The Chase Ink Business Cash® card is a mainstay in the FM Team’s wallets, primarily due to its ability to earn 5x Ultimate Rewards points on up to $25,000 in annual purchases at office stores and cellular/landline/cable providers.

Although the limit resets every year on the card anniversary, it’s still been fairly easy to track because Chase provided a summary of your activity from your last card anniversary. So you’d see something like, “Since your June ’25 statement cycle.” Once that graph reset, you knew that you were in your new cardmember year.

However, Chase recently changed how it displays your yearly earnings. Now, instead of tracking it by cardmember year, it’s tracking by calendar year, as shown below:

![]()

Now, every Ink Cash card we have lists the same “Since Jan 2026 statement cycle.” That’s led many cardholders to assume that the $25k annual limit now applies to the calendar year.

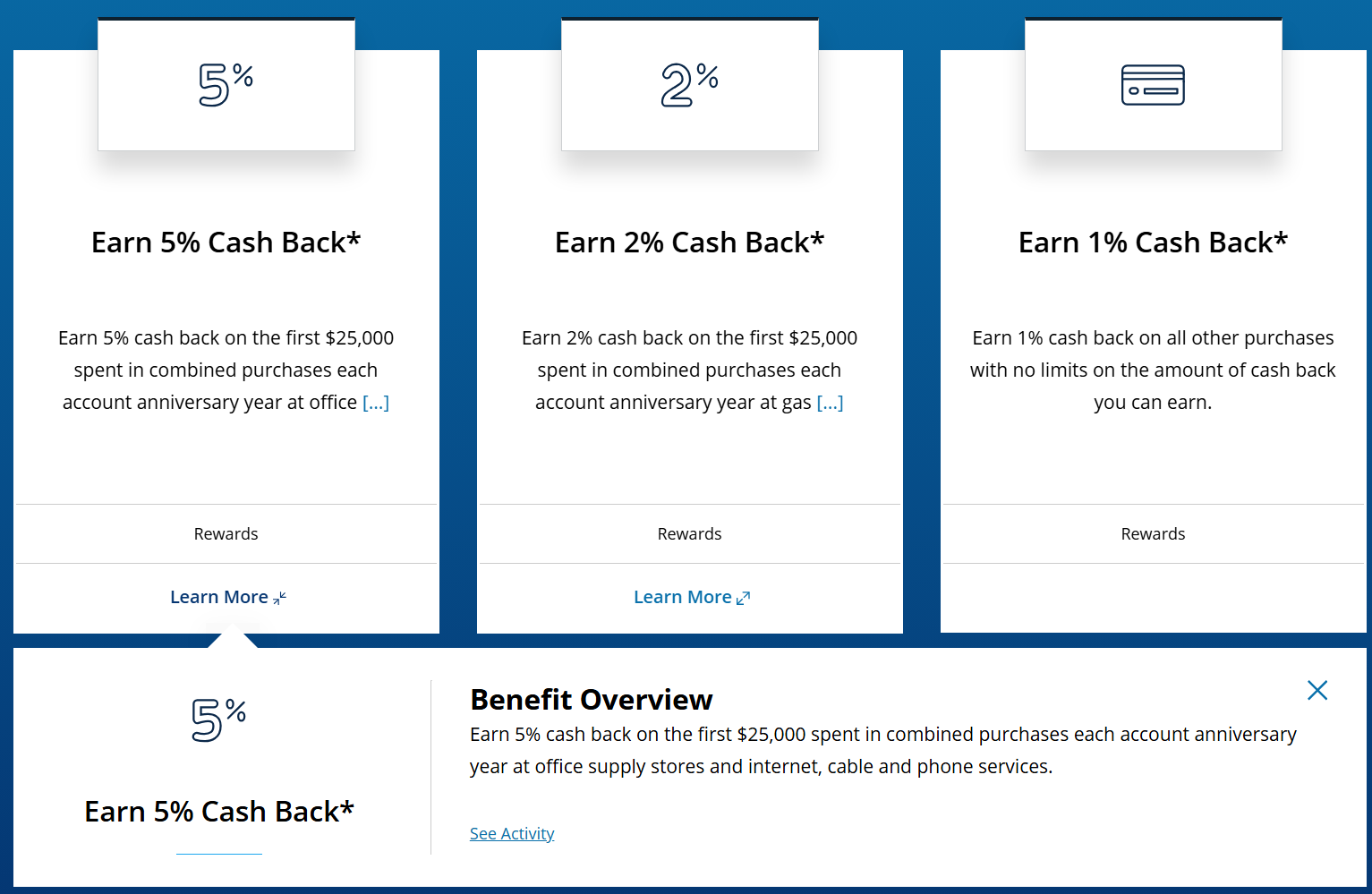

That is not the case…at least not yet. Chase still defines the $25k limit by cardmember year, NOT calendar year. This is shown in the app:

As well as on the card benefits page:

Quick Thoughts

We have no idea whether Chase intends to change the $25k maximum on 5x rewards to a calendar-year limit, but it hasn’t done so yet. It has, however, changed the way it tracks what you’ve spent. We also don’t know whether that’s a temporary glitch or a permanent change.

That’s incredibly unfortunate, as most cardholders are used to seeing where they stand relative to their limit in the rewards tracker. Now that it shows the calendar year, it’s no longer a reliable indicator of where you actually are, which will undoubtedly lead many people to put some spend on the card, assuming they’re earning 5x, when in reality they’ll only earn one point per dollar.

Hopefully, Chase clarifies this soon. In the meantime, if you usually max out your $25k of yearly 5x spend, it behooves you to track it manually to avoid disappointment at the end of the year.

I’m going through withdrawal on Visa or MC gift cards from Staples since I blew through my inventory a week ago. They haven’t been in sale the last 2 weeks. I got spoiled with them having either Visa or MC on sale at least every other week. I’m thinking they have to put one of them back on sale this Sunday.

real first world problem for me since 25000 isn’t easily divisible by 1800 or 593.85

I just secured messaged Chase to see exactly when my card anniversary is for that exact reason. Either way, I always spend exactly $2,100.00 per month on it which is $200.00 over the max, but whatever. At least I know I am getting 125,200 points per year from it. Better than a sign up bonus for very organic yearly spend I have to do either way.

Seems like this would be a target rich environment for MaxRewards or similar app to handle. There’s lots of cards with similar kinds of targets, like the Custom Cash for $500, or spend targets for rewards the annual Hilton Surpass $15K for the FNR, Atmos Summit for the 100K global companion pass, etc.

Good luck even finding the transfer to partners link on the portal – they hide it. Chase knows exactly what it is doing.