| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

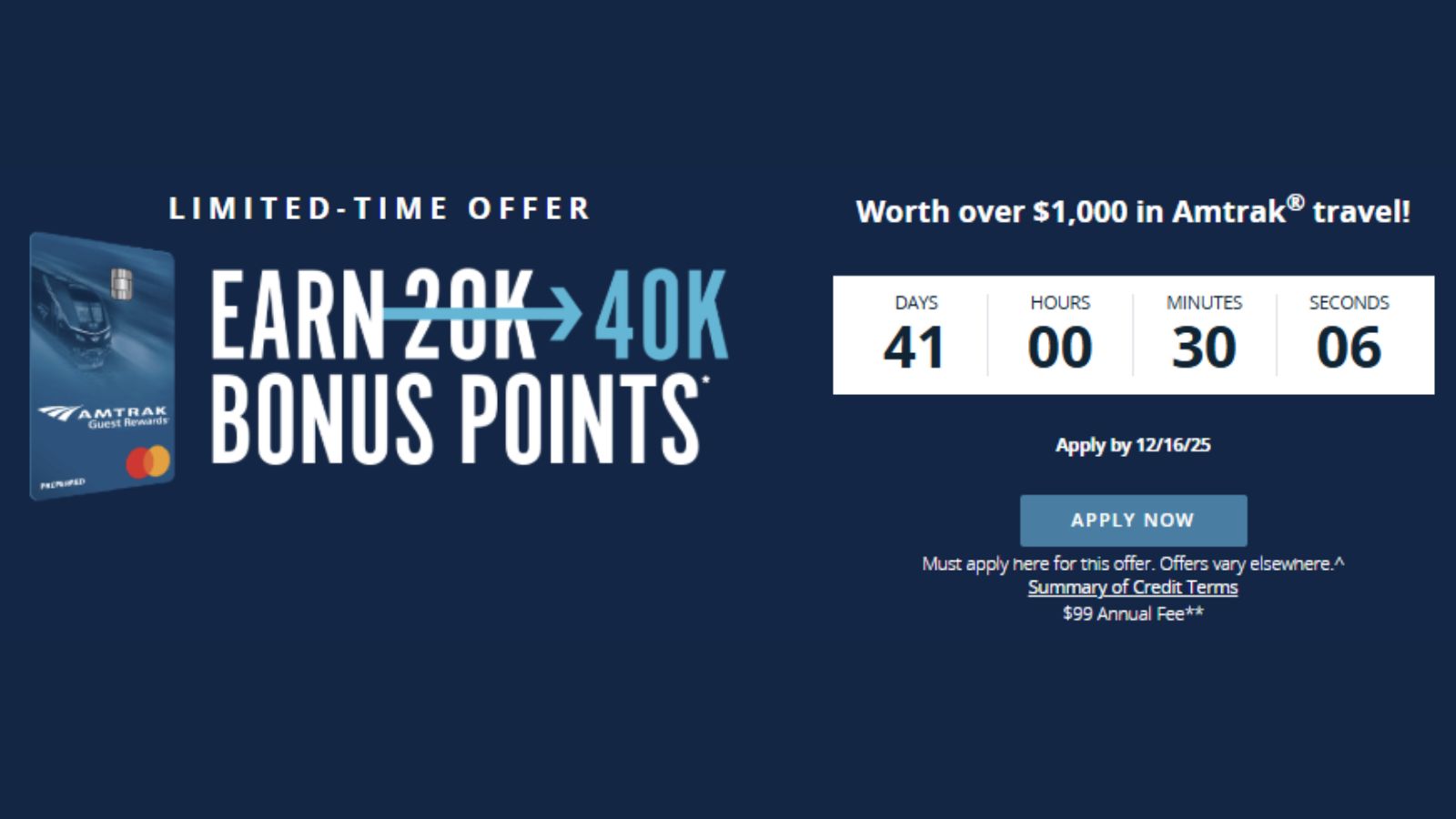

The Amtrak Guest Rewards Preferred Mastercard is once again featuring an increased bonus of 40K points after meeting the minimum spending requirement. While the Amtrak cards don’t get a ton of attention since there aren’t really any great uses of Amtrak points beyond Amtrak trains, the bottom line is that this offer can get you over $1,000 worth of train travel, so it can definitely be worth a look for those who live along the rail lines.

The Offer & Key Card Details

Click the card name below to learn more about this card and find a link to apply.

| Card Offer and Details |

|---|

ⓘ $408 1st Yr Value EstimateClick to learn about first year value estimates 20K points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 20K points after $1K spend in the first 3 billing cycles $99 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 30K points after $1K spend in the first 3 billing cycles + 2 companion certificates, 2 upgrade certificates and 2 lounge passes, or 40K points after $2K spend in the first 3 billing cycles Earning rate: ✦ 3X Amtrak ✦ 2X qualifying travel, dining, transit, and rideshare ✦ 1X elsewhere Base: 1X (2.56%) Travel: 2X (5.12%) Flights: 2X (5.12%) Hotels: 2X (5.12%) Dine: 2X (5.12%) Brand: 3X (7.68%) Card Info: Mastercard World issued by FNBO. This card has no foreign currency conversion fees. Big spend bonus: Earn 1,000 Tier Qualifying Points towards elite status for each $5K spent in a calendar year. Limit 4,000 TQPs per year. Noteworthy perks: ✦ 5% Amtrak Guest Rewards point rebate on redemptions ✦ Complimentary companion coupon ✦ One-Class Upgrade and a single-day ClubAcela pass each year. ✦ 20% rebate for onboard food & beverage purchases as a statement credit See also: Amtrak Guest Rewards credit card review |

Quick Thoughts

Keep in mind that on top of the intro bonus, this card offers a round-trip companion, one class upgrade, and a station lounge pass every year, including during the first year after initial approval. I’ve never used those benefits and can’t speak to how much they are worth, but it’s worth knowing about them.

Beyond that, Amtrak points can sometimes be worth up to 2.9 cents per point toward train travel. The value can vary based on what you’re booking, but there are plenty of situations where you can get north of 2c per point, which means that this bonus should easily get you $800 and possibly north of $1,000 worth of train travel. That’s a solid bonus without a huge amount of spending.

I don’t imagine that this bonus would draw anyone out of the woodwork to apply for an Amtrak card, but if you’re someone who occasionally takes the train and/or lives in an area that is well-served by Amtrak, this could certainly be worth a look.

Used Amtrak points from CC and utility transfer bonuses for a wonderful cross-country trip on the California Zephyr. Trip of a lifetime!

Also, Amtrak regularly runs BOGO sales on their suites (roomettes, family rooms, etc.) – even on points – so definitely worth a look.

If you use Amtrak (and if you live on the East Coast there is no excuse not to, as it’s way better than flying) this is easily one of the best travel cards, both for the bonus and the ongoing benefits. Companion pass alone pays for itself and a big benefit of the points, other than their outsized value (worth ~2.6-2.9 cents) is that award bookings are now fully refundable. Used to be a 10 or 25% penalty, but that’s now waived for points bookings. Most cash tickets have a cancellation fee unless you do business/acela. So when you book with points it’s like getting a flex fare instead of a saver fare, which makes the points more valuable.

I did not know award bookings were now fully refundable. What a great deal!

FNBO is the most incompetent bank that I have ever dealt with. I applied for this card the last time it had an elevated bonus and they claimed that they could not verify my identity and rejected the application… when I asked OK, what do I need to do or provide to you in order to verify my identity, they refused to tell me. After many HUCAs I finally found a rep that was able/willing to escalate the case and I thought that would finally resolve it, but then after a long wait, they came back and said they still couldn’t verify my identity and continued to refuse to tell me why. Kafkaesque

That’s a weird situation. Sorry to hear it. Do you have a SSN?

I do indeed have an SSN. There’s nothing unusual about my profile. Born and raised in the USA so my SSN has been established for quite a long time. No name changes. I’ve lived at the same address for many years. I literally have no idea what they are talking about.

Got the exact same runaround applying for a Virgin Atlantic card when they switched from BofA to Synchrony Bank. Excellent credit, born in US, many years at same address, etc. Rejected, escalated, rejected again, gave up.

@Jeleyne – have you tried applying for any cards from them since then? In theory I’d like to give it another shot b/c I do find this 40k bonus quite valuable…but I feel like I’d likely just end up banging my head against the wall again.

With the refresh of the CSR. This is my leading contender for all other transit and non-hotel/airline travel charges, since it is easily at least 5% back.

Had not thought of that because I’ve always had enough amtrak points, but if you can use more rail points, then this is absolutely true and makes a better return even then Altitude Reserve on general travel (if you can spend amtrak points as easily as cash).

Had it and closed it, can I do it again? Anyone?

Yes, based on my own experience and DPs I’ve seen, this is a very churnable card

Are those data points recent, since FNBO took over the card? I have churned this myself (and keep the no-fee version permanently) but that was before FNBO took it over.

Yes. In fact I think it’s *more* churnable now that FNBO is managing since they have fewer application rules than BoA

Can we have more than one of this particular card?

read the comments below. I answered this.

Anyone know if I can get the bonus even if I have the FNBO version of this card already? Maybe if I downgrade? Or maybe that isn’t required and I can apply for it anew since it was just a transferred acct from BoA and I technically never received such a bonus from FNBO, only from BoA many years ago? (I had to keep it for a few more years when it was acquired because I was using the benefits)

You can definitely have both versions of the card but I recall (not sure) that FNBO doesn’t allow downgrading like BoA used to do. I already had the no-fee card (originally from BoA, downgraded to no-fee card, then taken over by FNBO) and was approved for the Preferred card 2024. Just cancelled it after renewal (still got kept companion certs and lounge passes) and wonder when I’ll be able to get this again. If you use Amtrak (especially on the East Coast) this is one of the best value cards there is. Preferred is totally worth it if you ride the train enough but I have enough points to last a few years.

I signed up last month for the 20,000 point offer–any DPs on them matching to the larger bonus?

This is interesting. We normally use commuter benefits cards (pre-tax money) for cash Amtrak fares. I like the bonus, but our tax rebate might be more lucrative in the long run when it trades off with other bonuses.

$400 in GC’s sounds okay

Can points be combined between spouses? Looking to book a family room.

You can use your amtrak points to buy tickets for anyone, even a friend. Also they never check IDs against your ticket, at least not on Northeast Corridor trains.

I’m referring to combining my 6k points with my husband’s 43k points to book a room. Is that possible?

don’t know about combining points. use google

Does FNBO have any 5/24 rules?

If I had the amtrak card (which I closed awhile ago before the switch) when it was issued by Bank of America, can I apply for this one? Do I have to wait a certain amount of time from when previous one was closed or bonus posted?

No wait. You can apply now.

50-60k will get two people in a roomette on the Empire Builder, California Zephyr, or Southwest Chief during off-peak times. We combined an increased SUB on the CC, plus a mailer that offered 20k Amtrak points to switch our gas service for three months, to book the California Zephyr from Oakland to Chicago. A bucket list journey for anyone that loves gorgeous scenery.

What was the increased mailer SUB?

SUB on the credit card (at the time) was 50k. SUB on the gas mailer was 20k.

Also worth noting that points haven’t devalued. That was many people’s (and my) assumption when the Delta exec took over. I though points would become SkyPesos. Didn’t happen and it’s been long enough that I don’t think it will. Cabin comfort has also not devalued and, also surprising, the new coach cabins they installed are better than the old ones and roomier.

I think you are wrong about that. Prior to last year, each point was worth about 2,9

cents toward long-distance/sleeper. Now it seems that most trains get 2.5. Also dining on all east-of-Mississippi trains have been downgraded over the past 2-3 years.

For coach northeast corridor trips (I live in DC) I don’t think there has been a devaluation but if there was it was too small for me to notice. Definitely possible that it’s been different on other routes and classes of service.

The City of New Orleans which runs between Chicago and New Orleans, the food was definitely downgraded.