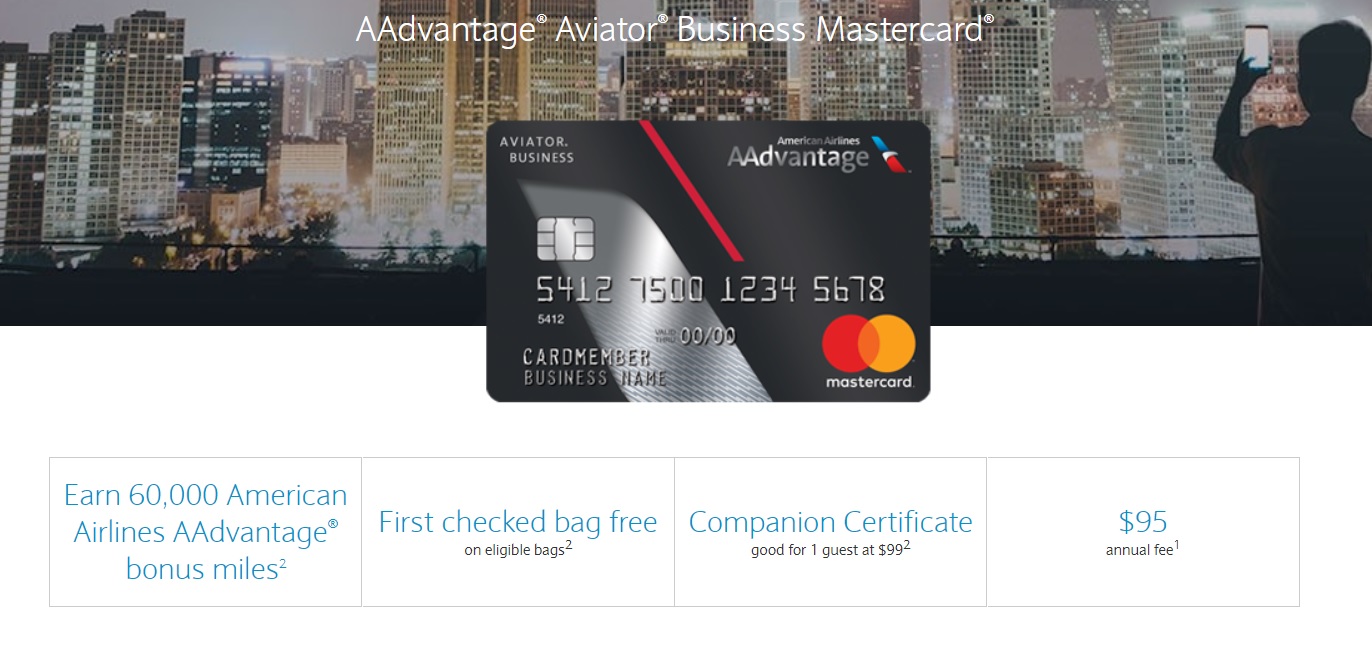

If you’re looking for American Airlines AAdvantage miles, the offer on the AAdvantage Aviator Business Mastercard has increased to 60,000 miles after first purchase update: after $1,000 in purchases within the first 90 days and payment of the $95 annual fee (note: the old offer required 1 purchase, the new offer requires $1K in purchases). While some people find AA miles very useful and others not at all, this is certainly a way to pad your balance without much effort if interested.

The Offer & Key Card Details

| Card Offer and Details |

|---|

Not currently available It appears that this card is not available at this time.$95 Annual Fee Recent better offer: Expired 2/6/23: 80K miles + a $95 statement credit after $2K spend in first 90 days. Earning rate: ✦ 2X AA, office supply, telecommunications services, and at car rental agencies ✦ 1X everywhere else Card Info: Mastercard issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: $99 companion certificate with $30K account year spend Noteworthy perks: ✦ First checked bag free ✦ Preferred boarding ✦ 5% bonus on miles earned the previous year after AF is paid ✦ 25% statement credit on in-flight purchases |

Quick Thoughts

Some people love AA miles and others hate them. Anecdotally, I’ve seen a lot more saver space open up over the past year than in the previous year or two, so it has looked to be improving based on my searches. Of course, that is likely route-dependent.

Still, the most valuable use of AAdvantage miles for most travelers remains for travel in international premium cabins on American’s partners. However, rumors abound that Etihad, arguably the most “glamorous” of American’s partners, may sever ties with American and join the Star Alliance any day now. If you’re looking to score this bonus with the hopes of flying on Etihad, it’s worth noting that it’s a gamble as to whether or not you’ll receive the miles in time (though note the end of ties is still a rumor and could easily fail to materialize).

Note also that some readers have reported that approvals on this card are harder than most business cards. That situation will of course vary from one person to the next, but it’s worth noting that Barclay’s may request additional documentation about your business.

H/T: Reader jeph36

I signed up last night and got instantly approved despite having opened 31 cards (and closing 17 of them) over the past four years. I did however take a hard hit on my TransUnion credit report. Which is a disappointment since that will probably set me back from my goal of getting under 5/24 with Chase.

The hard pull won’t count against 5/24, since it’s the new accounts that Chase is counting, not the pulls. The business card won’t show up under the accounts in your personal credit report, so you’re still on your path to getting under 5/24.

A new credit inquiry from this card will NOT add to your 5/24 number.

Chip

Ur a CC Stud Thank You..

CHEERs

Title on Boarding Area still says 1st purchase.

I had this last year JUST to prove a point I brought a $1 Large McD coffee+9% tax .Got the points Dumped the card 11 months later .The Fools just gave me a Hawaiian airlines card their Insane I wonder if they can read .

CHEERs

Ugh, it’s impossible to get approved for Barclays when you’re infinity/24…

How’s the churn on this? If I opened this 12mo ago and closed a couple weeks ago do I have a shot at the bonus despite the language?

Requires $1,000 in spend, not after first purchase.