Over the Summer, Best Western suddenly stopped taking new applications for their Mastercard issued by FNBO. As far as I know, there wasn’t much news about why that happened, when a replacement might be launched or who the issuer for a new card would evenutally be.

Fear not, all those questions have now been answered, as two spanking-new Best Western Visa cards have been launched and are taking applications. The issuing bank is Brookings, South Dakota’s own First Bank & Trust and the cards are being managed by Mercury Cards. No, I hadn’t heard of them either.

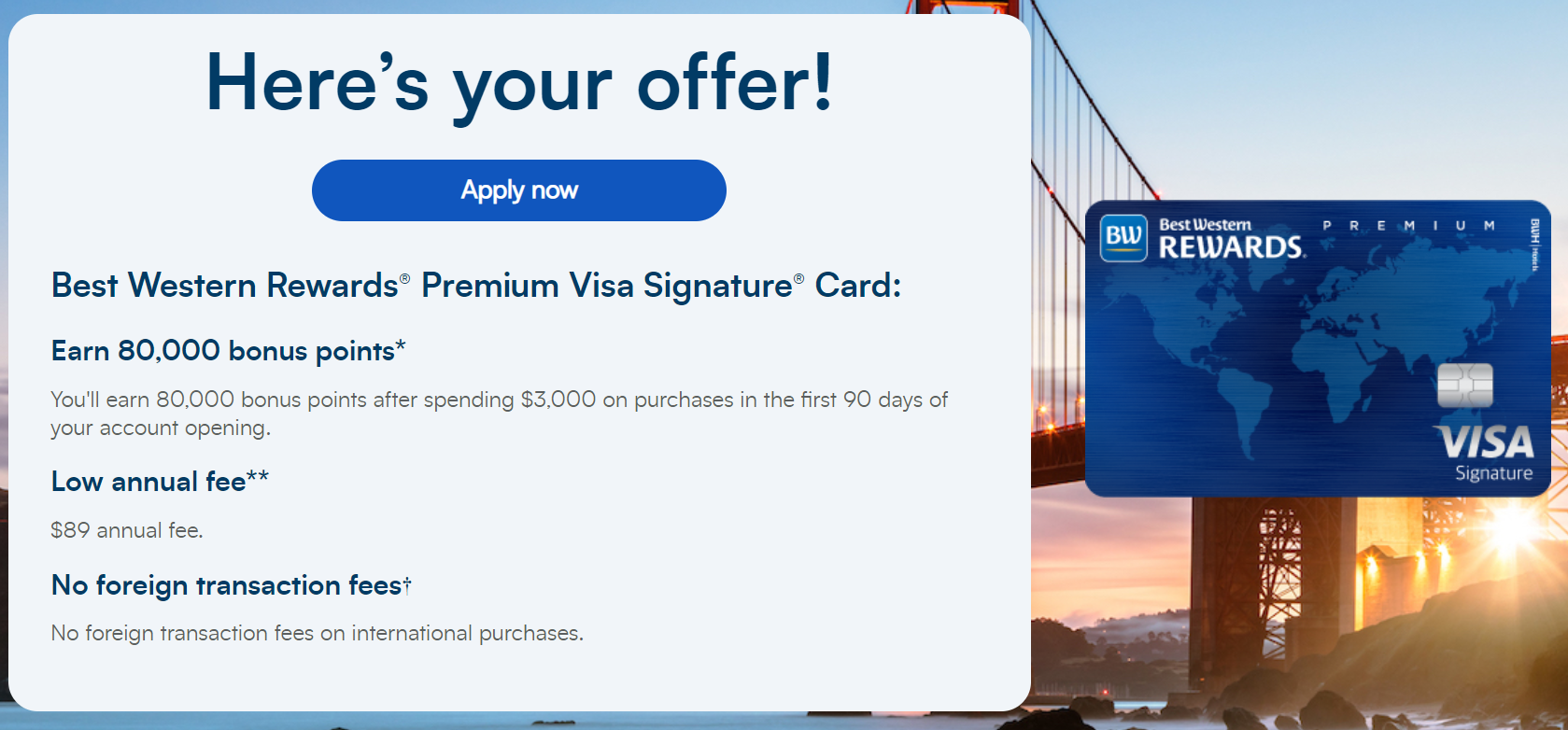

The cards come in two flavors: no-annual fee and $89 “Premium.” The landing page for each one specifies a welcome offer that requires “qualifying spend,” but makes you go through their pre-approval tool to find out what the actual amount is, an irritating innovation that I hope catches on like square wheels.

Both my wife and I filled out the pre-approval tool and got the same offers: 80K points after $3K spend for the Premium card and 40K points after $1,500 spend for the ruffian.

Offers and Key Card Details

| Card Offer and Details |

|---|

ⓘ $216 1st Yr Value EstimateClick to learn about first year value estimates 40K points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 40K points after "qualifying spend" (we saw $1,500) in the first 90 days No Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Not much to see here. If you're a Best Western loyalist, the Premium card is probably worth the annual fee. Earning rate: 4X Best Western ✦ 2X everywhere else Card Info: Visa Signature issued by First Bank & Trust. This card has no foreign currency conversion fees. Big spend bonus: 10,000 bonus points after $5K spend in cardmember year Noteworthy perks: Complimentary Gold elite status |

| Card Offer and Details |

|---|

ⓘ $343 1st Yr Value EstimateClick to learn about first year value estimates 80K points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 80K points after "qualifying spend" (we saw $3,000) in the first 90 days $89 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Best for those who stay often at Best Western hotels and might be worth keeping in the sock drawer for the annual free night award Earning rate: 10X Best Western ✦ 4X gas and grocery ✦ 2X everywhere else Card Info: Visa Signature issued by First Bank & Trust. This card has no foreign currency conversion fees. Big spend bonus: Free night award after $10K spend in cardmember year Noteworthy perks: Anniversary free night award ✦ Complimentary Platinum elite status |

Quick Thoughts

Neither of these cards will set the world on fire, but the $89 Premium version could be mildly interesting, especially for folks that actually stay at Best Westerns.

The primary attraction here is the complimentary Platinum status and the anniversary free night award. In the past, Best Western has run promotions where you earned a free night voucher that was good for any BW property in the US, Canada or the Caribbean. My assumption is that this anniversary certificate is the same thing, although the landing page is short on details. Even if you only stayed in Best Westerns a few times a year, I could see a free night award that can be used almost anywhere in North America being worth the $89 annual fee.

Platinum status, like most of Best Western’s elite program, isn’t terribly valuable. You get a shot at early check-in and late check-out, a 15% bonus on cash stays and some points and water when you check-in. The only difference between that and the Gold status you get from the no-annual fee card is that Gold only gets a 10% bonus. Nothing to write home about, but better than nothing, especially if you can talk your way into a late check-out on occasion.

The earnings details on both of these cards are underwhelming-ish, especially given that we found the Reasonable Redemption Value of Best Western points to be 0.61 cents each. 2x everywhere sounds great, until you realize that you’re getting around 1.2% back…paltry in today’s credit card world. That said, the Premium card’s 10x earnings at Best Western could be worth using it for cash stays, if you have them.

Today (2/12/25) I received a letter saying the FNBO card is being converted to the new issuer. Not too surprising. My question – I was working on the $5K spend bonus (my year ends in June, and am almost there. The letter is unclear if I will get the bonus (assuming I meet the “old” spend requirement. Can you guys fine out? I am sure many will have that question

Tim, you mentioned 14x hotel spend return in the text, but this new card is 10x.

While the card seems slightly worse than the one issued by FNBO, there are other interesting FNBO cards, so there’s an advantage to having this portfolio switch to Mercury.

Mulling over applying myself, having received the same “preapproval” you did.

Did anyone get both bank’s cards?

What kinds of CL is this new issuer offering, I wonder?

Thanks, fixed.

I presently have the FNBO best western card and will earn my 20000 bonus points in December I assume the card will be canceled. But I don’t want it. So I figure I’ll cancel it once I get my bonus points. My partner gets 40000 points around March ( I think he had a better bonus offer when he signed up) He’s going to keep his card. My question. if I cancel the new card can I reapply in 2 years and get the sign up bonus at that point ?

I just called FNBO customer service. They told me my Best Western credit card will continue to be active with their bank. They have no knowledge of another bank taking over Best Western. Sounds like I’ll get my anniversary bonus points and an annual fee charge in December. ( Not that I believe everything they just told me!)

Fun fact you can also match Wyndham Diamond to best western diamond select if you have a Wyndham earner business card 🙂

IHG Platinum works, too!

i keep getting the same message saying there are no offers available to me. Is this the future of credit card applications?

I’m getting the same thing every time I filled out the form with Mercury. I don’t have any issues getting approved with other issuers. It’s weird

Just had the same thing happen to me! Guess the only good thing is i believe no hard credit pull. Am I not getting an offer because I still have the old FNBO mastercard?

I have the FNBO card, and would get this one, but also keep getting the no offers for me message…

FNBO BW was always very sweet. Spend $5k/a, and get 40k BW points; upon anniversary renewal for $95. Those 40k BW points get me 2 or 3 stays in a medium BW in Europe.

I agree this seems like a step down from the old card. I’d rather have points than a cert.

I only get 20K points for 5K spend. Anyone try to call an the better offer??

M

Mercury Cards appears to be a subprime lender. Appears to not have the typical excessive fees that most do though. It’s apparently invite only via snail mail or credit karma.

Update: Looks it’s a 1% card with around a 30% apr. They seem to have good reviews overall and their app seems well designed. Not sure if all that translates much to the Best Western card or not though.