NOTICE: This post references card features that have changed, expired, or are not currently available

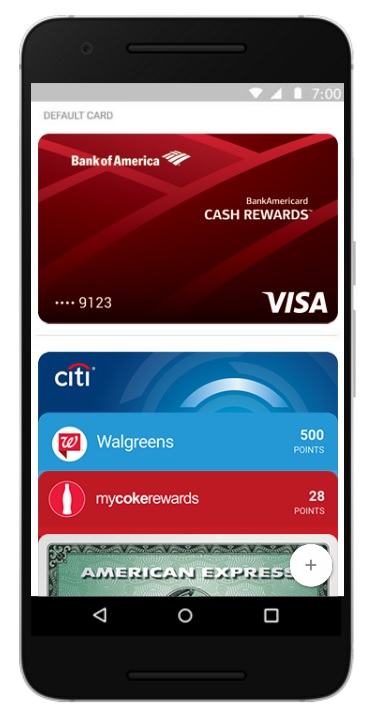

Earlier this year, I decided that the time had come to relieve myself of the Alaska Airlines Visa Signature card’s annual fee. However, rather than cancel the card altogether, I called to see if it was still possible to product-change from the Alaska card to Bank of America’s no-annual-fee Cash Rewards Card (sometimes called the “3-2-1 card”). It was quick and easy to make that change (and I even got a refund of the annual fee I had just paid on the Alaska card). After yesterday’s news from Bank of America announcing changes to the card coming on January 14th, I’m feeling really good about that decision.

Current earning structure

The Bank of America Cash Rewards card currently earns 3% back at gas stations and 2% back at grocery stores and wholesale clubs on up to $2500 in combined purchases (gas/grocery/wholesale) each quarter (then 1%) and 1% cash back everywhere else. While it has no annual fee, it’s a fairly ho-hum cash back card since it’s easy to get 2% cash back everywhere with no annual fee and one could get as much as 5% cash back at gas stations with no annual fee with other cards from our Best Category Bonuses page.

Things, however, get interesting if you have $100,000 or more in investments/deposits with Bank of America / Merrill Lynch. That would get you Platinum Honors status with Bank of America and therefore a 75% bonus on rewards. With that bonus, cash back at gas stations increases to 5.25% and at grocery/wholesale the return is 3.5% — again, capped at $2500 in total purchases each quarter. While wholesale clubs are occasionally a rotating quarterly bonus category good for 5x/5% on other cards (as they are this quarter with the Chase Freedom and Discover IT cards), 3.5% is otherwise a great return for wholesale clubs and 5.25% at gas stations is terrific as well – again, considering the fact that this is cash back and the card comes with no annual fee.

While the Premium Rewards card is likely more interesting as an “everyday” card for those with $100K on deposit, the Cash Rewards card isn’t a bad complement to have in the wallet.

Big changes coming

Yesterday, Bank of America announced the following changes coming on January 14, 2019:

- Card holders will be able to choose their own 3% back category from the following options: gas, online shopping, dining, travel, drug stores, or home improvement and furnishings.

- Card holders can change the 3% category (for future purchases) once each calendar month

- When redeeming rewards, there will be no minimum amount required when depositing your rewards into an eligible Bank of America account.

Most other card details are expected to remain the same: the $2500 quarterly cap will still apply to combined purchases in your chosen category and grocery/wholesale, it will carry no annual fee, etc.

Why that’s awesome

First of all, the flexibility to choose your own rotating category monthly is pretty awesome. If you regularly spend a lot in one of those categories, you could enjoy it as a 3% category all year long or you would have the freedom to rotate to choose whatever fits your needs each month (which coincidentally ought to make it easy to test what works without being locked in for more than a month or two waiting to find out). The ability to have a rotating 3% cash back card with no annual fee where you get to choose your own category is pretty cool.

But this of course gets really interesting if you have Platinum Honors with Bank of America. Keep in mind that the $100K required for Platinum Honors includes things like an IRA or an old 401k account, so even those who aren’t looking to move their entire investment portfolio to Bank of America / Merrill might be able to meet the requirements for Platinum Honors without massive changes.

With Platinum Honors, this card becomes pretty awesome for a no-annual-fee card as you’ll essentially be choosing your own 5.25% back card. It is of course capped at $2500 per quarter — though that’s a higher cap than the other rotating-category cards on the market and with this one you get to pick your own category. That’s $525 in cash back per year if you’re able to max out the cap on your chosen category(ies).

While the drug store category could be useful for some, the online shopping category also looks particularly interesting. We don’t yet know what will code as online shopping, but I expect it will likely at least include most major retail websites. If it includes popular gift card sites and/or things like eBay/PayPal, it could stack very nicely. For instance, gas gift cards occasionally go on sale at eBay for 6% off (typically $100 for $94). If you’re able to also earn 5.25% back on the purchase of the gift card, it would amount to nearly 11% off the retail price on gas (net $89.07 for $100). Alternatively, those who purchase Visa Gift Cards from online sites could see the cash back more than offset activation fees, especially when stacking with a shopping portal. Again, the caps aren’t huge — but you could easily come out a few hundred bucks ahead each year, which is nothing to ignore on a no-fee card.

Furthermore, since this card is a Mastercard, it would be a great card for paying the mortgage or other bills via Plastiq (See our Complete Guide to Plastiq credit card payments), especially during promotions. Last year, Plastiq ran a promo that continued for months (across two quarters) where Plastiq payments of $250 or less made with a Mastercard were fee-free. They followed that with a short-term targeted promotion whereby you could net a 1.25% fee. Even paying the normal 2.5% fee, you’d still come out 2.75% ahead — a profit of $275 on the year if you made exactly $2500 in purchases each quarter (and of course if Plastiq codes as online shopping). Any promotions would be gravy.

It’s even pretty good if you’re only able to hit Platinum status with Bank of America (rather than Platinum Honors). Platinum only requires $50K in deposits and comes with a 50% bonus, turning your 3% category into a 4.5% category. For things like online shopping, drug stores, and even dining/travel, that’s a pretty good return especially considering the flexibility. You could alternatively get 4% back on dining and travel with the Uber Visa; the advantage here is in being able to change your chosen category monthly (and of course in getting better than 4% back with Platinum Honors or higher — albeit with a side dish of foreign transaction fees on the BoA Cash Rewards card, so you won’t want to use this one overseas).

Bottom line

I product-changed my Alaska Airlines Visa Signature card to the Cash Rewards card mostly as a no-fee placeholder in case a more interesting product change opportunity came along. With the ability to choose your own rotating categories monthly starting next month, I might have to consider moving my IRA over as the annual return on this card might just be too much to pass up.

Have you been able to confirm that using the online category you received 5.25% cash back on plastiq? I have the card, but I am wondering if it really codes as online when charging a plastiq payment to it… If it does that is amazing.

I’ve called twice and each time they tell me it’s not possible to product change! Not sure if I’m just unlucky or if you did this right before the window closed. I’m going to call one more time tho.

Interesting. Let me know what happens.

Will do. Do you know the date you product changed?

I’ll have to check my records, but off the top of my head I think it was late April / early May.

Called a THIRD time and was told it wasn’t possible. However, I pushed a bit and told a rep that I read someone was able to do it recently, but maybe the window had closed. The rep paused and then said he’d try it anyway just to see. It went through!

I think the system doesn’t offer it as an option, but if they try to manually push it through it works or something.

With your PC, did you have the Alaska account close on your CR and a new one open on your CR? The rep said that’s what would happen, but I’m skeptical of any CSR’s accuracy on such things. This made me hesitate since I wouldn’t want a new account just for a PC.

[…] A Product Change To Consider: When annual fees are due, you face a decision of whether you think you get enough value out of your card to justify paying the annual fee. Here’s a situation to where downgrading your card could be rather lucrative. […]

[…] 3:55 BofA Cash Rewards revamp early 2019 (HT Nick at Frequent Miler link) […]

Nick,

Any DP if the Alaska Business can also be product changed to the BOA Business Cash Reward card

Nick, great article! But I don’t follow your comment, “Furthermore, since this card is a Mastercard“. The card is a Visa I believe. How does this change things? Thank you!

There are both visa and MasterCard versions. I currently have both. The mastercard changes things because of various masterpass promotions that could pop

Up and being able to pay basically any bill on Plastiq with a mastercard while visa is much more restrictive.

So if you have ‘n’ Cash Rewards cards, does that mean (n * $2500) limit for the bonus category?

“

I’m always surprised no one mentions BankAmeriDeals as another nice perk of B of A cards. They run very similar (often overlapping) promotions to Chase’s offers and work the same way — sign into the B of A website then click to add to your card and you get cash back in your account when you redeem the deal. Might be worth looking into!

Good point! In my case, that’s partly because I never get targeted for them. I’ve recently had some crummy offer for PBTeen (the first or second offer I’ve ever seen), which is a company I wouldn’t even know existed if not for this and Chase Offers (clearly, I’m not a regular shopper). Hopefully I’ll eventually get targeted for something useful.

Make sure to click through where you see the offer. There is a much bigger list beyond the single ones that show up on your landing page. You can also find the full list by clicking the “Rewards and Deals” tab at the top. I have 45 deals available, mostly dining ones that might make for good gift certificate purchases, but earlier this fall I had this one (which I wish I had the PTO to use!). Air New Zealand

Click here to earn 10% cash back on your Air New Zealand ticket purchase!

Book your next adventure with Air New Zealand and explore the bustling cities in Australia and the naturally stunning landscapes in New Zealand.

Visit our website to learn how you can fly to both Australia and New Zealand for one low price.

Earn 10% cash back on your ticket purchase from Air New Zealand, with a $146.00 cash back maximum. Payment must be made on or before offer expiration date. Offer expires 11/22/2018. Offer valid one time only. Offer not valid on third-party purchases.

Articles like this are why your blog is number one!! Keep up the good work.

Good reminder for me to remember product change possibilities, rather than to just cancel. Thanks.

Hey, Nick.

You might want to double check that retirement accounts, like IRAs, count toward Platinum Rewards. They didn’t for my husband. I put stocks in my account and that worked.

Interesting. If you go to the Preferred Rewards Frequently Asked Questions and see the question “How do I qualify?”, they have a link to a video (it says “Get simple tips to help you reach the required balance”. The transcript for the video says this:

——

The great news is that $20,000 can come from almost anywhere. It can be transferred from existing accounts at other banks or investment firms, from an old 401(k), an IRA, a vacation fund,or even a rainy day fund.

—–

I got that from this page — but it could certainly be wrong if you’re telling me that it didn’t count for you.

https://www.bankofamerica.com/preferred-rewards/faq/

I can confirm that IRAs were the only way I qualified. Roth & Traditional together.

Seconded! We use a combination of trad ira, Roth, and cma/brokerage to get there. If you’re joint on an account (not possible on a retirement account), it counts for both people.

Thanks, Nick, great write-up. I have this card and eagerly look forward to these changes. Wish there wasnt a $2500 cap but its still better than nothing.

Was seriously considering this card until I found out it has a 3% foreign transaction fee.

Deal killer for those hoping to select the travel or dining category and who travel a lot outside the US.

Well, deal killer for those who intend to use it outside the US – this definitely isn’t the card for that. But for those who can max out the bonus categories here in the US (and between online shopping, drug stores, and home improvement and the ability to change monthly, that ought to be pretty easy), it’s a nice little chunk of change — what I’d call low-hanging fruit.