NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Through December 29th, Points.com is offering SPG Starpoints for 35% off. Since the normal price is 3.5 cents per point, this discount makes it possible to buy those points for 2.275 cents each. But you can do even better:

- Start with TopCashBack to get 2.5% cash back (you can also use our affiliate link with our thanks, but then you won’t earn cash back)

Pay with your SPG Amex card to earn 2 points per dollar. Update: a reader has found that the purchase only earned 1X despite previous reports of 2X. Seems that they have changed the system.

By following the above steps, you will get more SPG points for less money (after the TopCashBack rebate). In the end, your cost per point will be only 2.12 cents.

Example

- Go through TopCashBack

- Buy 20,000 SPG points for $455

- Pay with your SPG card to earn 455 x 2 = 910 points

- Get back 2.5% of $455 = $11.38 from TopCashBack

Final cost = $455 – $11.38 = $443.62

Points earned = 20,000 + 910 = 20,910

Cost Per Point = $443.62 / 20,910 = 2.12 Cents Per Point

Marriott Rewards

Marriott usually sells their points for 1.25 cents each. Since SPG points transfer to Marriott at a rate of 1 to 3, you’re always better off buying SPG points if you need Marriott points. At the usual price of 3.5 cents per SPG point, that comes to 1.17 cents per Marriott point — a slightly better deal than buying from Marriott directly.

With the 35% discount, combined with the steps above, you can buy SPG points for 2.12 cents each then convert them 1 to 3 to Marriott Rewards. In the end, your cost per Marriott Rewards point will be only 0.7 cents each.

Airline Miles

SPG points transfer to many airline mile programs at a rate of 20,000 SPG to 25,000 airline miles. Thanks to that generous transfer ratio, by buying SPG points for 2.12 cents each, you can get airline miles for only 1.7 cents each.

Should You Buy?

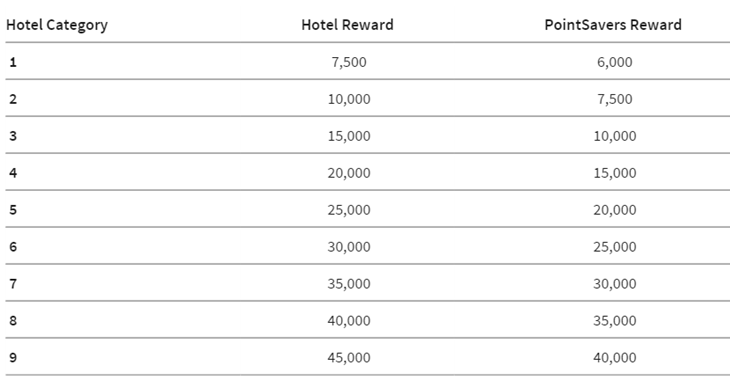

In general, I don’t recommend buying points or miles unless you have a specific award in mind for which you need extra points. Buying SPG points can be a great way to quickly get enough SPG or Marriott points for discounted hotel nights. Top tier Marriott hotels (such as the St. Pancras London) cost 45,000 points per night for a standard room. At .7 cents per point, you can get those rooms for $315. That’s not necessarily cheap, but compared to standard rates at such hotels it can be a great bargain. Even better are the lower end hotels. Category 2 and Category 3 (off season) hotels go for 10,000 points per night. Buy purchasing points, it’s possible to stay in these hotels for only $70 per night.

Buying SPG/Marriott points can also be a great way to get the extra airline miles you need to top off an award, especially when the points are available at a discount as they are now (through December 29th).

See also: Point alchemy: Turn pennies into United miles (Buy miles for 1.15 cents each)

How to Buy SPG Points

Unfortunately, when you start from a portal it’s not at all obvious how to buy points. Here are steps that have worked in the past:

- Click through to Points.com from TopCashBack

- Log into Points.com (or register if you haven’t before)

- Make sure SPG is added to your loyalty wallet

- Go to your loyalty wallet and click on SPG

- Click “Program highlights and benefits”

- A box should pop up on the right, scroll down to the section titled “Program Information” and under that click the link “Buy more Starpoints for your account”

An easier option is to use our direct affiliate link to buy SPG points, but then you won’t earn portal cash back. If you’d like the easier approach anyway (with our thanks!), click here: Click here to buy SPG points

Hi. Has anyone recently received 2x when buying SPG points using SPG cc? I know this worked in the past from my experience but there is at least one comment above stating that they did not receive 2x using the SPG cc. Thanks.

is buying SPG points from points.com considered MS (currently trying to make the spending minimum on amex platinum and was wondering if it will get clawbacked.

No, it is definitely not considered ms. It’s fine

[…] miles is a solid deal. With the current sale on SPG points that Greg wrote about last week (Buy Marriott points for 0.7 cents each), it might even be worth buying points if you have a strategic redemption in […]

I think that Marriott points are generally worth about 0.7 cents when booking rooms in the US. There are some much better deals overseas. For instance, in Johannesburg, South Africa, a room at the Protea Hotel Transit O.R Tambo Airport will run you $127 or 6,000 Marriott points (2.1 cpp). Or if you are visiting Victoria Falls in Zambia, the Protea Hotel Livingstone will run you $200 or 7,500 Marriott points (2.7 cpp).

South Africa is an interesting country to use your points in because the value of the Rand is low so there are a lot of Cat. 1 and 2 properties. As we know, that’s where the extreme value in hotel loyalty points tends to be. But there are good values in the USA in these categories, too. As a percentage of total USA hotels, though, we don’t have a lot of Cat.1 and 2’s.

FWIW, I travel a lot in South Africa and, so far, have only occasionally used my Marriott points. That’s because independent hotels are often very cheap in South Africa, and provide excellent, more personalized accommodations. And Marriott in South Africa stiffs you on some the standard elite benefits, like no free breakfast for Golds at Protea hotels. So it’s one of those places where “cheap” isn’t necessarily a good value.

I am having trouble finding the link to purchase spg points. Spent 30 minutes following your steps and nowhere on points.com does it say I can buy spg points. Can you please provide more detailed steps? Thanks in advance.

Sorry about that! I’ve added instructions to the bottom of the post.

I Have an AmEx offer for $60 off an SPG purchase. Do you think this would work to buy points?

I am going to buy points for my HI trip. Thanks for this.

I think that’s very unlikely to work, but please report back if you try it.

Elias: What did you mean obtain Platinum SPG for $280

Tom: What is MS?

Anyone: I have Gold Marriott, United, SPG, Hilton, Delta, among others, and Platinum Ambassador IHG and Jet Blue (Mosaic). I live on the West Coast and will need to travel at least once annually to Portugal; likely more frequently. It Seems reallllly hard to get any other Platinum statues level, and getting harder (IE DELTA), Which programs are the least demanding? Ill go with the low lying fruit—Intercontinental not so bad….especially if they offer nonstops from LAX to EU.

Lastly: What are the Lifetime Status hurdles for Marriott, and does it cover Ritz Carlton (wishful thinking lol)? What are the benefits of Lifetime—Im assuming it means you get all the benefits for that class off Elite status and never have to worry about it again? (Like I had to with United this year).

Finally an FYI: I applied for the Ritz Chase Visa and didnt get immediate approval; I assumed that Their rule re: # cards would preclude me. 2 weeks later, the card CAME (it is METAL, makes loud soundsvwhen dropped on marble floor! lol) despite the Chase rule. I had just received the BAirlines Chase Visa a week before applying for this card, and also have accrued many others over the years. The card also came in a lux box package of marketing swag and a note explaining that, although they approved me for this card, they lowered my spending caps on my other Chase cards—they did this once before to me. Overall preferred that over the denial, which I did receive for the Southwest card. Just sayin it seems they look at individual cases and I spent no any time or energy for that to happen.

However, I don’t like having a lot of annual fees, and am considering honing in on 2 airlines and 2 hotel partners with CCards, as well as AMEX Platinum and CITI Thank You Prestige. I know terminating credit cards is bad for your credit, but spending thousands on annual fees for redundant cards because they offered a great sign up program is expensive. Any thoughts on proceeding?. I discussed this with an AMEX Rep as I had too many of their cards and he advised cancelling my 2 SPG cards and will terminate the Premire Gold when the renewal occurs and just keep Platinum.

Since this was based on a discussion with their CC Rep I don’t believe I will be reprimanded with their new “anti gaming” crackdown lol.

MS = manufactured spending

I agree with Tom–I think this is a very good deal for Marriott points. I can usually get about 0.9 cents out of a point (occasionally more), so buying at 0.7 cents should be advantageous if you like Marriotts.

My lament is that I have plenty of nights for Gold Lifetime (about halfway to Platinum lifetime on nights) but I am low on points. So, my choices are (a) to wait until the new program is announced and hope that Marriott doesn’t change the rules without notice (which has happened so many, many times with airline points), (b) buy 50,000 Marriott points this year and next year at a price at which I may never recover my money (1.25 cents per point), (c) transfer Ultimate Rewards Points to Marriott, even though they are more valuable using them (i) for United, (ii) for Hyatt, (iii) for British Airways under certain circumstances, and (iv) through the Chase portal at 1.5 cents per mile for airfare, or (d) transferring United points to Marriott, even though Marriott points are worth a lot less than United points. So this promotion at 0.7 cents per point is great for all purposes except Marriott lifetime points, where IT DOESN’T WORK!

Making this even more difficult is that (a) no one even knows what Gold lifetime or Platinum lifetime means under the new program, or (b) when the new program will be announced, or (c) whether someone can continue to qualify going forward for lifetime under the rules of the old program, or (d) whether there will be some ability to combine Starwood and Marriott points, nights or both for lifetime purposes when the new program is announced.

I have received amazing benefits through “the hobby” but sometimes, it can be very, very, VERY frustrating.

I share the exact same frustrations as you, except I’m not as close to earning lifetime platinum as you are 🙁 Considering that everything they’ve done related to the merger thus far has generally seemed to be very fair, I’m assuming/hoping that they won’t make any extremely drastic changes to the lifetime elite status members without lots of advanced notice. I could be totally wrong, but it just seems that they are treating their new SPG members very gently with white gloves, and I’m hoping they will extend that same fair treatment to their own lifetime loyalists.

I think the bigger risk is that Chase could potentially lose the Marriott credit card renewal contract to AMEX (or at least have to cut some of the benefits in order to save costs, if it ends up being expensive for them to keep the contract). The benefit I’m most concerned about losing is the United Silver status match, which would almost certainly go away if AMEX wins the contract. I think the odds of AMEX actually stealing it away from Chase is slim, probably less than 33% chance, but the potential negative ramifications if it happens would be massive and extremely negative to people that have invested many years and tens of thousands of dollars to achieve lifetime status in the program in its current form.

That being said, if I were as close to lifetime platinum as you are, I would take the risk anyway and go full-steam ahead as much as possible just to seal the deal before the program merges.. There is definitely risk involved, but overall I have faith that they won’t screw over their own lifetime members that much.

If you are able to play in two-player mode, have your partner purchase a crapload of SPG points using the method above, convert them to Marriott, then have them transfer them to you with the intent of purchasing a travel package or a 7 night stay at a Cat 8 or 9 hotel… this should allow you to bypass the 50,000 annual transfer limit, and the points will count towards your lifetime status (although be aware that it will screw over your partner on their own lifetime status, so make sure they are aware that the elite lifetime points will be deducted from their account). This should give you around +250,000 extra elite lifetime points this year… then rinse and repeat early in 2018 before the programs merge for another 250,000 points, and you’ll effectively increase your lifetime point balance 500,000 or more. Hopefully that will be enough to get you to lifetime platinum status.

My question to you is, how did you manage to accrue all of the elite nights necessary to achieve lifetime gold/platinum? Have you simply had tons and tons of actual, legitimate Marriott stays over the course of many years, or have you MS’d on one of the Chase Marriott cards at $3000/night, or is there some other trick that I’m not aware of? I know the 15/year per credit card helps, but that would still take many, many years before even being close to lifetime status..

Nothing special. 15 nights per year plus spending on the Marriott card helped. No MS. Key reason why I’m short on points is in the early days of the program, I elected to receive airline miles instead of Marriott points, because “everyone knows that airline tickets are expensive and hotels are cheap.” Guess that changed!

I hadn’t thought through the implications of an AMEX takeover but, like you, I value United Silver and I agree that moving to AMEX would probably end that benefit. Appreciate the insight. Your analysis is spot on!

if your spouse if < 30,000 lifetime miles, and if you transfer 50,000 miles from their account – then do you get 30K lifetime miles or 50K (i.e. would they be -20K lifetime)?

You get the full 50k.. my SO is currently negative 250,000 lifetime points 🙂 hahahaha

if your spouse if < 30,000 lifetime miles, and if you transfer 50,000 miles from their account – then do you get 30K lifetime miles or 50K (i.e. would they be -20K lifetime)?

thanks!

This doesn’t seem like a bad deal to buy Marriott points, if you do A LOT of travel — especially if a good portion of it is to less urban locations where there tend to be Cat. 2 or below properties. Like with most hotel loyalty programs, the “best values” on the Marriott award chart tend to be in the low categories. Like you can buy a Cat. 2 Marriott stay for $70 with this deal. Since that price includes tax, I’m guessing you’ll typically save AT LEAST $30 this way, and substantially more on certain stays. Unless you can luck into a nearby IHG Point Break hotel for that stay, this is probably the cheapest rate you can get on a decent chain hotel most anywhere in the world.

I tend to be a “free agent” when I travel, and I have status of some sort in most of the hotel loyalty programs (but I also look for non-chain hotel opportunities as well). Since in any location I don’t know which chain is going to have the best deal (when factoring in hotel quality, location and price), I like to have points in all the programs. The SPG/Marriott programs are not so easy to “gin up” lots of points in, especially with credit cards (at least in my experience — if anyone knows a way, let me know!). So I tend to save my Marriott points for unique circumstances where the Marriott property is SO MUCH BETTER than the alternatives. Buying points at .7 cents though would encourage me to stay at more Marriotts for “ordinary” travel, like when I’m just looking for a decent cheap place along the highway. So I think I may be a buyer. I guess I could hold out for a better cashback promo before Dec. 29?

I doubt you’ll be able to find a better deal than this on acquiring Marriott points before the end of December without MS. However, if you are able to MS, you can always MS SPG points with the AMEX SPG card for significantly less.

Well, you could MS SPG to Marriott points, but it doesn’t seem to be a particularly easy transaction. I’m assuming that, for about $10, you could buy $1000 in gift cards and earn 1000 SPG points, and then transfer them into 3000 Marriott points. Or you could do the same thing and earn 6000 Honors points. I personally wouldn’t do the Honors thing without some other bonus (fee free gift card, free gas, etc), and I certainly wouldn’t do the Marriott thing. Any way to make it more lucrative than this?

If you are able to get 3000 Marriott points for only ~$10 by MS methods, that’s about 0.33 cents per point… I’m not sure how you don’t consider that an amazing deal. Even if your overall MS costs are a more conservative 1.5% ($15 for the same $1000), that’s still only 0.5 cents per point… still an excellent deal, in my opinion. I think the vast majority of people would consider Marriott points to be worth more than 0.5 cents each, especially considering you get the 5th night free on award redemptions, and you can also purchase the travel packages. If you spend 270,000 Marriott points on a United/Cat5 travel package, and then refund the 7-night Cat5 certificate for a 45,000 Marriott point refund, you are essentially paying 225,000 Marriott points for 132,000 United miles. If we are using the value of 0.5 cents per point, then you are only paying $1125 for 132,000 United miles, or in other words 0.85 cents per United mile… which most people would agree is an amazing deal. Obviously, it would take a hell of a lot of MS’ing to actually reach 270,000 Marriott points, but for some people it is well within the realm of possibility.

Tom,

Yes, paying 1/3 cent for Marriott points would be great, but it’s a bear to MS to get these points. You’d do better MSing for Hilton or Hyatt points (the latter through Ink). I’m sure SOMEBODY does it, but there’s got to be a better way to get cheap hotel stays.

Not disagreeing with you, but keep in mind that not ALL people like Hilton… especially with the new ascend card coming out, there will be so many diamonds and the benefits won’t be as meaningful. Marriott/SPG Platinum status still carries a LOT of tangible benefits, including United Silver status (through Marriott) and pseudo Delta Silver status (through SPG). Additionally, you can MS SPG/Marriott points ANYWHERE, whereas with Hilton points you are basically limited to grocery stores… some people prefer the wider range of 1x/3x everywhere MS possibilities, rather than being restricted to only grocery stores. For some people, myself included, it is worthwhile to MS SPG/Marriott points, but it certainly isn’t for everyone unless you place a strong value on SPG/Marriott/United.

easy way to purchase spg platinum again for $280

If you are only concerned about your SPG status, then yes, but if your goal is to achieve Marriott lifetime status, any points used to purchase status back will be DEDUCTED from your overall lifetime status totals, so proceed with caution.

Thanks!

How are you earning 2x per dollar with your amex card? I thought the SPG card was 1x on non category spend?

“even though the purchase goes through Points.com, past history has shown that if you pay with an SPG credit card you’ll earn 2X points for the purchase.”

https://frequentmiler.com/2017/11/03/point-alchemy-turn-pennies-united-miles-buy-miles-1-15-cents/

Good to know. Thanks.

I cannot personally verify this, I was just quoting from FM’s article, but I trust him. I’m probably going to attempt this myself within the next week or two.

I can confirm that you do not get 2x per dollar with your amex card. Our statement just dropped and bonus points did not post on the purchase.

I’m surprised by this. Just to confirm: you bought SPG points with your SPG card and only earned 1X?

Yes, that is correct. Purchased on SPG Biz card. Statement dropped 11/4

Sorry statement dropped 11/7

I did get 2X on my SPG Amex (small Biz) card for my purchase.

Me too! I checked my statement dated on 11/24, I bought 40000 SPG for $910 on 11/10, and got double SPG bonus for 910. I used SPG Biz card.

@ Tim Grable : Can you reconfirm again please if indeed you did NOT earn 2x on your purchase of SPG points using SPG cc? (I’m thinking of pulling the trigger to buy points with my SPG BIz, and in the past, I have gotten 2x on this). Thanks.

Yep, i can confirm that I did not get 2x’s on the point purchase.

Greg–one key point that I haven’t seen the bloggers in this space pick up on is that buying Starwood points is a great way to get Marriott points by conversion and much cheaper than buying Marriott points directly, but there is a catch. Purchased Starwood points will not earn Marriott lifetime points, even upon conversion of those Starwood points to Marriott. Purchased Marriott points will earn Marriott lifetime points. The reason this is important is that since no one knows what the new Marriott lifetime program will look like, there may be a real incentive to get lifetime status before the program changes, especially if someone is close to reaching a Marriott lifetime milestone. I’ve been looking for a Marriott discounted points purchase program for awhile, but haven’t found one yet. I know the rewards programs are run separately, but Starwood has run discounts previously, but not Marriott. Not sure why Marriott won’t jump onboard.

By the way, conversion of Ultimate Rewards points to Marriott will earn Marriott lifetime points (I tested it with 1000 UR points). Pretty bad use of Ultimate Rewards points, but could be useful to get someone to the next level of Marriott lifetime.

Everything DSK said is 100% accurate and I have run into the exact same issues myself. Additionally, if someone is close to achieving lifetime status, they can also transfer up to 50,000 United miles to Marriott per year (if they are Platinum) and that also counts towards lifetime status. If you are playing in two-player mode, you can also have your partner transfer up to 50,000 Marriott points to you each year (it will add to your lifetime total and subtract from theirs). I’m not sure if there is any limit to how many people can send Marriott points TO you, and there is no same-address requirement, so you might actually be able to get a bunch of friends to purchase SPG points using this discounted method, transfer them to Marriott so their cost will be about 0.7 cpp as mentioned above, and then transfer 50,000 of those points to your account. I haven’t tried transferring from more than one person though so I cannot verify this, so proceed with caution. This is probably only useful for someone who is close to achieving lifetime status and wants to obtain it before the program merge.

CORRECTION: The 50,000 point transfer limit applies both outbound and INBOUND: “A limit of 50,000 points per year may be transferred into or out of a member’s account”… so my idea of having multiple friends transferring into your account would not work, unfortunately. However, “Members who are transferring points in order to satisfy a specific award may exceed the 50,000 limit up to the amount needed to satisfy the reservation.” Does anyone know by how much they will allow you to exceed the limit. It seems like a 7 night stay at a category 8 hotel (40,000 points per night) would total 240,000 points after the 5th night free… that seems like a reasonable aware that someone would actually book, but it exceeds the 50,000 limit by 190,000 points haha… anyone know if they will actually let you bend the rules this much? You could then wait a few days/weeks and cancel your reservation to get the points deposited back into your account. I haven’t tried this yet, but I intend to, unless someone has any datapoints of this not working…?

Sorry for getting to this so late…

A workaround for those who want lifetime points goes like this:

1. Spouse buys SPG points

2. Spouse converts SPG to Marriott

3. You and spouse book a very expensive Marriott award that requires both of your points. Make sure the award is from your account. Her points then should be transferred to you and will count towards lifetime.

do you think this would count towards 7 nights + 132,000 United Miles. I feel there may be a shift soon on the lifetime programs….

What do you mean ‘would this count towards the 7 night cert’ …??? what???

Yes you can buy a travel package with the points and the points from your spouse will count towards lifetime status.