Capital One Shopping is a public shopping portal that has nothing to do with Capital One credit cards. Anyone can join Capital One Shopping. The Capital One Shopping portal is highly quirky, and some folks end up very frustrated with it. On the flip side, some of the targeted offers are incredible. In some cases, I’ve received upwards of 50%-70% back on stuff I already wanted to buy. Because this portal is quirky/buggy/potentially frustrating, I wrote this guide to increase your odds of understanding the upside as well as the limitations and frustrations of Capital One Shopping.

Introduction to Capital One Shopping

Capital One Shopping is a public shopping portal that anyone can join and use. No Capital One card is required.

Like all shopping portals, the basic model is that Capital One Shopping has agreements with various merchants whereby they receive a commission for referring you to a retailer to make a purchase. They pass along a portion of that commission to the customer in the form of rewards.

Like some other shopping portals, Capital One Shopping has several ways to use its offers: a desktop website, a web browser extension, an app, and targeted email offers.

The basic gist of the process is that you click through from a Capital One Shopping offer and/or activate an offer with their extension and immediately make a qualifying purchase with the chosen retailer. At some point thereafter, the purchase should “track” with Capital One Shopping (which is to say that you’ll see rewards pending). After some amount of time that varies by retailer (typically 30-90 days after purchase or after a booking is completed), the rewards become available for redemption.

Unlike most other shopping portals, rewards can not be redeemed for cash. Instead, rewards can only be redeemed for third-party merchant gift cards.

Capital One Shopping rewards can only be redeemed for gift cards

The next most important thing to know about the Capital One Shopping portal is that rewards earned through this portal can only be redeemed for merchant gift cards. Capital One Shopping rewards can not be redeemed for cash back, nor can they become miles. Redemption is via gift card only.

Unfortunately, this can be quite a source of frustration because the redemption selection has changed frequently. At times, we’ve seen broadly useful redemption options like Safeway, Kroger, and Walmart gift cards (none of which are currently available). At other times, the options have become incredibly limited, including mostly fashion brands that can often be found for sale at a discount elsewhere.

However, Capital One seems to have significantly expanded the gift card selection a couple of months ago, and I haven’t seen much change in the time since that expansion. At the time of writing, we’ve seen options like Marriott, Best Buy, Hotels.com, Lowe’s, ebay, and other broadly useful brands, travel and otherwise. Hopefully, this expanded offering lasts.

This really matters in part because many of the included brands are frequently availble on sale for less than face value. If you’re redeeming $100 of Capital One Shopping Rewards for a $100 gift card that you could have otherwise regularly purchased for $90, then you aren’t really getting face value out of your rewards. That may be OK, particularly if most of your rewards have been earned at rates far beyond those typically offered by other portals, but you have to consider that Capital One Shopping rewards shouldn’t be valued same-as-cash.

Links to the various forms of Capital One Shopping

Here are links to the various forms of Capital One Shopping:

- Capital One Shopping desktop site

- Browser extension

- Capital One Shopping app for Apple

- Capital One Shopping app for Android

You can create a separate Capital One Shopping login

As mentioned above, Capital One Shopping is a shopping portal that is almost completely separate from Capital One. The only way it is connected to Capital One (apart from being owned by Capital One) is that members have the option to create an account with an email address (i.e. without a Capital One credit card account) or to log in with their Capital One credentials. I have previously recommended creating a login with an email that is not associated with a Capital One credit card account.

The reason for the recommendation to create a separate login for Capital One Shopping is that, for a long time, it seemed that the best targeted offers went out to people whose login is not connected to a Capital One credit card account. However, according to several members of our Frequent Miler Insiders Facebook group, this may no longer be the case. Those using a Capital One cardholder login now report getting similar targeted Capital One Shopping offers to those logging in to Capital One Shopping with an independent email account.

However, for clarity, note that Capital One also has shopping offers within your Capital One credit card account. Those offers are not Capital One Shopping. Those offers within your credit card login are known as “Capital One Offers”. The big difference is that offers from within your Capital One credit card account are paid out in rewards to your credit card account. However, Capital One Shopping rewards can only be redeemed for gift cards.

Earn rewards through a referral offer (but the terms have become onerous)

Capital One Shopping sometimes offers targeted referral opportunities whereby an existing member can refer a new member and both sides can earn a reward. These offers are targeted and vary in value (we’ve seen anything from $25 for both sides to $200 for both sides in the past).

If you are an existing user, you can check here to see if you are targeted to refer others.

At the time of writing, some links are targeted to refer friends, whereby both sides can earn a rewards bonus:

- Nick's household Referral Link ($80 bonus)

Here are the steps required to earn the referral bonus:

- Create an account and verify your email

- Add the free shopping savings tool with full permissions – then use it for 90 days to enjoy free coupons and rewards at 100K stores

- You and your friend each get $80 in shopping rewards

If you refer other new users, note that you can only earn up to $500 in rewards per year in referral bonuses.

How to use Capital One Shopping

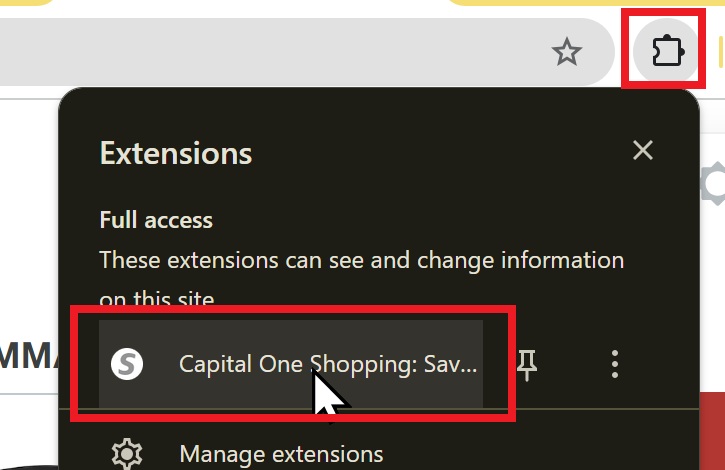

Install the extension (but I recommend doing this in a separate browser instance)

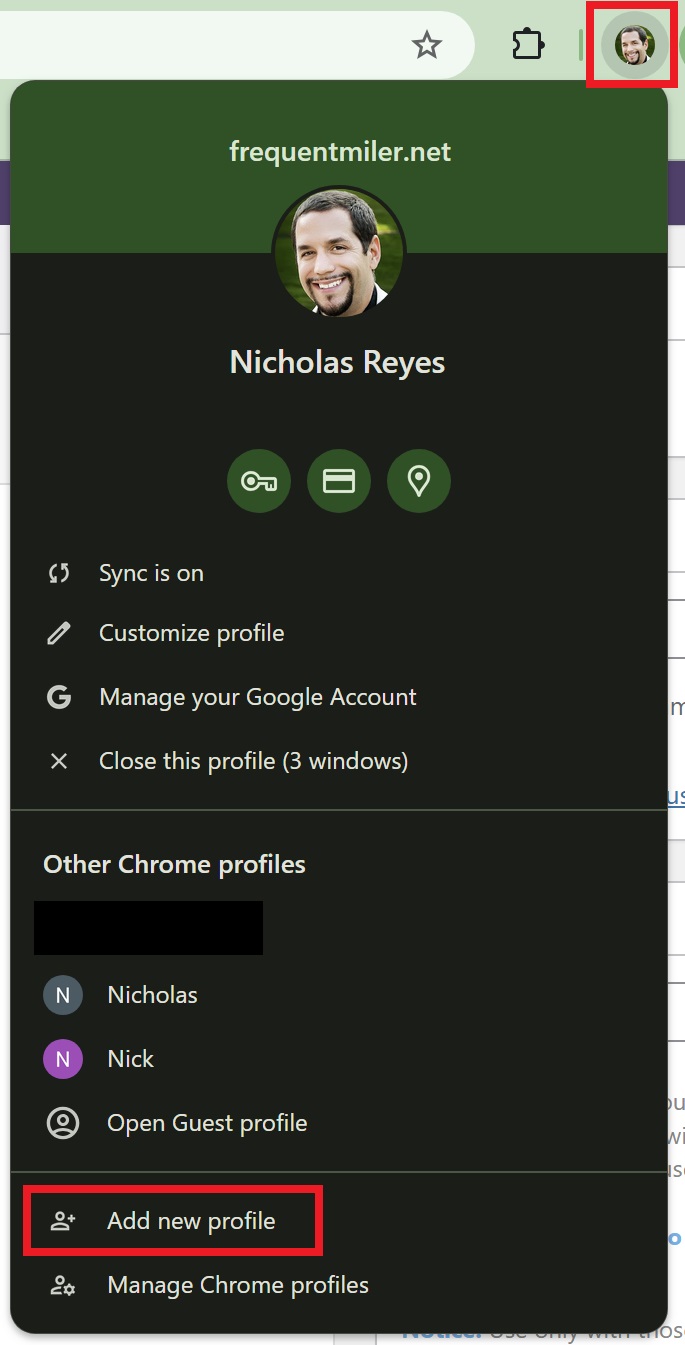

I don’t like having shopping extensions installed in the browser that I use most often. Part of the reason that shopping extensions exist is to track your Internet usage in order to market based on your interests. I prefer to have more control over what is tracked by an individual extension.

I mainly use the Google Chrome browser. In Chrome, it is easy to set up additional profiles. Simply click your picture or initial in the top right corner of Chrome, then click “Add Chrome Profile”. You’ll need an email address to associate with that profile, but this isn’t difficult.

I keep the Capital One Shopping extension installed in the “Nick” profile you see above. The extension is not installed in the primary instance of Chrome that I use, just that “Nick” profile.

This is intentional. We have anecdotally found that Capital One Shopping frequently sends elevated rewards rates based on your browsing history. When I know that I want to make a purchase at a store or travel provider where Capital One is likely to have elevated rewards rates, I’ll typically open the instance of Chrome with the extension installed and click around at the store where I hope to receive an elevated offer, but I will leave without making a purchase. Very frequently, I’ll receive a targeted email offer within days (sometimes within hours) for an elevated rewards rate at that store.

For instance, when Stephen reported on an offer for 65% back at TripAdvisor early one morning, I did not initially receive an offer. During late afternoon that day, I clicked around the TripAdvisor site in the browser where the extension was installed, but I left without making a purchase. A few hours later, I received an email offer that was good for 70% back.

While elevated rates of 70% back are rare, I am often able to trigger email offers for 20-30% back at brands like IHG, Choice Privileges, Best Western, Viator, TripAdvisor, Klook, GetYourGuide, and more. I’ve also triggered great offers at various brands that are completely unrelated to travel, such as 60% back at Shoebacca (I bought Birkenstock sandals and got 60% back), 60% back at Skechers (my wife and I bought several pairs of Skechers slip-ins and life hasn’t been the same since — it is like going from 2-wheeled luggage to spinner luggage!), 30% back on Goodyear tires, and a lot more. Those targeted offers often greatly eclipse what I can earn through other portals.

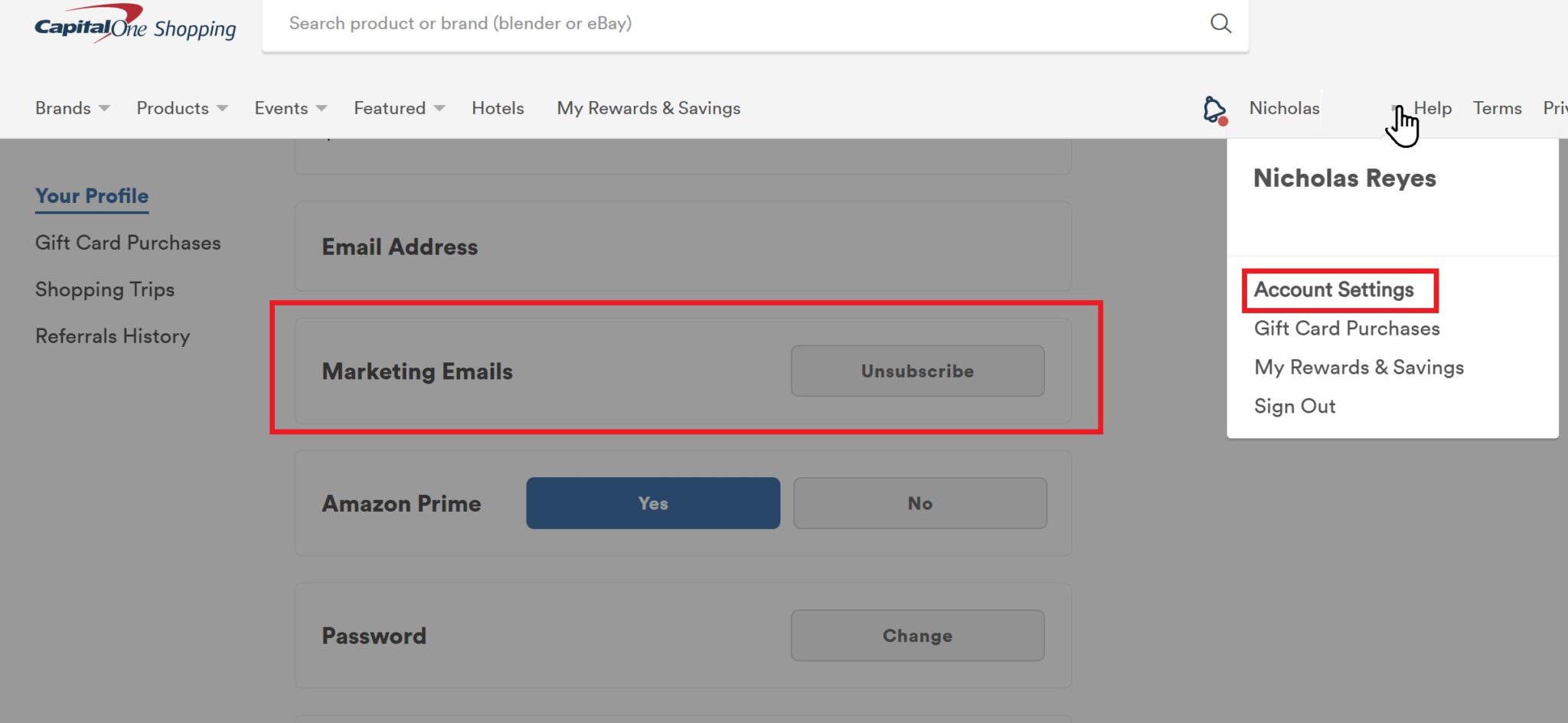

Opt in to email offers

The targeted email offers are really where it’s at with Capital One Shopping.

To receive email offers, visit your account settings and be sure to opt in to marketing emails.

Then, keep your eye out for emails from Capital One Shopping and open them.

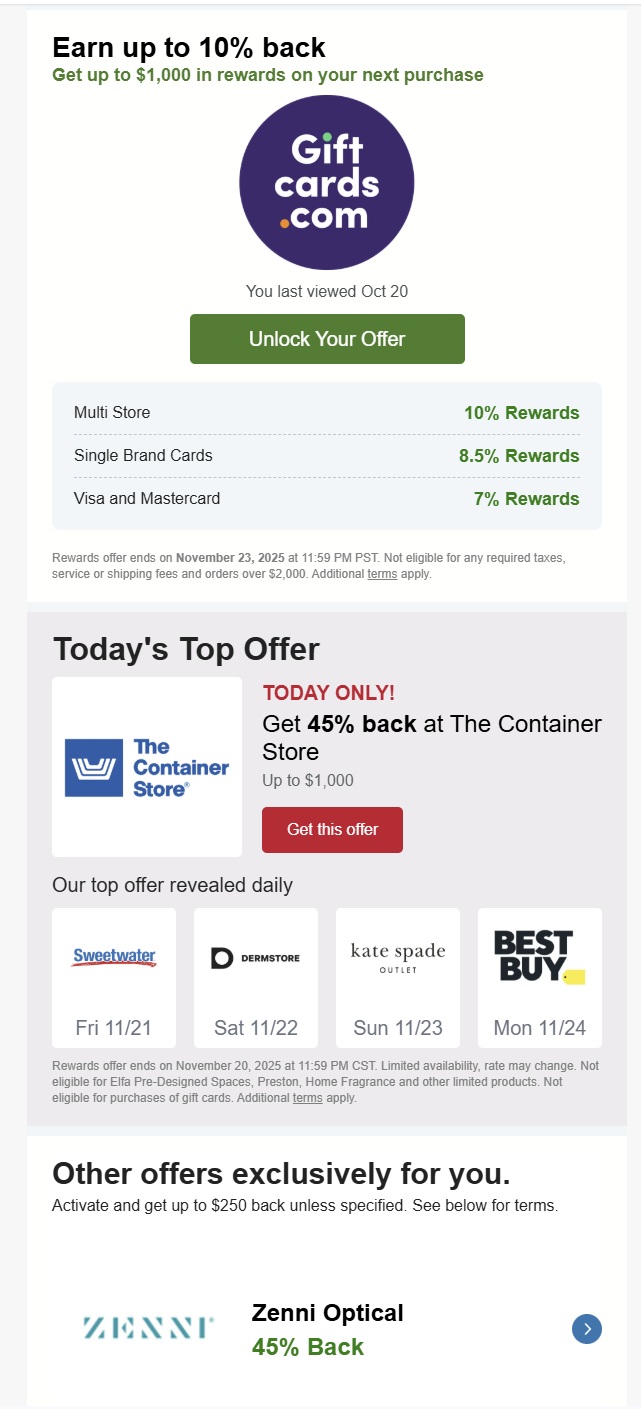

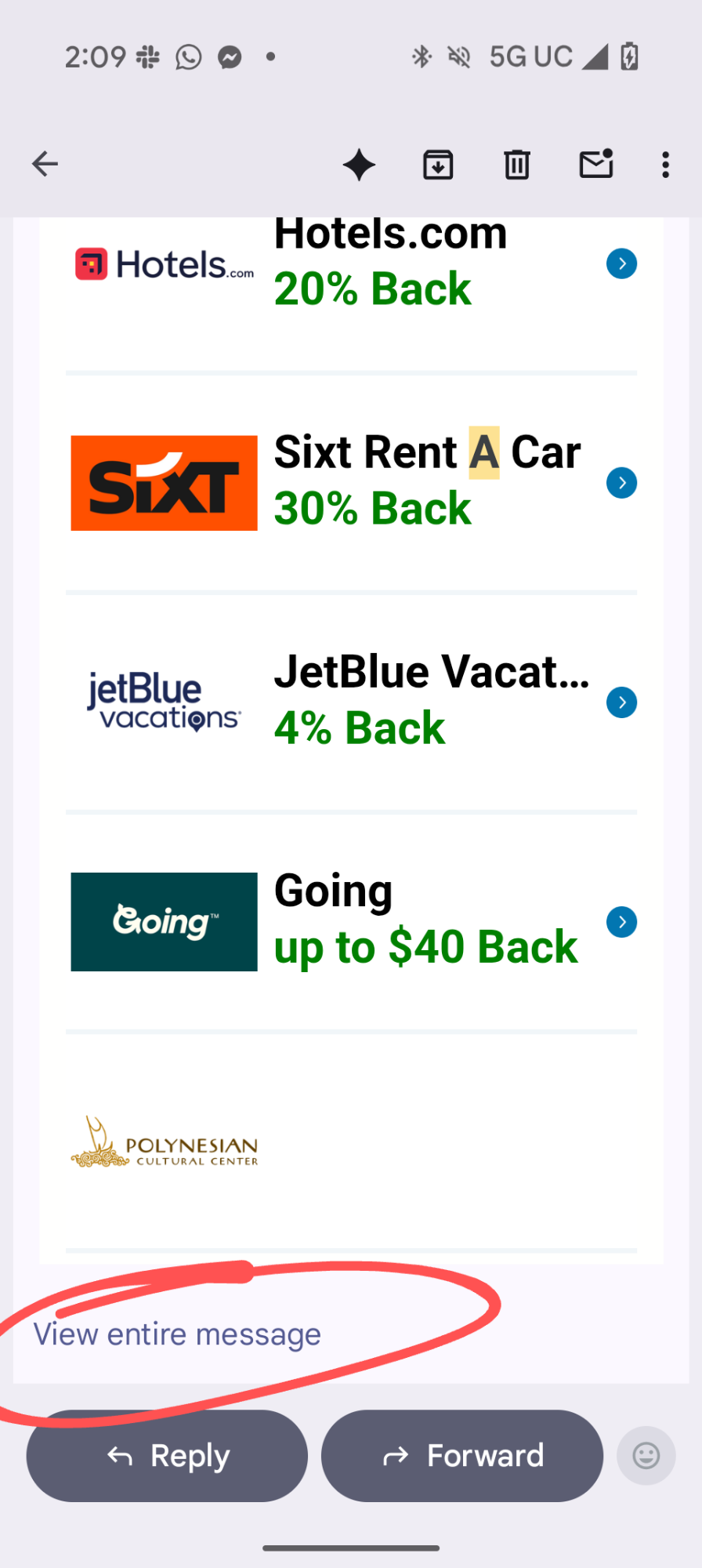

Sometimes, Capital One Shopping email offers will have a headline from a specific store you have visited, but you still want to click into the email and scroll through the entire thing. For instance, I recently received this email headlining an offer of up to 10% back at GiftCards.com, but as you can see, the same email contained completely unrelated offers for 45% back at The Container Store and Zenni Optical.

Be aware that your email reader may not display the entire message. Sometimes, my phone email reader cuts off the message, and I need to click a link at the bottom to “view entire message” in order to see all of the offers. See this post for more detail.

The email offers tend to be among the best Capital One Shopping offers. A few key notes to know about Capital One Shopping email offers:

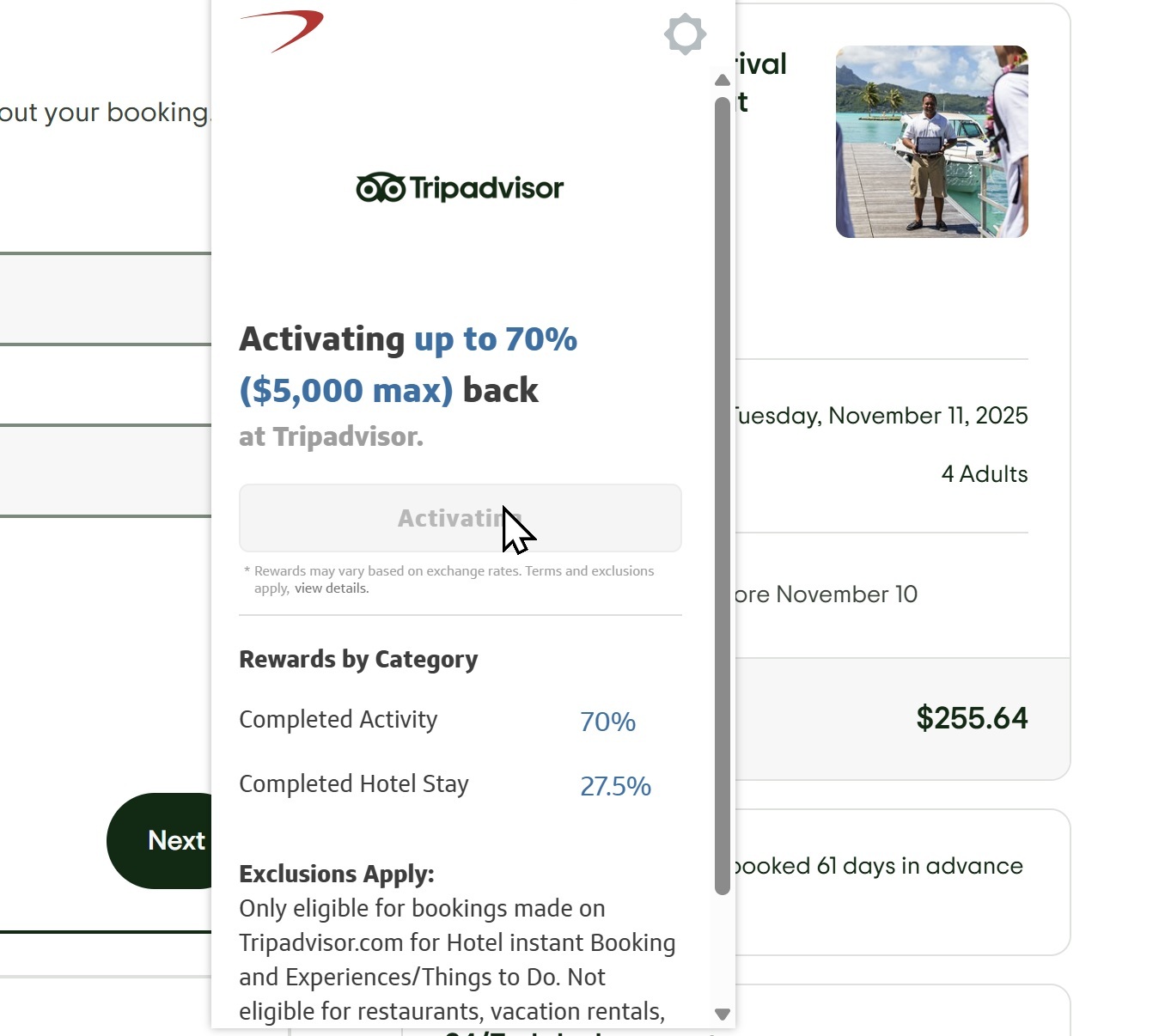

- The maximum amount that can be earned with a single purchase varies by email. Some email offers are valid for up to $250 back. Others are valid for up to $1,000 back and others still are valid up to $5,000 back. Pay close attention to the details!

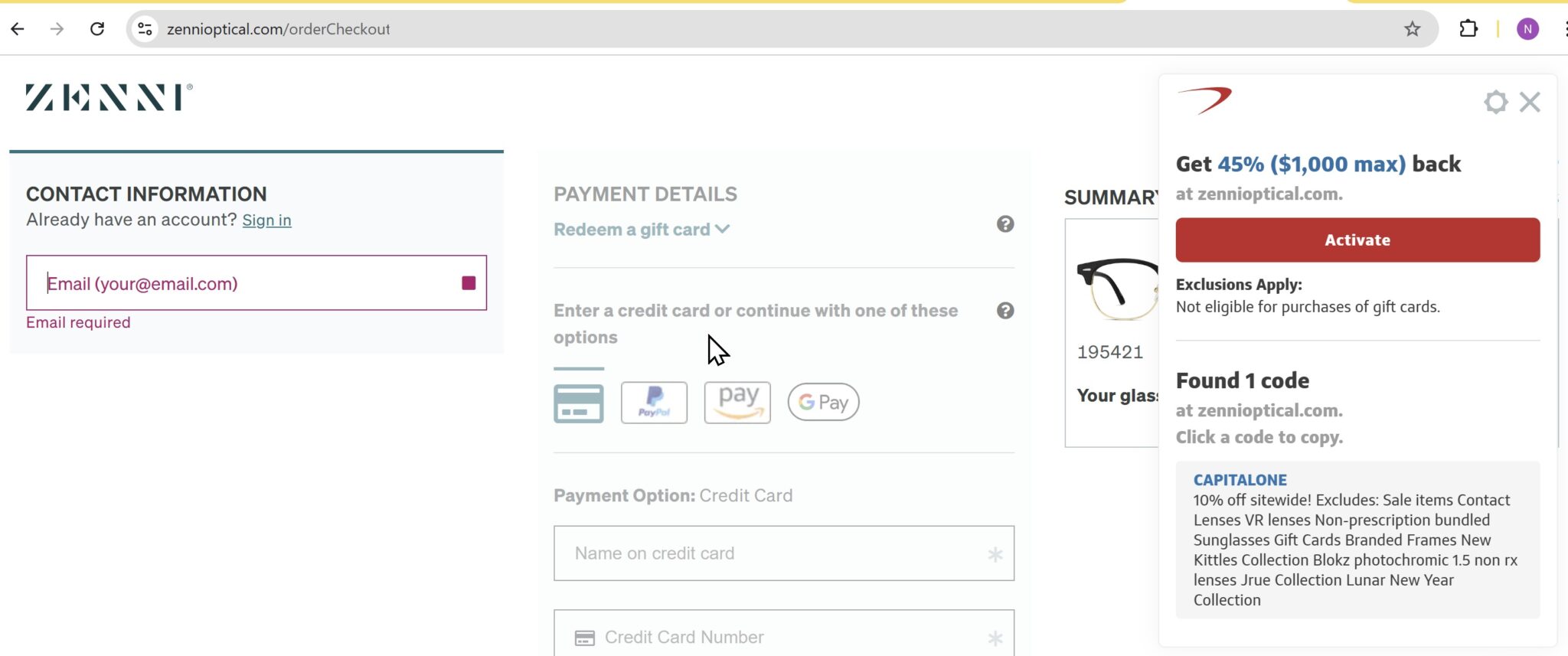

- Best practice is to click through the email link in the browser where you have the extension installed (see the next section) so that you can double confirm the targeted rate with the extension. Note that the rate shown by the extension may be different from the emailed rate if you do not click through from the email. In other words, if your email shows an offer for 45% back at Zenni Optical and you simply go to the Zenni website, the extension may not show that offer unless you click through from the 45% offer in the email.

- Email offer expiration varies. Your mileage may vary when clicking through older emails.

- When an email offer says “Up to X% back”, you know that there are exclusions and/or categories with different payout amounts. The way to know which categories apply is to click through from the email in the browser where you have the extension installed, then activate the extension after landing on the target website. The extension pop-up should show the breakdown as shown here (see the rate for a Completed Activity is 70%, whereas the rate for a Completed Hotel Stay is 27.5%).

Check the desktop site and app for targeted offers

The CapitalOneShopping.com desktop site and app sometimes feature solid targeted offers. I tend to avoid using the app as mobile purchases don’t always track properly through shopping portals.

On desktop, you’ll want to scroll the Capital One Shopping home page to see targeted offers. Important things to know include:

- Scroll the whole list. Sometimes, you’ll see multiple entries for the same store at different rates. For instance, you might see lululemon advertised at 15% and also see lululemon at 30%. If you click through the 30% button, you’ll get 30% back — but if you click through the 15% button, you’ll only get 15% back.

- You do not need to buy the advertised product to earn the associated rewards. While you’ll often see rewards examples based on buying specific products, you do not need to buy the specified product to get the advertised rewards. In most cases, the rate shown will apply to any product purchased at the destination site. In some cases, the rate will say “Up to X% back”, which indicates that there are different rates based on purchase category. Clicking through and activating the browser extension (as shown below) will give you insight into which categories are associated with which rates.

An example of the purchase flow (Capital One Shopping Best Practices)

The best offers usually come from Capital One Shopping emails. The best practice for successfully earning your rewards is:

- Click through from your chosen email offer in the browser where you have the Capital One Shopping browser extension installed (note that you don’t necessarily need the extension installed, but this makes it easier to verify that the offer has been activated). I do this in a browser instance that has no other extensions installed to minimze the chance of any interference.

- Add qualifying items to your shopping cart.

- During the checkout process, open the extension to be sure that the offer matches the email

- Click the red button to “Activate” the offer

- Complete checkout

I do all my “shopping” (i.e. clicking around to decide what I want) in a different browser, then go to the browser profile with the extension installed when I know what I want, adding everything to my cart and checking out right away in order to minimize the chance of failure to track.

As you’ll see in the drawbacks below, many readers report tracking failures with Capital One Shopping (while reporting that they use other portals without issue). I can’t speak directly to that experience. I follow the flow above and use Capital One Shopping monthly, and I have a 99% success rate with my orders tracking as expected.

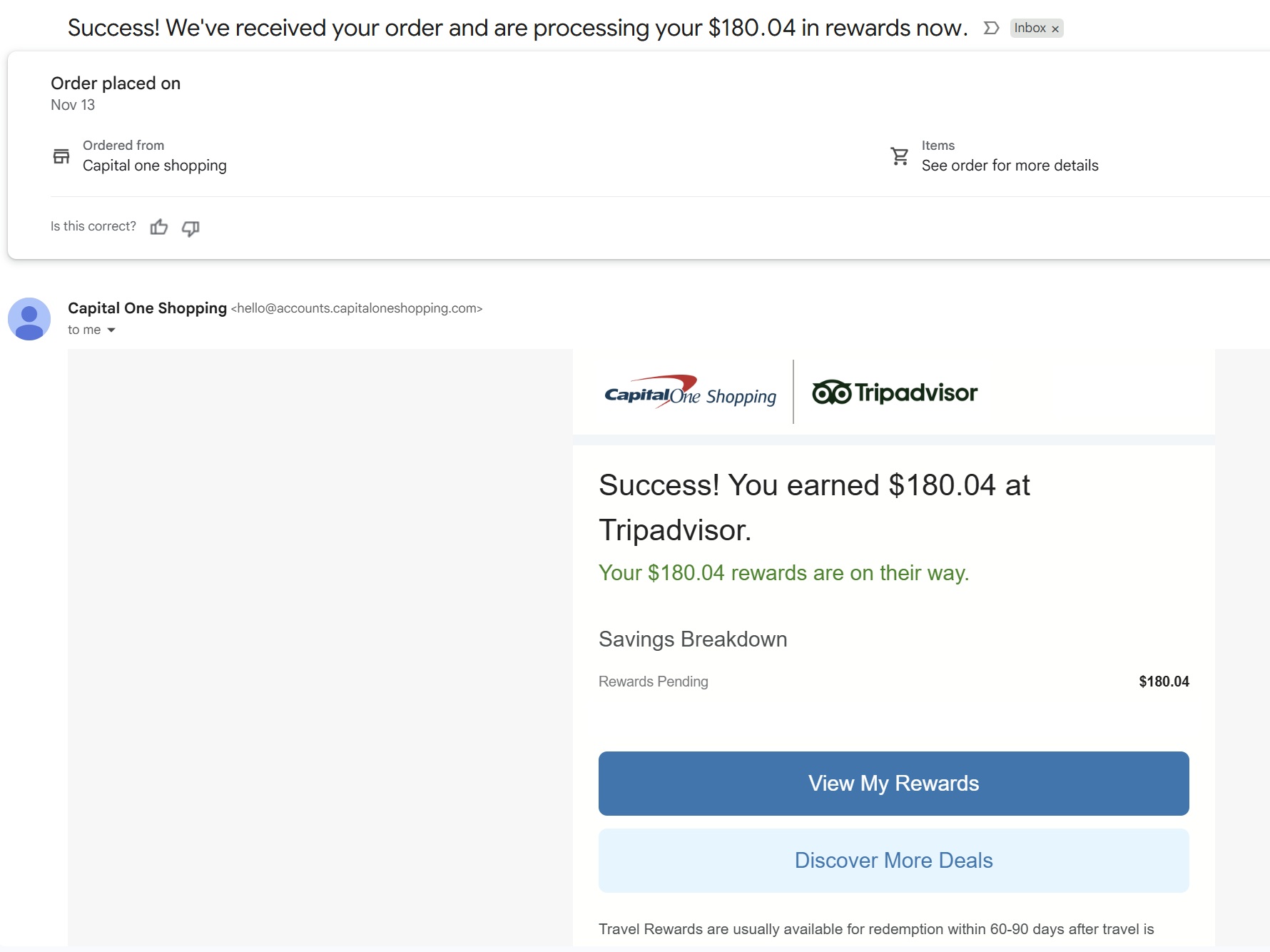

Capital One Shopping tracking

Capital One Shopping does not track as quickly as some portals. Whereas purchases through portals like Rakuten or Rove Miles tend to sometimes track within hours (triggering an email to confirm tracking), Capital One Shopping offers typically take days to show tracking. They sometimes send an email to confirm that an order has tracked (with the subject line, “Success! We have your order for….”), but this is incredibly inconsistent.

Most of the time, I do not receive an email confirming tracking. However, if you go to “My Rewards & Savings”, you can see a history of your purchase activity. Purchases will show up as “Pending”, “Ineligible”, or “Credited”. Here’s what they mean:

- Pending: Your purchase tracked successfully. The line item will show how much you spent on your purchase and how much you are due in rewards.

- Ineligible: Your purchase was reported by the merchant as ineligible for rewards. This may be due to the purchase being in an excluded category, or to using a coupon code not found on Capital One Shopping or because it is a travel-related purchase that will become “pending” after travel is complete. See this post for more detail on this.

- Credited: Your rewards have become eligible for redemption.

After first making a purchase with most merchants, your rewards should show up as “Pending” as long as you have followed any store-specific terms. A “pending” status indicates that the order has tracked to pay out, so long as you don’t make any returns/cancellations. You can see the pending shopping rewards on your “My Rewards & Savings” page to verify that you’ve gotten the quantity of rewards you were expecting.

Note that any adjustments made after placing an order (like if you have to call customer service for a price adjustment or you need to make a change to the shipping address, etc) may invalidate rewards. I always assume that if a customer service representative accesses my order, it may invalidate my rewards (this is true with any shopping portal purchase).

The time between when rewards are “pending” and “credited” (i.e. available to be redeemed) varies by merchant. Generally, you’ll need to wait 60-90 days after a purchase for rewards to be credited/available for redemption. This is relatively consistent with other shopping portals (for instance, Rakuten only pays out quarterly, so it sometimes takes more than 100 days to receive rewards from purchases). Some purchases credit to my Capital One account as soon as 30 days after purchase, but other merchants consistently take a couple of months.

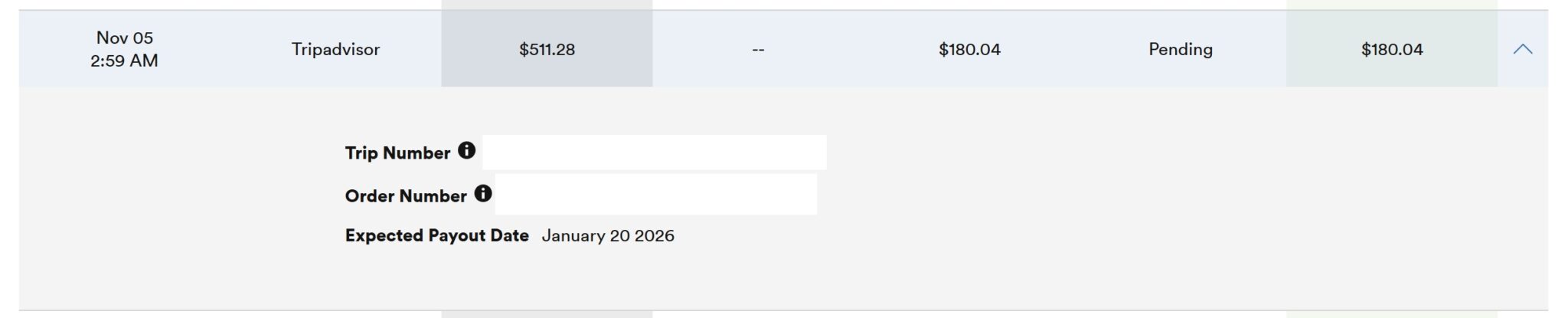

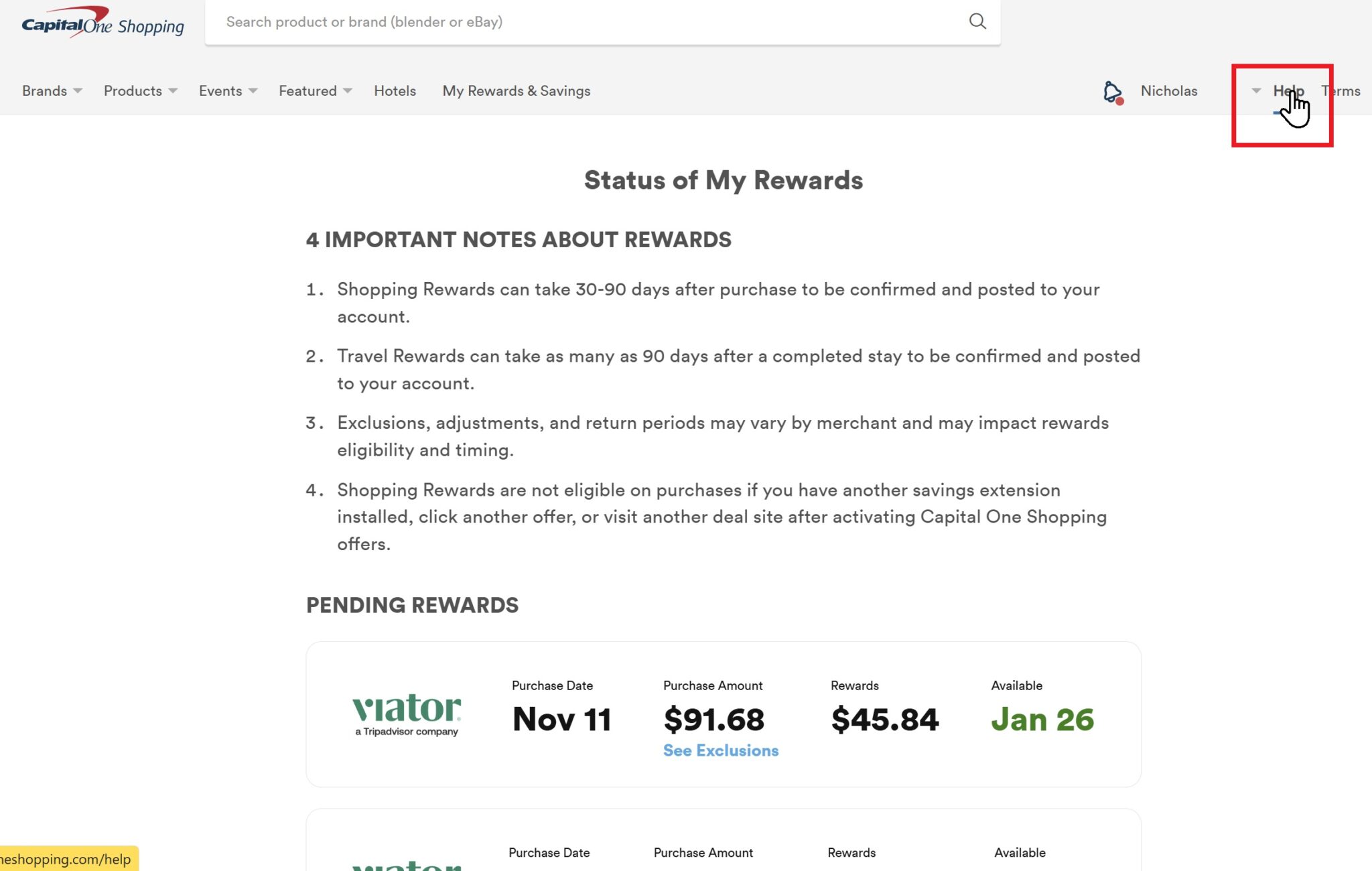

How to know when rewards will change from “pending” to “credited”

When you go to “My Rewards & Savings” in your Capital One Shopping account, you’ll see a summary of your purchases and rewards. If you click the arrow next to a “pending” purchase, it will show an expected payout date in the expanded details.

Alternatively, you can click “Help” to go to the Capital One Shopping Help page. The resulting page shows a list of your recent successfully-tracked purchases with the dates when the rewards from those purchases will become “credited” and available for redemption.

Note that purchases which show up as “ineligible” under “My rewards & savings” will not show up under “Help”.

Capital One Shopping drawbacks

You need to have some portal experience to know which offers are “too good to be true” versus just being really good

One of the biggest hangups I see with Capital One Shopping is that you need a semi-pro understanding of shopping portals in order to know in advance what isn’t likely to work.

Here’s what I mean: Capital One Shopping tends to send targeted email offers for products you have browsed. Despite how it looks in the email, those offers are not limited to the specified products. The specified products are merely a reflection of items you have browsed. Unfortunately, Capital One Shopping doesn’t use intelligence in what it displays here.

So, for instance, if you have browsed Visa Gift Cards at Office Depot’s website, you may receive a targeted offer for Office Depot advertising rewards on that Visa Gift Card you viewed. However, experienced portal shoppers know that purchasing a Visa Gift Card from Office Depot will not track through a shopping portal. That’s because Office Depot does not directly process gift card sales — the charge from a gift card purchase on Office Depot does not actually come from Office Depot. That won’t trigger rewards through any portal.

That is particularly frustrating with Capital One Shopping because of the fact that their targeted emails will still show the ability to earn rewards on that purchase, even though you won’t. You therefore need a semi-pro understanding of shopping portals. Most people with a high amount of portal experience know to disregard that sort of email offer, but relative newcomers to shopping portals wouldn’t reasonably know which offers aren’t actually going to pay out.

Some examples of stores where you need to exercise similar caution include (note that this is not an exhaustive list:

- Walmart: There are many category exclusions through any shopping portal and rates vary considerably depending on category.

- Macy’s / other major department stores with a notably wide selection of products: There are many category and brand-specific exclusions that you’ll find across all shopping portals, particularly at major department stores like Macy’s. The devil is in the details, so pay close attention to category-specific rates and exclusions. If you’re buying something that is fulfilled by a third party, pay special attention to exclusions in the portal terms.

- Target: I don’t know if Capital One Shopping sends offers for Target, but very few items purchased at Target trigger portal rewards through any portal.

- Food delivery services like Omaha Steaks, Kansas City Steaks, Blue Apron, Good Chef, etc: Many of these services change the prices and deals considerably depending on how you click through to their website (whereas traditional stores like Macy’s or Skechers.com, etc do not). It is really hard to stack rewards on these meal delivery or food delivery services; while you can typically get portal rewards when clicking through, using a gift card for one of these services will almost always both change the price and negate rewards, as will trying to use any kind of coupon code.

- Any store with an “Up to” rewards rate: This isn’t always a bad thing, but you do need to pay attention to the categories. After clicking through from a targeted email with an “Up to” rate, click on the extension to verify the various category rates and exclusions.

- Avis Car Rental: I haven’t yet gotten an Avis rental to pay out via Capital One Shopping, presumably because I can’t find a way to exclude both coupons and the “Avis Worldwide” discount while logged in to my Avis account (both of which are excluded).

- Office Depot/Office Max: Note that gift card purchases are processed by a third party (GiftCardMall) and will not track.

- Beware of ordering multiple items in a single order. Some stores will charge you separately as the separate items in your order ship, and this may negatively impact your rewards. For instance, I once purchased a laptop and a cheap accessory from Lenovo. The cheap accessory shipped first, and my purchase, though originally tracked at the full ~$1,400 purchase price of the laptop + accessory, was adjusted to tracking at $24.99 (the purchase price of the cheap accessory that shipped first). In that case, Capital One Shopping customer service made it right and credited me with the ~$410 in rewards that I was due. In the future, I would be sure to make a major purchase like the laptop in its own transaction.

- Beware of the caps on rewards. Some email offers are valid for up to $250 back, while other email offers are valid for up to $5,000 back. I once made an expensive StubHub purchase with a targeted cash back offer only to find out that my rewards were capped at $250 back (which was far less than what I thought I was due).

- Beware of any store where you use a gift card that functions like a promo code. I don’t know how to describe these sites except to say that you’ll get to know them when you see them. Omaha Steaks is a good example: you enter a gift card code in the same box where a promo code would be entered, instead of entering the gift card code as a payment method at the end of the checkout process. Any store with that type of system is likely to report the purchase as having used an excluded coupon code.

There are surely many other similar examples. As someone with a great deal of shopping portal experience, none of the above are a big deal to me. However, for a newcomer, there are opportunities for disappointment that a frequent portal shopper is more likely to avoid.

Gift card redemption options are limited

As noted above, rewards can only be redeemed for gift cards. That’s a bummer since it means that you’re stuck with the options available at the time when you want to redeem rewards.

Making that worse if the fact that selection has historically varied. Sometimes, redemption options are great. Other times, not so much. In recent times, Capital One Shopping seems to have expanded the seleciton and made it more consistent, but we don’t know whether that will last.

Customer service varies (many readers report frustration)

When I was missing rewards on my aforementioned Lenovo purchase, customer service was responsive and made it right. However, many readers have reported that after a few successful customer service claims, customer service reps usually refuse any additional help. That is frustrating in cases where the problem is not on the customer’s end! It seems like there is an internal limit as to how much they are willing to help in cases of missing cash back. Luckily, I haven’t had to make additional claims.

I should also add that many readers have reported long lag times in getting assistance. Reps tend to require that you wait a minimum amount of time before filing a claim, which tends to be months. There may then be a maximum amount of time after which a claim can be filed. I imagine that much of this depends on merchant policy for following up on missing cash back claims, but it is nonetheless frustrating.

Is Capital One Shopping trying to avoid paying out?

A common reaction to any shopping portal failing to pay out is the assumption that the portal has nefarious motivations, intentionally trying to cheat the customer out of high cash back earnings.

Truthfully, I think this concept is bogus. It just doesn’t make any sense: the basic gist of a shopping portal is that they earn a commission for sending you to a store to make a purchase. They give you a cut of that commission. If they get paid, they have no reason not to pay you. I don’t think that Capital One Shopping (or any portal) is out to cheat an individual out of a couple hundred bucks. Their entire business model relies on people continuing to make purchases. Denying your cash back claim of a couple hundred bucks risks losing your repeat business, which is surely worth a lot more.

At the same time, if the merchant doesn’t pay the portal, the portal isn’t going to pay you (in most instances). Some portals are better than others at deciding when to eat the loss and pay out even if they haven’t been paid, but most portals aren’t going to do that frequently. They rely on information supplied by the merchant about whether you made a qualifying purchase and how much you are due. The portal should (and generally will) push back with the merchant to look into your claim, but if the merchant refuses to pay, chances are good that the portal isn’t going to pay you.

My guess is that the vast majority of portal tracking failures are on the merchant end. I tend to avoid repeat purchases at stores with a poor history of tracking (like Avis rental cars!). I am much more likely to write off a retailer than a portal (generally speaking) since I tend to assume that the tracking failure is on the merchant end. I know that most portals want to make their commission at least as much as I want my rewards.

Within my household, we have earned more than $10,000 worth of Capital One Shopping rewards over the past couple of years. In some cases, we have earned $300-$500 on a single purchase. Most of my purchases track correctly by following typical shopping portal best practices: click through the offer, then go directly to the merchant page and make a purchase in one smooth motion. I don’t tend to click through the offer just to “shop” and look for something to buy. Instead, I “shop” in another browser. Only after I know exactly what I want to buy do I click through from Capital One Shopping. Then I simply add whatever I know I am buying to my cart, make sure to activate the offer, and check out. I’ve had a high degree of success with that simple flow, but others report numerous instances of purchases not tracking as expected.

Bottom Line

Capital One Shopping can be an exciting shopping portal because of the huge targeted rates that far exceed what can be earned through other shopping portals. Unfortunately, it can also be frustrating because of reader-reported issues with tracking failures and poor customer service responses. Still, I have been highly successful with this portal. By following best practices, I have a very high rate of success. As such, and because of frequent elevated rewards offers, I tend to use Capital One Shopping more than any other portal. There are certainly quirks and drawbacks that make it less user-friendly than other portals, but in instances where I’m getting upwards of 30-70% back, I am often willing to put up with those quirks thanks to my high rate of success with those offers. Hopefully, this guide helps others find success with those offers as well.

Now CapitalOneShopping requires you to link a bank/credit card for verification. Please update the post.

Are you running into that when signing up, redeeming, or some time in between? I just yesterday redeemed another $380 in rewards for a gift card, no bank or credit card required for verification.

This is for new accounts created after November or December I believe.

Extremely detailed overview and instructions! THANK YOU Nick !

I scored a few Viator 40% off deals and then a week or so later got 40% off Get Your Guide which was fantastic for day trips or even transportation needs we have for upcoming European trips.

I hope I get your 70% offer Viator offer Nick ( jealous !! – you should have taken the $1,000 Bora Bora Catamaran Tour ! )

I no longer get crazy offers from cap1, what should I do? create new account and season it? I was mainly using for Trip.com and Hilton which was around 25% cashback, now it is merely at 7%

Can I pay with PayPal and still earn the capital one rewards?

Yes, unless it’s specified in the terms but I have never seen it. Although not sure if Pay in 4 would give you cashback of only 1/4 or full.

When an offer caps rewards (e.g. 25% back with $1,000 max), does that limit the amount of rewards you can earn per purchase or total? Could I make one purchase that maxes out the $1,000 back and then click through again and make another purchase to earn a second $1,000 back?

(I know some offers specify single use, so this question pertains to offers that don’t impose that limit.)

Not sure where to post this, I was targeted for Walmart $80 off $100.

It says up to $250 back. I read the terms. It doesn’t state single-use. But I cannot find out if this is up to $250 back per transaction, or per all orders, or what other limits it has. It has an expiration though. I already placed one order, I just don’t know how many more I should place.

Picture:

just got 22 percent off macbook air which was already at a low black friday discount. Incredible. new M4 macbook air for $600 after the cap one rebate? Thank yOU!

@Nick Reyes 40% back at Walmart today ($1k max)…I dislike this portal but I have to jump on these deals, craziness. Hearkens back to the BING / Microsoft days of buying gold/etc on Ebay for the cashback

That’s a fantastic, thorough guide, Nick, thank you for it. They credited my $50 off $50 Under Armor offer, but not before: They made me wait for 30 days; I sent them screen shots of the offer and screen shots of the purchases; resent the same after they claimed they hadn’t received them first time around. An adventure.

I wonder how they decide to stop making manual adjustments for certain accounts. I’ve probably had between 15-20 manual adjustment credits over the past year or so.

The reps are usually very responsive and make the adjustments after attaching the screenshots I take for each purchase (strongly recommended).

My account is approaching $13K, so I’ve been considering creating a new account for fear of this one getting shut down. But then I wonder if I’m being given more adjustments than others based on my purchasing history…

Can you expand a bit on the redemption process? I’m new to this portal (always used Rakuten) and all of my rewards are still pending, but I tried to click around to see what the giftcard options are and couldn’t find them.

Do you have a strategy for redeeming? Let the rewards pile up and wait for a really good gc option, or cash them out as you earn them?

Lastly, does Marriott handle gift cards better than Hilton? Last thing I need are more giftcards that hotel desk staff don’t know how to use. Thanks!

I agree that Capital One likely isn’t intentionally cheating customers by keeping the whole commission.

But I feel that refusing to even *investigate* missing cash back claims once a customer has “too many” (3 or 4?) previous claims is absolutely an intentional choice that goes against the idea that their model isn’t tacitly counting on some breakage.

Put another way, they don’t just want loyal customers, they want who don’t create too much hassle for them by forcing them to employ more customer service reps that hurt the bottom line.

This guide is excellent. I have my account linked to my Capital One bank login and my wife has a separate email login on her account, and I can confirm that we haven’t seen any difference on the rate or size of targeted offers.