NOTICE: This post references card features that have changed, expired, or are not currently available

The offer described in this post is no longer available. To find current Barclaycard offers, please click here.

Barclaycard is offering a new, very good card with a very good sign-up bonus!

A few days ago, my wife received a credit card sign-up offer from Barclaycard. While the offer wasn’t the best I’ve ever seen, it turned out to be pretty darn good…

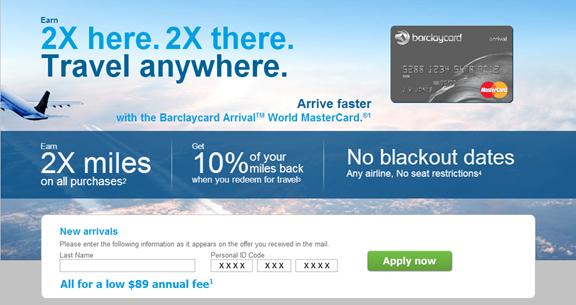

There are two versions of this card. Confusingly, they are both named the Barclaycard Arrival World MasterCard. There is the free version of the card with a public 10,000 point signup bonus, and then there is the $89 annual fee card with a targeted 40,000 point signup bonus.

Besides the annual fee and the sign-up bonus, the main difference between these cards is that the $89 card earns 2 miles per dollar for all purchases, whereas the no-fee version earns 2 miles per dollar for travel and dining, but just 1 mile per dollar for everything else.

Carry-on miles

Both cards offer a feature called “carry-on miles”. Miles can be redeemed for statement credit at any time for a value of 1 cent per mile. However, if you redeem miles for travel you get back 10% of the miles. In other words, if you plan to always redeem for travel, you can think of the $89 version of the card as being like a 2.2% cash back card. Valid travel expenses include: Airlines, Travel Agencies & Tour Operators, Hotels, Motels & Resorts, Cruise Lines, Passenger Railways and Car Rental Agencies.

The value of the bonus

Redeeming points with this card for travel reminds me of the hypothetical turtle that always goes half way to its destination. It gets closer and closer, but never arrives. When you redeem your points for travel, you get back 10%. You can then redeem those points for travel and get back 10%. And so on.

With the 40,000 mile sign-up bonus, you could redeem those miles for $400 worth of travel. Then, you would get back 4000 miles. You could then redeem those miles for $40 worth of travel. Then you would get back 400 miles….

OK, its not worth going further than that. The signup bonus is worth about $440. That’s not the best sign-up offer available (see “Best credit card offers“), but it is pretty darn good!

I think it’s time for my wife to do a little credit card churn… If you’re interested in this offer, watch your mailbox!

[…] Barclaycard Arrival World MasterCard […]

I opened this card In January and have blogged about my experiences with this card, good and bad, here: http://fishing4deals.com/2013/03/08/barclaycard-arrival-targeted-credit-card-offer-450-in-free-travel-or-not/

[…] back. There are several good 2% cash back cards out there (the best of which, I think, is Barclays’ Arrival World MasterCard which actually earns better than 2% if you cash in for travel) so I like to use 2% as the cash-back […]

[…] earns 2.22% back towards travel for all purchases (or 2% cash back). See my post “Barclaycard Arrival World MasterCard” for details. My wife received a targeted 40K offer for this card (which has expired), […]

Jason: I don’t know for sure, but my guess is that option 2 is more likely to work.

Although my wife received the targeted Barclays Arrive 50k no fee offer in the mail, I only received the 20k no fee offer. The two offers include two different URLs and of course two different invitation codes. I would love to get the card for my wife and then apply using her URL or invitation code. Has anyone tried this? I see two options:

1) I could use the URL on my wife’s offer but enter in my own invitation code. As a test, I tried this (without finalizing the application), and I do get the banners for the 50k offer. However, I am not sure if entering my invitation code will trigger the 20k offer in the system.

2) I could use the URL on my wife’s offer and her invitation code, but then change the application information to be for me. I haven’t tested this yet (I am at work without the mailing in front of me) but I do believe that you can edit the pre-filled fields.

If no one has tried this yet, which option do you think gives me the best shot at the 50k? Thanks very much.

Can you get giftcards with these points? At what ratio? Are these the World Mastercard points that BofA cards give?

duhmel: I don’t know

chris p: Ooh, 50K is even better! Congrats.

My wife just got an offer in the mail today for this card with 89 fee waived first year and 50k for 1k spend. Looks like she will be getting a new card this evening.

Steve: I haven’t yet done it myself, but I believe that as long as you apply for multiple cards in one day, Barclays will combine the pulls into just one hard pull. To be safe, open the applications in separate browsers and apply as close in-time to each as possible.

FM, how can you apply for multiple Barclay cards simultaneously and only experience one hard pull? What’s the procedure? That’s definitely something I’d be interested in.

Adam: yes, the Priceline card is a good option for 2% returns

Jim006: even when traveling on miles and points, there are many travel expenses that come up. Examples: fees for redeeming miles, parking, airport transportation, etc.

Jason: you can apply for multiple barclay cards at once and only get one pull. $440 for $1000k spend is great.

PJ: agreed

400 rebate on 1000 spend NOT bad. that is 40 % rebate

Call it what you want – these are not miles. This is just another marketing ploy ala Capital One Venture Card. Like someone had already mentioned, this offer is for suckers. $440 for a hard pull? C’mon. That’s outrageous. You should settle for no less than $1000 in value from these crooked banks.

Since most of us in the game rarely pay for travel, seems this sort of card is of limited use.

FWIW, just got a targeted offer on another Barclays card – the NFL card. Spend $500 a month in Jan, Feb and Mar and get 20,000 points. You can use those points as cash to pay your CC bill, so in effect they are giving you $200 rebate on $1500 spend (which can be buying gcs for example). I recently signed up to get the 40000 points (= $400 value) for a paltry $1K spend. Now another $200 for some more paltry spend. I like Barclays…