NOTICE: This post references card features that have changed, expired, or are not currently available

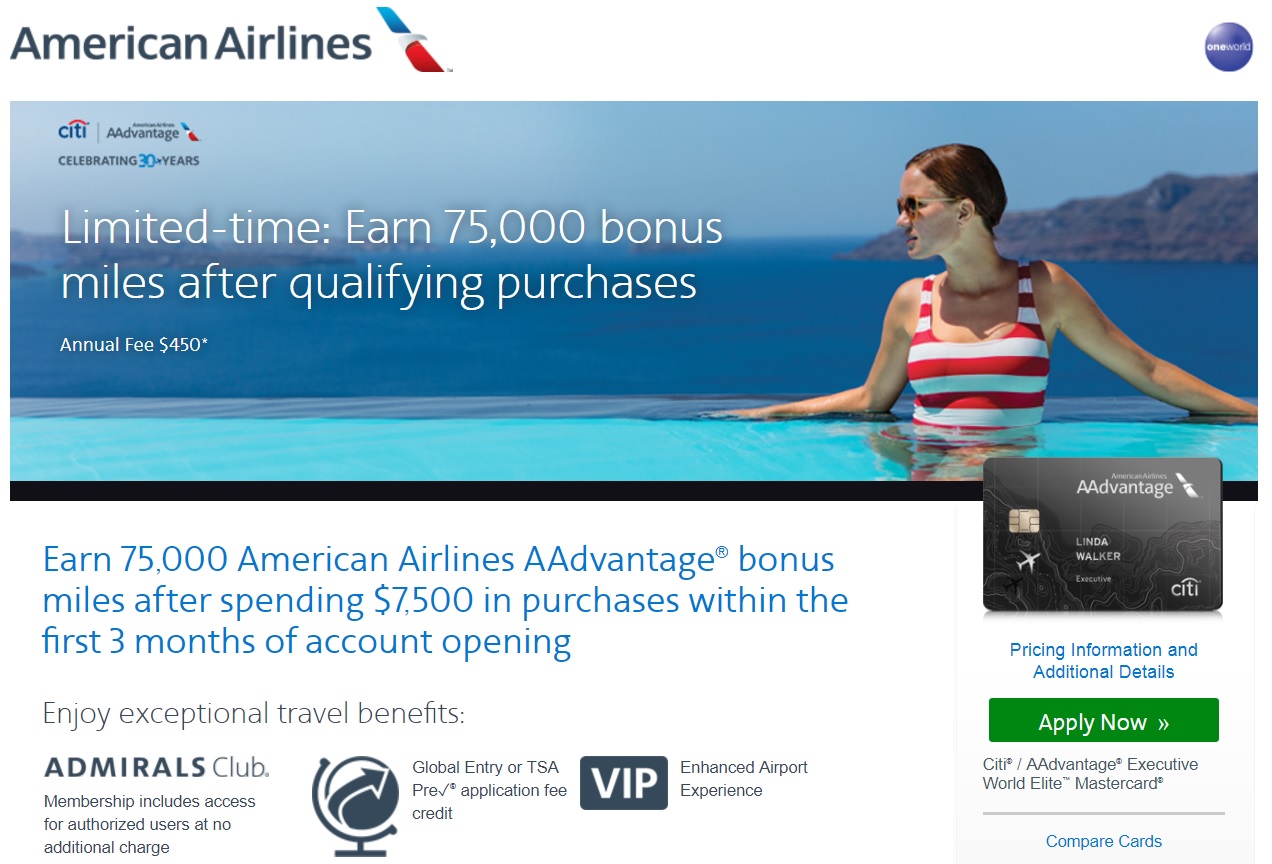

The Citi AAdvantage Executive World Elite Mastercard has an increased signup bonus offer: 75,000 American AAdvantage Miles after spending $7,500 in the first 3 months. This card comes with Admirals Club Membership for the primary cardholder and access for authorized users — if you were considering a membership, it might make more sense to sign up for this card and collect some miles if you are eligible.

The Offer

- 75,000 American Airlines AAdvantage bonus miles after $7,500 in purchases in the first 3 months

- Link added to our Best Offers Page

Card Details

- $450 annual fee is not waived

- Admirals Club Membership Included for the primary cardholder (including access to partner lounges) and Admirals Club access for authorized users even when traveling without the primary cardholder

- 2X on American Airlines purchases

- 1X everywhere else

- First checked bag free

- 25% savings on eligible in-flight purchases on American Airlines flights

- Up to $100 Global Entry or TSA PreCheck application credit

- 10K elite-qualifying miles when you spend $40K in a calendar year

- Up to 10 authorized users for free

Quick Thoughts

With the Citi Prestige having lost Admirals Club access this past weekend, those who need that access may be interested in this card — especially now that the public signup bonus is 75,000 miles. That’s a nice signup bonus, though with targeted 65K bonuses floating around on the $95-annual-fee Citibuisness and Citi AA personal cards and a 50K bonus available on the Barclaycard Aviator with just a single purchase and payment of the annual fee, I think you would have to value the Admirals Club access highly to be enticed by this offer. Still, with access for you and two guests — and up to 10 authorized users and their guests — it’s not a bad deal for those who do want Admirals Club access (and you’d do well to get 75K miles rather than the normal signup bonus of 50K miles). American Airlines miles aren’t particularly useful for travel on American Airlines as saver availability is nearly nonexistent on American flights. However, these miles can still be quite valuable for international partner redemptions. Remember that Citi’s 24-month language will prevent you from getting the signup bonus if you have opened or closed another Citi AA card within the previous 24 months.

H/T: One Mile at a Time

Nick, do you know if you could have 2 Platinum Select cards at the same time? I just applied for my first one, but if I wait a year to downgrade or cancel it, my 24 month clock resets, so I would in essence have to wait 36 months before applying again. If I keep the card, I would only have to wait 24 months, and then cancel the original card after signing up for a 2nd one.

Nick,

My only card in this family is the Platinum Select. Annual fee is now due, and I’m thinking about downgrading to the Citi AAdvantage Bronze card (no annual fee) since I recently picked up Aviator Red, and it has all the same benefits. Don’t want to close, as it’s over 15 years old. If I change from Platinum to Bronze, would that affect my ability to capitalize on this offer on the Executive card? Am I technically “closing” the card? Thanks for any advice you can provide.

If it has been 2 years since you opened the Platinum Select card, then apply for the Admirals Card first, and immediately downgrade the Platinum Select to Bronze. This way you don’t reset the 24 month clock before applying, in which case you would be locked out for another 24 months from getting the card!

The truth is that we’re not sure how downgrading affects you.

However, in your case, as someone else said while I was typing this, I see no advantage to downgrading before you open the Citi AAdvantage Executive card. I would hands-down apply for the Executive card first and then downgrade to the Bronze card. That way, you have no risk of resetting the clock before your Executive app — and, in face, since the Executive app resets the clock anyway, you then won’t reset the clock by much more if it does reset on a downgrade.

One note: if you have the ability to hit the $7.5K spend in the first month, I’d probably do that before downgrading the Platinum Select.