NOTICE: This post references card features that have changed, expired, or are not currently available

A month ago we updated our post about Chase credit card signup offers that bypassed 5/24 (See: New offers bypassing 5/24 (approval NOT guaranteed) as even more people became targeted for them.

I was one of the lucky ones who saw offers for United, Southwest and Marriott credit cards. I wasn’t really in the market for any of them, but I wasn’t going to pass up the opportunity to bypass 5/24 and so applied for the United Explorer card and was approved.

It turns out there’s an alternative opportunity for some MileagePlus members to get hold of the United Explorer credit card even if you’re over 5/24, but it’s not something that appears when logging in to your Chase account.

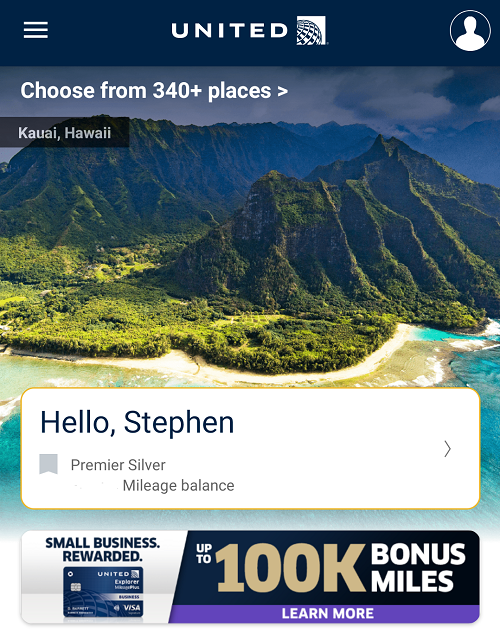

Instead, it’s an offer that’s showing up for some in the United app. My understanding is that it’s a banner ad at the top of the home page that says you’re pre-approved prequalified, so if you see a Star Wars ad or an image of a destination, I think it means you’re not targeted.

As you can see in the image above, my app did display a small business card offer, but there was no pre-approved prequalified wording. Tapping on the offer didn’t show any pre-approved prequalified wording…

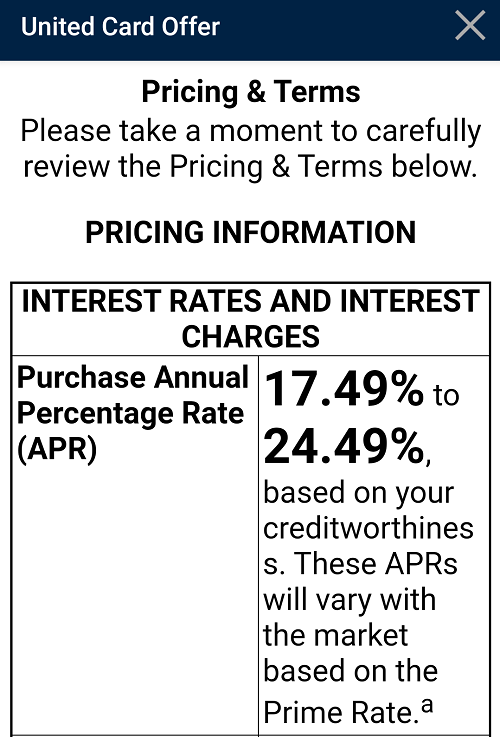

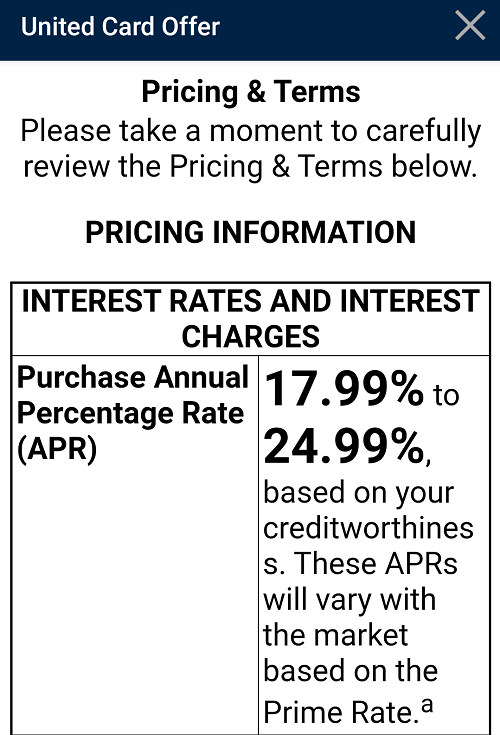

…while tapping on ‘Learn More’ and then ‘Pricing and Terms’ displayed an APR range. It seems like offers that bypass 5/24 display a specific APR rather than a range like 17.49% to 24.49% as shown below.

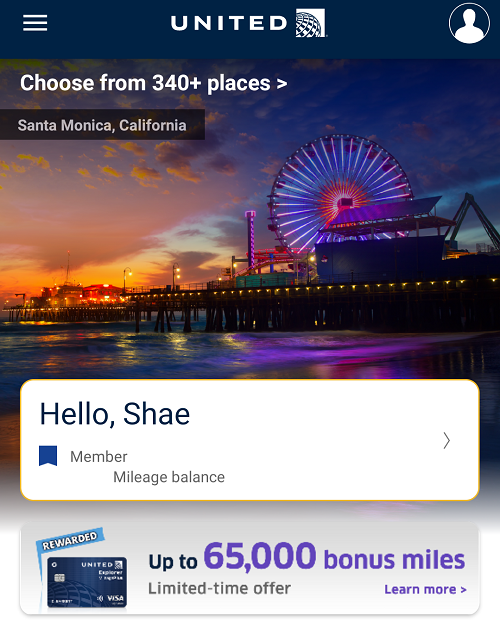

When logging in to my wife’s account in the app, she didn’t have a banner specifically listing a pre-approved prequalified offer either. She did have a small banner for the United Explorer card though, so I was curious if this would turn out to have the set APR in the pricing.

When tapping through to the pricing, her offer displayed an APR range too, so it doesn’t look like her offer would’ve bypassed 5/24 either. That’s a bit of a moot point though as she is actually under 5/24, so I don’t know if hers is a reliable data point.

Reader Josh reached out to us though to let us know that he’d successfully applied for a United Explorer card despite being over 5/24. He saw the pre-approved prequalified offer in the United app and had a specific APR of around 18% listed.

His application wasn’t immediately approved. Instead, he received a message stating “Thanks for your application – we will get back to you within 7-10 business days.” After hearing nothing for several weeks, the Explorer card appeared when logging in to his Chase account and he received the card a few days later. He’s since met the minimum spend requirement and received the signup bonus, so even if you’re not approved immediately, there’s still hope.

If you’re interested in getting a United Explorer card and are over 5/24, it’s therefore worth downloading the United app to see if you’ve been targeted for this offer. Good luck!

Update: Josh has provided a screenshot of what the offer looks like. The banner actually says ‘You’re Prequalified’ rather than ‘You’re Pre-approved’.

Hubby got the pre-qualified offer. I got the pre-approved offer. We’re both way over 5/24 so did the application for the hubby and he was instantly approved. Thanks for the heads up about this!

Steve

Awesome I got the Dam Card !! Chase turned me Down 4x then this .OOP’s need to spend $20K in 30 days and I GOT 4 cards in 4 months too . Used ur link FM ($$$) and who says the “Good Old Days ” are Gone ?? I was Tinking they would ” Shut Me Down “..

CHEERs Brit

Merry Xmas

[…] Hat tip to: FM/DOC […]

[…] 2019.12 Update: There is a brand new place to test prequalified supply: in the United Airlines APP! See beneath for particulars. HT: FM. […]

I applied I’ll take the 65k (just 40k no fee) But we will get back to u .No united card in 4 years and no points Left so Shut down I’ll live with Citi and Amex it will work .

CHEERs

Saw your post last night. got in the app, and there’s the ad. Clicked through P&T, saw the fixed APR. Not convenient to apply via a phone, so login’ed to UA account via desktop. Same ad. Applied, got “We have received your application, blah, blah”. Thought I need wait a week to hear back. This morning, received an email from United, “We’ve deposited into your MileagePlus account the two United ClubSM one-time passes you receive as a new UnitedSM Explorer Cardmember.” What!? really? login’ed to my Chase account. Sure enough, the card is already there! less than 24 hours. lol. I am 9/24 with 3/24 on biz. Thanks Stephen! Never understood why the fixed APR enables the bypass of 5/24.

Good 4 u I got my BMO like that online 48 hrs ,card in 14 days the p lounge card 17 days..

CHEERs

Seems that I have the pre-qualified offer but when I click into Pricing & Terms it is showing me the APR 17.99% to 24.99% based on credit worthiness. This doesn’t seems fixed so thinking this won’t bypass?

No, need to be fixed APR based on the DPs.

Can I assume if one is over 5/24 that if you get approved for a card that the new card would just add to your 5/24 total?

Yes, it only get you pass the 5/24, but did not make chase to forget it is a new account.

If I have 2 United cards from years ago still active. 1 that use to be a continental airline CC can I still get the bonus with out closing those accounts?

I don’t have the prequalified version of the offer, but the regular versions states the following:

“This product is available to you if you do not have this card and have not received a new Cardmember bonus for this card in the past 24 months.”

Although you might not have received a bonus for it in the last two years, it sounds like you already have the card and so you wouldn’t be eligible. Unless you have the United business card rather than personal card for one, and the Continental one got converted to some different type of card.

Worked for me as well, >5/24, instant approval with ridiculous credit line. I had the Star Wars screen but noticed that if I refreshed the screen and click quickly on the banner ad (before the Star Wars promo loads), I was able to see the pre-qualified offer.

Thank you for posting this! I’m at 10/24 and I got instant approval!

Need to spend $10k to get 65k miles though

Good point. My specific offer was 40k for $2k spend, then 25k more for another $8k spend. I did get the offer and snapped it up. I’ve been wanting this card but 5/24 has been the obstacle.

Worked for me. I’m over 5/24 and got the fixed rate of 17.99%. I was instantly approved, but my wife didn’t get the offer on hers or else we would’ve tried for both.

Update: 45 minutes later, I went back into the app under my wife’s account and the offer was there. She’s also over 5/24 and was instantly approved!!!

Folks that got the card (congrats!) – anyone has this card already?

Also over 5/24 and got it to work, said “prequalified” and got the fixed rate, thanks for the tip