NOTICE: This post references card features that have changed, expired, or are not currently available

Update 7/6/21: We now have multiple data points that indicate that this update in language does not prevent you from getting the Schwab card and bonus if you’ve had the “vanilla” Platinum before. Rather, the updated language was to indicate that if you have had previous versions of the Schwab card (for instance, the previous version that had a $450 annual fee or the version that had a $550 annual fee), you will not be eligible to receive a bonus on the $695 version. However, the Schwab, Morgan Stanley, and vanilla Platinum cards continue to be treated as unique products and as such you are eligible to get the welcome bonus one time on each. We’ve seen success reports from people who have now received the bonus on the Schwab card despite having the vanilla Platinum and Miles to Memories was able to confirm the unique products treatment from Amex’s media team.

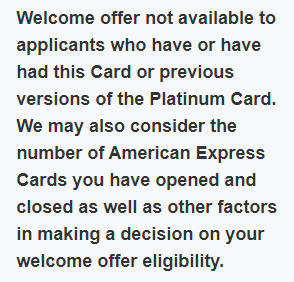

When we posted this morning about the new offers out on the Amex Platinum cards, we initially noted in the post something that has been common knowledge for a long time: for many years, it has been possible to get the bonus on the Schwab and Morgan Stanley versions of the Platinum card even if you have had the “vanilla” Amex Platinum card before. However, reader Aaron pointed out that there has been an update to the language on the Schwab Platinum application page as seen here:

That language is somewhat vague, but as it is new I take it to mean that they intend to restrict the bonus from people who have had the vanilla Platinum before — or possibly also the Morgan Stanley version or the no-longer-available Mercedes-Benz or Ameriprise Platinum cards.

Update: As indicated at the top of this post, we have now confirmed that this language only applies to previous versions of the same card, but the Schwab, Morgan Stanley, and vanilla Platinum cards are each separate and unique products. For instance, if you have had the “vanilla” Platinum card before, you are still eligible for either the Morgan Stanley or Schwab versions and their associated welcome bonuses assuming you have not had those cards before.

That is a major bummer for anyone who held out these past couple of days in the hopes for a bump in the new offer, particularly anyone looking to take advantage of Schwab’s Invest with Rewards feature. The rumor is that Invest with Rewards will begin offering 1.1c in value per Membership Rewards point starting on 9/1/21 (down from the current 1.25c), so some people were surely looking to open that card sooner rather than later and may have held out for the new offer. Unfortunately, it seems that the new offer may not be available if you’ve had other versions of the Platinum card.

Also of note: at the time of writing, we do not see any similar language on the Morgan Stanley version of the Platinum card. That could obviously change at any time, so I recommend reading offer terms carefully and thoroughly and taking plenty of screen shots if you intend to apply.

I’m so bummed. I just opened the Schwab Platinum, but had the vanilla a few years back. I direct messaged and asked about the 10x restaurants and small business. Please alert your readers that after the pop up, just because they send you the card, doesn’t mean you’ll get the 100k plus the 10x. Thankfully due to your advice, I know how to get all of my Southwest air, NYT, Saks (mascara) credits for this and next calendar year. I also found a couple Hotel Collection spots in San Jose, Costa Rica and in Rome.

I’m trying to understand what happened. Did you get the pop-up saying you would not get the welcome bonus during the application process and then you applied anyway? If you got that pop-up and applied anyway, it is true that you would not be eligible for the welcome bonus — both the 100K and the 10x are part of the welcome bonus, so you would not get either of them. Is that what happened, or did you not get the pop-up during the application process?

Worth noting that either way, having had the Vanilla Platinum a few years back doesn’t prevent you from getting the Schwab welcome bonus (we now have plenty of data points to confirm that), but if you get the pop-up that says because of your history with Amex you are not eligible for the bonus, that means you will not get the welcome bonus for whatever unknown reason their algorithm has determined.

The way it is written, it could include the Business Platinum as well.

I would like to if that is true too: does Business Platinum affect bonus on personal Platinum?

No, it does not

Ah yes. Along with the trash changes to the Platinum! Yay!

Just when you thought the new Amex changes couldn’t get any worse! 🙂

To me, because of the phrase “previous versions,” this reads as a poorly-written attempt to clarify that if you had the $495 or $550 Schwab Platinum, you are not eligible for the $695 Schwab Platinum. But I agree that it makes sense to act conservatively until we know more.

It certainly may be that – it’s vague for sure.

Do you have any updates on the Platinum Schwab welcome bonus? I was approved but I will not know until tomorrow if bonus will be given (via chat)…Any thoughts on cancelling the card if welcome bonus not honored, or just keep the card for the benefits (10X restaurants, small business spend). Thanks

PS: Did NOT get the popup warning prior to application (perhaps because application is processed via Schwab website instead of Amex)

I’ve been trying to sign up for the Schwab plat card for months now and continue to get the “no bonus for you” pop-up even though I’ve never had this version of the card before. So I feel like this rule has been already in effect for some time.

Just added it earlier this week and already had the vanilla Platinum currently.

i’ve had the same issue… keep getting the “no bonus” popup, and have not had this version previously.

definitely a big bummer

Just signed up for the schwab platinum last night and can’t exactly remember if I saw a bonus offer or not. Is there a way to check?

It can take up to 72 hours for the welcome offer to “attach” to your new card in the amex system. Then you can confirm the offer details (bonus, spend etc.) via amex support chat. You’ll have to give it a few days.

I got the “You’ve closed too many cards, so we don’t like you.” pop-up on the Schwab. I’ve never had the Schwab card. P2 got that pop-up when he applied for the Resy card. He’s never had a personal Platinum. We‘ll try again in a few months and see what happens.

We did close a lot of cards in the last year or two downsizing our card portfolio. P2 has one last card to close this month and we’re done. We’ll see how long it takes for Amex to be satisfied that our card closing days are behind us. If it takes a year, no worries.

I suppose I don’t have a choice but do the same: wait. I didn’t close that many cards though, none in the past couple of years, so I don’t know why they’re denying me bonus. The only thing I can think of is that I downgraded my “vanilla” plat and then closed it, and they didn’t like that.