With no advanced warning, Amex today introduced big changes to their suite of Delta SkyMiles cards. Annual fees have increased, but Amex has made up for that by throwing in “coupon book” rebates plus a few exciting enhancements…

Big picture

Delta Gold, Platinum, and Reserve cards now have higher annual fees, new rebates, and new and improved perks. Most new perks are available immediately (although pre-issued companion certificates don’t seem to include the enhancements). Existing cardholders won’t get charged the new fees until their next renewal on or after May 1 2024. In other words, if your card renews before then, you’ll be able to lock in the old annual fee for another year while also benefiting from new perks.

Delta SkyMiles® Gold changes

The Delta SkyMiles® Gold American Express Card and the Delta SkyMiles® Gold Business American Express Card have new increased annual fees, increased Delta flight credits after $10K spend, and a new prepaid hotel credit…

- Annual Fee: $150 (up from $99)

- Flight credit: $200 Delta flight credit after $10K in purchases in a calendar year (prev: $100 flight credit for the same spend)

- Prepaid hotel credit:

- Consumer Delta Gold Card: Get up to $100 back per year as a statement credit for prepaid hotels or vacation rentals booked through Delta Stays on delta.com/stays

- Business Delta Gold Card: Get up to $150 back per year as a statement credit for prepaid hotels or vacation rentals booked through Delta Stays on delta.com/stays

My Take on the Delta Gold changes

I’m not a fan of these changes. Previously I thought of the Gold cards as an inexpensive way to get a free checked bag for each passenger. It was never a rewarding card for actual spend and that hasn’t changed. Yes, the increased Delta flight credit has made the first $10K of spend a bit more rewarding but not enough for me to recommend people move their spend to this card.

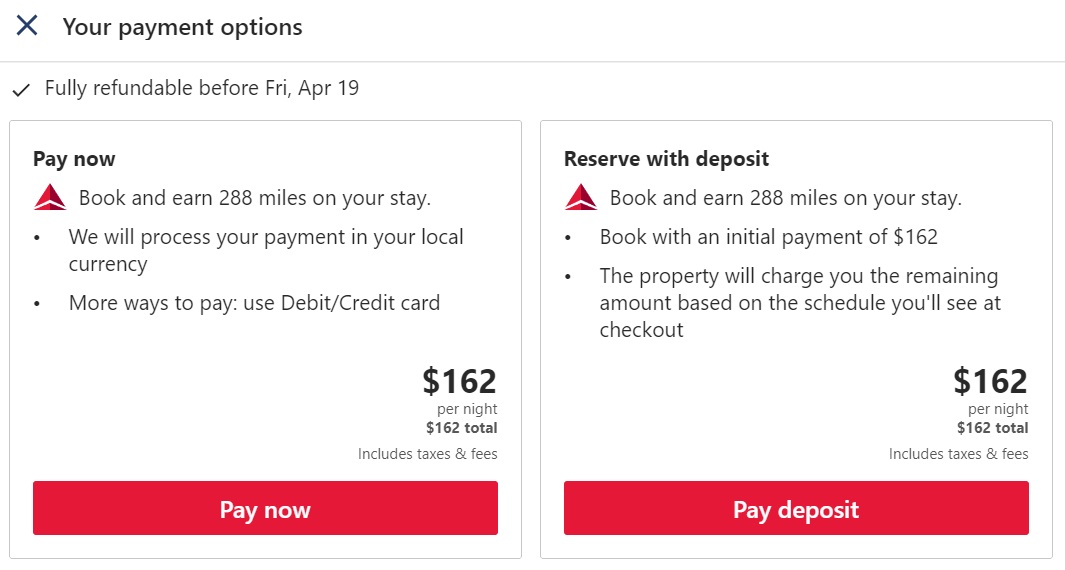

What about the prepaid hotel credit? I took a look at Delta Stays and found that the prepaid rates appear to all be non-refundable. Ick! In my opinion, you shouldn’t value these credits anywhere near face-value because you should be able to find the same hotels through other sites for potentially lower prices and with refundable bookings.

Updated Take: The finding that you can book prepaid refundable hotels in order to earn the new hotel credits changes my recommendation. I now think that the changes are very good since most people can likely make use of a hotel credit throughout the year. The business version, in particular, with its $150 hotel credit is a great choice.

Delta SkyMiles® Platinum changes

The Delta SkyMiles® Platinum American Express Card and Delta SkyMiles® Platinum Business American Express Card have new increased annual fees, multiple new rebates, new perks, and greatly improved companion tickets (earned each year upon renewal)…

- Annual Fee: $350 (up from $250)

- Rebates:

- $150 or $200 Prepaid hotel credit:

- Consumer Delta Platinum Card: Get up to $150 back per year as a statement credit for prepaid hotels or vacation rentals booked through Delta Stays on delta.com/stays

- Business Delta Platinum Card: Get up to $200 back per year as a statement credit for prepaid hotels or vacation rentals booked through Delta Stays on delta.com/stays

- $120 Rideshare Credit: Enroll and earn up to $10 in statement credits each month after using your Card on U.S. rideshare purchases with Uber, Lyft, Curb, Revel, or Alto. [Enrollment required]

- $120 Dining Credit: Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants [Enrollment required]

- $150 or $200 Prepaid hotel credit:

- New Perks:

- $2,500 MQD Headstart: Cardmembers automatically get $2,500 MQDs (Medallion Qualifying Dollars) towards elite status each year.

- Earn MQDs with spend: Earn 1 MQD (Medallion Qualifying Dollar) for every $20 spent on the card. Note that this is very poor compared to the Delta Reserve card which earns 1 MQD per $10.

- Complimentary Upgrade List: Card Members without Delta Medallion elite status will be added to the Complimentary Upgrade list, after Delta SkyMiles Medallion Members and Reserve Card Members.

- Hertz Five Star Status: Register at delta.com/mypromos/eligible, and “Enroll in Promotion” at delta.com/hertz [Enrollment required]

- Improved Perks:

- Annual companion ticket: Get an economy companion ticket (subject to taxes & fees) each year upon card renewal. Previously these were only valid for travel within the lower 48 United States, but now they can be used to fly to Alaska, Hawaii, Mexico, the Caribbean, and Central America. Specifically, the new certs will be valid for round-trip flights originating within the United States, Puerto Rico or the U.S. Virgin Islands (USVI) and flying to the following destinations: the United States, Puerto Rico, USVI, Mexico, Antigua, Aruba, Bermuda, Bonaire, Grand Cayman, Cuba, Jamaica, Bahamas, Turks and Caicos, Dominican Republic, Saint Kitts, St. Maarten, St. Lucia, Costa Rica, Belize, Guatemala, Panama, Honduras, and El Salvador.

My Take on the Delta Platinum changes

Overall, I like it. First, and most importantly, I’m super excited about the enhancements to the companion tickets. If I can use this each year to fly two to Hawaii for the price of one, I’m sold. Plus, even though I’m not a fan of the coupon book credits they added, it shouldn’t be hard to get at least $100 of value from them each year in order to make up for the card’s higher annual fee.

Above, in the Gold card “My Take” section, I touched on issues with the prepaid hotel credits. The rideshare credits are annoying mostly just because they’re only $10 per month. If we can earn the credits by buying Uber or Lyft credit for future rides, though, that would be pretty cool (to be clear: I do not know if that would work). And the dining credit is an issue for me because none of the restaurants I go to regularly are on Resy. And, if I ever go to one on Resy, will I remember to bring my Delta card? Probably not.

Updated Take: The finding that you can book prepaid refundable hotels in order to earn the new hotel credits makes me like the Delta Platinum changes even more than before. The business version, in particular, with its $200 hotel credit is a great choice!

Delta SkyMiles® Reserve changes

The Delta SkyMiles® Reserve American Express Card and Delta SkyMiles® Reserve Business American Express Card have new increased annual fees, multiple new rebates, new perks, and greatly improved companion tickets (earned each year upon renewal)…

- Annual Fee: $650 (up from $550)

- Rebates:

- $200 or $250 Prepaid hotel credit:

- Consumer Delta Reserve Card: Get up to $200 back per year as a statement credit for prepaid hotels or vacation rentals booked through Delta Stays on delta.com/stays

- Business Delta Reserve Card: Get up to $250 back per year as a statement credit for prepaid hotels or vacation rentals booked through Delta Stays on delta.com/stays

- $120 Rideshare Credit: Enroll and earn up to $10 in statement credits each month after using your Card on U.S. rideshare purchases with Uber, Lyft, Curb, Revel, or Alto. [Enrollment required]

- $240 Dining Credit: Up to $20 per month in statement credits on eligible purchases with U.S. Resy restaurants [Enrollment required]

- $200 or $250 Prepaid hotel credit:

- New Perks:

- $2,500 MQD Headstart: Cardmembers automatically get $2,500 MQDs (Medallion Qualifying Dollars) towards elite status each year.

- Earn MQDs with spend: Earn 1 MQD (Medallion Qualifying Dollar) for every $10 spent on the card.

- Complimentary Upgrade List: Card Members without Delta Medallion elite status will be added to the Complimentary Upgrade list, after Delta SkyMiles Medallion Members and Reserve Card Members.

- Improved Perks:

- Annual companion ticket: Get an economy or first class companion ticket (subject to taxes & fees) each year upon card renewal. Note that while these can be used for Premium Select seating, they cannot be used for Delta One. Previously these were only valid for travel within the lower 48 United States, but now they can be used to fly to Alaska, Hawaii, Mexico, the Caribbean, and Central America. Specifically, the new certs will be valid for round-trip flights originating within the United States, Puerto Rico or the U.S. Virgin Islands (USVI) and flying to the following destinations: the United States, Puerto Rico, USVI, Mexico, Antigua, Aruba, Bermuda, Bonaire, Grand Cayman, Cuba, Jamaica, Bahamas, Turks and Caicos, Dominican Republic, Saint Kitts, St. Maarten, St. Lucia, Costa Rica, Belize, Guatemala, Panama, Honduras, and El Salvador.

- 4 Delta Sky Club® one-time guest passes per year (previously 2 passes per year)

- Sky Club Access change (reminder):

- Delta Sky Club access when flying Delta on any fare except Basic Economy. Starting Feb 2025 Delta Reserve cardmembers will be limited to 15 Sky Club visit-days per year (unless cardmember has spent $75K in a calendar year)

My Take on the Delta Reserve changes

Meh. I’m not a fan but it’s hard to explain why. The annual fee only increased by $100, but they added $560 in credits ($610 for the business card). That should be a big win, right? And it is a huge win for those who regularly book restaurants through Resy, who rideshare monthly, and who are fine with booking nonrefundable hotels. After all those rebates, it’s like getting Sky Club access, companion certs, and more almost for free (after rebate). But for me, at least at the moment, it seems more like a big headache to worry about using those credits month after month. Still, I’ll see how it goes. If it turns out that using the credits is easier than I’m thinking at the moment, maybe I’ll become a fan of the changes. For now, though, not so much.

I should mention too that I am excited that the Delta Reserve card’s annual companion certificate has greatly improved, but the Delta Platinum companion certs have also improved and so I’d be just as happy with those.

Updated Take: The finding that you can book prepaid refundable hotels in order to earn the new hotel credits makes me like the Delta Reserve changes after all. The business version, in particular, with its $250 hotel credit is a great choice, but with either one, the $100 increased annual fee is more than offset by the hotel credits and other new perks.

Bottom Line

The Delta Gold, Platinum, and Reserve cards have increased annual fees. In exchange, we get some improved perks and a bunch of coupon-like credits that could make up for the annual fee, but probably won’t for most of us. My guess is that anyone who previously thought that their Delta card was worth keeping will continue to feel that way. Maybe they’ll eke out enough value from the new credits to make up for the higher annual fee. Some will feel like the enhanced perks make up for the higher fees even without the credits (for example, I’m very excited by enhancements to companion tickets). Similarly, I’d guess that almost anyone who previously didn’t think a Delta card was worth paying for will continue to think that. The rare exception will be those who think they’ll get great value from those coupon-like rebates.

Updated Take: The finding that you can book prepaid refundable hotels in order to earn the new hotel credits makes me like card changes more than before. The business version of each card, in particular, are great choices because they offer $50 more in hotel credits than their consumer card counterparts.

For more details about each card discussed here, please see our updated guides:

- Delta SkyMiles® Gold American Express Card

- Delta SkyMiles® Gold Business American Express Card

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

Can I book a room through Delta Stay using my Amex Delta Business Platinum card for my daughter to use and get the $200 credit? Also, if it is a refundable reservation and I cancel will I be able to use the credit at a later date?

Yes you can do that. If you cancel, it’s possible that they won’t claw back the credit anyway, but to be safe make sure you have another booking within the same calendar year.

Do we know if the hotel credits will be calendar-year or card-anniversary based?

Answer: I checked the terms and it does indeed specify calendar year.

Wow thats awesome an makes the first year value outstanding (I’m uograding not applying so my Renweal is July or August so I can.also use the CP ).

While not nearly as good as Amex FHR booking its also more flexible with more options.

I tool an upgrade offer to Plat .as I had a tax payment due (and 3/24) – it was ok 25K Sky Pesos and $250 statement credit – but $250 plus $400 Delta stay credit (2024/2025) and $120 Resy Credit = $770 plus CP. And will will probably use maybe $50 of the Ride share credits with Amex Uber Cash for when we travel typically we fly about 5-6 months of the year. So thats $820-$830 less $350 and few months prorated AF. Is a $500 womner not including 25K miles.

Great point about how the upgrade offers can still be good even without as much of an “intro” bonus, if you can use the annual benefits. Typically if I get an upgrade offer I will also try to get the card itself “new” before taking the upgrade offer, to “double dip” since you can’t get new upgrade offers or the intro bonus after you have one. However, that’s not always possible (e.g., if you have the maximum number of AMEX cards)

If I book a $300 hotel room on delta stays, will I get the full $200 statement credit right away? Or do they issue a certain amount per booking?

Yes you’ll get the full amount. Remember to select the pay in advance option or it won’t work.

[…] in Daytona Beach, Florida, when the news broke about the changes to the Delta credit cards (read Frequent Miler’s post about the changes). I currently have the American Express Platinum Delta SkyMiles Business Credit […]

If based in NY and you have all three US airlines available, and have a need for top-tier status which card works best to put spend through? I’m thinking AA even after these Delta changes given you can spend $10k a month on their higher-end cards and you get OW Emerald, and can transfer miles to partners outside of OW like Etihad for great F / J products.

Delta gives you a boost to Silver status through the head-starts, but otherwise it looks like you need to spend ~$500 more a month on the card to get Platinum. AA top tier seems more achievable than Diamond as well and SkyTeam is an inferior alliance.

Is the hard product on Delta so much better? If you want the cheap European J one-way tickets with Delta you’re better off getting Air France or Virgin miles another way maybe and transferring them.

Let’s see…

AA

So yes AA requires less spend for top tier status unless you get a bunch of Delta cards in order to bridge the gap with multiple $2500 Headstarts

Question about the “Refundable” term on the Delta Hotel reservation. Is the implication here that you can book a refundable rate to the Delta CC, get credited for the CC charge, then refund it at a later date? Isn’t there a risk of claw back or account closure?

Yes there’s always that risk if you haven’t already booked another future stay

Already got credited for a hotel stay next month in Australia–$250 in my pocket.

The Delta Platinum Business card shows the welcome offer of 100K for $3K/6-month spend on https://frequentmiler.com/dlplatbiz/ from the link above, but the actual offer seems to be $8K/6-month spend required! (not a typo — used to be $3K, I believe, now $8K!)

The only positive thing for me is that it’s even more unlikely I’ll get another Delta card.

I’ve been doing some coupon testing and found that Amex is sending confirmation emails pretty quickly so I can give preliminary (not-confirmed) results:

Rideshare Credits:

Hotel credits:

Resy credits:

Thanks for dong these tests, Greg!

With delta hotel bookings, are you able to apply your elite status?

Unfortunately no

Buying $10/$20 gift cards is a good tip for the Resy credit. I just went to a Resy listed restaurant this past weekend, used my delta card for the meal, and received the $10 credit two days later with an email confirming it. I need to try the hotel credit. Thanks!

Thanks for testing these, Greg. When you say “Lyft $25 in-app reload”, is that refilling Lyft Cash or a buying an e-gift card? It appears that you can do both methods in the app so just wanted to confirm which method you had used. Thanks again.

Great question. On the payment screen I clicked add cash.

Biz cards seem like the winners here. Biz gold is net zero cost if you use the stay credit, biz plat is net $30 if you can use both that and the rideshare.

On most other rideshare credits, I’ve been able to use for Uber Eats. I wonder if that’ll work here too.

Its actually better since the Delta stay credit is Calendar year like FHR credit – so first year year is an extra $150-$250.

Will Uber Eats work for the rideshare credits? Didn’t see terms mention that.

The terms say no. I’m testing it anyway.

Any luck?

No. It didn’t work

Haha thanks for checking Greg! On a side note: I did receive my hotel credit ($200- delta plat biz) made with a refundable booking. I don’t use the card much but I’ll leave the credit there for future restaurant outings.

Overall this is a positive change for me in my circumstances. Previously I could not justify holding a Delta card beyond the 1st year to get the SUB, but now I might get the Biz Gold. I am an airline free agent, so it is nice to have a Delta card since I will not have status. I book my own work travel (which is then reimbursed) and stay in a lot of small/mid-size cities where status means very little at a Country Inn & Suites, HI Express, Hampton Inn, etc. So I can pretty much “cash out” the $150 back from the hotel credit, bringing the net cost down to ~$0. Tack on the 10% mileage discount for card holders, and it looks like a keeper.

For the other new benefits, I am not convinced I would ever use the companion cert. I would value Resy at $0. Ride-share I might put 50% value on.

Also, I am seeing what I consider to be better SUBs doing a booking at Delta: 50K plus $400 credit for Gold, or 70K plus $400 credit for Platinum. I did not spend a lot of time trying to get anything else.

With these credits Amex is now asking me to pull out these sock drawer cards monthly. That’s way more than I want to think about them.

I agree with that but if you ignore the monthly credits and creatively use the hotel credit once per year you’ll come out ahead compared to the old annual fees.

I have a mixed reaction to these changes. I downgraded my Delta Amex Platinum years ago as my husband has one and I could ride the coattails of his status when we traveled together. Things have changed and most of the time I travel domestically- i am alone (work or going to see family) I have been wanting to apply for the Delta Amex Business plat when an elevated bonus arrived because I wanted the status booster, free checked bags, and minimum Main cabin 1 boarding. I travel ATL- LAX for work 6 RT a year plus about 7 or 8 shorter domestic hops all on Delta, so a little status booster could come in handy. I’m not thrilled about the increase in fee but am hopeful that the resy benefit (we go to resy restaurants often) and the hotel credit could at least partially offset. We don’t use rideshare a tremendous amount so not likely much benefit to us. We have never had any issues using my husband’s companion certificate, but i am curious how the fare classes availability will work on Hawaii, Caribbean, etc. For me the SUB is worth giving this a go for at least a year, and then seeing how things pan out. Thanks to Greg for the deepdive here.