| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

When it comes to bank account bonuses, Chase is one of our bestest buddies around, running frequent incentives on both the personal and business side.

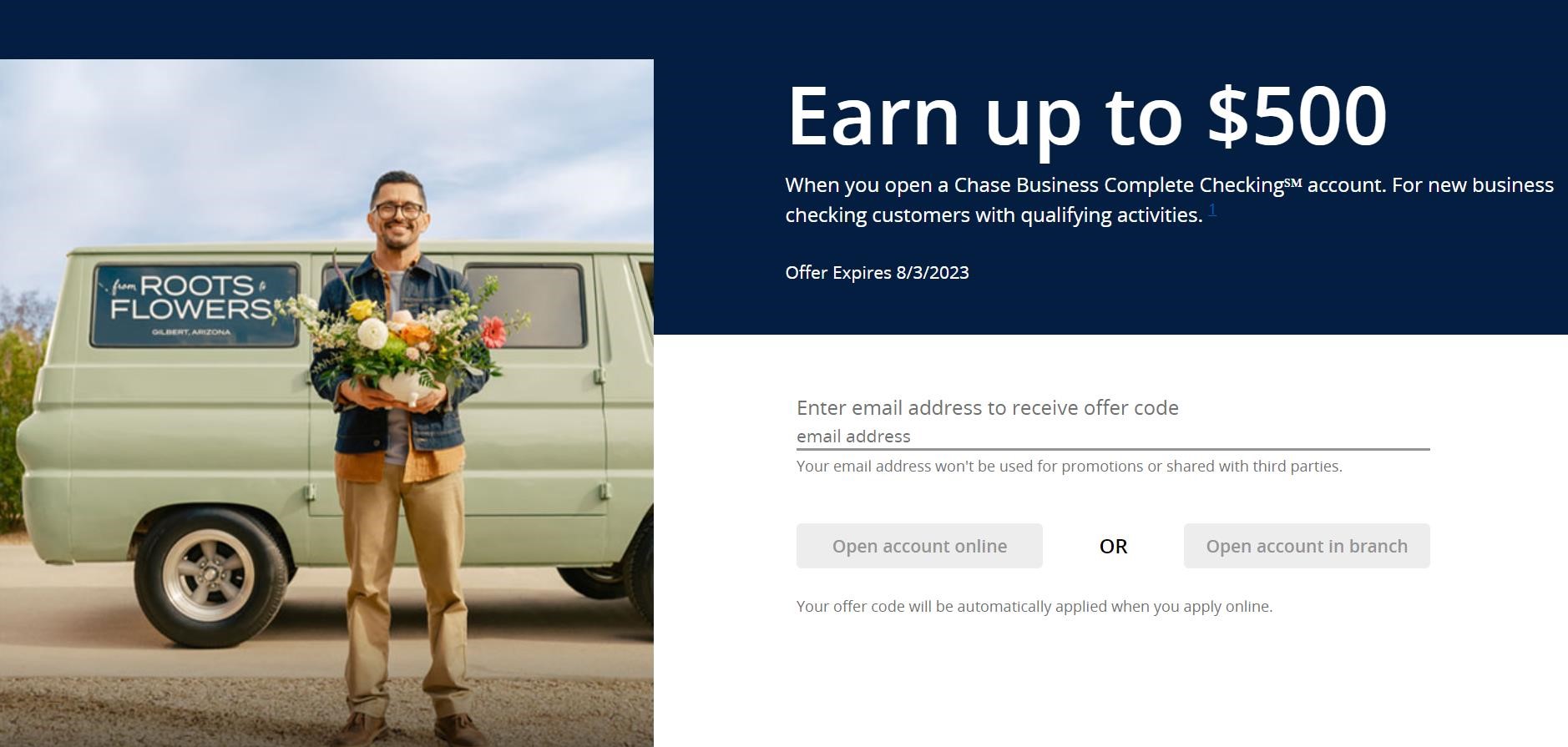

Today, Chase launched a (widely-reported) offer for new Business Checking enrollments. There is one link for a $300 bonus on total deposits of $2000-$14999 or a $750 bonus for $30K+. There is also a second offer link for a $500 bonus on $15k+ in total deposits.

The noteworthy part of this offer is that it is fairly easy: no direct deposit requirement and a very low activity threshold. But the trade-off is that the deposit requirements are a bit high. So should we do it?

The Deal

- Chase is offering the following bonuses after opening a new business checking account and making qualified total deposits of:

- Offer Expires: 8/3/23

- In order to apply in branch, you must first get an offer code from the links above.

- For online applications, offer code applies automatically.

To receive the business checking bonus:

- Open a new Chase Business Complete Checking account online or present this offer at your local Chase branch.

- Deposit new money into your checking account within 30 days of offer enrollment and maintain this balance for 60 days from offer enrollment. The new money cannot be funds held by your business at Chase or its affiliates. Business checking bonus and new money requirements are as follows:

|

- Complete 5 qualifying transactions within 90 days of offer enrollment. Qualifying transactions include debit card purchases, accepting credit and debit card payments with QuickAccept℠, Chase QuickDeposit℠, Footnote2Opens overlay ACH (Credits), wires (credits and debits), Chase Online℠ Bill Pay.

- After you have completed all the above checking requirements, we’ll deposit the bonus into your new account within 15 days. Offer is good for one-time use.

Key Terms and Conditions

- Checking offer is not available to existing Chase business checking customers, local, state or federal government entities or agencies, Not for Profit organizations, Political Action Committees, or those with campaign accounts, or whose accounts have been closed within 90 days or closed with a negative balance within the last 3 years.

- You can receive only one new business checking account opening related bonus every two years from the last enrollment date and only one bonus per account.

- If the checking account is closed by the customer or Chase within six months after offer enrollment, we will deduct the bonus amount for that account at closing.

- There is a $15 Monthly Service Fee (MSF) that we’ll waive if you meet any of the below qualifying activities for each Chase Business Complete Checking℠ account in a monthly statement period. Qualifying activities for how to avoid the MSF: (A) Maintain a linked Chase Private Client Checking℠ account, (B) Meet Chase Military Banking requirements, or (C) Fulfill at least one of the following qualifying activities: (1) Maintain a Minimum Daily Ending Balance of at least $2,000 in the Chase Business Complete Checking account each business day during the monthly statement period, excluding the last business day of the statement period; (2) Have at least $2,000 of aggregate eligible deposits (net of chargebacks, refunds, or other adjustments) into the Chase Business Complete Checking account, at least one day before the end of the monthly statement period, using one or more of the following: Chase QuickAccept℠ including Chase Smart Terminal℠, InstaMed Patient Payments and InstaMed Patient Portal and/or other eligible Chase Payment Solutions℠ products. Eligible deposits must be made from Chase Payment Solutions associated with the same business as your Chase Business Complete Checking account, as reflected in Chase records. The cutoff time for eligible deposits is 11:59 PM Eastern Time one day prior to the last day of your Chase Business Complete Checking monthly statement period; or (3) Spend at least $2,000 on eligible Chase Ink® Business card purchases in the most recent monthly Ink card billing cycle, which may be different than your Chase Business Complete Checking monthly statement period. Eligible purchases must be made using Ink Business Card(s) associated with the same business as your Chase Business Complete Checking account, as reflected in Chase records, and must earn Chase Ultimate Rewards® points.

Quick Thoughts

Based on how I read the terms, you only have to leave the money in the bank for 35 days or so to get the bonus. This is because you have to deposit within 30 days and leave it for 60 days…both dated from enrollment. So, you could transfer the money in at day 25 or so and then transfer it back out at day 61 and still meet the terms. It’s also worth noting that sole proprietorships under an individual’s SSN are eligble as well.

The targeted $750 is ok, but not as good as the $750 Business Checking offer that we saw at the end of 2021. That one offered $750 for maintaining a $10,000 balance for 2 months and completing 25 qualifying transactions. While the transaction threshold for this new offer is only 5, the balance necessary to get to the $750 bonus is tripled to $30,000.

The main public offer of $300 for a $2000 deposit or $500 for $15,000 is decent. The $300/$2000 bonus effectively gives you 15% back for parking your $2k in Chase’s hands for 30-60 days. By the same rationale, the $500/$15,000 bonus is paying 3.33% during the same period, the $750/$30,000 bonus, 2.5%.

The nice thing about this set of offers is that it’s about as easy as a bank account bonus can be: no direct deposit requirement, only 5 transactions on the debit card to make it work and you can stay fee-free for six months by leaving the $2k in the account or by spending $2k/month on an associated Ink Card (which is no issue for many of us)…AND you can sign-up online.

I’m tempted to take the plunge on one of these bonuses in the next week or two. I’m not expecting that $750/$10k bonus to return and I don’t have a business checking account in the last 24 months associated with any of my Ink Cards. In my opinion, this is worth taking a look at, especially those wanting to easily dip their toes into the bank account bonus pool.

If I have multiple businesses with ink cards through chase, am I able to get this bonus more than once by applying under a 2nd business?

It should be noted that it seems that it is nearly impossible to open these accounts online. Plenty of DP over at DOC, application errors out saying they can’t open this type of account online.

I had the same problem. Sole Prop with 2x Ink cards. Had a mailer that was same bonus but only required $20k that expired yesterday. Still same error. Got new mailer in the mail last night for new offer with $30k requirement. Tried it too and got the same error.

If anybody is able to open online, I’d love to know which combination of business structure / business type is the key.

Last time I went to branch to open. The banker wanted business license. I had it from the County. She opened it with no problem. It’s quick and easy to do it at branch.

I have done it online

Same Here

Can’t open online…

Every time I try to apply online as a sole proprietor it gives me an error. Any suggestions other then going into a chase?

I’m thinking about taking advantage of this. Just got a Ink Unlimited card in March. I can hit 2k spend with it pretty easily. Clarification: if I wait until day 25 or so to deposit the 2k, does the 2k in spend on the Ink card have to be in the SAME month, or the month following?

[…] 【2022.4 更新】新的开户奖励是 $300/$500/$750。HT: FM. […]

That’s the big catch. You cannot be a current client.

Only if you’ve received a checking account bonus in the last 24 months. Otherwise, you’re fine (although some folks with multiple “businesses” may need to apply in branch, unfortunately.

24 months up in July, if I close my account tomorrow 90 days = August 3, pushing the limits?

thx, thx for the article… how to know for sure if u r targetted easily? I have tried about 3 times and I always go til the last window to then receive an error, I m already a biz chase customer but only CC holder, never ever a biz account w them…

Do you have more than one official business name that you’re a cardholder for? I got the same error message, from what I understand, the system can’t figure out how to match the multiple “businesses” with checking account history, so you get the “have to go in branch” error.

I’m going to have to apply in branch myself.

Took advantage of their 750 deal last summer so I’m out on this unfortunately. I didn’t see you guys post anything on the Wells Fargo $1500 deal and I was surprised. I wondered if you were holding off to not kill it too quickly

Whoa! Sure wish I had known about that one!

What Wells Fargo deal? Is it still on?