Ultra-premium credit cards often have great perks like lounge access, elite status accelerators, free nights, companion tickets, etc. The problem is that the annual fees, which can be as high as $695, can be overwhelming. All of these pricey cards are worth getting for their initial welcome bonuses, but they can be very expensive to keep… especially if you have more than one. How can you decide which are worth keeping?

The premium card worksheet

In order to help identify which cards to keep or cancel, I created a Google Doc spreadsheet with tabs for each of the most popular ultra-premium rewards cards (and a handful of popular premium cards). On each tab you can enter your estimated value for each perk and then return to the summary tab to see which cards are keepers.

–> Click here to open and copy the spreadsheet into your own Google account

The rest of this post goes into detail about how I recommend using this worksheet, but here are some quick tips for those who don’t plan to read the rest (I get it: even though there’s some really good stuff below, you’ve got other things to do):

- Don’t double-count overlapping perks! For example, assign value to Priority Pass only to the card that you’re most likely to keep.

- Value perks based on how much you’d be willing to pre-pay if it was available as a subscription. Don’t estimate based on how much you’re likely to save.

- If your total value of perks equals or exceeds a card’s annual fee, then its a keeper.

Background

To make up for big fees, issuers (especially Amex) have been adding “sponsored perks” where you can get rebates from spend with specific vendors (Equinox, Peloton, New York Times, DoorDash, Dell, Saks Fifth Avenue, etc.). On paper, it looks like you can get back more money than the annual fee for these cards. And you can, if you would actually pay for these products and services anyway. The reality, though, is different. Take the Business Platinum Dell credits, for example. Each year, January through end of June and again July through end of December, you can get $200 back from Dell purchases, for a total of $400 back. If you regularly buy $200 or more from Dell, both early in the year and late in the year, then the rebate really can be thought of as being worth nearly its face value. But, if you find yourself scrambling twice per year to figure out what to buy, the rebate should be worth considerably less to you. In my case, since Dell rarely has in-stock XBox gift cards anymore (which can be used for anything in the Microsoft Store), I value these Dell rebates at only half of face value. It’s nice to get free software, microphones, earbuds, chargers, cables, and other gadgets twice per year, but not face-value nice.

When it comes time to pay the annual renewal fee on each of your premium cards, it makes sense to evaluate whether or not the card’s perks and rebates are at least as valuable as the card’s annual fee. If the answer is “no”, then I recommend calling to cancel the card. If the card issuer offers a great retention bonus, great — keep the card for another year. If not, go ahead and cancel or, better yet, product change to a fee-free card if possible (note that Amex Platinum cards do not have a product change path to a free card). Before cancelling, though, please take a look at our checklist for cancelling credit cards to avoid losing points and other rewards.

How to estimate value

When you pay a credit card’s annual fee, you are essentially pre-paying for a year of perks that this card offers. The best way to determine what these perks are worth to you is to decide for each one, how much you’d be willing to pay if it was available independently as an annual subscription. Consider the Amex Business Platinum card’s wireless cell phone credits, for example. The Business Platinum card offers up to $10 back per month when you use your card to pay your cell phone bill. On the surface, that sounds like an easy $120 back per year for most of us. But you shouldn’t value it at the full $120. Imagine if your phone company sold a benefit like this separately: What would you pay annually to AT&T (for example) to save $10 per month off your bill? You wouldn’t pay $120, would you? It wouldn’t make any sense to pay $120 up front for a total of $120 in savings spread out through the year. Instead, you might pay $100 (for example) for a $120 in savings.

Other examples:

- Chase Sapphire Reserve $300 Travel Credits: This is a really easy credit to earn since all travel purchases count. But how much would you pay in advance to get $300 back? Keep in mind, too, that the Sapphire Reserve doesn’t give you points for that $300 in spend. That’s almost $15 in rewards lost to that spend. I’d argue that you shouldn’t value this perk at more than $285 and it would be reasonable to value it less.

- Amex Platinum $200 Prepaid Hotel Credit: Consumer Platinum cards offer $200 back per calendar year towards prepaid Fine Hotels & Resorts or The Hotel Collection bookings. That’s great, but how much would you pre-pay for this rebate? Keep in mind that unless you habitually book through Fine Hotels & Resorts or The Hotel Collection, you might end up not using this perk at all. Personally, I wouldn’t value this at more than $100 per year.

- Marriott Bonvoy Brilliant 85K free night certificate: You might save $500, $700, $900 or more off a hotel night when you use this certificate, but there’s no way you should pay that much in advance. The only reason to pay in advance for a free night certificate (especially one that expires after a year) is if you expect to get way more value than you paid. So, for example, you might be willing to pre-pay $300 for the chance of saving $500 or more.

Overlapping perks

One and done perks

There are many valuable perks that have no incremental value if you have the same perk from multiple cards. For example, getting Hilton Gold status from one credit card is great, but getting it from a second card has no incremental value. Here are some more examples where you might value a perk from one card, but having on multiple cards doesn’t make it any more valuable:

- Free checked bags

- Elite status with a specific hotel, airline, or car rental service

- Lounge access to a specific type of lounge

Diminishing return perks

Some perks have diminishing value with each extra card that offers the perk. For example, each of the Amex Platinum consumer cards (the regular consumer Platinum card, and the one’s from Schwab and Morgan Stanley) offer $240 per year in Digital Entertainment Credits: Up to $20 per month rebate for select digital entertainment services (Disney+, The Disney Bundle, ESPN+, Hulu, Peacock, SiriusXM, The New York Times and The Wall Street Journal). In my case, I subscribed to the New York Times e-edition anyway, and so value this perk on my generic Platinum card pretty highly. I pay about $17 per month, or $204 per year and so I value these savings at about $180 (i.e. I would be willing to prepay $180 for those savings). But I also have the Schwab Platinum card which I have used to subscribe to Peacock Premium for $11.99 per month. I wouldn’t pay for Peacock Premium without the rebate, though, so here I value the perk at only about $25.

How to value overlapping perks

The trick to doing this right is to first figure out which of your cards are the most likely “keepers” and assign perk values to those cards first. Then go to your next most likely to keep cards, and only assign incremental value (if any) to perks that overlap with your keeper cards. And repeat with the next most likely to keep cards, and so on.

If you have a bunch of premium cards, this is not easy! For example, many premium cards offer Priority Pass memberships. If you have more than one, then it’s a good idea to figure out which card is the most likely “keeper”, but keep in mind that the value of Priority Pass varies by card. Priority Pass from Amex or from the Venture X card doesn’t include free meals at Priority Pass restaurants. And, with other cards, details vary about how many guests you can bring in and what it would cost (if anything) to add authorized users with their own Priority Pass membership. One of the best options overall is with the Chase Ritz card which offers Priority Pass with unlimited guests, and free authorized users, each of which can get their own Priority Pass with unlimited guests. But the Ritz card isn’t easy to get (you have to start with a Chase Marriott consumer card and upgrade) and its perks aren’t ideal for everyone. Still, if you have the card and highly value its key benefits like the $300 incidental travel rebate and 85K free night certificate, it makes sense for this to be your first-in-line keeper card. Estimate the value of Priority Pass on that card, but not on any others. If the Ritz card isn’t for you, a good alternative is Capital One’s Venture X card which also offers Priority Pass to your free authorized users (but this version of Priority Pass doesn’t include restaurants or experiences). Having a single “keeper” card with Priority Pass solves another problem: you’ll never have to wonder which of your many Priority Pass cards is the right one to use at any given time. Get the one that comes with your keeper card and never request another.

A real-ish example

I used to show my own spreadsheet here, but my situation has become too complicated to explain in a single post. Many of the cards I have are keepers just because writing and talking about credit cards is my career. I wouldn’t have as many cards otherwise. So, instead, I created a spreadsheet for a friend. She currently has the Chase Sapphire Reserve card, the Chase Freedom Unlimited card, Amex Gold Card, and a Delta SkyMiles Platinum card. She also currently has Delta Platinum Medallion Elite status and values that highly. She is also thinking about upgrading her Delta Platinum card to a Reserve card in order to get Sky Club access and to get a better way of earning Medallion Qualifying Dollars towards elite status through credit card spend. She has a job where she is reimbursed for travel that she pays for herself and so she believes that it would be very easy for her to use the new Delta Stays hotel credits available through Delta cards.

For this exercise, I filled out the spreadsheet on my friend’s behalf as if I were her and imagined her valuations for each card perk…

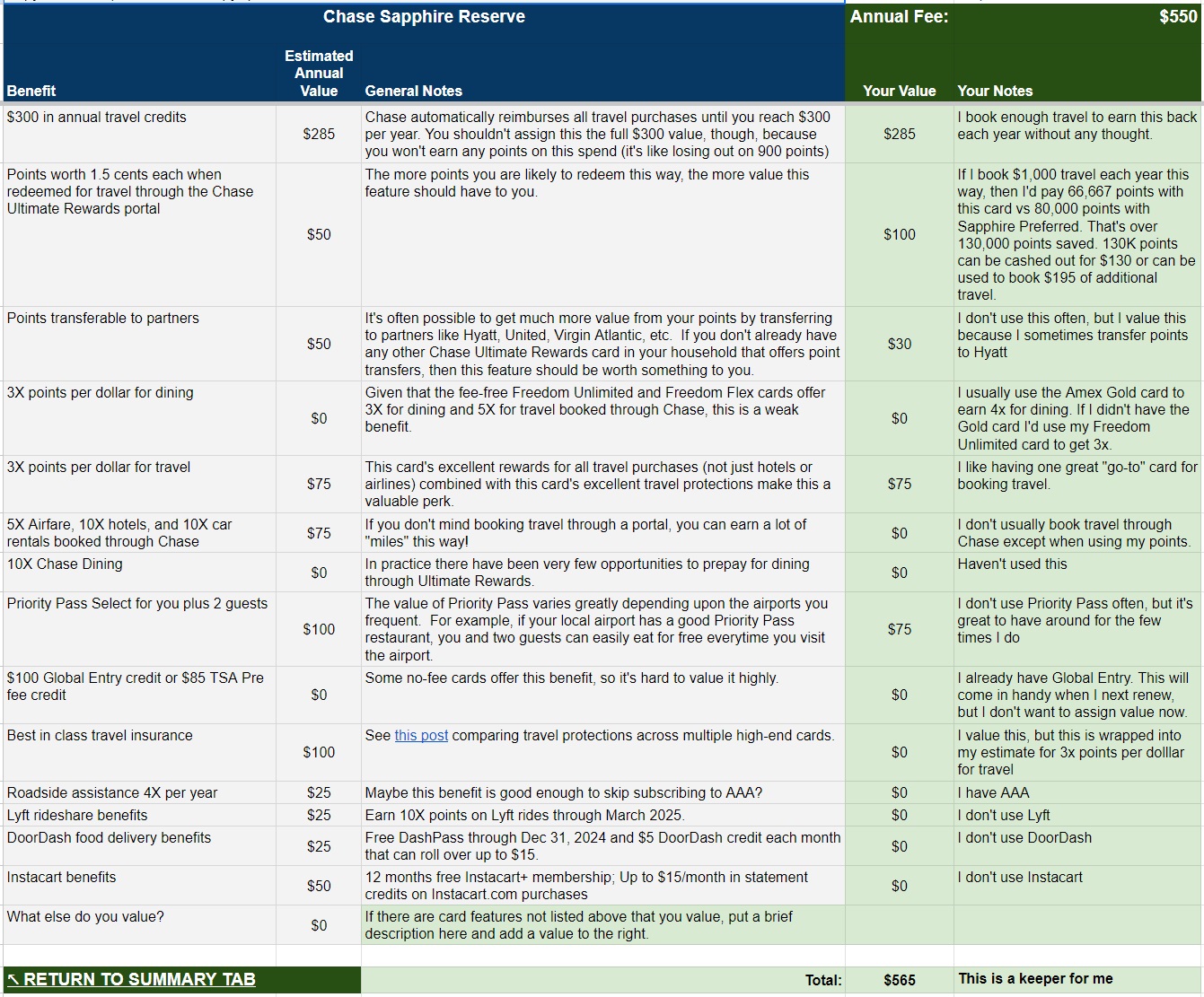

Chase Sapphire Reserve

| Card Offer and Details |

|---|

60K Points ⓘ Affiliate 60K after $4K spend in 3 months$550 Annual Fee Alternate Offer: 70K after $4K spend showing on some accounts when logged-in to Chase Recent better offer: Expired 12/1/22: 80K after $4K spend FM Mini Review: Excellent all-around card for frequent traveler. Best when paired with no-fee Chase Freedom Flex, no-fee Freedom Unlimited & no-fee Chase Ink Cash Click here for our complete card review Earning rate: 10X hotels & car rentals booked through Chase Travel℠ ✦ 10X Chase Dining ✦ 5X flights booked through Chase ✦ 3X Travel and Dining ✦ 10X Lyft (through March 2025) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: $300 Annual Travel Credit ✦ Points worth 1.5 cents each towards travel when booked through the Chase Travel(SM) Portal✦ Transfer points to airline & hotel partners ✦ Primary auto rental collision damage waiver ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Up to $100 Global Entry fee credit ✦ $5 monthly DoorDash in-app credit through December 2024 ✦ Free DashPass through 2025 ✦ Earn 10X on Lyft spend✦ Free Lyft Pink All Access Memberhsip through December 2024 ✦ $15 monthly Instacart credit ✦ 12 months free Instacart+ See also: Chase Ultimate Rewards Complete Guide |

My friend’s (made-up) valuations for the Sapphire Reserve benefits total just a bit over the card’s annual fee. She should keep this card.

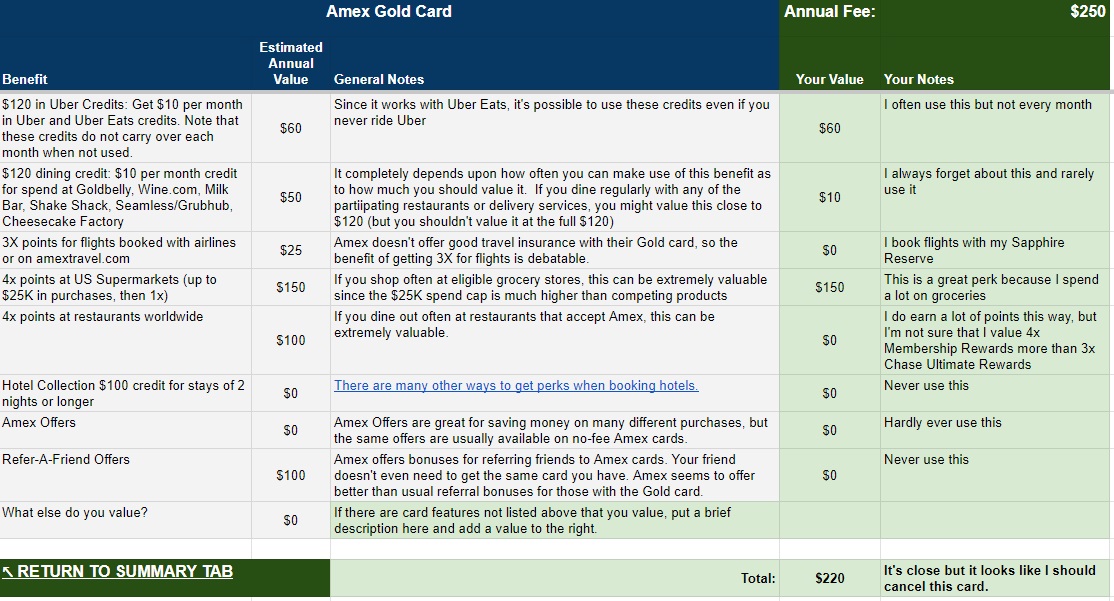

Amex Gold Card

| Card Offer and Details |

|---|

90K Points + 20% back at restaurants ⓘ Friend-Referral 90K points after $6K in purchases in the first 6 months + 20% back at restaurants for the first 3 months up to $100 back. Terms apply. (Rates & Fees)$325 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 90K after $6K in the first 6 months + 20% back at restaurants for the first 12 months up to $250 back [Expired 6/8/22] FM Mini Review: This card offers an awesome return on US supermarket and worldwide dining spend, putting it at or near the top-of-class in both categories. Dining credits and Uber / Uber Eats credits go a long way towards reducing the sting of this card's annual fee. Earning rate: 3X points for flights booked with airlines or on amextravel.com ✦ 4x points at US Supermarkets (up to $25K in purchases, then 1x) ✦ 4x at restaurants worldwide ✦ 1X points on other purchases. Terms apply. (Rates & Fees) Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $10 in statement credits monthly with participating dining partners (Goldbelly, Wine.com, Milk Bar, Shake Shack, Seamless/Grubhub, Cheesecake Factory) ✦ $10 monthly Uber or Uber Eats credit (use it or lose it each month) ✦ $100 hotel credit on qualifying charges on stays of 2 nights or longer, plus a room upgrade upon arrival, if available with The Hotel Collection at americanexpress.com/hc ✦ Enrollment required for select benefits. |

It turns out that my friend doesn’t value the Gold card perks as high as the annual fee and so she should call to cancel when the annual fee next hits. If she gets a great retention offer, great, she can keep the card another year. If not, she should make sure she has another card that earns Membership Rewards so that she won’t lose her points.

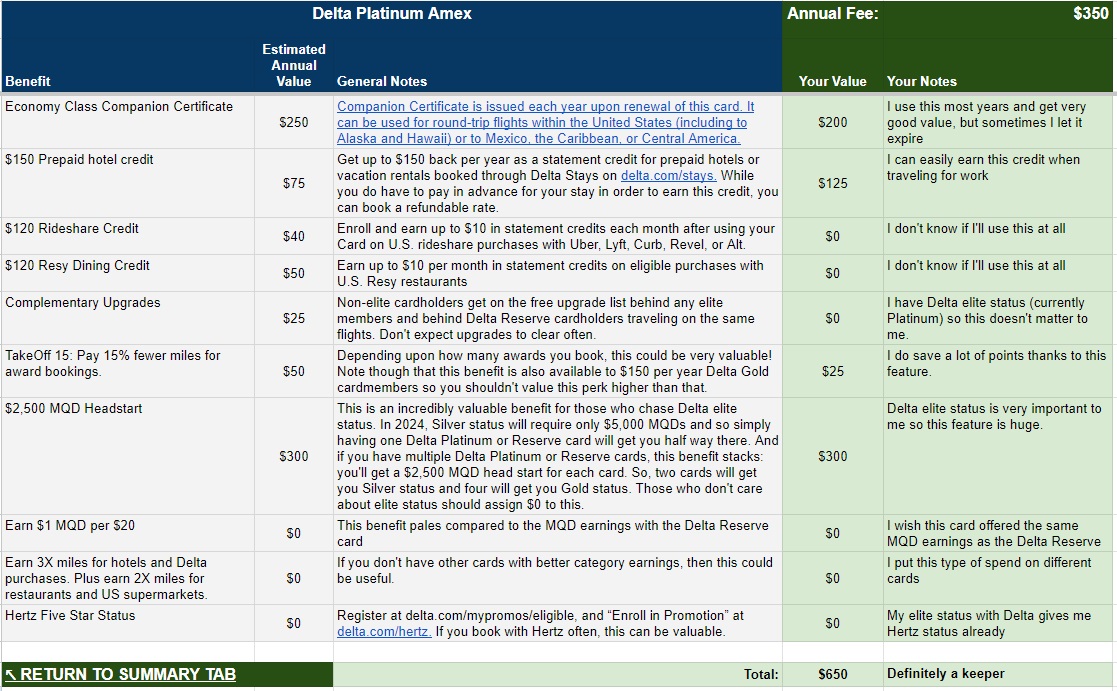

Delta SkyMiles Platinum Card

| Card Offer and Details |

|---|

50K miles ⓘ Affiliate 50K miles after $3K spend in 6 months. Terms apply. (Rates & Fees)$350 Annual Fee FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 2X restaurants ✦ 2X US Supermarkets Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $150 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants [enrollment required] ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Complimentary Upgrade list: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers (ticket must be purchases on or after 2/1/24 to receive this benefit) ✦ Cell phone protection ✦ Terms and Limitations Apply. (Rates & Fees) |

Mostly due to the fact that my friend highly values Delta elite status and that this card offers a $2,500 MQD Headstart, it’s a clear winner. That said, she may do even better with the Delta Reserve card and so I filled that out on her behalf too…

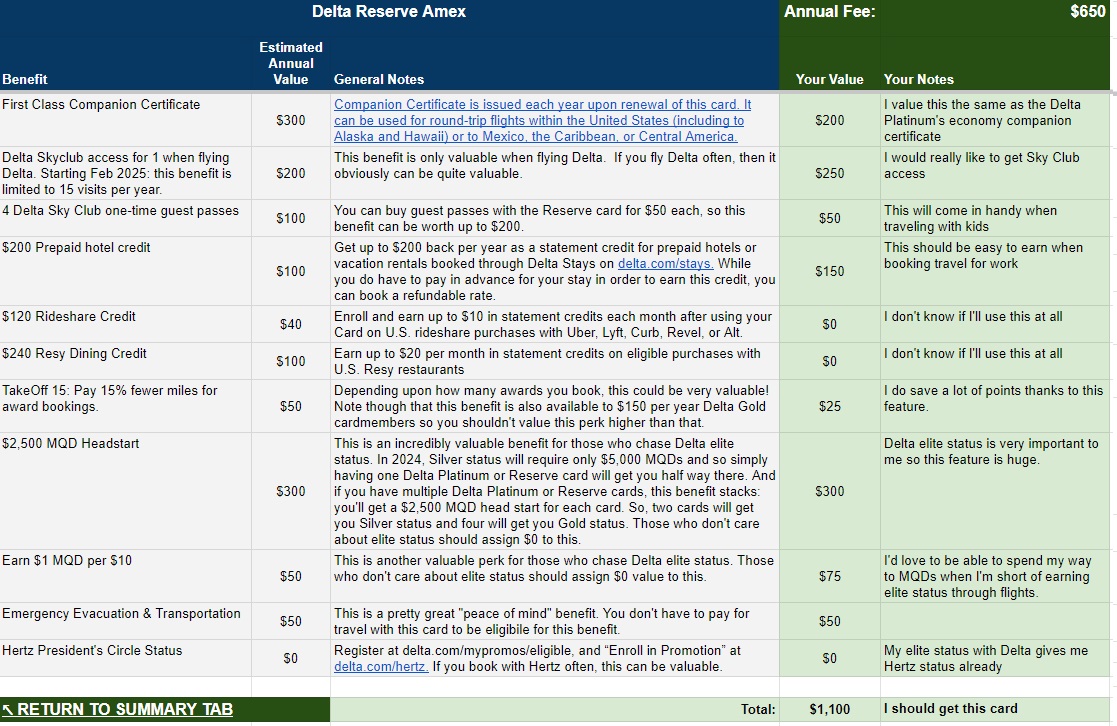

Delta Reserve Card

| Card Offer and Details |

|---|

60K Miles ⓘ Affiliate 60K miles after $5K spend in first 6 months. Terms apply. (Rates & Fees)$650 Annual Fee FM Mini Review: Excellent choice for frequent Delta flyers who can make use of SkyClub access and companion certificate. Also a good choice for big spenders seeking Delta elite status. Earning rate: 3X Delta Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $10 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy or first class companion certificate (subject to taxes & fees) after card renewal ✦ SkyClub access (starting 2/1/25, 15 visits per year (after 15 visits have been used, additional visits can be purchased for $50 each) or to earn an unlimited number of visits each year starting on 2/1/25, spend $75K or more on eligible purchases between 1/1/24 and 12/31/24, and each calendar year thereafter. ✦ 4 Delta SkyClub one-time guest passes ✦ Centurion Lounge access when flying Delta ✦ Earn up to $200 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $20 per month in statement credits on eligible purchases with U.S. Resy restaurants [enrollment required] ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Complimentary upgrades ✦ One statement credit every 4 years for the $100 Global Entry application fee or one statement credit every 4.5 years for the $85 TSA Precheck application fee ✦ Priority boarding ✦ First checked bag free on Delta flights. ✦ Hertz President's Circle Status ✦ Terms and limitations apply. (Rates & Fees) See also: Delta Reserve complete guide |

The Delta Reserve card has even more upside in this example than the Delta Platinum card. My friend would get Sky Club access and the ability to earn a reasonable number of MQDs through spend. She should apply for a Reserve card (that’s better than upgrading because she’d be able to earn a welcome bonus) and then either keep or cancel her Delta Platinum card. An advantage to keeping it is that the MQD Headstarts are additive so she could get even more of a boost towards elite status. If she thinks that she can make good use of two companion tickets each year then this would be a good strategy.

An even better strategy for my friend would be to look into getting Delta business cards. They have the same annual fees and perks as their consumer counterparts but come with even more hotel credits. To keep things simple for this exercise, though, I made the assumption that she is not comfortable applying for business cards.

Please update for the $325 Amex Gold

I have the Chase Sapphire Reserve card and recently received the annual $300 Chase travel credit for hotels booked through Chase Travel. I did not receive the 3x for travel spend, as mentioned in the article, but I DID receive the 7x bonus points for hotels booked through Chase Travel.

The Citi Premier is the ONLY credit card that adds and extra 24(!) months of warranty to an existing warranty. Extremely useful! Easily worth $100/year if you use it at least once a year.

To me, the biz plat still offers decent value between UA Travel Bank and the 35% rebate.

I have several AMEX cards that offer Dell statement credits. So, can I buy a Dell product for, say, $400 and put half of the cost on each of 2 cards and have the $400 credited away?

Yes. One thing Dell is good about is allowing you to “split tender,” i.e., use more than one card when you check out. Two is certainly okay; someone else will chime in here with the limit, in terms of number of cards per Dell purchase.

Remember, this is a Dell issue, not Amex. Amex will pay every half year up to $200 per Business Platinum card on purchases at Dell. How you are paying other amounts to Dell is not a “thing” for Amex.

I’m not a regular Delta flyer, but I would like status by getting both the reserve and platinum cards with automatic Silver with a potential status match. Is there the potential for good status matches for Silver in the future?

It would be cheaper to get the personal Skymiles Platinum + the business one ($350 each) to get to Silver status.

I wouldn’t do it if the only goal is to status match elsewhere.

Thanks for responding!

I’ve never used it (maybe stupidly) but is the Fine Hotels & Resorts or The Hotel Collection bookings worth using? Or are the prices just high and the savings don’t really save you anything?

Never used The Hotel Collection because it requires a two-night stay, but the FHR credit can be fabulous! There are folks who specifically search for high-end places that cost about $200/night and use it that way (ie, a free night). I typically use it to get a high-end place at a reduced rate (say, a $300 hotel where my bill is $100) and I tend to stack the benefit from several cards for a longer stay (example–I made four separate reservations for a 4-nite stay in Abu Dhabi on the way back from a trip to India). In April, we’re staying three FHR nights in Doha on the way to Jordan. That will be my last stack as I’m cancelling most of these cards, but I will still look to use my one remaining FHR, probably on a stopover somewhere. The free breakfast and $100 benefit makes for an affordable stay at a typically luxurious hotel. That said, I may not be the typical traveler as fancy hotels are not important to me–I usually book IHG Holiday Inn Express for the free breakfast and call it done. To me, the FHR credits allows my DH and I to stay at fancy resorts we would never pay for. And, to be honest, even though I will always feel out of place in such expensive places, it is fun to periodically hang out in a high-end resort atmosphere and feel overly pampered! I’m sure other readers will chime in with their thoughts as well, but I do think you’re missing out on a great benefit if you don’t look into it!

Thanks. We may be going to Europe in March so I’m hoping to use my collection of Hilton, Marriott points and other credits including this one.

(Managed to use LifeMiles and Flying Blue for a couple of one way business tickets.)

I have a 2 night stay in Abu Dhabi coming up and I’m thinking of splitting up my reservation into separate ones. Did you stay at the same property for all 4 nights and did they let you stay in the same room? Curious if you would willing to share which hotel you stayed at. Thanks!

Yes, we stayed at the Ritz Carlton, which we liked very much. I made separate reservations, then connected them at the front desk upon arrival. (I actually called the main Ritz Carlton reservation number ahead of time and asked that the reservations be connected, but the Ritz was unaware of that when I showed up so I now consider that to be a waste of time.) It didn’t seem to be a big deal for them to connect them (half were in my name; half in P2’s name) and we definitely stayed in the same room. I expected one $100 credit (you typically get one $100 credit when you book back-to-back FHR nights) however when we got the bill, it appeared they credited back the entire dinner that we charged rather than just $100. I don’t know how that worked out–just happily accepted it and didn’t ask questions. We thought the breakfast and dinner buffets were absolutely fabulous and the staff went out of their way to make us feel welcome, In fact, I mentioned to the lovely woman who walked us to our room that my throat was killing me and she showed up to our room 30 minutes later with a silver tea service complete with honey and lemon and little cakes to eat with it. I’m not used to that level of service and was blown away! Hope you have a lovely stay as well!

Greg, it looks like something got messed up on the valuation for the Reserve card. There is no line for the $300 travel credit, and her value of $150 for a $550 AF card makes it a keeper?

I don’t know what you mean. I did hide some rows that she valued at $0 to make it easier to see the rest of it, but the bottom line total is still there: $1,100 for a $650 card. What am I not seeing?

he means chase sapphire reserve i think you are looking at delta reserve

Yes, my apologies, forgot there were 2 Reserve cards. I was referring to the Chase Sapphire Reserve.

Got it! Thanks!!!

Fixed.

I would argue that cell phone credits–or anything else that is legitimately taking the place of money you would spend anyways–should be fully valued same as cash.

My car insurance is $1200/year, which I can either pay fully right away, or pay $100/monthly (surprisingly with no installment surcharge). Are you saying I should still pay $1200 immediately despite no pay-in-full discount, rather than pay only $100/month and keep the rest in the bank at 5% interest?

I have a $100 a month cell bill. I have 5 Biz Plats. Those $10 credits per card function exactly the same as cash–there’s no time value of money involved.

I disagree (unless you were able to convince Amex to let you pay your $3475 AFs in interest-free installments), but you are of course welcome to value those credits however you please. I’d also be happy to pay your remaining $50/month on your cell bill for the next 12 months if you give me $600 upfront 🙂

The time it takes to make 5 x $10 payments x 12 times yearly could instead be spent either earning money or having fun. And unless you truly enjoy it, coupon tracking is not what I want to be occupying my thoughts. Adding to what Vincent pointed out about lost investment return due to paying the card AF upfront for a benefit that comes later, I’d never give full value to these coupon benefits, even if I fully use them.

Yeah – the only significant credit I’m aware of that I’d even remotely consider assigning a true 100% value to is the US Bank Altitude Reserve’s $325 restaurant/travel credit, and that’s only because rewards are still earned on those transactions, and most years I’ll use that $325 credit within the first couple of months between mobile wallet at restaurants/fast food chains and travel expenses.

Even then, the prepayment penalty, the potential for an unpublished change making the transactions no longer earn rewards, and the small chance that a lifestyle change somehow makes the credit far less useful still makes me think it’d be better to value it around $300-$310 (so ~95% of face value.)

I strongly disagree, particularly on monthly credits. Using the $10 monthly cell phone credit on the Platinum as an example:

Each person will value each aspect of this a bit differently – for me, the biggest downfall with the credits is the active management aspect, especially as my current cell phone carrier (T-Mobile) won’t let you get the autopay discount if your autopay method is a credit card. There are ways to work around this, but I’d have to actively manage that, and hope that they don’t decide that any credit card transaction in a month voids the autopay discount (as Verizon is reported to do currently.) Thus, I’d probably only value it at 50% for the first card, and 80% for each additional card (because once I’m in the site having to actively manage it anyways, the additional effort for the second through fifth cards is much lower.)

Just a question: In your spreadsheet, there are cards that would be widely accepted as “premium” cards. But, in the case of the Amex Gold, Amex Green, and Chase Marriott Bountiful (among others), are they “just there” or do you consider them to be premium cards? Thanks. (PS – I can’t imagine how much work you put in to create and maintain the spreadsheet.)

Originally the sheet was limited just to “ultra-premium” cards costing $400 and up, but over time I added more and more over $100 “premium” cards. Now I think that it would be good to complete some of the groupings. e.g. I’d like to list all of the cards with a fee for the big airlines, the big hotel chains, and transferable points programs.

New version of spreadsheet! This is my 8th copy on my drive.

I cancelled several premium card last year and it changed my valuation of perks on cards that I’m keeping. Also perks I struggled to get values last year gets lower valuation this year. Interesting how the same perks valued differently.

To me it’s a good practice to keep refreshing the sheet.

Thanks Greg.

I don’t quite agree with the valuation method. I would take a non-branded card with easily transferable currency and find the one with the most net value (for my usage pattern, the Venture X would win) and the others would have to stand on their own. In every case, to be a “keeper”, the other cards would have to show value above and beyond the Venture X (ex. if one card offers 3 points for restaurants and Venture X gives me two, how much is that extra worth to me? ex. CSR offers best in class travel protections, but how much better is it than what Venture X gives me and what would I value that difference at?).

With regard to the Ritz-Carlton card as the initial point of comparison, the 15 qualifying nights can be had with Marriott’s zero annual fee card; no value there. Lounge access is not as broad as Venture X and Venture X lets you add up to four AU’s with that access. That pretty much leaves the only significant value coming from the free night certificate and the travel credit. Since I just did a forced redemption on a Marriott free night since Marriott refused to extend the expiration, I’m not very generous with how I value that perk. Also, I often take trips where the hotels and airfare are mostly done with points (I have employee rates with one of the major chains, but I am leaving that out of these valuations), so that does not coincide well with travel credits that expire (OK, Venture X forces their travel portal on you which is really annoying; their $300 annual credit is worth, at the most, $200 to me because of it).

It sounds to me like you do agree with the valuation method, but you don’t agree with my choice of a keeper card. That’s great. The whole point of offering this as a spreadsheet is so that readers can choose what they value most.

Separately, great point about not valuing the 15 elite nights due to the free Bonvoy Bold offering the same. I’ll change that going forward

I can see your point. I would still build my initial list of keepers around universal currencies vs proprietary ones if only because the proprietary ones are the most volatile as far as valuation and restrictive in use. My Venture X and my Chase UR generating cards would come first and then I would value the rest per the aforementioned methods. Also, as long as Vacasa stays solvent, the Wyndham Rewards Earner Business card has been awesome.

@Greg, great article. One question to add. How much value do you place on keeping a card open just to make the bank happy? Perhaps this applies mostly to Amex with their pop-up prison and inability to convert some cards to no annual fee versions? For example if I valued a platinum card and found my valuation was just $10 or $20 less than the annual fee, I might keep it open just to keep amex happy and hopefully stay out of pop up jail.

That makes sense to me. Plus, you may be able to get a nice retention offer once every other year and so it could be worth keeping open for that purpose too

“I subscribed to the New York Times e-edition anyway, and so value this perk on my generic Platinum card pretty highly. I pay about $17 per month, or $204 per year and so I value these savings at about $180 (i.e. I would be willing to prepay $180 for those savings).”

You should never pay $17/month. Either change to another email/account to get the introductory offer (about $5/month) again, or go through the process of cancelling your subscription and they will offer you a renewal at the introductory level. Then you can free up a little room for another “free” subscription.

I would agree. I receive almost daily a solicitation for $50/year. My friend subscribed and then cancelled. Lo and behold, NYT offered him the same e-subscription for $1/month, an offer he couldn’t refuse.

@Greg,

From the list, it seems that you have Ritz and Brilliant.

Doesn’t these two cards conflict and you cannot have both?

You can have both. You just can’t get the Brilliant welcome bonus if you already have the Ritz card. I got all of my Marriott cards before all the crazy rules existed anyway.