signup bonus, but if I remember correctly, it took some phone calls before it posted to my account.

The additional bonus points will only be given if you wire in foreign funds. For all transactions in US currency, the charge is $ 30.00.

My bank charges $ 45.00 for a wire transfer, so I still save with FX and I do about 10 to 15 wire transfers per month. It’s also very easy and quick to use, all payees are stored and it literally takes less than 60 seconds to initiate a payment.

Been there done that.

It is meant for businesses with significant foreign exposure.

This is a waste of time for the average joe milking sign up bonuses.