Amex is already making me eat my words.

I had just last month written about my plans to peel off some of my ultra-premium credit cards in an effort to get my annual fee output under control. In that post, I said things like “I don’t think we’re going to be able to justify multiple household Platinum cards in the future” and “I am leaning slightly toward keeping a single Business Platinum card”.

Little did I know that Amex would get the last laugh, giving us such a compelling set of benefits on the consumer side that I am now considering the idea of keeping multiple consumer Platinum cards (between my wife and me). Meanwhile, I will almost surely drop all of our Business Platinum cards, perhaps keeping a Business Gold for the chance to upgrade in the future if I need the pay-with-points rebate benefit.

Now, my U.S. Bank Altitude Reserve is almost surely on the chopping block unless U.S. Bank somehow knocks it beyond the park walls with its transfer partner program, and I might need to rethink our keeper card situation. Amex’s power move here makes me turn my eyes next toward my multitude of middling cards. With a solid set of ultra-premium benefits across my top-tier cards and enough no-annual-fee everyday-workhorse cards in our household, I have to begin to wonder which of the $95-$350 cards I can send to the circular file. More on that to come soon . . .

This week on the Frequent Miler blog…

Introducing the $895 Consumer Platinum card

If you told me at the beginning of the year that we would see a credit card up the ante to an annual fee of $895 and people would want it, I might have told you that you were crazy. Somehow, Amex knocked it out of the park with its consumer Platinum card refresh, increasing the annual fee by $200, but adding more than $1100 in additional credits that most cardholders will probably value at more than $200. Amex clearly decided to go toe-to-toe with Chase, and in Internet lingo, Chase got owned in that fight. If you are an existing cardholder, don’t forget to use your first quarterly Resy and lululemon credits by the end of the current quarter (which ends on 9/30/25). If you haven’t yet had an Amex Platinum card, the value proposition for the first year is terrific.

Introducing the $895 Business Platinum card

An exciting development for Business Platinum cardholders is the addition of the same twice-annual $300 credit for prepaid Fine Hotels & Resorts or The Hotel Collection reservations (once Jan-Jun and once Jul-Dec) that has come to the consumer Platinum. On the surface, an increase of $200 on the annual fee in exchange for up to $600 in hotel credits might sound good to those who already have the Business Platinum card. That said, we didn’t see other enhancements that are nearly as intriguing as the coupons on the consumer card. Big purchases of more than $5,000 at a time, as well as those in select categories, will now earn 2 points per dollar spent, which may be huge for those with very high spend, but there just isn’t enough else here to make the business card nearly as compelling as the consumer version.

Which is the best Amex Platinum card in 2025?

While I noted above that the consumer card seems more compelling to me, the answer may not be so simple for you. And even if you agree with me on consumer vs Platinum, should you be going for the Schwab Platinum, the Morgan Stanley Platinum, or the vanilla Platinum? Who should pick the business Platinum over those? This post is meant to help you choose which is best for you.

The $895 Platinum Card: Shockingly Compelling | Frequent Miler on the Air Ep324 | 9-19-25

If that’s not quite enough Platinum card content for you in one week, check out the latest episode of Frequent Miler on the Air to hear Greg and me discuss the hits and misses from Amex’s Platinum refresh, the prediction that Greg absolutely nailed, and why we think Amex went in the directions they did. We also talk about the secret to a happy points and miles marriage, Hilton’s latest devaluation, and a lot more.

How we’ll be judging the 100K Vacay challenge

Our team challenge kicks off in just a few days, with Greg’s benchmark trip set to begin this week, and Tim, Stephen, and I checking in with him on October 1st. Then, our travel window begins. In this post, Carrie lays out how she and Greg will be judging Tim, Stephen and I — and how you will help decide whether the winner beat Greg’s benchmark trip. I considered so many options for this trip, and I can’t wait to see how it all shakes out. I’ll say this much: I might be more excited about this trip than I have been about any of my challenge trips so far — and if you have followed past challenges, you know that is saying a lot.

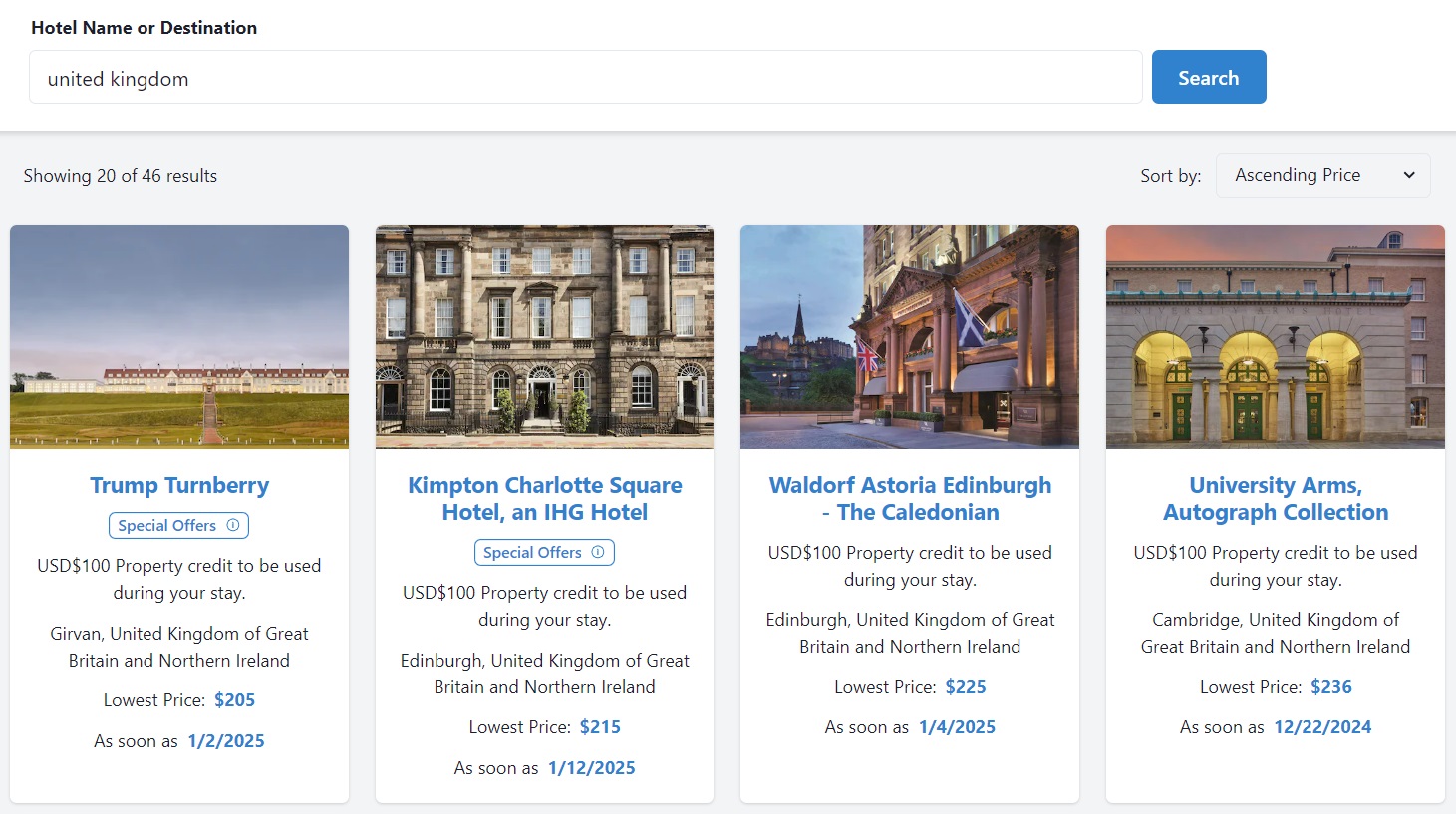

MaxFHR: An awesome way to help use your $300 Fine Hotels + Resorts® credits

With both consumer and Business Platinum cardholders looking for opportunities to spend the July-to-December $300 prepaid hotel credit (as well as those in subsequent semi-annual periods), now is the time to familiarize oneself with MaxFHR. This tool helps you find the least expensive FHR properties in the world and look through pricing calendars for various properties. While you won’t necessarily find them in New York and Paris, there are actually quite a few places around the world where you can stretch that credit to cover a night — or maybe even two. In fact, just yesterday I posted in our Frequent Miler Insiders group because I found that the Grand Hyatt in Vail, Colorado, was available for $136 plus tax and resort fee almost every day in October (and the resort fee should be waived for Globalists, meaning that a single $300 credit would have covered two nights!). I also saw an FHR property in New Zealand yesterday for $77 per night, and I booked a President’s Week trip for my family using the credits from some of our household cards to cover 4 nights in full, thanks to MaxFHR. I am a big fan.

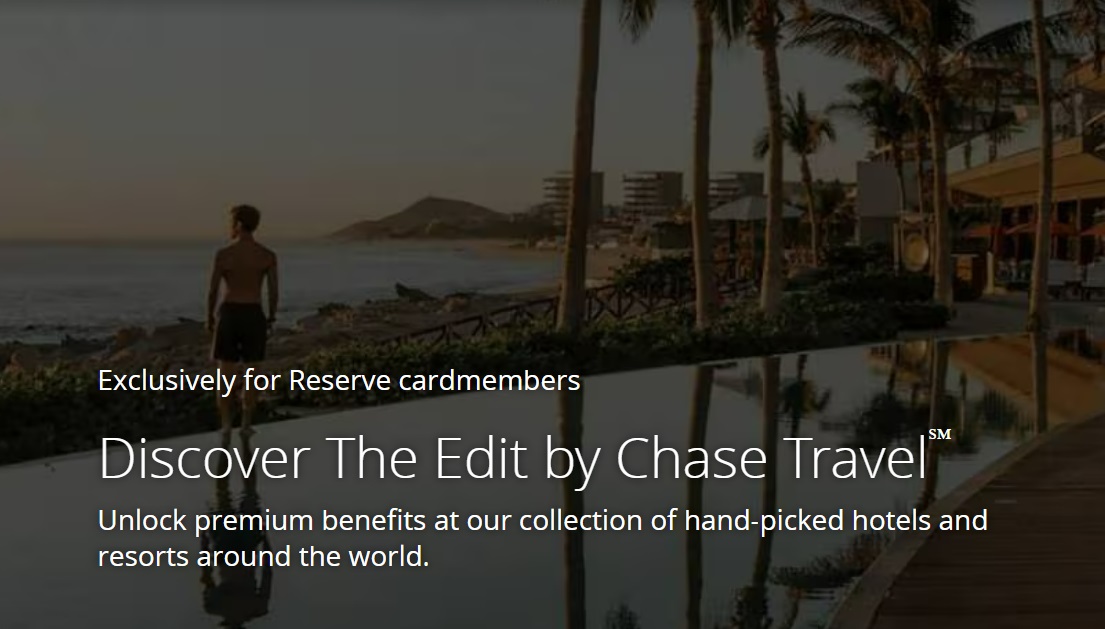

New Sapphire Reserve benefit for 2026: a $250 credit for select Chase Travel℠ hotels

Chase clearly realizes two things: Amex has stolen its thunder with the Platinum card refresh and all those Sapphire Reserve cardholders who opened their accounts when the card launched in the fall of several years ago — which means that many cardholders are facing renewal, and those whose renewal happens after October 26th will be facing the new, increased annual fee. I think Chase felt like it had to scramble to add something to make the card compelling enough to keep people around. Enter this new 2026-specific benefit, which will get you a credit for booking at select chains, which include IHG properties. This is a nice value-add to the Chase coupon book, though they still have a long way to go to catch up with Amex.

Chase is making an edit to The Edit credit

One of my gripes with The Edit credit is that it currently requires reserving and pre-paying for a two-night stay during two halves of the year in order to use the whole credit. However, that changes on January 1st, with the credits applying to your first two qualifying stays each calendar year, regardless of when during the year you want to book. That’s a huge positive change that many would love to see from Amex as well, though, as long as Chase requires a two-night stay to use your credit and lacks the breadth of coverage of Fine Hotels & Resorts, it will still lag a bit behind Amex here, in my opinion. Still, my family will be much more likely to use this benefit than we would have been to book two stays of at least two nights at the

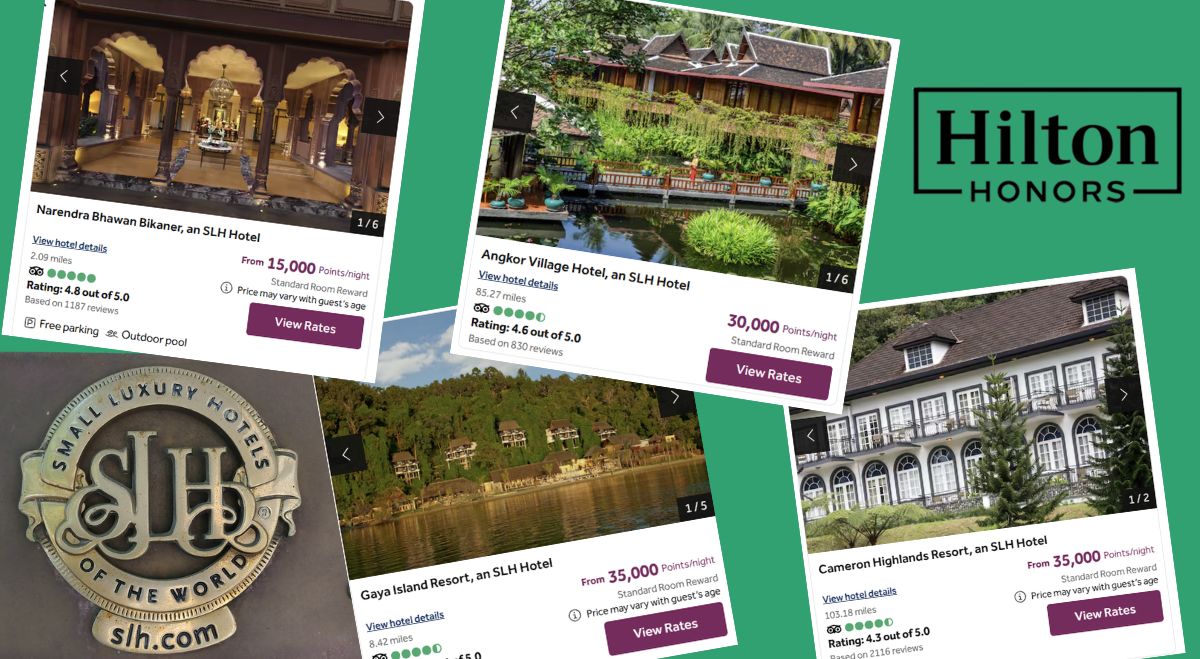

Cheap luxury: SLH properties for 40K or fewer Hilton points per night

Small Luxury Hotels of the World (SLH) is well-known for high-end properties, many of which cost a small fortune whether using cash or points. However, not all SLH properties are budget-busters. In this post, I’ve collected a number of SLH properties that can be booked (at least sometimes) using 40,000 Hilton Honors points per night or fewer.

Best credit card for gas spend | Coffee Break Ep70 | 9-16-25

For the past few years, it has been frequently accepted that the Wyndham Earner Business credit card is the best choice for gas station spend, but, given our recent downward adjustment of the Reasonable Redemption Value of Wyndham points, we were left to re-explore the best options for gas spend. While the “best” option is less obvious than before, I am still happy to earn 8 Wyndham points per dollar while filling my tank. In fact, I am writing this Week in Review from a Wyndham property where I redeemed 27,000 points for two nights (thanks to the 10% discount for cardholders!) that were otherwise going for more than $660. While I recognize that isn’t an average redemption, I love having a stash of Wyndham points for the right situations.

Rethinking my hotel free night certificates

Greg has decided to downsize his collection of hotel free night certificates by declaring that he will deep-six many of his Marriott and IHG cards while downgrading Hilton cards. On the one hand, his plan sounds a little crazy to me, knowing how easy it is to get more value from the certificates than the cost to acquire them. On the other hand, I find this a perfect play knowing Greg’s strong preference for more boutique-like hotel experiences. I expect that Greg will really sink his teeth into all of his Amex FHR and The Edit by Chase Travel credits, and so long as he is paying for those also, something has to give. The only part of his plan I don’t like is his plan to downgrade his Bonvoy Boundless to a Bold. Greg should totally upgrade that to a Ritz card! He’ll use the $300 credits without issue, so an additional ~$150 net for a second annual 85K free night certificate is almost a no-brainer in my opinion.

Alaska Airlines Atmos Rewards Complete Guide (2025)

Alaska Atmos is quickly becoming my favorite frequent flyer program. With elite earnings on award flights, a compelling premium credit card, and solid deals to Europe and Asia from the East Coast, I just can’t get enough of Alaska Atmos. As our resident Alaska Atmos expert, Tim has fully updated our Atmos Complete Guide for 2025 as Alaska and Hawaiian prepare to merge the programs on October 1st.

That’s it for this week at Frequent Miler. Keep an eye on this week’s last chance deals to catch those ending this month.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

Any idea when USBAR will announce their new transfer partners? Mine is up for renewal in a few weeks…

Thank you for publishing an honest and correct assessment of what happened here. Amex hit a home run. Heads should be rolling at Chase. Chase screwed this up badly months ago and Amex did what good businesses should do – rub salt in your competitor’s (in this case self inflicted) wound.

It might be too early to declare Amex the winner, but I think we can safely call Chase the loser. It seems clear that Chase miscalculated very badly and thought they could take away market share from Amex with a very underpowered card. My guess is that the new Amex will be pretty popular, but of course it is always possible that both Amex and Chase lose from people turned off by the high annual fees and the long list of coupons.

Chase is the largest bank in the US and the largest bank by market cap in the world. Amex is a wonderful company but nowhere close to Chase in terms of market cap. But Amex has always done premium very well and looks to cultivate its premium customers.

Chase launched the Reserve a decade ago as a means to cultivate high net worth individuals and folks that it thinks one day might be high net worth individuals. But it was a victim of its own success from the start – Chase didn’t realize how many people would sign up. Chase has the market cap to have a product that does not make an incredible amount of profit or is a loss leader so that those HNWIs can be favorably inclined toward the full panoply of Chase’s other banking services. But for whatever reason Chase has never thought that it is appropriately targeting those HNWIs and feels taken advantage of.

The problem is that Chase didn’t just raise fees and give more coupons, they also changed the fundamentals of the card. They may now shed some of the folks they never wanted in the first place, but the problem is they are also greatly irking a number of the HNWIs that they were actually targeting.

Against that backdrop, here comes Amex on a white / mirrored horse saying “Premium customers rejoice! The King has returned. There can be only one.”

Heads should be rolling at Chase over this complete bungling of its perception in the marketplace by HNWIs.

What you say makes sense. LOL at the “white / mirrored horse”!

Here’s a question. Would you recommend the new Amex Platinum to folks who aren’t hobbyists? (My answer would be “no” in most cases because even if someone is a good match for the credits it take a lot of organization to make sure they get used…unless they are putting most of their spend on a card with a lot of 1x.)

Perhaps not as a long-term keeper but given the large sign-up bonus, you could view the annual fee (minus whatever credits you can capture) as the price to “buy” points.

For example, if you receive a 200k point offer, the cost is $895 / 200k = 0.4475 cent per point. And, if you transfer those points to an airline during a transfer bonus (say, 25%), you’re looking at $895 / 250k = 0.385 cent per point.

That’s if you capture no stated credits. If you can capture only $600 of credits (say, $300 digital entertainment and only $300 of Resy), your net cost is $295 . . . for 200k points. That’s a home run. And, this example takes little effort.

Don’t feel compelled to capture a lot of statement credits. This ought to be fun. Best of luck

Thanks. Make sense. I already have the card and am all in on it, but I keep a ridiculous number of spreadsheets to track all my credits across multiple cards. In the past I have never recommended this card to friends who weren’t seriously into the hobby, but was trying to decide if the math has changed enough.

Could not disagree with you more, that’s just plain ole FUZZY MATH.

D-

Can you get more value from the credits than the annual fee, even factoring in the time-value of money? Potentially. But this is a travel card. Amex is selling access to lounges. If you don’t travel and you’re not going to use the lounges or take advantage of the 5x points on flights, there are much better points earning cards/card combos out there. There’s no reason to put much of any spend on the Amex Plat itself.

Yeah, that’s the problem with the card for the casual user. It isn’t good for spend. Actually I suspect that is why the math works for Amex, because a lot of folks get it because they are dazzled by the credits and lounge access and then put a lot of 1x spend on it. But to really make it work you need have other cards with better bonus categories and be willing to put the effort to use the right card and track credits to make sure you use enough of them to get sufficient value. Even for those of us who are a bit obsessive it is still a lot of work.

For what it’s worth I usually suggest either Venture X or Citi Premier / Double Cash for newbies, depending on their interests.

Yep.

Agree completely with your recommendations. Would pair VentureX with the Savor and would pair Strata Premier/DC with Strata Regular as well. Both $0 and have some nice extra bonus categories.

The citi trifecta costs all of $95 ($0 if you use the $100 hotel credit on the Premier). It’s really a no brainer, but no meaningful lounge access.

C1VX does have a real $395 cost but only $95 if you use the $300 credit. Plus they are opening nice lounges. Very shortly they’ll have lounges in the exact same NYC places as Chase (LGA TB and JFK T4). For the average consumer, why pay Chase significantly more $ for access to older lounges?

Well I should add that in Atlanta the Amex Platinum is a very popular card for lounge access, for obvious reasons.

Indeed. And no C1 lounge in ATL.

There are lounge access cards and then there are points cards. That’s the way to think about all of this, in my opinion. If you want the fancy mirror platinum to throw down at a restaurant to impress your friends, I’d suggest getting friends that care about whether you are maximizing your points earning on that meal!

I don’t think I have any friends who would be impressed by a mirror card, and I wouldn’t try to impress them with one even if I did. I wish you could get it in plastic like the Delta cards.

i’m surprised Apple hasn’t figured out a way to make the ApplePay experience “special” and have your phone display something related to the card and have a special chime for a premium card, etc. And they can charge a fee for allowing the card issuer to display the special graphic / play the special chime.

Or a way to split a restaurant bill unequally 7 ways so I can use 3 Amex Platinums, 2 Amex Golds, and 2 Delta Platinums to pay for a $420 bill.

100k Vacay Winnung Entry

———————————-

1) Based in Dallas;

2) HAVE $100 coupon from Frontier, which flies to 30+ destinations from DFW. Coupon expired 8/3025;

3) HAVE $300 Hotel credit from Citi Strata Elite. Expires 12/31/25;

4) HAVE:Hilton free night cert. Expires “soon”;

4) JSX announces new route: DAL->DEN with short-term half-price ticket promotion.

5) DO: Fly DFW->DEN for $48 each (2 peeps). Paid in full with coupon;

Stay Hilton Slate (Tapestry Collection). One night free cert. Other two paid for with Citi hotel credit.

Fly JSX from close(r) in airport in Denver to DAL (20 minutes from home by Lyft/Uber) Only $250 each.

Result: Great vacation funded entirely by short-fuse specials!

Nick, do you know if the amex Lululemon credit works if you go into a Lululemon store and buy a gift card?

Nobody would know because the benefit hasn’t even been around long enough for a charge to finish processing, no less be credited. That said, I can’t imagine that the store register processes a gift card purchase any differently than it processes any other type of purchase. I would think that anything you buy in-store should work.

I’ll circle back in a day or so and let you know.

The terms and conditions for this credit (in the Amex Plat t&cs) specifically say that gift card purchase will not count.

That being said, I’m not sure if Amex can separate in store gift card purchases from “genuine” purchases and if it can, I’d be interested to know if a $20 “genuine” purchase + a $55 gift card can be separated out as well or if that would trigger the full credit. I’m a little tempted to take one for the team and find out 🙂

DOOO it, DOO it, Doo it lol

Well, whatever you do, do it before September 30! Then we can all have a nice data point for 10/1.

Alternatively, enjoy buying “whatever” $75 and buy it through Rakuten and get the extra MR points. Hopefully they’ll have another 10x points for LLL day before 9/30.

While the value of (for example) $300 in credit at restaurants should be less than $300 since you are prepaying and things can come up to cause you to not use it, I would agree Amex changes turned out better than expected.

I went ahead and signed up for the CS Platinum card and once the AF comes due on my regular Platinum, I will likely cancel it despite the additions because I just don’t want to have that much in AFs. My CSR is coming due soon and that one might get cut and I’ll see if they will let me downgrade it to CP. I still have the freedom unlimited to keep the points alive.

Right now we are hustling to spend the Resy credits and see what hotels we can use with the FHR/THC credit on our Germany/France/? trip late this year that are at a reasonable cost.

Jack has stated what I’ve often thought and mentioned elsewhere. People often will chase 3x or 4x points on categories where it makes little difference. Get an extra 3,000 points at a value of about $60 or so and yet pay an AF of $90+.

For now I’ll enjoy the extra “credits” (which I’ve already paid for in full or part with the AF) and decide what to do next.

Nick, considering the total value of all of the points and card benefits you earn/receive in an average year, what percentage of that total value does each of your middle-of-the-pack cards represent? Or even nominal dollar value?

The average household spends $2500 per year on gas. In the big scheme of things, does the difference between 3X and 5X really move the needle enough to justify its own card? $50 to $100 in value difference? One can frame the concept to the net value of a hotel card solely held for a free night certificate or a whatever card.

Marriott 35k FNCs are not worth it. Hilton FNCs are absolutely worth it. In the end, few cards seem to move the needle enough to bother. I get the argument that you’re in the business and you’re doing it for that. But, I think you owe yourself a measure of simplicity.

Hard disagree on Marriott 35K FNCs not being worth it. I haven’t used one at a hotel that would have cost less than $400 in years. I have multiple times gone somewhere on a weekend where I otherwise wouldn’t have gone (because of cost) if I didn’t have a 35K FNC. Don’t get me wrong, they aren’t my favorite thing, but I am happy to trade $100 or $125 for those every year.

In terms of whether the difference between 3x and 5x moves the needle enough to justify a card, I think you have a point that makes some sense there. However, with the Wyndham card costing $75 per year and giving you 15,000 points at each anniversary, I find that card super easy to justify. Do I stay at Wyndham properties frequently? No. Am I happy to have the points when I need them? Absolutely.

But you’re right that I’ll need to consider which to keep and which to cancel!

I have 2 EV’s so no gas purchases