For the past several years, all of the major credit card issuers have been sending 1099-MISC forms valuing referral bonuses as income. Capital One has sent 1099s this year with strange amounts that didn’t seem to make sense — until Dave Grossman at Miles Talk was successful in getting a breakdown of the “income” included on his 1099 form. It turns out that Capital One is using a very strange valuation for miles earned from referrals, but stranger yet is that they are including the card’s Global Entry reimbursement as income. This whole situation just seems absolutely nutty to me.

Beginning a few years ago, issuers began to treat referral bonuses differently than the points earned from spend or welcome bonuses.

You do not receive a 1099 for rewards earned from spend since those rewards are usually not considered to be income but rather rebates meant to incentivize purchase activity. Thus, rewards earned from welcome bonuses and credit card spend have not historically been treated as income in most cases. Keep in mind that this is not financial advice and I’m not a tax expert, so consult your own tax professional if you’re in need of advice.

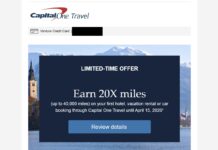

Since there is no spending involved when referring a card to a friend or family member, referral bonuses have been treated as income for the past several years. Usually the 1099 forms are fairly straightforward and easy to understand, with most issuers valuing their points at $0.01 per point or mile. However, this year’s Capital One’s forms have been hard to decipher.

My wife received a form for $1,250.73 worth of income. I knew that she had earned the limit of 5 referral bonuses on her Spark Cash card at a bonus of $200 cash back each time ($1,000 total). I wasn’t immediately aware of where the other $250 may have come from. Eventually, I realized that she referred a friend to the Venture X card in late 2021 and the 25,000 points from that referral posted in 2022. I still didn’t quite get where they came up with the extra $0.73, but I wasn’t going to lose sleep over it.

Then we started getting really strange reports in our Frequent Miler Insiders Facebook group from people who had earned bonus amounts that didn’t seem to add up with their referrals. Many contacted Capital One and were told that the form was right, but agents couldn’t explain where Capital One had gotten the numbers.

Eventually, Dave of Miles Talk was able to get a full breakdown of his bonuses. There were two big takeaways.

First, he found out that Capital One is valuing each mile at 1.0029c (that’s $0.010029). What?!?? Obviously one has to marvel at why in the world they decided to value the points at one and twenty nine one thousandths of a cent just from the standpoint of ridiculous and unnecessary complexity.

Stranger yet to me is that when Capital One closed Greg’s account without warning or recourse, they redeemed his miles for a statement credit at their clear cash value: 0.5c per Capital One mile. I say that’s their clear cash value because that is the value you can get if you want to use miles for cash. You can only get 1c per mile when redeeming against a travel purchase. Obviously if you transfer to partners, you may get much more value — but that’s a contingency on which I think it is difficult to make a case for the value of the income. Capital One gave Greg no explanation and completely stonewalled him on requests to at least redeem the miles at a value of 1c per mile as he could have toward travel purchases or to allow him to transfer the miles to partners.

I’m no tax professional and I’m happy to pay my fair share, but Greg’s situation is an illustration of why I think it’s kind of crazy to be taxed on point-based referral bonuses as income — as Capital One proved in his case, the points don’t really belong to you and could be confiscated and redeemed for half a cent per mile at any time. That’s not likely to happen to most people, but it’s frustrating that it could.

At any rate, I see quite a discrepancy between how Capital One valued Greg’s miles when they decided to confiscate them and how they are valuing miles when people earn them from referrals. That’s…interesting.

But that’s not where they decided to stop getting wild and crazy. Dave also found out that he had an additional $100 worth of income included in his 1099 because he had used his Capital One Venture X card to pay the application fee for Global Entry. One of the Venture X card’s features is a statement credit for the Global Entry application fee.

While I suppose they enjoy the freedom to value miles as they see fit (I just wish they would be consistent about it both when shutting down someone’s account and when awarding the miles as a referral bonus), I don’t really understand under what premise they have taken the Global Entry reimbursement to be income. While I am not qualified to make a judgment as to what is income or what is not, a reimbursement that requires a purchase feels like a textbook rebate. Apparently Capital One thinks otherwise.

At the end of the day, I think it is possible to challenge the card issuer’s valuation of miles or the fact that the Global Entry fee reimbursement shouldn’t really be considered income, but I have no idea whether you’d win and I expect that it would be far more effort and potential headache than it’s worth. Still, this really devalues Capital One’s Global Entry fee reimbursement, particularly for those in higher tax brackets. While other similar fee rebates from other card issuers create a net cost of $0, the net cost for someone at a higher marginal tax rate here might not make it worth using this fee credit. It certainly doesn’t feel like a 100% discount on Global Entry.

None of this is hugely consequential — at most we’re talking about tens of dollars. But it nonetheless seems pretty nutty to me how Capital One has handled this. I’ll accept that they are nutty and move on, but it’s worth being aware of the way Capital One will report the value of miles and the Global Entry reimbursement. There was no similar inclusion of travel rebates like the $300 in Capital One Travel portal fee credits or the $200 vacation rental credit that launched with the original welcome bonus (long since expired).

Individuals should request from Capital One a schedule of income comprising the 1099. Provide that schedule to your tax return preparer. Tell your tax return preparer to EXCLUDE income allocated to statement credits associated with a purchase (such as TSA pre-check credit or dining credit, etc.) and to include a footnote on your tax return references their non-taxable character under TC Memo 2021-23 (Docket Number 13080-17). This is called a “disclosed position.” If you’re right, you’ve saved yourself the tax. If you’re wrong and tax is due, the disclosed position will allow you to avoid a penalty on the underpayment.

Did you expect anything less from a predatory lender.

It’s not really Capital One’s fault. They are likely just as conflicted about how to comply with the unnecessarily complex tax laws our elected officials pass. This is what “tax the rich” ends up looking like after the rich lobby for exemptions to new laws. The rest of us schlubs end up with $600 thresholds on our paypal transactions and a pile of bank 1099’s to sort through at year end for a few hundred bucks of referrals.

Keep watching NewsMax.

What is that?

It’s a news station not part of the corporate media complex that Tom bows down to so he can feel good about himself.

I’m no tax expert but to me the biggest “tell” is how the other major banks treat the same situation differently. Why does Cap1 seem to have this desire to bolt in a customer unfriendly direction compared with its peers? Reminds me of how, for the longest time, they reported business card accounts on your personal credit report….

I’m on team Nick with this one. I just can’t see how they are classifying the global entry credit as income when you have to purchase something (global entry) in order to get the credit.

Dude you take more selfies than the average 13 year old girl

You really need a hobby. Your obsession with Nick is unhealthy.

Strange. I got 25k points last Summer for a Venture X referral but no 1099 form for me yet

They only have to issue a 1099 once your “income” is over $600.

Thanks Bonnie. This is the same limit for ebay sales I ran into. Of course ebay sales and 1099’s make legal sense while these Referrals and Global Entry “income” is dubious. Ironic that they are treating Global Entry as income even when many (including myself) can’t get an appointment to obtain one….

Does this apply for Amex and chase as well?

This is just capital one catching up. Churning is a business for me so I already expense the annual fee as a loss and report sign up bonuses as unreported income at a value of $0.005/pt. If I get audited I will just submit Greg’s shutdown post as proof. /s

Just curious for the “churning business” what other income and expenses do you report? I’m just trying to figure out why anyone would report SUBs as income when even the government doesn’t recognize it as income. Thanks.

Can you redeem points for half a cent, and send Capital One a 1099-MISC for the difference ($0.010029 – $0.005) as their income?

We can all agree that Capital One’s actions are wrong-headed. But, we should all acknowledge that Capital One is going to do what it’s going to do. And, the fact that it’s doing what it’s doing makes Capital One less attractive as a card issuer. Period.

I concluded that Capital One was a non-starter for me. This report reinforces my decision.

Capital One has very unusual criteria for approvals, as well. But I agree, why bother!

“While other similar fee rebates from other card issuers create a net cost of $0, the net cost for someone at a higher marginal tax rate here might not make it worth using this fee credit.”

I am not sure how you came to the conclusion that the inclusion of the global entry reimbursement as income might not make it worth using the fee credit if you are in a higher tax bracket. No one is in the 100% tax bracket.

What he means (I’m pretty sure) is the same as what I meant which is that many of us have multiple cards we can put GE on. I would have saved $35-$40 or so in tax by using any of my other GE rebating cards, for example, as opposed to putting it on the VX. It’s not breaking the bank, but for sure if I knew this in advance I wouldn’t have used the benefit – I’d have put it on my Prestige, etc.

Dave is exactly correct.

Referral bonuses should only be income upon redemption. Until then, like you say, you haven’t earned anything, you don’t own the points as they could choose to confiscate at any time.

If they consider it income, then do you then have a court case for stealing your property if they confiscate points? I’d say this is good evidence for Greg to file a small claims court case.

Now calling card benefits income that you paid for with the AF is just plain incorrect. Everyone should be adjusting that on their returns, and the IRS needs to do something about a bank knowingly issuing false 1099s.

Report the credit card annual fee as a loss since you had to pay it to get the credits.