Earlier this week. US Credit Card Guide published a useful tidbit: it is now possible to get the introductory bonus again on the U.S. Bank Altitude Reserve if it has been at least 5 years since you last received the welcome bonus on the card. While that’s a disappointingly long time between bonuses, it is great to know that it is possible to get the bonus again.

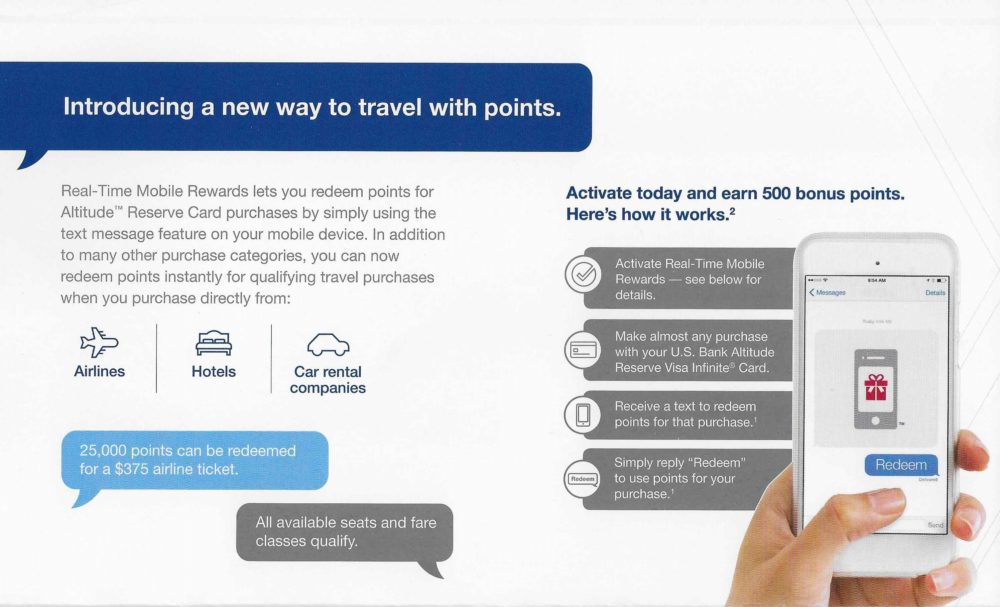

The Altitude Reserve is a fantastic keeper card to have for people who make a lot of purchases in-person. The card offers 3 points per dollar spent when using mobile wallet, and points can be used at a value of 1.5c per point through the US Bank portal or Real-time mobile rewards. That combines to make for an effective 4.5% back on purchases where you can tap your phone or watch to pay.

A member of US Credit Card Guide’s forums picked up on a change in the terms & conditions on the Altitude Reserve application. The terms now say:

Existing or previous U.S. Bank Altitude Reserve Visa Infinite cardmembers are not eligible if you have received a new account bonus for this product in the last five years.

I find the wording there particularly interesting because it sounds to me like even existing Altitude Reserve cardholders can get the bonus on a second card so long as it has been 5 years or more since last receiving the bonus. That’s great news for early-adopters as this card launched almost exactly 7 years ago. Based on the terms, it sounds like those who opened the card and earned the bonus within the first couple of years that the card existed might be eligible to get the welcome bonus again.

This does represent a long timeline compared to other US Bank cards, where it is often possible to earn the welcome bonus again much sooner than 5 years in the future. Still, it’s good to know that this bonus is not a once-in-a-lifetime bonus and to read that you may even be able to get it as an existing cardholder.

how exactly can you get the bonus if you already have had the card for 5 years?

I’m sure you could close your current card and re-apply, but I would bet that you can just apply for another and have two (and then cancel or product change the first one if you want). US Bank doesn’t prevent you from getting another of the same card to my knowledge.

Isn’t this one of the cards that still allows the restaurant benefit with Priority Pass?

Yes

AS Bank Altitude Cards are very restive in terms if using its rewards for Travel. Cistomer service are not friendly and used all available means to make your transactions very stressful.. It’s a torture dealing with this company.

Quick comment regarding “The Altitude Reserve is a fantastic keeper card to have for people who make a lot of purchases in-person.” This is true, and I’ll add that I also make ApplePay purchases online at many merchants.

Seems like a great card. Curious for those people who have the card where it fits in your portfolio. Is it when you’re not working on a SUB? Or when there’s con category bonus multipliers?

I’ve had the card for many years. Great at Costco (4.5% cash back via real time rewards vs the Citi Costco 2% cash back card). It’s my go to card for all ApplePay purchases that fall outside restaurants and grocery stores. I use it almost exclusively when traveling since most places in Europe take ApplePay and this card has no Forex. $325 travel and dining credit applied automatically against the $400 AF and it’s often possible to get $50-$100 retention offers when your AF posts. The primary rental car coverage came in handy when I had a $600 chipped windshield a few months ago which covered the whole bill.

I totally second Grant’s great summary. Easy to get almost all of your international spend at 4.5% cash back since Apple Pay so broadly accepted.

When you aren’t working on a SUB and you just don’t want to fish through cards to figure out which one to use, the tap to pay for 4.5% is an easy way to know you are getting a pretty good return. I like it as well for farmer’s markets and festivals where you have no clue what anything will code as and you may not want to be deal with a wallet around crowds.

Just bought tailored suits in Vietnam and even though they charged a 3% cc fee, I was able to use ApplePay so I knew I would still come out ahead with USBAR and have the cc purchase protection vs cash.

Heading to my 2nd year lol.