Bank of America issues a number of cards with co-brands such as Alaska, Air France, Amtrak, Asiana, etc. Clearly they started at the beginning of the alphabet when looking for partners (Spirit and Virgin Atlantic notwithstanding). But this post is not about those cards. This post is about Bank of America’s own rewards cards: Cash Rewards, Travel Rewards, and Premium Rewards.

None of Bank of America’s own cards would be interesting except for one key thing: Bank of America has an elite program for their banking customers. The higher your tier, the more rewards these cards earn. As a result, at the top “Platinum Honors” tier, these cards become very interesting.

Bank of America’s line-up

Here’s the basic info about each card for those without Bank of America elite status. As you’ll see, none are particularly interesting on their own. In each case, you can do much better with other cards on the market.

Cash Rewards Cards

Bank of America offers both a consumer and business version of the Cash Rewards card, each with no annual fee. Each offers a fixed 2% category and your choice of a 3% category, and 1% elsewhere. The consumer card limits 2% and 3% rewards to $2500 combined spend per quarter. The business card limits 2% and 3% rewards to $50K combined spend per calendar year.

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 3% back on your choice of the following: gas and EV charging, online shopping, cable, streaming, internet & phone plans, dining, travel, drugstores, home improvement & furnishings (can choose a new category monthly). ✦ 2% back at grocery stores & wholesale clubs ✦ 1% back everywhere else. 2% and 3% rewards are capped at $2500 in combined purchases per quarter Base: 1% Travel: 3% Dine: 3% Gas: 3% Grocery: 2% Shop: 3% Phone: 3% Other: 3% |

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 2% on dining plus 3% on 1 choice from: gas stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services (for the first $50,000 in combined choice/dining purchases each calendar year, 1% thereafter) and 1% everywhere else. Base: 1% Travel: 3% Dine: 2% Gas: 3% Phone: 3% Office: 3% Biz: 3% |

Bank of America also now offers an Unlimited Cash Rewards card, which features no annual fee and 1.5% cash back everywhere.

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 1.5% everywhere; Earn up to 2.625% back everywhere with Bank of America Platinum Honors status Base: 1.5% |

Travel Rewards Cards

Bank of America offers both a consumer and business version of the Travel Rewards card, each with no annual fee. Each offers 3X points for travel booked through their portal and 1.5X points everywhere else. Points can be used like Capital One Miles to erase travel purchases at a value of 1 cent per point. Alternatively, you can move points to the Premium Rewards card in order to straight-up cash out those points for a penny each.

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 1.5X everywhere; 3X for travel booked through BOA's travel center Base: 1.5% Travel: 3% |

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 1.5X everywhere; 3X for travel booked through BOA's travel center Base: 1.5% Travel: 3% |

Premium Rewards Card

Bank of America offers only a consumer version of the Premium Rewards card. This card has a $95 annual fee, but also includes $100 annual airline incidentals fee reimbursement. This card offers 2X for travel & dining purchases, and 1.5X everywhere else. Points can be redeemed for cash back at 1 cent per point.

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: ✦ 2X travel and dining ✦ 1.5X everywhere else Base: 1.5% Travel: 2% Dine: 2% |

Bank of America’s elite program

Bank of America offers separate banking relationship elite programs for consumer and business customers. Both require $100K in deposits to earn top tier Platinum Preferred status.

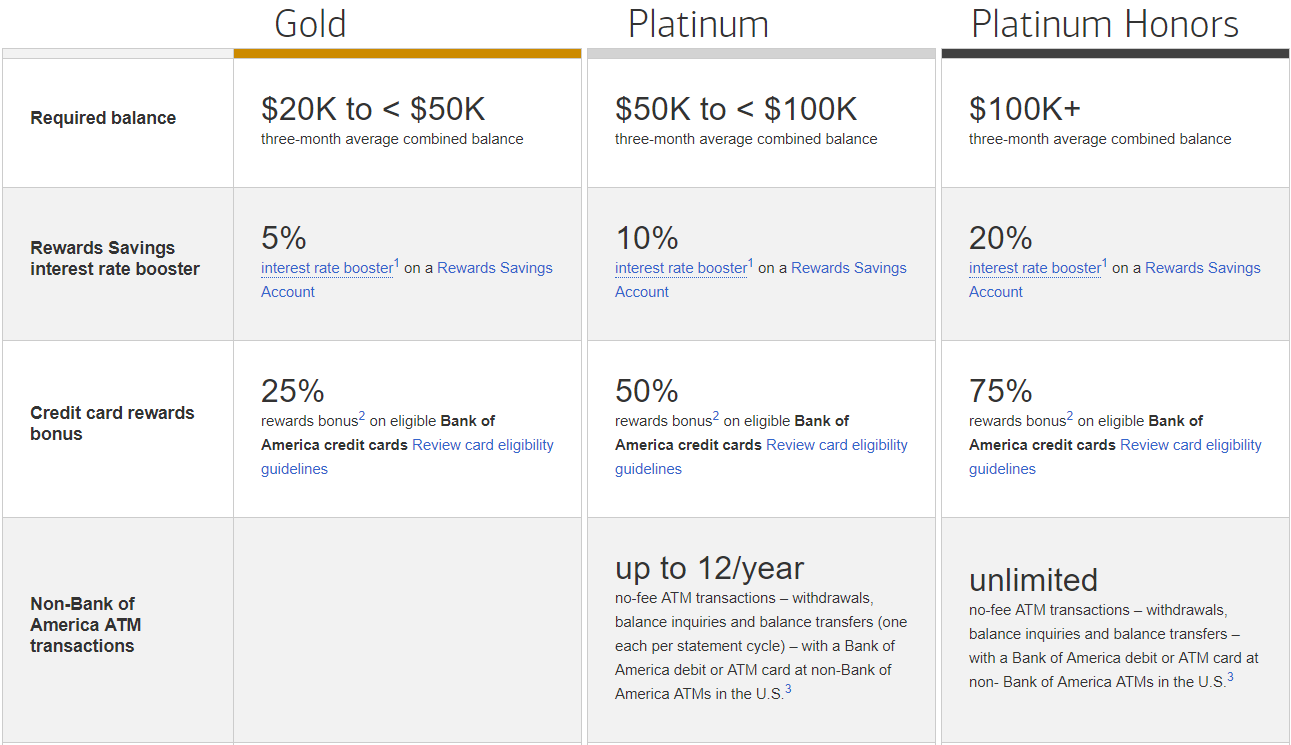

Preferred Rewards

Here’s a selection of just a few of the perks of the Preferred Rewards program. The important thing to remember is that you need $100K in combined balances to get a 75% rewards bonus on your Bank of America consumer credit cards.

Shortcut to consumer Platinum Honors status

If you have a retirement account that is managed by a different institution, you can move control of the funds to Merrill Edge. In many cases you can even earn a cash reward when doing so! Merrill’s usual bonus is $250 for $100K invested or $600 for $200K invested. Sometimes they run promotions that are even better. You can find more information here.

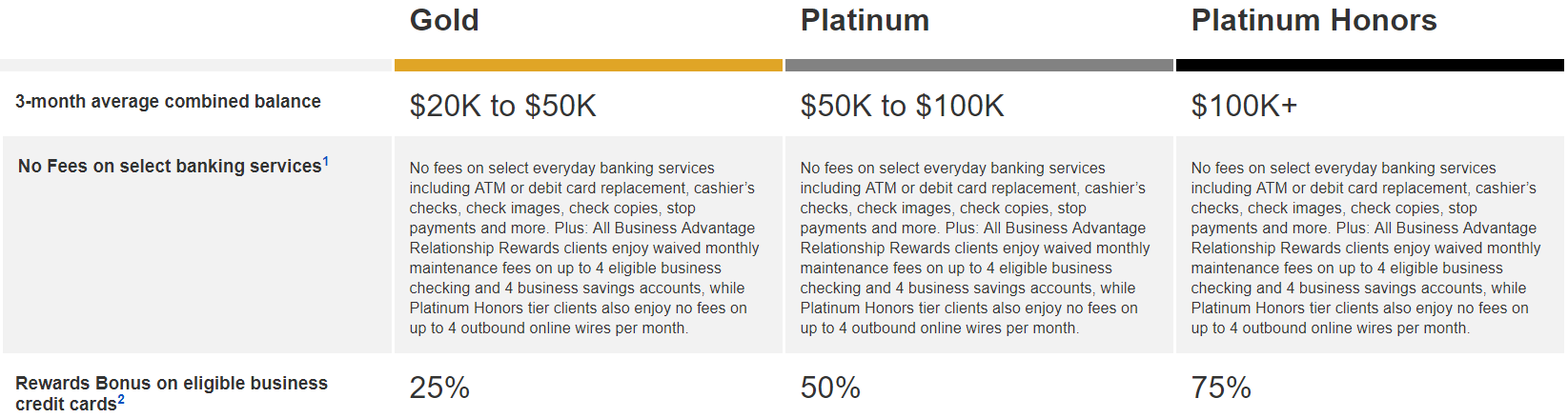

Preferred Rewards for Business

Bank of America offers a separate, but nearly identical, elite program for businesses.

Here’s a selection of just a few of the perks of the Preferred Rewards for Business program. The important thing to remember is that you need $100K in combined business balances to get a 75% rewards bonus on your Bank of America business credit cards.

Shortcut to business Platinum Honors status

Unfortunately, I don’t know of any tricks to make this easy. For those with small businesses the easiest option is to open a business checking or savings account with Bank of America and add $100K in funds in order to reach top status. The good news is that once you reach that status level, you can withdraw funds and your status won’t drop for 12 months. It’s also possible to open a Merrill Edge small business account and fund that with $100,000. The advantage to that approach is that you can then invest the money so that it will earn a good rate of return.

If you open a Bank of America business checking account, search for promotions first. One that recently expired (but the landing page is still live at the time of this writing) is for up to $500.

If you open a Merrill Edge small business account, make sure to speak with a Merrill advisor and ask them about promotions. You should be able to get at least $250 for adding $100K or at least $600 for $200K.

Consumer & Business programs are separate

You need to earn Platinum Honors status in the consumer program in order to get a 75% bonus on eligible consumer cards. And you need to get to Platinum Honors status on the business side in order to get a 75% bonus on eligible business cards.

The Platinum Honors credit card line-up

This is where things get interesting. Here’s the info about each card for those with Platinum Honors status.

Cash Rewards Cards with Platinum Honors

Now we’re talking! Each card’s 2% category is now worth 3.5%, and the 3% category now earns 5.25% cash back! If it wasn’t for the category bonus caps ($2500 per quarter with the consumer card, $50K per year with the business card), this combination would be unbeatable.

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: With Platinum Honors Preferred, 5.25% back on your choice of the following: gas and EV charging, online shopping, cable, streaming, internet & phone plans, dining, travel, drugstores, home improvement & furnishings (can choose a new category monthly). ✦ 3.5% back at grocery stores & wholesale clubs ✦ 1.75% back everywhere else. 5.25% and 3.5% rewards are capped at $2500 in combined purchases per quarter Base: 1.75% Travel: 5.25% Dine: 5.25% Gas: 5.25% Grocery: 3.5% Shop: 5.25% Phone: 5.25% Other: 5.25% |

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: With Platinum Honors status with Bank of America's Business Advantage Relationship Rewards program, this card earns: 3.5% on dining plus 5.25% on 1 choice from: gas stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services (for the first $50,000 in combined choice/dining purchases each calendar year, 1.75% thereafter) and 1.75% everywhere else. Base: 1.75% Travel: 5.25% Dine: 3.5% Gas: 5.25% Phone: 5.25% Office: 5.25% Biz: 5.25% |

For ongoing unbonused spend, you can’t beat the 2.625% back everywhere that you’ll get with the Unlimited Cash Rewards card after the 75% bonus on that card’s usual 1.5% earnings).

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 1.5% everywhere; Earn up to 2.625% back everywhere with Bank of America Platinum Honors status Base: 2.625% |

Travel Rewards Cards with Platinum Honors

Once you sprinkle in the 75% bonus to these cards, they offer the same 2.62% return as the Unlimited Cash Rewards card. The only downside is that points must be redeemed against travel purchases to get full value.

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: With Platinum Honors status with Bank of America's Preferred Rewards program, this card earns: 2.625X points for all spend (and 5.25X for travel purchased through BOA's travel center) Base: 2.625% |

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: With Platinum Honors status with Bank of America's Business Advantage Relationship Rewards program, this card earns: 2.625X points for all spend (and 5.25X for travel purchased through BOA's travel center) Base: 2.625% |

Premium Rewards Card with Platinum Honors

This is a great option for those with Platinum Honors status who want a few travel perks along while earning 2.62% everywhere (and 3.5% for travel & dining). Unlike the other cards listed here, this one has a $95 annual fee, but it includes an annual $100 airline incidental fee reimbursement and travel protections.

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: With Platinum Honors status with Bank of America's Preferred Rewards program, earn: 3.5X travel and dining ✦ 2.625X everywhere else Base: 2.625% Travel: 3.5% Dine: 3.5% |

Wondering if anyone has opened a ‘Merrill Edge small business account’? I have Platinum from opening the business checking and funding with $50k w/in 30 days – that’s sort of a shortcut. The normal way is you have to have an average of the balance for a few statements (3?). I have about 8 months left of Platinum Honors, but was looking on how to maintain that, or if I should just go the personal card route.

Thx

Yes, I created a Merrill Edge business account years ago. It was a big hassle at the time (similar to buying a house!), but it’s possible they’ve made it easier since then. Fortunately, once it’s created, it’s an easy way to park money in ETFs (or whatever you want to invest the money in) so that the money will count towards Business Preferred Honors status

[…] Preferred Rewards program, which offers up to a 75% bonus on credit card points (see this writeup by […]

you might want to update this post now that there is a 2.62% straight cash back option with the “Business Advantage Unlimited Cash Rewards credit card”

Do both P1 and P2 earn the Platinum Honors status (and hence their individual credit cards) if P1 and P2 have a joint BoA account with $100k in deposits? Or is it only the primary account holder of the deposit account?

Good question. I don’t know.

Yes, both will have the Platinum Honors status. Each person’s balance for Premium Rewards qualification is calculated as sum of that individual’s account balances regardless of joint or individual. Joint account balance counts for each person.

Hi, is the ability to move points from the Travel Rewards to the Premium Rewards still available and how does one do that?

Yes. Log in and go to Rewards under your Travel Rewards account and then you should find an option somewhere in there to transfer points.

[…] Edge accounts was in part to fix our retirement planning, but we got to that goal because of the Premium Rewards card with the allure of Platinum Honors in the Bank of America Preferred Rewards pro…. Additionally, the increased bonuses on the Merrill Edge accounts under the offer we used required […]

[…] per quarter in your choice of categories, which could be grocery stores) unless you can qualify for Bank of America Preferred Rewards Platinum Honors, in which case the Cash Rewards card (and MLB variants) offer 3.5% back on up to $2500 per quarter […]

[…] that 75% bonus, the rate is increased to 2.625% which is an excellent return on everyday spend. Check out this post for more details about Preferred Rewards and the eligible Bank of America credit […]

[…] Bank of America Premium Rewards card is already pretty awesome if you have Platinum Honors (See: Bank of America cards: Awesome if you’ve got $100K lying around). Given the wording of the email, I strongly suspect that this is not targeted, though we’ll […]

[…] are not currently enrolled. Greg has written a lot about the Preferred Rewards program before (See: Bank of America credit cards: awesome if you have $100K lying around). As you’ll see in term #2 above under the last section (“Customers not enrolled in […]

[…] has written before about how the Bank of America credit cards can be pretty awesome with their Preferred Rewards program, particularly the highest-level Platinum Honors. Greg recently wrote about how having that level of […]

One significant negative of Bank of America that I’ve discovered is that their Claims process is SLOOOOOOOOOW.

I filed a claim 6/10 for a charge that went through on 5/5.

Today is 7/13.

Per CSR, they have not even begun to investigate my claim yet but he assured me it will “definitely” still be resolved within the 90 day window.

It is also frustrating that I have to call them; there is no way to send a Secure Message.

Does anyone have any experience with disputing a transaction with Bank of America?

I made a very large purchase in late April. Communications issues, delivery problems, & a partial delivery of poor quality caused me to file a dispute 6/9. I haven’t heard anything from BofA yet; no confirmation letter, no request for details or documentation, nothing.

I did call them (no chat or DM option, ugh) a few weeks in and they said they have 30 days to begin the investigation.

I was pretty confident based on a dispute with Chase and one with Amex that I’d be on solid ground disputing this transaction but am concerned now that this dude has had my money for well over two months that I may be screwed.

Why would you take 2.63% back on everyday spend when the AMEX Blue Business gets effectively 3.1% based on your most recent valuations of transferable points (also Citi Double Cash would get 2.9%)? I get that the B of A 2.65% is cash and the Amex (or Citi) is more limited in it’s use. However, in absolute value to those of us in this game, I think I’ll take the 3.1% and not tie up $100K with B of A.

Great question. The answer is a bit complicated. Obviously, for people who aren’t interested in booking sweetspot awards, cash back is a better bet. For me, the reason is different. Since I already have a healthy stash of transferable points in all 3 major currencies (Amex, Citi, and Chase), the value of adding additional transferable points is much lower. As long as I have enough points for any awards I’m likely to make in the next few years, it doesn’t make sense to pay much for additional points. And I do think of it as paying for points if I opt for a 2X card instead of 2.6% card. By opting for points, I’m basically buying points for 1.3 cents each. That’s a good price when building up a points nest egg, but a bad price when you already have plenty.

[…] Preferred Rewards. I am not aware of any other co-branded card that is eligible for the up to 75% bonus on points earned that comes with Bank of America Platinum status. The bonus categories still aren’t very good (you’d probably be better off with the […]