Bank of America has notified Alaska Airlines Visa Signature cardholders of changes coming to the credit card. The good news is that there will soon be some potentially useful bonus categories on the card. The bad news is that the annual fee is increasing and in order to get the tree checked bags benefit, you will need to pay for your ticket with the Alaska card. That’s a big bummer since many readers will prefer to pay using a card that offers trip cancellation / interruption / delay insurance to pay for their ticket rather than the Alaska card.

Alaska Airlines Visa Signature adds bonus categories and requirement for checked bag benefit

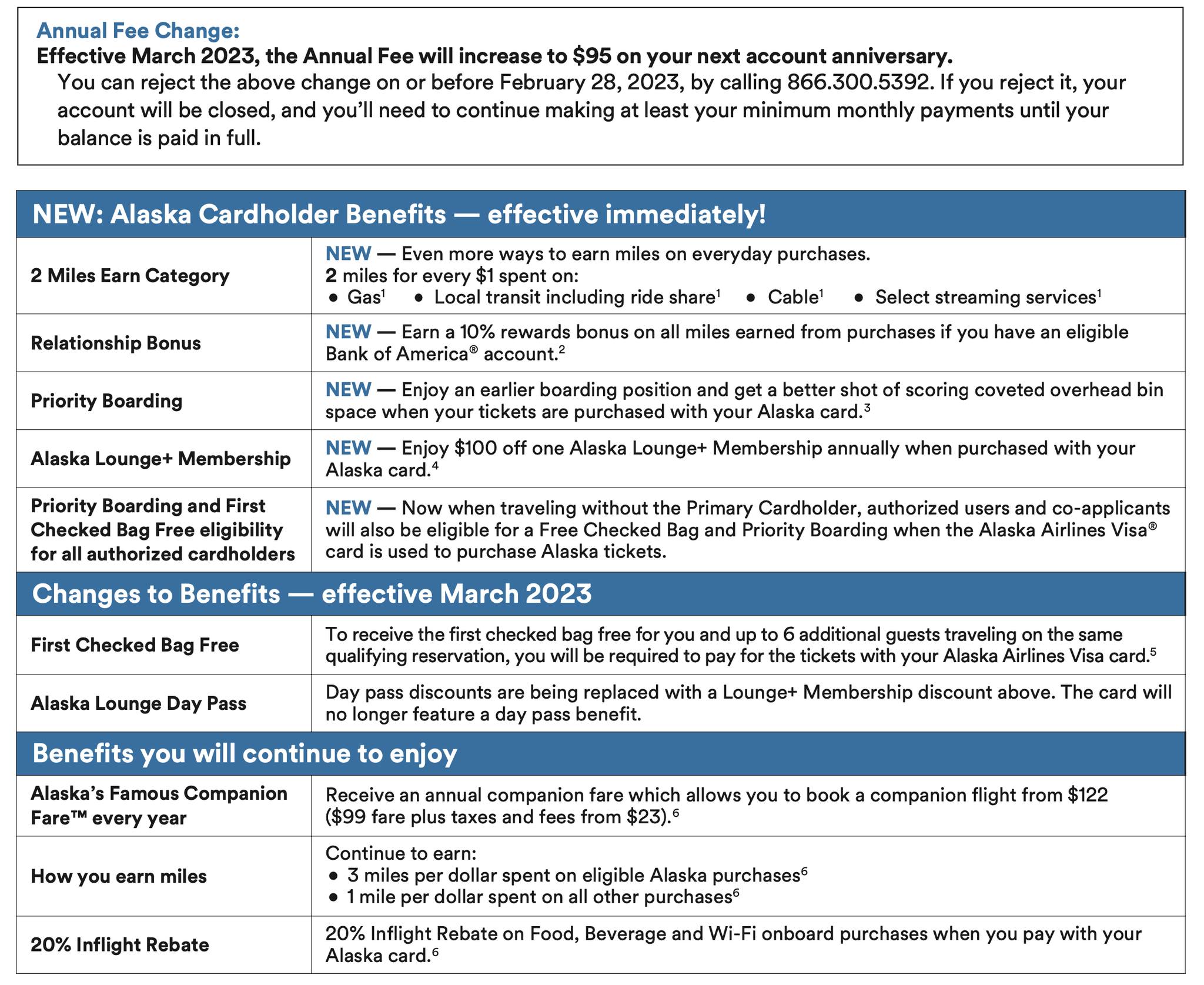

A member of our Frequent Miler Insiders shared the screen shot above with changes coming to the card in March 2023. Key highlights include:

- Increase in annual fee from $75 to the new fee of $95

- Earn 2 miles per $1 spent on gas, local transit, cable, and select streaming services

- A 10% bonus on all miles earned if you also have an eligible Bank of America bank account (i.e.e you’ll earn an effective 2.2 miles per dollar spent on the bonus categories above)

- Free checked bag benefit will now only apply if you paid for the flight with your Alaska Airlines Visa Signature card

There are a couple of other changes noted in the screen shot, but those above are probably most important for most people. The card will still feature its annual Companion Fare Code.

It’s great to see a couple of bonus categories on the card. While an effective 2.2 Alaska miles per dollar spent (for those with a qualifying bank account) will not be the best category bonus for gas spend, it’ll nonetheless be a decent return for someone who highly values Alaska miles.

Unfortunately though, I suspect that many readers will be disappointed with the requirement to use the Alaska Airlines Visa Signature card to pay for their flight in order to receive a free checked bag. Personally, I always use either my wife’s Chase Sapphire Reserve or my Chase Ritz-Carlton Visa Signature to pay for flights or award taxes because of the excellent travel protections.

I wonder if it might be possible to somehow have your cake and eat it too by buying a cheap fare on your Sapphire Reserve card and then changing your itinerary to the flight you really want and paying the difference on the Alaska Visa Signature. Since you’ll have paid for part of the fare with the CSR (and possibly keep the same confirmation number?), I think the Chase travel insurance benefits would likely apply. I don’t know for sure whether you’d get the checked baggage benefit by only putting part of the cost of the ticket on the Alaska card, but I’d be curious to try it.

Overall, the main reasons to get the Alaska card will likely continue to be the welcome bonus and the annual companion fare code, but I’m sure that the loss of the easy-to-use checked baggage benefit will be a disappointment for those who live in Alaska markets on the west coast.

HI, any data points regarding buying an upgrade to trigger free baggage?

[…] Alaska flights and Alaska lounge discounts, these changes are more noteworthy.As first reported by Frequent Miler, some changes to the personal Alaska Airlines Visa® Credit Card have already taken effect, while […]

For the companion fare/ What about the 6000 annual spend? Is that just for new cards holders?

I am curious how the free bag benefit works for those who already purchased tickets months ago when there was no requirement to purchase the ticket using the AS credit card. I assume like most rules that one would still get the free first bag. But I kind of wonder how that might play out next August when I fly them with a ticket not purchased using the AS credit card.

Same situation here.

Received similar letter today for the Alaska buiness card. Interestingly the letter does not mention any increase to the annual fee. For the new 2x categories, the business card substitutes shipping for cable & streaming.

[…] first reported by Frequent Miler, some changes to the personal Alaska Airlines Visa® Credit Card have already taken effect, […]

[…] first reported by Frequent Miler, some changes to the personal Alaska Airlines Visa® Credit Card have already taken effect, while […]

[…] first reported by Frequent Miler, some changes to the personal Alaska Airlines Visa® Credit Card have already taken effect, while […]

Did the changes include sports equipment? We fly frequently with fishing rods and have never been charged. Flew Friday and there was no charge for our rod case. Sunday coming home it was a $40 fee (2nd bag).

Given the new $100 Alaska Lounge discount, I wonder if my spouse and I (who both have elite status) could stack these card-based discounts with elite-based discounts and split the cost?

So a $650 Alaska+ membership is $550 for elite members. Then if we split the charges it would be $275 per person. Then if each of us have the $100 discount, it would end up being $175 per person. Great deal if this works!

I love Alaska Air, it’s pretty much the only airline I use unless I go somewhere they aren’t flying, but I will never get their card as long as it’s through BofA.

First of all BofA has left Oregon and Washington ,second it should be 1 free bag automatically with purchase of ticket for travel from any type of payment, that’s discrimination to people that are not with BofA.

I live in Portland and am a five-minute walk to my BofA branch. Not sure they have “left” Oregon. And I think the hyperbolic use of the word discrimination is bit much considering all of the people in this country who experience actual discrimination. Just my 2¢

Where to start

Just paid $70 for my son’s frequent flyer ticket baggage plus $105 just to have a plus seat. Alaska is so so dead. We’re just cashing in miles and walking away. If someone has a funeral and the only option is a 1200 mile flight we sadly won’t make it. Shame on you Alaska!

I’m sure Alaska will miss you terribly.

Like many others I am curious if these changes will apply to the business card. I have both consumer and business and have only received a notice for consumer card which specifically included the last 4 digits of my consumer card. So I’d expect that we’ll get a separate notice if business card is affected.