As has long been rumored, the annual fee on the American Express Platinum card increased today to $695. Along with the fee increase we have seen the addition of a number of new benefits, but they have turned out to be more disappointing than rumored. The card is probably still a win for many people, but the credits are more restrictive than we’d hoped. While the card now features a public offer worth 100K points after minimum purchases, that public offer comes with 10x when you Shop Small in the US and at restaurants worldwide on an even higher limit in purchases, which could mean up to 375,000 500,000 total points (update: the new Resy offer is even better!) for those who can max out the offer’s full potential (but those interested can still get the old 10x categories, perhaps for a limited time). Surprisingly, the 100K offer is also available on the Schwab and Morgan Stanley versions of the card, which marks the first time that I remember an elevated offer applying to those cards (and makes me feel silly for picking up the Schwab card just a couple of days too soon). Full details and information about alternatives in this post.

New Platinum card bonus: 125K + 15x, different categories & higher cap (updated)

Whereas you previously needed to use a special referral link to get the 100K + 10x offer, the public offer is now good for 100,000 points after spending $6K in the first 6 months — that’s an additional $1K in purchases over the previous offer — and the $695 annual fee is not waived in the first year. The new public offer includes a big bump in new categories: Earn 10x when you “Shop Small” in the US (presumably purchases at most small businesses) and at restaurants worldwide on up to $25K in purchases in the first 6 months.

However, once again there is an even better referral offer on some cards. Select Platinum cardholders can generate a referral link for 125,000 points after $6K in the first 6 months and the same bonus categories.

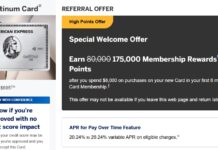

Update: The absolute best deal is via restaurant reservation website Resy, which is now offering 125,000 Membership Rewards points after minimum purchases as seen below and also 15x at restaurants worldwide and when you shop small in the US. Note that the landing page for this offer says 15x on up to $25K spend in the eligible categories in the first 6 months, though somewhere in the application terms it says 15x on up to $6K spend. We are 99% sure that the second instance must be a typo since all of the other forms of this offer are good on up to $25K spend and the landing page includes that offer in large print. However, if you’re going to apply, we strongly recommend keeping screen shots just in case (which is always a best practice and and has saved me many headaches over the years). As has been the case since last year, we will keep our Best Offers page updated with this increased offer as long as it is available. See more bonus detail here (and click through to our dedicated card page for more information):

| Card Offer |

|---|

100K points + 10x Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 100K points after $8K spend in 6 months + 10x points at restaurants worldwide on up to $25K spend in 6 months. Terms apply.$695 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 175K points after $8K spend in 6 months. |

That new spending bump could be massive for someone who spends a significant amount at small businesses as it brings the potential to earn as much as 250,000 points on top of the 125K welcome offer points. That’s incredible for someone who spends a lot at the right types of businesses. I assume that the Shop Small offer will work at most small businesses in the US, though it might be worth making a test purchase and waiting a few days to be sure before making big purchases. You could use the Shop Small Map, but I find that it isn’t always accurate or inclusive.

You can no longer get the old 10x categories

Update: While old referral links initially showed the old categories, those links are no longer active.

If you prefer the old 10x categories of the old offer, you’ll want to find a referral link that was generated before the offer changed. For example, we have an alternate offer on our Platinum Card page that comes with 100K points after $5K in purchases in the first 6 months plus 10x at US gas stations and US supermarkets on up to $15K in eligible purchases in the first 6 months. I don’t know how long those old links will work, so if you prefer the US gas station and US supermarkets as your 10x categories with the reduced $15K cap, you may want to make a move on that referral offer sooner rather than later. Note that the annual fee has increased to $695 even with those old referral links.

New Platinum card benefits disappointingly restrictive but still include airline credits

The new benefits are very close to what was rumored, but with some additional restrictions:

- $200 Airline Fee Credit remains a benefit (many had speculated this would be discontinued, but it has not been). Note that this is a calendar year benefit.

- $179 CLEAR credit: Up to $179 per year of CLEAR charges reimbursed. This is a calendar year benefit. [new benefit]

- $300 Equinox credit: $25 per month. Can be used towards $39.99 monthly fee for Equinox+ fitness app (previously named Variis by Equinox) or toward monthly Equinox All Access, Destination, or E by Equinox membership fees. [new benefit]

- $240 Entertainment credit: $20 per month. Can only be used for one or more of the following: Peacock, Audible, SiriusXM and The New York Times. [new benefit]

- $200 credit for prepaid hotel bookings with Fine Hotels & Resorts or The Hotel Collection only. This is a calendar year benefit. [new benefit]

- $200 in Uber / Uber Eats Credits: $15 per month ($35 in December) of Uber Cash which is lost if not spent within the month. [continued benefit]

- $100 in Saks Fifth Avenue Credits: Up to $50 in credits each year from January through June; and another $50 July through December. [continued benefit]

- $100 Global Entry or $85 TSA-Precheck fee reimbursement: Get reimbursed once every 5 years. [continued benefit]

Truthfully, the new card comes with an amazing amount in annual credits if it’s all stuff that you would ordinarily use. However, I can’t help but think that the customer who would naturally pay for this exact suite of expenses every year is rare and I am personally disappointed by a few key details.

First, I am not interested in the Equinox credit. While it will be easy money for those who already subscribe, the monthly credit is neither enough to cover the monthly app subscription cost entirely (you’ll still pay $15 a month out of pocket to subscribe to the fitness app) and you otherwise need to live near Equinox gym locations and also be willing to pay $250 a month or more for a membership (minus $25 with this benefit). Again, if you’re already subscribing/a member, this is an easy win. Personally, I didn’t even bother syncing the offer when they ran this same deal as a 6-month Amex Offer last year. I find this to be a snoozer.

The Digital Entertainment credit turns out to be much more restrictive than I had imagined. I had expected that this would work broadly on your selection of digital entertainment apps, but it turns out that it is limited to just Peacock, Audible, SiriusXM and The New York Times. That’s a big bummer unless you happen to subscribe to a couple of those already. Peacock is five bucks a month and if I didn’t already find it compelling enough to drop a Lincoln on it monthly, I’m not particularly excited about getting it for five bucks less. Audible is eight bucks a month. SiruisXm costs either $5 or $8.25 per month for the first 12 months (then it’s more, though I’ve heard that you can get them to knock it down substantially by calling in each year). The New York Times is currently $4 a month for the first 12 months. So this credit would almost be enough to cover all four services for new users — but my perspective on Peacock is applicable to the rest. If I wasn’t already paying five or eight bucks a month for these things (and I’m not), I don’t find them particularly exciting. I am paying $14.99 a month for Spotify, so I would have liked to have gotten a credit for that. It’s frustrating that Amex made this one so narrow. Even if SiriusXM were all the same to me, I don’t want to re-build playlists and downloaded content somewhere else. Again, this will be great for those who were already subscribed but I suspect not very exciting for the rest of us.

Unfortunately, I imagine that many will also find the prepaid hotel credit disappointingly restrictive, though I’m still satisfied enough. This credit will only be valid on prepaid Fine Hotels & Resorts and The Hotel Collection bookings (The Hotel Collection is a set of hotels that offer enhanced benefits a notch below FHR with a minimum 2-night stay requirement). The bummer here is that not everyone books through one of these programs once a year. Unlike some, I typically do book through Fine Hotels & Resorts once or twice a year on average. However, I don’t like the prepaid requirement here: whereas I have found FHR bookings typically still qualify for hotel points, elite credit, and elite benefits when paid at the hotel, prepaid bookings are typically handled like any other 3rd party online travel agency booking, meaning no hotel elite credits or benefits. Saving $200 probably makes up for the hotel points you would have earned, but sacrificing nights toward elite status or other key elite benefits might not be appealing during those one or two times when I want to book an FHR stay. Personally, I find this annoying but not a deal-breaker. I’ll still probably book an FHR stay once or twice a year for one or two nights and let Amex pay for it. An added bonus: this is a calendar year benefit, meaning that it will be possible to take advantage of this one twice in the first calendar year before renewing. For those who recently opened the card with the previous $550 annual fee, using this benefit this year and sometime before renewal next year will make for a great deal.

The new CLEAR credit is great news for CLEAR fans and I am glad to see that service covered in its entirety, which makes it a terrific benefit for most travelers. I don’t think we’ve seen anyone but Amex offer a credit for CLEAR and I know that this service is popular with many travelers.

I am also glad to see the airline fee credits stick around. While some have found them frustratingly difficult to use, I am glad to keep them as a way to offset the expense of having a Platinum card.

Are these changes a net win or net loss?

I can concede that the changes probably make for a net win for some cardholders without considering the new increased offer (and the ability to earn up to 350K points with the welcome offer is downright monstrous). The value proposition gets close even for me despite my disappointment with some of the restrictions.

That’s because I don’t typically have any difficulty using the $200 in airline fee credits. The Uber credits aren’t useful for me at home, but as we have begun getting out more I’ve been able to use them (and they are more useful now that we have several Platinum / Gold card credits in the family to use each month since they can stack together in a single account), so I’ll get decent use out of that $200 in credits. As established above, we’ll surely find a situation every year where the $200 Fine Hotels & Resorts credit gets us a free night or two with breakfast and a $100 credit at the hotel, so it is very likely that we’ll use that up as well (and yes, I do occasionally find situations where $200 would cover two nights at an FHR property — it’s not common, but it can happen). We’ve come to enjoy the Saks credits and while we typically use them on something we wouldn’t have bought, we have actually been happy with what we’ve gotten — so while I don’t value that at face value, I don’t value it at zero either. We typically get some value out of other Platinum benefits each year whether that is rental car elite status, the Platinum concierge, purchase protection, etc. It’s far from a slam dunk — like shooting from the opposite base line far from a slam dunk — but we will could probably renew without feeling terrible about it (and all the better if we actually sign up for CLEAR). On the other hand, do you want to be searching for a reason to justify your $695 annual fee? That’s a steep price to pay with wishy-washy valuations.

Some people will obviously make out far better, particularly those who will find near-full value in the Equinox and Digital Entertainment benefits. Others will surely balk at the $695 fee and the bottom line is that it’s hard to argue with that reaction as it is a lot of money to spend for credits that you need to stretch out of your normal behavior zone to use.

Good news: Schwab and Morgan Stanley versions also increased, but…..

Surprisingly, both the Schwab and Morgan Stanley versions of the card are also seeing the new 100K + 10x offer. That is terrific news for those interested in those cards who held out hoping to see an increase with the new fee. I certainly feel disappointed to have opened the Schwab card within the past week only to see the offer increase by 67% without even accounting for the 10x categories. Ouch. I did chat with customer service to see if they would match and someone is going to investigate and get back to me, but I’m not very hopeful.

Still, if you are interested in these two co-branded Platinum cards, keep in mind that they are separate products from the vanilla Platinum and you can get the welcome bonus once on each of them. So if you aren’t eligible for the vanilla Platinum but still want to take advantage of the new offer, these are alternatives.

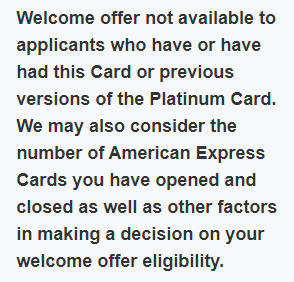

Update: As pointed out by Aaron in the comments, the Schwab Platinum card has updated language that may restrict you from earning the bonus if you have had other versions of the Platinum card before. It has previously been possible to get the Schwab and Morgan Stanley versions even if you have or have had the vanilla Platinum, but this updated language with the Schwab offer indicates that this may no longer be true – at least for the Schwab flavor:

There is no such language appearing on the Morgan Stanley version yet at the time of writing this sentence. I recommend checking carefully and you may want to take screen shots of the language if you apply.

Note that you will need brokerage accounts with these institutions to apply for their version of the card, though it’s not too hard to gain access.

All of the other Platinum benefits noted above apply to these versions of the card as well as the new $695 annual fee. Click the card names here for more details:

| Card Offer |

|---|

80K points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 80K after $8K spend in first 6 months. Terms apply. (Rates & Fees)$695 Annual Fee This card is only available to clients that maintain an eligible Schwab brokerage account. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 100K points + 10x when you Shop Small in the US & at restaurants worldwide [Expired 1/20/22] |

| Card Offer |

|---|

80K points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 80K after $8K spend in first 6 months. Terms apply.$695 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 125K points after 6k spend [Expired 11/8/23] |

Bottom line

It had long been rumored that the Platinum card would undergo some big changes this month and in the past few days we had gained a pretty good idea of what to expect. Unfortunately, some of the new Platinum card benefits are more restrictive than we would have hoped, but on the other hand it is good to see the airline credit stick around and many folks will find good value with more than $1300 in annual credits possible if you manage to use all of them. Most people probably won’t use all of them and I think many will find it hard to justify keeping the card long-term. Still, with what could be a monstrous welcome offer worth up to 350,000 total points and the increased offer also applying to the Morgan Stanley and Schwab versions of the card, there is plenty of good news still for those who waited to pick the card up at the new fee — and those who struck while the iron was hot and applied recently now pick up some additional benefits that make it an excellent value if you locked in the lower fee for a year before today’s increase. Ultimately, that crowd makes out pretty well if they can use the new credits even a bit.

FYI, the 6 month period where you earn 10x or 15x is measured as 183 days from the application date. It’s not measured from the approval date or receipt of the card. In my case, I applied in January and my card took 18 days to arrive, but I learned from Amex those 18 days are just lost in terms of the promotion.

DP – I have a vanilla platinum (and previously had a biz platinum). I recently signed up for a new biz plat, no popup, approved, met the spend and received the points. I then signed up for the Blue Business Plus, after seeing the offer in the app, no popup, approved, still working on meeting the spend. I just signed up for the Schwab plat, no popup, approved, fingers crossed 🙂

A follow up to my previous post: I just received an email telling me that my new Schwab card had been delivered. Went to the front door and there was a large overnight envelope outside with my car inside. Clicked the link in the email to confirm receipt and after logging in to my Amex account, I discover that they’ve given me a Schwab appreciation bonus of $200. Did I miss this in the terms or do they just appreciate me more than others?

For anyone interested, it turns out that that bonus is based on the value of assets you have under management at Schwab. Nice little rebate and another reason I’ll keep this version going forward rather than my vanilla Platinum.

Yup. Sorry I didn’t get to answer you yet. The Morgan Stanley card rebates the entire $695 with much less in assets if you’re willing to jump through some hoops. https://frequentmiler.com/which-is-the-best-amex-platinum-card/#American_Express_Platinum_Card_for_Schwab

Just as a factual issue, my Equinox membership in DC is $160 a month. Not cheap but not $250 and not more expensive than a lot of other options to take classes that require you to pay by the class.

Does that membership qualify for the credit? I looked up the cost of the All Access, Destination, and E memberships that are listed as qualifying for the credit and on the Equinox website the cheapest of those I saw was $250 a month. I am admittedly not very familiar with Equinox though.

I think the website is letting you join all the clubs across the country but I don’t know anyone who’s doing that. However they have one of the lowest level computer systems I’ve ever seen. Nothing comes through as anything but Equinox. Which sometimes causes a bunch of issues for internal promotions. But I’d be shocked if they could figure out your membership type based on the charge given each club is a different amount. Someone will figure it out! It won’t be me. I have never had this card but I just can’t justify $695 when I’m still not traveling enough to spend the cash of MRs I have.

Don’t know your situation but cant imagine Uber Eats credits are hard to use… one meal a month free or close to free…. but agree on most of the rest.

There is no Uber where I live. The closest town that has Uber is 30 miles away (and then after that it’s like 60 miles). In that nearest town, there are only 2 or 3 the options for pickup are Subway, Denny’s, Panera, a diner, and an absolutely awful pizzeria in a town with at least a dozen pizzerias. The only of those that we’ve used (after trying the pizzeria one time and finding that it held true to its rep) is Panera. Delivery adds McDonald’s, KFC, Burger King, Five Guys, Applebee’s, and Dunkin Donuts. Out of those, the only that we have/would use is Five Guys, but that also adds the inconvenience of having to order delivery to the Five Guys parking lot and sitting there waiting for a driver to walk out with our food to stop them and explain that yes we really ordered delivery to the parking lot rather than walking in to pick up the order or having them bring it out curbside because we have credit card credits that only cover delivery at this place. It ends up being an effort to use the credit either way because the times when we’re in that town and needing a meal, there are options we far prefer over Panera or Five Guys, so we have to happen to be in the town and need a meal and not want something other than Panera or Five Guys. The stars just don’t always align on that. I’ve sometimes ordered delivery for friends in other cities to use up the credits, and that’s kind of nice.

When we travel, the Uber credits are way more appealing because there is almost always a time when we’re arriving late at a hotel or something and could use a meal delivered to us and obviously most cities have far more options (we’re just not into most fast food).

So that’s what I mean when I say that the credits haven’t been very useful for me, but now that we’re traveling more they are becoming more useful.

Makes sense. I’m based in NYC but I get travel perks are always YMMV.

Hi Nick. My local Uber Eats options are better than yours, but not by much! Is it possible for one order to apply multiple Amex credits (2 Plats, 2 Golds)? I thought I tried that before and it failed. Thanks!

The amex Uber credit is essentially just a type of Uber cash that gets used first by default. If you had $40/mo and placed an order > $40 it’d use the full credit. No need to do anything special other than link your cards by adding them as payment methods.

That said AFAIK cards need to be linked to an Uber account with the same name. If P1 & P2 you can’t combine credits.

I’ve had no trouble adding P2 cards to my Uber account so that all of the credits are in one account.

Same experience as Greg.

This is exciting news! I’ll try linking my P1 & P2 cards to the same Uber account.

@Nick Reyes – any luck in your efforts to get AmEx to match your 60k schwab card to the newer offer?

[…] rumors were true, the new annual fee on the premium Platinum card is now up to $695! Catch up on all the latest with it in this post: New 125K + 10x Platinum live: Disappointing restric…. There are higher public offers too. Update: The changes and links and posts about the Platinum […]

Is there an ultra amex coming out?

I mean, Amex already has that: the Centurion card.

Does anyone know if the CLEAR benefit will trigger if signing up through Delta SkyMiles at the $119 discounted price?

Since the benefit just started today, it is impossible for anyone to know for sure yet. but we expect that will work (and you could then add a family member for $50 more I believe).

Thank you. I’ll probably give it a try and report back if I don’t see others posting about it first.

Nick, I applied and was approved for the Schwab version on the 30th. My terms had the old language, but I got the Amex popup. I’m cashing out a fair amount of MR, so I accepted anyway. Have you heard of anyone receiving a bonus after seeing the popup?

I hit things a bit harder in the past, but my last Amex was at the end of 2018 and I just dipped below 5/24 earlier this year. I do have recurring spend on at least one card with them monthly. I’m doubtful myself, but I’d like to hear your thoughts.

I was in the same situation when the rumors came out and went ahead. Shocknigly the bonus tracker showed up, I confirmed terms via chat, screenshoted, and went for it. Points awarded before statement close. YMMV of course. Very unexpected.

Delete this post

Even though I opened this card two weeks ago with a 75k SUB, I’m not that mad about the 125k/100k SUBs being offered now; that’s just how the cookie crumbles some times. But that 15x multiplier on restaurants is insane. I asked the Amex chat if I could get that, and was shot down (unsurprisingly). I’m curious if anyone else can get it added on.

As to the rest of the changes, I’m not sure how to feel. CLEAR, Peacock, and NYT are all things I use anyway, so I guess it’s a push. We’ll see how I feel next year.

For those of us who have multiple platinum cards but don’t plan on keeping them, I wonder if you can prepay for future years of CLEAR. Probably asking too much, but I might try exploring this.

Plats are now a joke – about 1% may get value from them now. Easy to finally cut the cord. Good riddance.

Ate existing cardholders getting the benefits?

Yes. See my response to the same question above in the comments.

Curious if anyone who signed up for Schwab version over the last few days will have any luck matching to the higher offer. Mixed thoughts elsewhere on internet regarding amex matching offers but obviously no data points on this specific issue yet. I will probably attempt it in a few days via a chat with amex, but at this point I will just consider myself lucky to get a bonus at all with the new restrictions on versions of the platinum. Any insight others have or data points would be useful. Will post my results when I attempt as well.

The first person I chatted with around 4:30am said that someone would get back to me. The second person I chatted with during business hours shot me down cold-hearted and flat in a “nah, we don’t ever do that” sorta way, which isn’t true as I believe I recall some folks actually getting matched to the 75K + 10x offer back in November.

Any luck getting a match to the new schwab offer?

Anyone know how Cafe purchases at Equinox locations code ? I’m not a member, but they do sell food in the cafe at the gym entrance. Might be worth to to see if it triggers a credit.