UPDATE: terms for the Business Platinum card’s pay with points rebate have changed since this post was written.

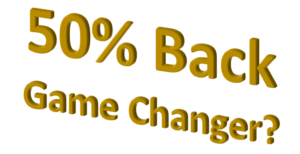

Starting today, October 6th 2016, Cardholders of The Business Platinum® Card from American Express OPEN have access to two new benefits:

- Earn 50% points back when paying with points through American Express Travel for a flight with their selected airline. Cardholders will also receive this benefit when booking a first or business class ticket with any airline.

- Earn 1.5 points per dollar on any purchase of $5,000 or more.

The first new benefit is intriguing. The second is only mildly interesting. Amex Everyday Preferred cardholders can already earn 1.5 points per dollar on all spend by making sure to use their card 30 times each billing cycle. And, they’ll earn even more points with purchases at gas stations and grocery stores. And, of course, Chase Freedom Unlimited cardholders can earn 1.5 Ultimate Rewards points everywhere without any restrictions.

The 50% points back benefit is the interesting one. It effectively means that you can get 2 cents per point value when redeeming points to purchase airfare either on your selected airline or for business or first class on any airline. That’s huge.

Amex Biz Platinum 50% bonus: A game changer

This benefit is bigger than you may have thought…

Economy Flights on Your Selected Airline

Suppose you’re looking into booking a flight that costs about $400. You find that you can book the same flight with 25,000 airline miles. If you don’t already have the miles, you can transfer 25,000 Membership Rewards points to an airline program and book the award. You just got $400 / 25,000 = 1.6 cents per point value. Yay!

But, what if you have the Business Platinum card and the $400 flight is on your selected airline? Your new option now is to use 40,000 Membership Rewards points to book the flight through Amex Travel and you’ll get 20,000 points back. Your final cost would be 20,000 Membership Rewards points instead of 25,000 miles. Plus, by paying for the flight through Amex Travel, you’ll earn redeemable miles and elite qualifying miles on the flight as long as you link your frequent flyer number to the trip.

Economy Flights on a Non-Selected Airline — Possible Free or Cheap Upgrade

Take the same example as above: let’s say that you can buy a $400 economy flight, or book it with 25,000 airline miles. If the $400 economy flight is with an airline other than the one you selected as your preferred airline with your Business Platinum card, then you won’t get a rebate if you pay with points. In this example, it seems clear that you should book the flight with airline miles (unless you have FlexPerks points, but that’s another story).

That said, maybe you can buy a business or first class seat on the same flight for not much more money… Let’s say that the same flight offers first class seats for $500. In that case, you can pay with points and you will get the 50% rebate. For this $500 first class flight, you’ll pay 50,000 points and get 25,000 points back. In other words, you’ll have paid just 25,000 points for a first class flight. That’s clearly better than spending 25,000 miles for an economy award ticket!

When pricing flights, it is always worth checking one-way fares as well. In some cases, a round-trip first class fare may be far more expensive than an economy fare, but the difference may be much greater in one direction or the other. In those cases, it can make sense to use Membership Rewards to pay with points for the lower priced one-way business or first class fare.d

Low Cost International Business Fares

While airlines have repeatedly increased award prices for international business and first class flights, ticket prices haven’t followed the same trend. Whereas award prices have slowly and steadily increased, paid prices continue to fluctuate up and down as airlines strive to fill their flights with paying customers. Let’s look at how that affects award choices…

In the past few years, AA, Delta, and United have increased their saver level business class award prices between North America and Europe. Where all three used to charge 100,000 miles round-trip, AA now charges 115,000 miles, United charges 115,000 for United flights or 140,000 for partner flights, and Delta recently increased their lowest level round trip award from 125,000 miles to 140,000 miles for flights beginning in 2017.

Meanwhile, $2,000 round-trip business class sales are not uncommon. With the Amex Business Platinum card, you could buy a $2,000 ticket for 200,000 points and get 100,000 points back. Net cost: 100,000 points. And, again, you can earn redeemable and elite qualifying miles for that flight.

Another advantage to paying with points is that airport fees and fuel surcharges are included in the total point price. You would pay nothing out of pocket. With international mileage awards, on the other hand, fees and fuel surcharges can be steep. Sometimes, they can be ridiculously steep, like this $1,140 fee when booking a British Airways flight with AA miles:

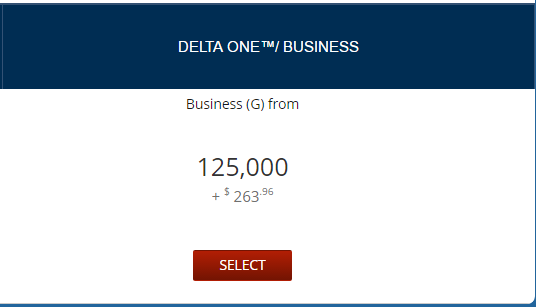

Of course, British Airways is a known culprit in this regards. But, even airlines that don’t impose fuel surcharges can charge quite a bit in fees due to airport fees and government taxes that they pass along. For example, Delta wants $264 in addition to miles for a round trip award to London:

And United — an airline than never passes along fuel surcharges for award tickets — wants $304 for a flight to London on United in one direction and Lufthansa in the other:

Some airlines charge far less in miles for flights to Europe, but they often charge even higher fees. The point is that when booking awards with miles, the mile price is rarely the only price. Often there is a significant cash component as well.

These examples are meant to show some of the side benefits to paying for airfare with points rather than booking awards with miles.

No need to search for award space

A huge advantage to paying with points, of course, is that there’s no reason to search for award space. If a flight is available for sale, it should be available to purchase with points. And when airlines have sales, you can buy those flights for fewer points. This will make travel planning much easier!

Of course, as I showed yesterday with regards to paying for flights with Chase points, it is possible that not all flights are available through Amex Travel, or they may price differently than other flight search engines. I don’t know. But, like with Chase, I expect that most flights price the same through Amex Travel as elsewhere.

The 2 cent per mile award break-even point

Even if you ignore the fact that you can earn miles on flight bought with points, the new Amex Biz Platinum 50% rebate means that those who are flush with Membership Rewards points should only consider transferring points to miles when they’ll get more than 2 cents per mile value after accounting for taxes and fees. You can use the following formula to calculate the value of miles for an award:

mile value (cents per mile) = 100 x [(best flight price) – (total of award taxes and fees)] / (miles required for award)

Let’s say you want to fly to London in business class and you find that you can book a Delta award for 140,000 miles plus $264 in fees. And, let’s suppose that the best alternative paid price (on any airline that you’re willing to fly) is $3,000. In that case, we can calculate the value of the miles:

mile value = 100 x ($3,000 – $264) / 140,000 miles = 1.95 cents per mile

In this example, you’re better off paying with points. Pay 300,000 points, and get back 150,000 points for a final cost of 150,000 points. Yes, the number of points is higher this way, 150,000 vs. 140,000 with the Delta award, but when we combine the cash component of the award into the equation it becomes clear that paying with Membership Rewards points is the way to go.

If the miles per dollar calculation had resulted in a slightly higher result, such as 2.05 cents per mile, then you might have a tough decision. Paying with points is still arguably better (since you’ll earn miles on the flight), but in some cases award tickets offer more flexibility in terms of changes and cancellations. These factors vary both by airline and within airline based on your level of elite status. In other words… it’s complicated.

The new benefit more than makes up for the Citi Prestige

I used to be excited by the Citi Prestige card’s benefit that allows you to buy AA flights with points for 1.6 cents per point value. That benefit is going away next July. Now, instead, you can get even better value in paying with points with the Business Platinum card, and you can choose your favorite airline!

Meanwhile, compared to the Sapphire Reserve which offers 1.5 cents per point value on all travel, this benefit is much more limited, but it is also more valuable for qualifying flights. Where a qualifying $3,000 flight may cost a Business Platinum cardholder 150,000 points, it would cost a Sapphire Reserve cardholder 200,000 points. That’s a significant difference.

Why I listed this as a “minor” game changer

To get the Business Platinum card, of course, you need to actually have some sort of business. And, the card is expensive: $450 per year. It does offer $200 in airline fee credits annually, but only for fees incurred on your selected airline. It is far from the nearly effortless $300 in travel credits offered by the Chase Sapphire Reserve.

For those who have the card despite the high annual fee, this new benefit could mean a huge shift in how they book awards. It used to be a no-brainer: except in rare cases, airline miles were the only economical way to book international business class flights. But, now the math has changed. Now, in many cases, paying for these flights with points rather than with airline miles will be the way to go.

That said, in order to make this work for high-end flights, you need to have a huge stash of Membership Rewards points. Suppose, for example, that you want to take four people on that hypothetical $3,000 business class trip that I described above. In that case, if you wanted to book everyone together on one itinerary, you would need 1.2 million Membership Rewards points in your account. Sure you would get back half of them, but still — that’s a lot. Of course, you could instead book each ticket separately, wait for the points rebate and then book the next one. If you did it that way you would “only” need 750,000 points in your account.

So, I do think this new benefit will be huge for some, but it will have limited reach for many. For me, I know that it will change the way I search for and book flights. After all, I recently took advantage of an offer to earn 50,000 Membership Rewards points for upgrading to the Business Platinum card. It looks like that was a good move.

[…] unveiled enhancements to their Platinum cards (5X airfare rewards on personal Platinum cards, and game-changing enhancements to their Business Platinum Card) they stated that these changes were just the beginning. I took that to be a promise of more good […]

[…] The past few months have been full of surprises and changes in the points & miles world. Many of these changes centered around high-end $450 per year credit cards… Citibank announced a huge devaluation to their Prestige card. Soon after, Chase released their new blockbuster Sapphire Reserve Card, with its 100K signup bonus, 3X earnings for travel & dining, 1.5 cents per point value towards travel, and $300 travel reimbursements. At around the same time, Chase increased the annual fee for their Ritz Carlton credit card, increased its signup bonus, and changed it to a Visa Infinite card. Amex responded to the Sapphire Reserve by adding 5X earnings on flights to their personal Platinum cards. Amex then surprised us further with interesting changes to their Enhanced Business Platinum card: They introduced both a new public 100K signup offer; and enhanced benefits: a 50% rebate on flights purchased with points; and a 50% bonus on points earned for purchases of $5,…. […]

[…] But Amex must have set a piss-off-customers record with the removal of the 50% flight rebate. They introduced the benefit on October 6th 2016 and are set to take it away from most existing cardholders by June 1 2017. The feature survived […]

[…] increasingly loving the Amex Business Platinum’s 50% pay with points rebate. I originally called this benefit a minor game changer, but in practice, for me, it is […]

[…] these changes are correct, they would be a nice value-add to the Business Platinum card. With the 50% points rebate on premium cabins and your preferred airline, it is now easy to get at least 2 cents per point in value from Membership Rewards points. An […]

[…] card and have chosen Delta as your airline, this deal could be especially hot. Thanks to the 50% rebate when paying with points, you would pay 38,600 points and receive 50% back for a net of 19,300 points round trip. You should […]

[…] from $15K to $20K. But, surprisingly, this offer remains high on the list. Note that this is the only card that makes Membership Rewards points worth 2 cents each towards most airfare. And, of course, Amex Platinum cards come with a slew of awesome […]

[…] year, Amex introduced an awesome new benefit for Amex Business Platinum cardholders: Get a 50% rebate when you pay with points for airfare with your selected airline, and when you pay w…. The 50% rebate means that points are worth 2 cents each when used this way (the old 30% points […]

[…] You can read more here: Amex 50% bonus is a (minor) game changer . Here’s why… […]

[…] spend requirement, but it also offers 100,000 valuable Membership Rewards points. Plus, this is the only card that makes Membership Rewards points worth 2 cents each towards most airfare. And, of course, Amex Platinum cards come with a slew of awesome […]

Hello:

I only have American Express Blue Credit Card now. I went to the American Express travel site and randomly found an international flight costing around $720 or 144000 points. Is it normal to cost double the points (vs $720 or 72,000 points)? If that is the case, there is no advantage of getting the Enhanced Business Platinum card which gives you 50% points back. Am I missing something? Want to make sure before I apply for the Enhanced Business Platinum card.

Thank you for all your inputs.

Once you have a premium Membership Rewards card (like the Business Platinum card), you will see 1 cent per point price for travel. Then the 50% rebate will make your points worth 2 cents each.

How long does it take to get the 50% points back ?

I believe it takes about a week, but I only have one data point so far.

I got mine back the very next day. Love this new card benefit!

[…] Maximizing value from Membership Rewards points is a bit more complicated than with Chase. Some of the best value transfer partners (ANA and Aeroplan, for example) require knowing how to avoid potentially huge fuel surcharges. Unlike Chase though, Amex Membership Rewards points do transfer directly to Delta, and Delta sometimes offers very good value for your miles (see: Delta SkyMiles sheds SkyPeso moniker). The other approach to maximizing value is to get the $450 Amex Business Platinum card which offers 2 cents per point value when you pay with points for select airfare. Specifically, Get a 50% Pay with Points rebate for your selected airline, and for business or first class with any airline (see: Amex 50% bonus is a (minor) game changer . Here’s why…) […]

Can your designated airline be a foreign carrier?

I don’t think so

[…] The Business Platinum card now offers a fantastic new perk: Earn 50% points back when paying with points through American Express Travel for a flight with their selected airline. Cardholders will also receive this benefit when booking a first or business class ticket with any airline. This new perk makes your Membership Rewards points worth 2 cents per point towards paid flights. That’s pretty awesome. That means that with the 100,000 point signup bonus, it is possible to get up to $2,000 worth of flights! For details and caveats, please see: Amex 50% bonus is a (minor) game changer . Here’s why… […]