In April, I was super excited when Capital One finally approved me for a credit card. By some miracle, I got in on the 100K Venture offer despite the fact that Capital One had rejected all of my previous card applications year after year.

Capital One finally liked me.

The offer I had signed up for was for up to 100K “Miles”: Earn 100K with $20K spend in 12 months, or still earn 50K with $3K spend in 3 months. Once the card arrived, I used it for all of my daily spend except when other cards offered good bonus categories. In other words, this became my go-to “everywhere else” card when I couldn’t earn 5x for dining, 4x for grocery, 8x for gas, etc. To-date, I had earned the 50K portion of the signup bonus, but I was still working towards the full 100K. I had many more months to complete the remaining spend. I thought.

I never used the card for anything anyone would consider questionable. Really. I know you don’t believe me because Nick didn’t believe me when I told him. But it’s 100% true. I never used the Venture card to buy a single gift card or to pay friends or to fund a gambling account or anything else remotely sketchy. I’ve gone over and over my statements, and seriously can’t see a single purchase that a card issuer wouldn’t like.

But Capital One found something somewhere that it didn’t like.

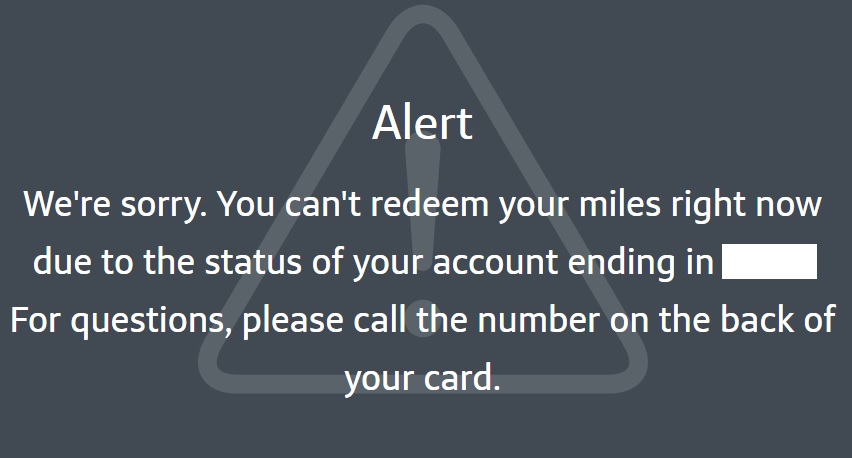

On June 25th, Capital One unilaterally closed my account without warning. I discovered the offense on July 1 when I received an email from a subscription service saying that my card couldn’t be processed. I then logged into Capital One and saw that my account was labelled as “Restricted”.

I called Capital One. I didn’t learn anything from from the call other than that my account was closed and that I would receive a letter. And that the result was final. End of.

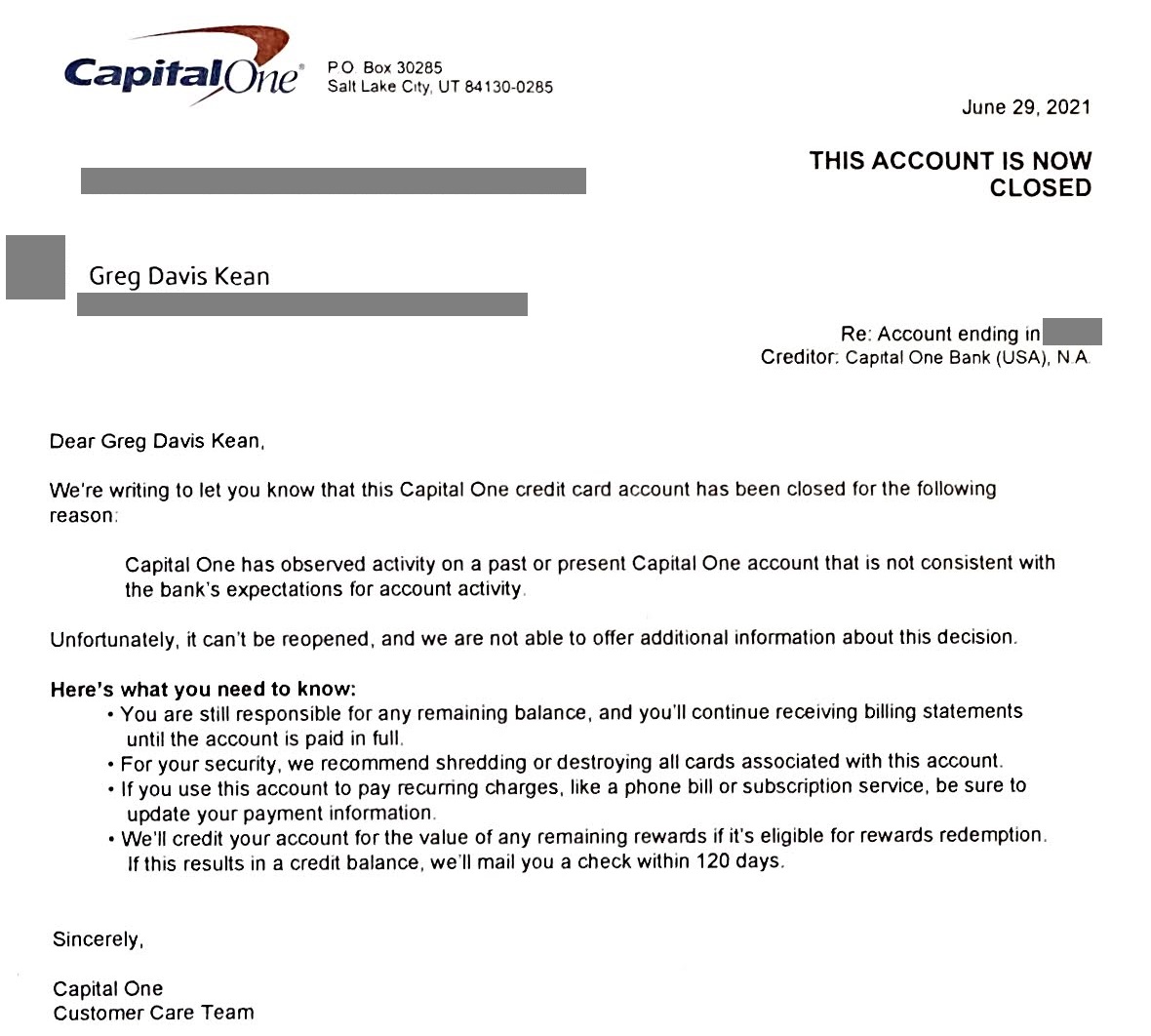

The letter, when it came a week later, said that they didn’t like activity observed on a past or present Capital One account:

We’re writing to let you know that this Capital One credit card account has been closed for the following reason:

Capital One has observed activity on a past or present Capital One account that is not consistent with the bank’s expectations for account activity.

Unfortunately, it can’t be reopened, and we are not able to offer additional information about this decision.

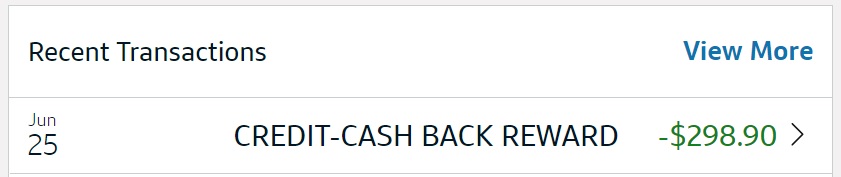

The worst part of all of this is what Capital One did with my rewards. Rather than letting me transfer the “miles” to airline miles or hotel points, they automatically used my points at a half cent each to partially pay my credit card balance. Yep, they converted nearly 60,000 hard earned “miles” to just short of a paltry $300.

Why was I shut down?

I don’t know. I didn’t use the Venture account in any questionable ways. And I don’t have any other Capital One products. The only Capital One product I’ve ever had was an ING Orange online savings account that was bought by Capital One whereby it became a Capital One 360 account. Years ago (Jan 4, 2015), Capital One forcibly shut down that account too. That time I did do some weird stuff completely by accident and so they shut me down without giving me a chance to explain my error. Fair enough. Today, are they continuing to punish me for my (accidental) sins from 6 years ago? That’s my best guess. That’s my only guess.

What’s next?

I’m not going to try to get my account reopened. If Capital One doesn’t want me as a customer, then I don’t want to be their customer. But I’m not happy about what they did with my rewards. I’m going to push back to see if I can get a different outcome. A half cent per mile is just not okay.

Capital One closed down my checking and savings accounts and three credit cards five years ago.

Yesterday they sent me an invitation to apply for a business card and I thought what the heck $750 bonus. I applied online and was approved instantly for 20K. We’ll see how long this lasts.

Still alive? They shut me down 2 years ago. I applied a month ago and was approved, then less than 2 weeks later they shut it down.

Still alive. I’m spending quickly to get my bonus ha ha.

Had a similar experience. Stopped allowing me to pay my bill with the debit card I had used for over a year. Couldn’t tell me why and kept saying they would have IT call me. Went on for months while I became more frustrated and vocal each month because of the fees and hassle of transferring money all over to accommodate this unexplained nonsense. Out of nowhere they closed my account with a balance and it’s shockingly (sarcasm) accrued a balance over the limit after all this time. I reported it to the CFPB. Since then they’ve sent me emails twice a week with my “options to fix my account.” Hahahaha. Im not stupid. I didn’t break it. They did. It’s not on my credit. If I acknowledge this I’ll be on the hook for their bs. But I suppose they really aren’t up to date on the consumer laws with this continuing harassment.

When did they close it? After a certain amount of time overdue biz accounts can make their way over to personal credit reports so be careful. CapOne is the absolute worst. They shut down my whole family for a reason they won’t tell me. No clue what it was.

Capital one is the worst!! They closed my account for consistently paying off the balance and someone else I knew for arguing with the customer service representative that berated THEM! Aka no real reason. They need to be OUT OF BUSINESS this hurts your Credit Score

I had an account closed by capital one during COVID 19. I contacted them for payment assistance. They said they would help by closing my account and I needed to destroy my card and was responsible for each and every payment. I asked if this was how they are helping and she said yes sir it is will there be anything else. I hung up, and suffered with the negative info on my report still today. I reapplied for a card and was told the same as others when denied. On a previous account they witnessed activity not consistent with their expectations for account usage. I have many letters sent and a FTC complaint. They have refused to tell me the account activity that was a problem and now say this phone call never happened according to records they have. So my previous account was closed for reasons unknown and I’m denied credit for the same reason and expected to deal with the harm they have caused to my credit. The sent a statement that the well being of their customers was important. I think it’s important that they smear the customers name while protecting thier name with consumers using any means necessary. They have refused to answer in writing and evaded answering the question every single time. They will not explain the activity they are speaking of. I think it was bullet purchases but I’m also going to say it’s because of a donation I made to a black church and use the racist card for an answer. I thought of that anyway. Looks like we going to court though. I’m not giving up

The reason was clear..YOU DIDNT PAY YOUR BILLS SANDY!!

Thats my best guess, too…Approved you and THEN realized they didnt mean to play nice after all.

Capital one did the same to me, except they said the account was not consistent with their expectations for usage. They are so full of it. I used those cards on a weekly basis for over a year. If I didn’t consistently use them then why do I have a balance of $1200 on one card and $1180 on the other? And had used both cards 3 times each just before you closed them. You and I know darn well why you did that and it’s because of the 1099A that I filed to get my credits owed to me from your Company, and the “Accepted for value” coupon I provided. Since that’s exactly what your statements provide at the bottom part of the statement that says ” tear here”. People incase you don’t know this, the statement is a coupon that you are suppose to endorse correctly and send back as the credit the owe you for taking out a bond under your ss# and trading it. That credit they give you is from your own bond. I know this because i was 15 years inside the trade world and was the person who provide the contracts for these bonds to these Corporations, banks, and Government agencies. Yup, they have been making a killing from your SS# and signature. Read the back of your statement, you will see the word “Coupon”. Now look up the definition of coupon. These greedy Corporations take the coupons you submit with your payment, and they send them to the IRS for credit, which means they get paid twice. DO YOUR HOMEWORK, THEY HAVE BEEN RIPPING US OFF FOR YEARS. THEY ARE THE DEBTORS, NOT US. LOOK UP HJR- 192 PUBLIC LAW 73-10 to start with

I tried using UCC codes just as you’re describing and the same happened to me! Can anything be done to dispute?

Capital are the most backwards company I have ever seen they literally kept 1,7888.00$ of my money and you can never reach anyone unless it’s credit card related.So me and my husband have our own business and customers sometimes pay with checks so I’m usually the one to make the deposits well my step son had got into his account stealing thousands of dollars so we just used my capital one account well I deposited several checks and on accident I had deposited 2 old checks simple mistake.So I called immediately to let them know the error I had made which it didn’t effect me nor capital one,so I’m speaking with the gentleman telling him what’s going I hear cows and chickens and a child screaming I’m the background yes you read thatsright out of nowhere he says well we as capitol one are going to go ahead and just close your account I was like huh for what u serious then he hung up on me. So I read after account is closed you will receive the remaining balance in 10-15 business days.Well I have called and called only to have to leave a voicemail it’s been 2monthes what do I do

You are making fun of the guy when it’s you who is the deadbeat!! Huh!!

Between BOA and Cap1 both are crap banks. My 2 cap one credit cards were just shut down without notice after making a payment to 1 and now I have to wait til tomorrow morning to sort out why. It’s probably because my BOA account took so long getting Cap1 their money something else came out and returned the d*** payment. Smdh.

*returned my first payment I made for the month …I meant

Greg, do u have an update of this issue? Any outcome

I have the same situation as you, the account was suddenly closed yesterday after open for a little over two months. I have met the bonus requirement and total 140k pts were turned to $700. The only business with them is the same as you while back to 7 years ago, their old 360 account similar as yours was closed by them without any explanation. I did not know any reason but do not care much because no big deal.

this time is a huge loss, do you have any suggestion on how to fight for this unfair case?

Greg, do u have an update of this issue? Any outcome

I have the same situation as you, the account was suddenly closed yesterday after open for three months. I have met the bonus requirement and total 140k pts were turned to $700. The only business with them is the same as you while back to 7 years ago, their old 360 account similar as yours was closed by them without any explanation. I did not know any reason but do not care much because no big deal.

I called cap1 and no one can explain the reason and $395 fees can not be refunded though I have not use single penny of those $300 travel credit yet

this time is a huge loss, do you have any suggestion on how to fight for this unfair case?

Ugh sorry to hear that! Your case lends a lot of support to the 360 shutdown theory. I never got anywhere with any escalations unfortunately. Instead I moved on to other opportunities. And when my wife got the 100k bonus for the VentureX I made sure to use all of the points ASAP

Capital one stole my reward points when the closed down ourone account because of inactivity.They said they sent a letter which we definitely didn’t receive. We go online ever day to pay and check our balances as we have other credit cards and savings accounts with them. Why they wouldn’t send a notice or e mail to us online is beyond comprehension. Wasn’t even aware there was an issue till one day we went to sign on and saw the account was closed and still no notification. Called and was told to bad thats just they way we operate and they weren’t kidding. Closing our other accounts and financials as we just don’t trust the many more please beware of their practices. I know whats in my Wallet nothing as they sold our hard earned money.

I explored Cap One’s pre-authorization offer and received an “offer” for only a “secured credit card”!!!!!! I have (and have had) 3 800+ credit ratings. I understand that credit decisions are not solely based of credit scores. However, to receive a secured card offer (which, in substance, is not really a credit card at all) was such an insult that I immediately realized I would never want to do business with that institution in any event–so I haven’t. Your article clearly indicates I made the correct decision.

Greg, Chase did this to me last year, closed my account n took away my earned n bonus points.. without explanation..a year later, I reapplied n was denied no reason given..I was not late on the card.. what can u do?

By mistake I paid Capitol One MasterCard instead of my President Choice MasterCard $4203.09 Oct 19/21. It took 6 phone calls n much of my valuable time to get them to finally return this money to my Scotia Bank Acct which took place Dec 31/21. Each phone call was a promise it would be back in my acct in 5 working days but didn’t say how many 5 working days this would take. Talk about frustration n I’ll never deal with Capitol One ever again

That’s why I never “upgraded” my Capital One Quicksilver 1.5% cash back for the Venture 2x “miles”. Cash back is more tangible than fictitious miles.

Welcome to Capital One. The card company that doesn’t understand what disputing a charge or fraud protection means.