NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

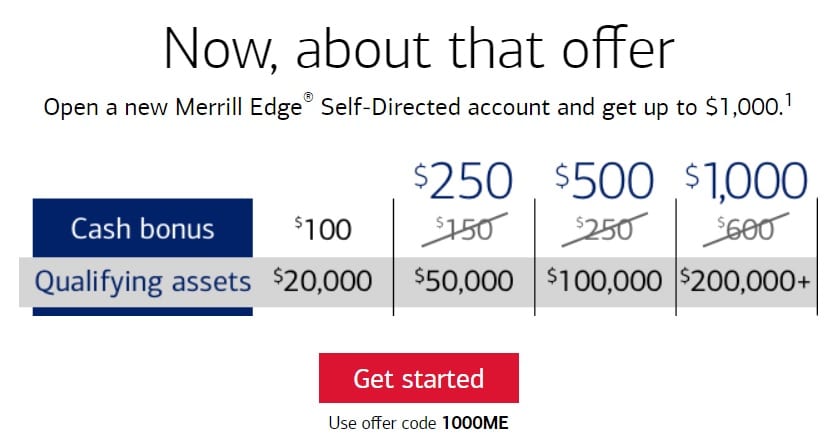

Merrill Edge is offering an increased bonus right now when you open a new Merrill Edge Self-Directed account transfer funds over to them using promo code 1000ME. As suggested by the promo code, you can get a bonus of up to $1,000, with the transfer also earning you Preferred Rewards status with Bank of America.

The Deal

- Open a new Merrill Edge Self-Directed account and transfer funds to earn one of the following bonuses when using promo code 1000ME:

- Transfer $20,000-$49,999 & get $100 bonus

- Transfer $50,000-$99,999 & get $250 bonus

- Transfer $100,000-$199,999 & get $500 bonus

- Transfer $200,000+ & get $1,000 bonus

- Direct link to offer.

Key Terms

- Must fund your account with at least $20,000 within 45 days of account opening to earn a bonus.

- Assets transferred from other accounts at Bank of America, MLPF&S, Bank of America Private Bank, or 401(k) accounts administered by MLPF&S do not count towards qualifying net new assets.

- The bonus will be added to your account 180 days after meeting the funding criteria.

- For purposes of this offer, qualifying net new assets are calculated by adding total incoming assets or transfers (including cash, securities and/or margin debit balance transfers) from external accounts, and subtracting assets withdrawn or transferred out of the account within the preceding 52 weeks.

Quick Thoughts

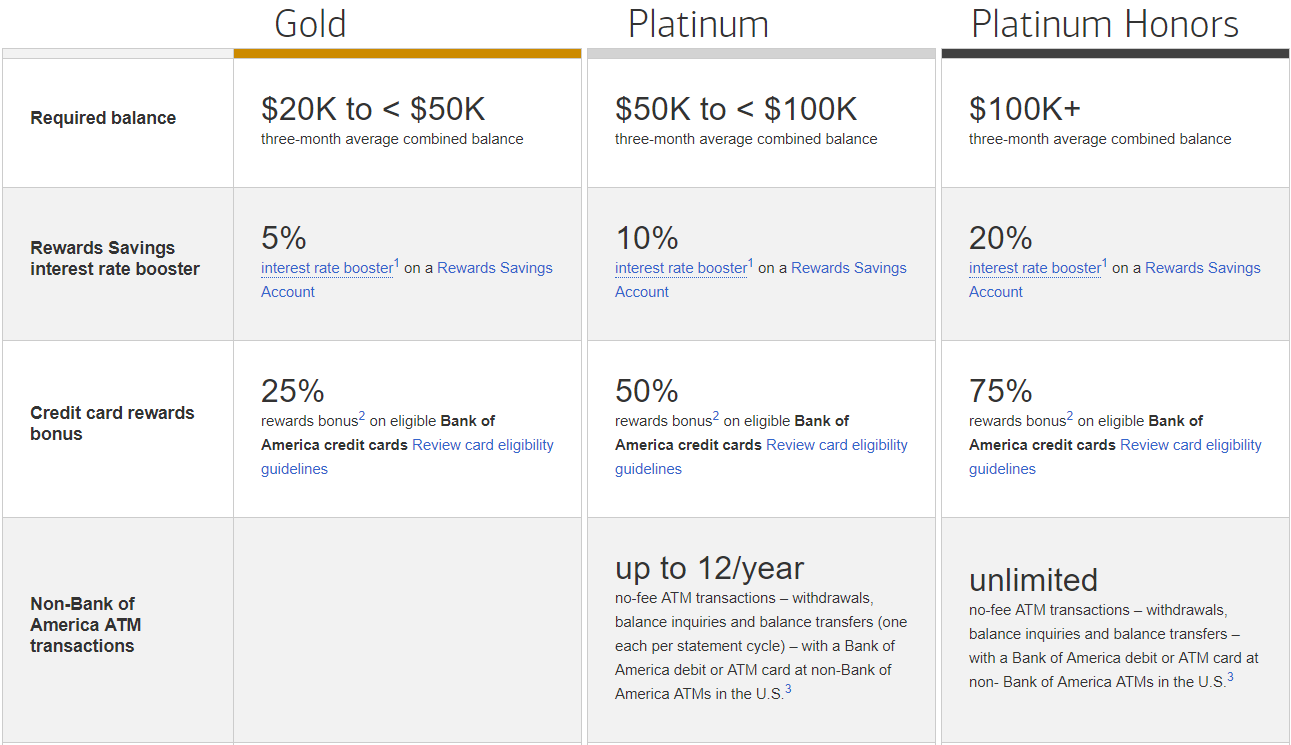

Merrill Edge is part of Bank of America, so the funds you transfer over will qualify you for Preferred Rewards status provided you transfer over enough to earn you a bonus. Here’s a table showing the investment thresholds and the benefits you’ll receive:

With this Merrill Edge promo, if you invest the lowest amount needed to earn a bonus ($20,000), you’d get a $100 bonus and earn Gold status which gets you a 5% interest rate booster and 25% rewards bonus on eligible credit card spend. Note that the 5% interest rate boost isn’t an extra 5% interest – it’s 5% extra on whatever your interest rate is. If the interest rate on your savings account with Bank of America is 1%, the booster will make that 1.05% rather than 6%.

If you invest $50,000 you’ll get a $250 bonus from the Merrill Edge offer and Platinum status which gives a 10% interest rate booster and 50% rewards bonus on your BoA credit cards.

Finally, if you invest $100,000 or $200,000, you’ll receive a bonus of $500 or $1,000 respectively. An investment of $100,000 or more will get you Platinum Honors too, so with that you’ll get a 20% interest rate booster and, potentially more lucratively, a 75% bonus on the rewards earned when using BoA credit cards.

That can be lucrative because some Bank of America cards offer 1.5% cashback. With that 75% bonus, the rate is increased to 2.625% which is an excellent return on everyday spend. Check out this post for more details about Preferred Rewards and the eligible Bank of America credit cards.

An important thing to note is that this particular Merrill Edge offer requires that you leave the transferred money with them for at least 180 days. The standard bonus requirement is 90 days, but the increased bonuses can make it worth leaving that money with Merrill Edge for longer than normal.

Something else worth noting is that if your current brokerage charges a fee to transfer your money elsewhere, it’s worth asking Merrill Edge if they’ll cover it. Nick did that recently and was able to get the $125 account termination fee covered by Merrill. This apparently isn’t an official policy, but something they’ll often do if you ask.

Do you think they will make an exception and put me in the 200k+ category if I bring in slightly less around 190k?

I’m assuming the bonuses are automated, so I doubt it. You could certainly ask a rep if that would be possible as there’s no harm in trying, but if doing that be sure to get it in writing.

If I open a new joint cash management account and transfer more than $100,000 into that account, will all owners for that account receive Platinum Honors status?

I’m afraid I’m not sure – BoA should be able to answer that.

[…] funds within 45 days and keeping them on deposit for 90 days (that offer has since expired, though there is a new offer for bigger bonuses that requires leaving the funds on deposit […]

[…] BoA/Merrill Edge: Get Up To $1,000 Bonus When Opening New Account & Transferring Funds Over […]

[…] BoA/Merrill Edge: Get Up To $1,000 Bonus When Opening New Account & Transferring Funds Over […]

Data Point: I was enrolled in the lesser previous offer of $600 after 90 days and $200K in assets, but I called and asked to be moved over to the newer offer of $1,000 after 180 days. After being placed on hold for ~10 minutes or so, the agent confirmed he was able to successfully override my account and apply the new offer. He said the only catch would be that the 180 days will begin today rather than beginning from the ~30 or so days ago when I initially opened my account. I felt that was a fair trade-off—definitely still worth the extra $400.

So I had an interesting experience and datapoint to add. Curious if anyone else has run into this and maybe it will avoid frustration for someone?

If you have funds in two types of investment accounts like Rollover, Roth, Traditional, and are trying to move funds from your current institution to ME to meet the requirements for a bonus, you might be asked for more info.

I was trying to add funds from another institution and I currently do not have any relationship with BofA or ME.

My plan was to move money into ME in a like for like transfer and qualify for one of the bonus thresholds. I have two accounts with my current institution that both would add up to meet the amount, or so I thought….

Both account types were IRAs. I had funds in 1 Roth IRA account type and 2 Rollover IRA account types. Added together I would meet the bonus threshold but I decided to call in because I had some other questions about BofA / ME investment options. On a whim I asked about my accounts if that would qualify for the bonus threshold. The first rep said technically the ME account even though it manages all types of BofA and ME investment accounts, the bonus threshold only applies to cumulative funds transferred into one account type. In other words – I didn’t have enough funds in one “Type” of account to qualify for the bonus I wanted.

He said however since there were two separate account types they’d need to request for approval to meet the threshold I wanted to meet and it would be likely to be approved IF..I could provide a link or an email with the targeted offer…”Wait what? Targeted, well ok”.

I decided to try the HUCA.

2nd rep took my info, and reached out to others and then called back about 4 hours later. Same explanation. Since the account types are different it would require further review and I’d have to provide information proving I was “Targeted”

Seems like that’s not totally right according to Terms but I’m sure not rolling the dice with the amounts I was looking to move with two reps telling me essentially the same thing.

The rep I spoke to in referring to the bonus offer said something about the “email you received”, however, I don’t see any language in the T&Cs stating that the offer is limited to those actually targeted. It merely states that you must mention or enter the offer code.

The bonus is for opening a new account and moving funds, not for just transferring funds like the title says. Had my hopes up. May want to update 😉

That’s a very good point, thanks – I’ve updated the post to include that.

Expiration date for the offer?

I couldn’t find an expiration date listed for the offer unfortunately. I’m not sure if they’re planning on running it for x amount of time or until x number of people use the promo code.

Are there any fees with Merrill Edge? Right now I’m with eTrade, but $1k sounds nice for doing nothing.

The landing page for the offer states the following:

Get unlimited free online stock, ETF and option trades with no trade or balance minimums. Options contract and other fees may apply.

Then further down in the terms on that page it says:

Other fees may apply. Free and $0 means there is no commission charged for these trades. $0 option trades are subject to a $0.65 per-contract fee. Sales are subject to a transaction fee of between $0.01 and $0.03 per $1,000 of principal. There are costs associated with owning ETFs. To learn more about Merrill pricing, visit our Pricing page.