NOTICE: This post references card features that have changed, expired, or are not currently available

Note: This post is a re-write of a previously published post: Citi Prestige vs Premier vs Preferred. Since that post was written, there have been big changes in the ThankYou program…

Lately I’ve had a bit of a crush on my Citi Prestige card. I signed up for the card in September 2014 in order to take advantage of both expiring and new benefits to the card (see “Citi Prestige experiment failed, yet I’m way ahead. Here’s how…”). Since then I’ve practically fallen in love with this card (see: A great combination: American Airlines status plus Citi Prestige). While it is a fairly expensive card, it’s easy to get huge value from its perks and point redemptions.

That said, recently the Citi Premier card has changed dramatically: Citi has overhauled the card’s category bonus structure, and has expanded options for getting more than 1 cent per point value from its rewards.

And then there’s the no fee but also similarly named Citi ThankYou Preferred card. As you’ll see below, there are a few really good uses for this card.

Which is right for you? Any of them? All of them? Let’s drill down into each, from least to most expensive:

Citi ThankYou Preferred

Annual fee: $0

Current signup bonus: 20,000 ThankYou points after $1500 spend in 3 months.

Category bonuses: 2X dining and entertainment; 1X elsewhere

There’s not a lot to say about this card. Its best traits are its decent signup bonus for a no-fee card and not horrible earnings for dining and entertainment. Unless you also have the Premier or Prestige card, points are worth at most 1 cent each. So, for spend, you would do much better with a no-fee 2X everywhere card such as the Citi Double Cash card or the Fidelity Investment Rewards card. Still, the card is worth considering for its signup bonus alone.

The are, though, two really special things about this card:

- This card is available as a downgrade from the premium cards (Prestige and Premier). So, if you’ve accumulated points on either of those cards and you want to cancel, but you don’t want to lose your ThankYou points, you can downgrade to this card instead. In my experience, even if you already have a Preferred card, you can still downgrade a premium card to the Preferred card and then have two (or more) Preferred cards.

- Valuable retention offers are sometimes available with this card. For example, when I called and said that I was thinking of cancelling my Preferred card I was offered 4 bonus points per dollar at grocery stores, drug stores, and gas stations for a maximum total of 35,000 bonus points.

Citi ThankYou Premier

Annual fee: $95 (waived first year)

Current signup bonus: 50,000 ThankYou points after $3K spend in 3 months

Category bonuses: 3X travel and gas; 2X dining and entertainment; 1X elsewhere.

Perks:

- Redeem points for 1.25 cents each towards airfare, hotels, car rentals, and cruises

- Transfer points to participating loyalty travel programs

- No foreign transaction fees

Where the Preferred card is good just for its signup bonus and retention offers (in my opinion), the Premier offers an excellent combination of category bonuses and valuable rewards. If you travel often and/or spend a lot on gas, it’s hard to do better than 3X points, uncapped. 2X for restaurants is competitive with most other rewards cards; and “entertainment” is a broad category for which other banks haven’t offered bonuses. Here’s what Citi says about it:

Q: How is the entertainment category defined?

A: Entertainment is defined broadly as purchases made for live performances (e.g., concerts, theater), movie theaters, amusement parks and cultural events (e.g., zoos, museums). Entertainment merchants include sports promoters, theatrical promoters, movie theaters, amusement parks, tourist attractions, record stores and video rental stores.

When redeeming points, your best value will be to transfer to airline programs such as Singapore Airlines or Air France or to use the points directly to buy travel at a discount. When used to buy travel (airfare, hotels, car rentals, and/or cruises), points are worth 1.25 cents each, which happens to be the same rate offered by Chase with their Ultimate Rewards program for Sapphire Preferred and Ink Plus cardholders.

Compared to the Chase Sapphire Preferred, this card has better category bonuses for the same annual fee, but it has fewer useful transfer partners. Overall, I see this card as being extremely competitive compared to the Sapphire Preferred as an all around go-to travel credit card.

Citi Prestige

Annual fee: $450 ($350 for Citigold customers. Also, those who apply in-branch are often offered the $350 fee)

Current signup bonus: 50,000 ThankYou points after $3K spend in 3 months.

Category bonuses: 3X airlines, hotels, and travel agencies; 2x dining and entertainment; 1X elsewhere.

Perks:

- $250 air travel credit (including airfare) per calendar year

- Free lounge access: AA Admirals Club Lounge access, and Priority Pass Select with free guests

- $100 Global Entry application fee credit

- Use points for 1.33 cents value for any flight; or 1.6 cents per point value on American Airlines

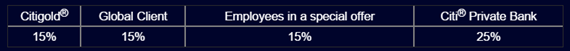

- 15% to 25% Relationship bonus for Citi Gold, Global Client, and Citi Private Bank customers.

- Transfer points to participating loyalty travel programs.

- 4th night free hotel benefit

- Complementary green fees at many golf courses

- No foreign transaction fees

It used to be that the Prestige card offered $200 of travel credits each year, but only to reimburse fees (such as checked bag fees). Now they’ve increased the benefit to $250 per year and made it available for all airline charges. This means that you can pay for a single flight with your Prestige card and automatically get $250 of that charge reimbursed each calendar year. To me, this makes the air travel credit so easy to get that it might as well be considered a discount off of the annual fee. When looked at that way, the annual fee is really just $200 ($450 – $250). Citigold customers (and those who signed up in-branch and got the $350 annual fee) do even better and net a mere $100 annual fee after accounting for the $250 rebate. That’s only $5 more than the Premier card!

When considering that the annual fee is not nearly as high as it appears (thanks to the air travel credit), the card’s earning rate and perks are pretty darn good. Unlike lounge club access with many other cards, this one includes the ability to bring in guests for free (even with the Priority Pass Select membership). In comparison, the $450 Amex Platinum card offers free lounge club access only to the cardholders themselves except when visiting American Express’ own lounges. Amex also offers $200 in airline fee credits to help offset the annual fee, but you have to pick a single airline each year and are reimbursed only for fees, not for airfare.

Like the Amex Platinum card, the Prestige card offers a $100 Global Entry fee credit. If you, or a family member, or friend hasn’t yet signed up for Global Entry, I think it is really worth the effort. Even if you don’t travel internationally often, this will give you automatic entry into the TSA-PRE program so that you won’t have to take off your shoes, take out liquids, or any other such hassles when going through security for most domestic trips.

The Prestige card also makes your ThankYou points more valuable, especially when used on American Airlines or US Airways flights. Where the Premier card gives you at most 1.25 cents value per point towards travel, the Prestige card tops out at 1.6 cents per point. For example, with the Premier card, a $500 flight would cost 40,000 ThankYou points. With the Prestige card, the same flight (if on AA or US Airways) would cost 31,250 points. That amounts to nearly 22% fewer points.

On the other hand, the Premier card allows cardholders to buy other forms of travel for 1.25 cents per point value: hotels, car rentals, and cruises. The Prestige card gives you only 1 cent per point value towards those rewards.

Another difference between the Prestige and Premier card is the category bonuses. The Premier Card offers broader 3X coverage: where the Prestige card offers 3X for airlines, hotels, and travel agencies; the Premier card offers 3X for all travel and gas. For some people, the 3X gas earnings, alone, can make the Premier card worth holding above the Prestige card.

One point earning advantage that the Prestige card has over the Premier card is its annual relationship bonus. With a Citigold, Global Client, or Citi Private Bank relationship, you’ll earn an annual point bonus of 15% to 25%:

The relationship bonus explicitly does not include promotional bonus points (such as the signup bonus), but it’s unclear to me whether or not it applies to category bonus earnings. For example, if you spend $10,000 on the card entirely within the 3X category, you’ll end the year with 30,000 points. Then, with a 15% relationship bonus, will you earn 1,500 more points (15% of the base 10,000 points) or 4,500 points (15% of 30,000 points)? Either way, it’s a nice little perk.

Which is right for you?

For those who sign up for cards just for the signup bonus (and then cancel or downgrade to a no annual fee card at the end of the year), I think all three cards are good options. Even though the Prestige card doesn’t waive the $450 annual fee the first year, you can easily recoup more than the fee by signing up for the card mid-year. By doing so, you can earn the $250 annual airfare credit twice before the second annual fee comes due.

Any keepers?

Since the Preferred card is free, there’s no reason not to keep it. However, the question of whether or not to keep the Premier or Prestige card is less clear…

For those who spend a lot on gas and/or on travel not included in the Prestige card’s 3X categories, the ThankYou Premier card is likely to be a keeper. This is especially true if ThankYou points are redeemed for travel (for 1.25 cents per point value) or transferred to high value airline loyalty programs. At the very least, Citi may offer to waive your annual fee each year if you call and ask. Last year Citi let me keep my card for free (details in this post), and this year they offered to wave the fee if I spent $4500 on the card in three months.

If you manage to secure the $350 annual fee (either through Citigold checking or signing up in-branch), then keeping the Prestige card makes sense for almost everyone. Your net annual cost will be just $100, your points will be more valuable when used for airfare, and you’ll get a slew of useful benefits. For everyone else, I think it really depends upon how much value you get from the card’s earning structure, rewards, and perks. The answer to that will depend upon your own situation.

Personally, I’ve already received a huge amount of value from the card’s 1.6 cents per point American Airlines redemptions, the card’s lounge benefits, and the card’s 4th Night Free hotel benefit. So, I’m pretty sure I’ll keep the card.

Most likely I’ll signup for CitiBusiness Preferred Banking in order to get CitiGold checking for free. If that works out, my annual fee will be reduced to $350. I think it’s totally worth it. Of course, I’ll call when the annual fee comes due to see if they can offer any extra incentives to stay on board…

I have the Citi Premier Card, I’m thinking of getting the Prestige and then downgrading it to the Preferred card after a year of spend. Is this possible while keeping my Premier card open?

Yes

Thanks! and the points earned with the prestige will stay intact without expiration?

Yes as long as they keep your credit card number the same, the downgrade should preserve your points

I do not play golf, but my grown son does. I would like for him to be able to use this benefit. is there a way for that.?

I don’t think so. The benefit is specifically for the primary cardholder.

Does anybody know if Citigold account by itself entitles its holder for Priority Pass membership without the Prestige card? People on FT keep mentioning that, however nothing like that on the Citigold website.

Question about Citi Prestige $100 Global Entry credit – I already have global entry, but if i sign up for one of these cards, can i pay for my wife to get global entry and still get reimbursed? I think you alluded to this possibility.

Thanks,

Chris

Yes, definitely. I did this for my mom. She signed up for Global Entry and used my Prestige card to pay. I received the $100 rebate, as expected.

Building on the Global Entry Question – Does anyone have any experience travelling with a minor in your party and using Global Entry? If my wife and I both have Global entry and we travel with our 1 year old, will we all be able to go through or get relegated to the old cattle chute?

The Premier now offers 1.25 cents per point on their site for all travel. The Prestige offers 1 cent per point. I know that when you combine both into the same account you definitely get the upgraded 1.6x for AA.

So that has me questioning for all other travel when you have both which wins the 1x or the 1.25x?

The higher value should always win: 1.25X for non-airfare travel

[…] Miler compares the Citibank Prestige, Premier and Preferred Cards. My household recently acquired the Premier cards using our own links #high5 […]

[…] A new comparison of Citi Prestige, Premier, and Preferred cards – Comparing all three of Citi’s main three ThankYou points earning cards after all of their recent changes. […]

The Premier is unlikely to be a keeper by itself. 3.75% (1.25 cents/point*3) for gas is barely going to net you much, if anything more compared to the 5% Sallie Mae, 3.3% on the free BOA Cash rewards and rotating 5% quarters on the Discover IT and Chase Freedom floating around. 2.5% for entertainment would require $19000 spend just to cover the annual fee over, say a 2% Double Cash. You’d need to make over $5.5k in travel spending just to cover the annual fee versus a 2% Double Cash, and if you can cover that, you’d probably still be better off with the Prestige.

I agree that its probably not worth keeping if you also have the Prestige card, but without the Prestige card you need the Premier.

Hubby just got the Premier and I got the Prestige, which we combined for 100K+ TY pts. We used them for 5 nights at a resort in Hawaii in February. They had a “special” deal for a beach front resort that is usually 65,000 pts/night down to 21K pts/night. We have all of our flights booked into next year and needed points for hotels. Not the highest return on our points, but suited our needs.

I first saw the room I wanted on-line. But when I went back to book, only more expensive rooms showed on the web site. I called and the CSR was wonderful. She found the room I wanted (deluxe ocean view) and booked it for me.

Does anyone know if the Prestige card is always a 50K bonus or is this time limited? I’d like to pick up the card but ideally I would wait a month or 2 as I just signed up for the Premier and a couple others from different banks.

I don’t know for sure, but my guess is that the 50K offer is here to stay for quite a while

Regarding airfares being higher through the ThankYou portal:

.

A few people have mentioned this, but in my experience it has been rare for the ThankYou portal to charge more than about $5 more than the best available airfare. When I plug in simple round trip or one-way searches, I have always found competitive prices, with just a few exceptions:

1) There are times where the ThankYou search engine doesn’t bring back enough results so the exact flight that you found elsewhere may not be in the search results. This can sometimes be fixed by making your search more specific: put in departure time and airline to the search criteria, for example.

2) At least once, where US Airways and AA were marketing the same flights, the ThankYou engine gave me a higher than expected price result. In this case, I was flying AA one way and US airways for the return. I fixed this problem simply by booking two separate one-way trips through the ThankYou portal.

3) Complicated routes with stop-overs: I haven’t always been able to replicate results found elsewhere. Side note: the FlexPerks engine seems to be much better at this sort of thing.

.

Can someone please comment on what Dave posted about airfares being higher when using Thank You Points. If this is true the card has less value.

On Flyer Talk, there’s some stories of calling in and getting the lower fare, but extremely YMMV. I haven’t taken the time to try yet.

Alaska is sending out a new targeted offer for 50k miles after 2000 spending. Anyone has a working link? Thanks!

Just did some random comparisons for the golf course benefit of “3 free rounds”. I’ll highlight one instance, but is indicative of the 3 course I checked in the state.

1. says I have to book either 2 or 4 and THE COURSE doesn’t allow single bookings. I go to course website, MORE than happy to book singly.

2. price for a round is $57 per person. When I go to the courses website, it is $38.99 / person (again, either 1 person, 2, 3, or 4 ppl)

3. Tee time was the EXACT time/date for the above.

Soo, at an $18.01 premium, with 2 person min (for elite prestige), that’s $36.02 you OVERPAY usnig the Prestige .v. booking the course’s site or via phone. So, on a 2 person round, you save $2.97. For a 4 person round, (since only yours would be free), you just overpaid $33.04 by getting that ‘free round’, while your buddies got jacked on their fees.

Citi Prestige….Citi-lump of coal w/ this benefit.

Apologies..I could book 2,3 or 4, I missed the ‘3’. Still cannot book singly. Anything above 2, is a negative return, and a very marginal (7.6%) savings, when booking for 2. Other courses were similar results/experiences around me.

Dean, thanks for this info. That’s very discouraging. I’ll stop touting the free golf benefit until/unless I find that it is more valuable in other areas.

I had the same issue. The golf benefit is terrible (mine was $50 over the course’s own rate), and even worse, the system kept erroring out when I tried to book. Luckily, Citi manually credited me for the round and I avoided having to overcharge my friend since I couldn’t/didn’t have to use their system.

I have the Premier card and have gotten great value out of the entertainment and restaurant bonus from sports tickets and wineries. What I don’t understand is how the points combine or not if I get the Prestige card and is there a way to merge those points so I get 1.25 for hotel reservations

check this out

http://www.milevalue.com/how-to-combine-citi-thankyou-points-into-one-account-prestige-premier-preferred/