Marriott has several different credit cards across two different issuers, some of which can be very attractive. You might be considering signing up for a new card, but if you’ve ever signed up for any Marriott card in the past, chances are very good that you are blisteringly baffled by Bonvoy’s byzantine card bonus rules. Are you eligible for a new card bonus? The answer depends upon which cards you have now, which you’ve had before, when you signed up, when you canceled, and the color of the moon.

What follows is my best attempt to simplify the rules…

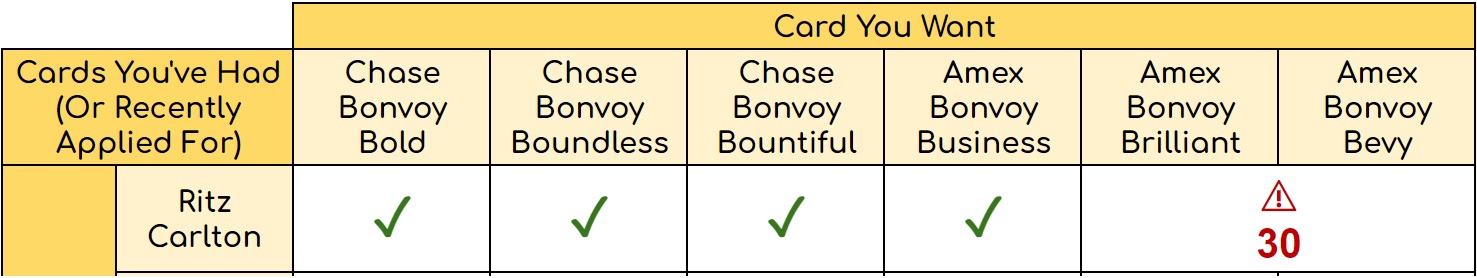

All-in-one Eligibility Matrix

This display visually shows the rules as I understand them:

| Card You Want | |||||||

| Cards You've Had (Or Recently Applied For) | Chase Bonvoy Bold | Chase Bonvoy Boundless | Chase Bonvoy Bountiful | Amex Bonvoy Business | Amex Bonvoy Brilliant | Amex Bonvoy Bevy | |

| Chase | Ritz Carlton | ✅ | ✅ | ✅ | ✅ | ⚠30 | |

| Bonvoy ($45 card) | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | |

| Bonvoy Premier | ⚠24 | ✅ | ✅ | ✅ | ✅ | ||

| Bonvoy Bold | ✅ | ⚠90 ⚠24 | ⚠30 ⚠90 ⚠24 | ||||

| Bonvoy Boundless | ✅ | ||||||

| Bonvoy Bountiful | ✅ | ✅ | ⚠24 | ||||

| Bonvoy Business ($45 card) | ✅ | ✅ | ✅ | ⚠30 | ✅ | ✅ | |

| Bonvoy Premier Plus Business | ✅ | ✅ | ✅ | ⚠90 ⚠24 | ⚠30 | ||

| Amex | Bonvoy | ⚠30 | ⚠30 ⚠90 ⚠24 | ✅ | ✅ | ✅ | |

| Bonvoy Business | ⚠90 ⚠24 | ⛔ | ✅ | ✅ | |||

| Bonvoy Bevy | ✅ | ✅ | ⛔ | ||||

| Bonvoy Brilliant | ✅ | ⛔ | ⛔ | ||||

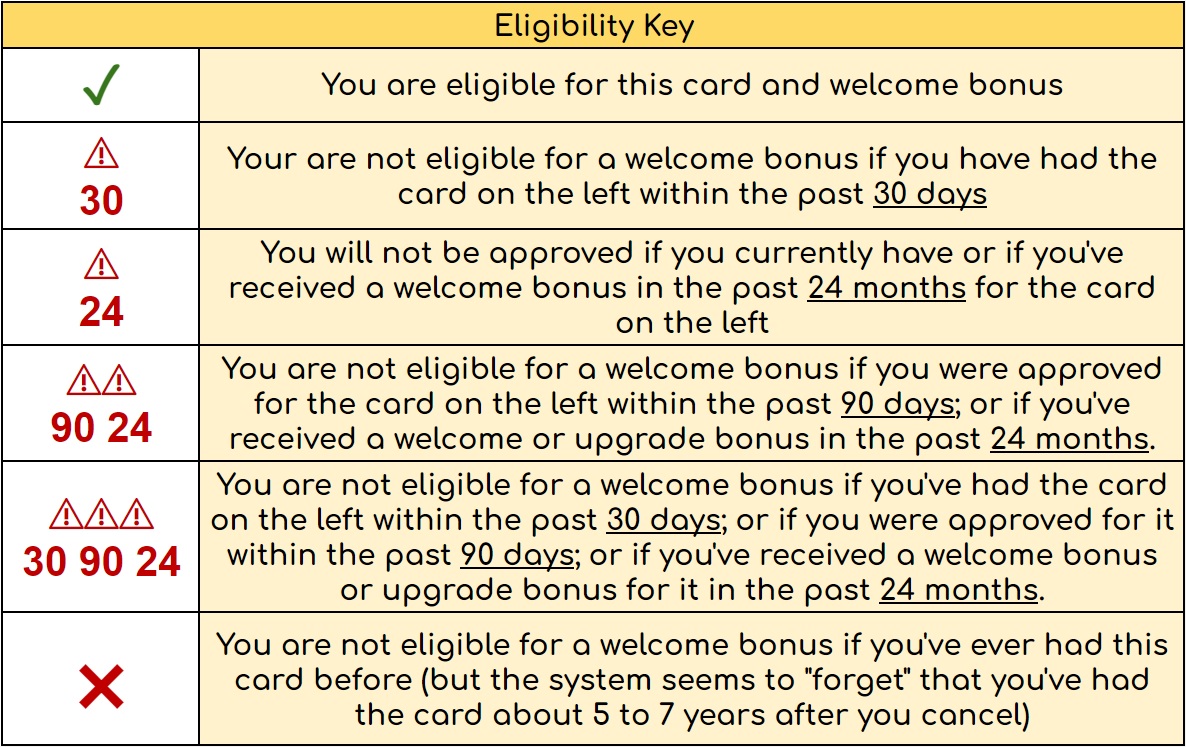

| Eligibility Key | |

| ✅ | You are eligible for this card and welcome bonus |

| ⚠30 | Your are not eligible for a welcome bonus if you have had the card on the left within the past 30 days |

| ⚠24 | You will not be approved if you currently have or if you've received a welcome bonus in the past 24 months for the card on the left |

| ⚠90 ⚠24 | You are not eligible for a welcome bonus if you were approved for the card on the left within the past 90 days; or if you've received a welcome or upgrade bonus in the past 24 months. |

| ⚠30 ⚠90 ⚠24 | You are not eligible for a welcome bonus if you've had the card on the left within the past 30 days; or if you were approved for it within the past 90 days; or if you've received a welcome bonus or upgrade bonus for it in the past 24 months. |

| ⛔ | You are not eligible for a welcome bonus if you've ever had this card before (but the system seems to "forget" that you've had the card about 5 to 7 years after you cancel) |

Hoping to get a Chase Marriott card?

Here are the currently available Chase Marriott cards:

| Card Name w Details & Review (no offer) |

|---|

$95 Annual Fee Earning rate: ✦ 6X Marriott Bonvoy ✦ 3X gas stations, grocery stores, and dining on up to $6K in combined purchases each year ✦ 2X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn Gold status when you spend $35K each year ✦ 1 Elite Night Credit towards elite status for every $5K spent Noteworthy perks: ✦ Annual free night certificate for 1 night at a hotel redemption level up to 35K ✦ Automatic Silver status ✦ 15 nights of elite credit each year ✦ 1 Elite Night Credit for every $5K spent See also: Marriott Bonvoy Complete Guide |

FM Mini Review: The best use for this card is probably to downgrade from the Ritz or Boundless card to avoid the annual fee. That way, you can always upgrade again when you need the annual free night or other perks No Annual Fee Earning rate: ✦ 3X Marriott Bonvoy ✦ 2X grocery stores, rideshare, select food delivery, select streaming, and internet, cable and phone services ✦ 1X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Automatic Silver status ✦ 5 nights of elite credit each year See also: Marriott Bonvoy Complete Guide |

$250 Annual Fee Earning rate: 6X Marriott.✦ 4X restaurants & grocery on up to $15K spend per year ✦ 2X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: One 50K Free Night Award after $15K calendar year spend. Noteworthy perks: 15 night credit towards elite status every year upon account anniversary ✦ 1,000 bonus points with each qualifying stay ✦ Gold elite status See also: Marriott Bonvoy Complete Guide |

In order to get accepted to any of the Chase cards, you must not only satisfy the Marriott specific rules shown in the chart near the top of this post, but you must also be under 5/24:

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

Hoping to get an Amex Marriott card?

Here are the currently available Amex Marriott cards:

| Card Name w Details & Review (no offer) |

|---|

$125 Annual Fee Earning rate: 6x at Marriott Bonvoy properties ✦ 4x at restaurants worldwide, U.S. gas stations, wireless telephone services purchased from U.S. suppliers and on U.S. purchases for shipping ✦ 2x on all other eligible purchases. Terms Apply. (Rates & Fees) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn an additional 35k free night certificate (can be topped-up with up to 15k additional points, subject to resort fees) after you spend $60K on purchases in a calendar year Noteworthy perks: Complimentary Marriott Gold elite status ✦ 15 Elite Night Credits each calendar year ✦ 35k Free Night Award every year after card renewal (subject to resort fees) ✦ Complimentary premium Internet access at Marriott properties ✦ Terms Apply (Rates & Fees) See also: Marriott Bonvoy Complete Guide |

$250 Annual Fee Earning rate: 6X Marriott.✦ 4X restaurants & U.S. Supermarkets on up to $15K spend per year ✦ 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: One 50K Free Night Award after $15K calendar year spend on eligible purchases. Noteworthy perks: 15 night credit towards elite status every year upon account anniversary ✦ 1,000 bonus points with each qualifying stay ✦ Gold elite status See also: Marriott Bonvoy Complete Guide |

FM Mini Review: Decent ultra-premium option for Marriott fans, especially those aiming for lifetime status tiers $650 Annual Fee Earning rate: 3X airfare -on flights booked directly with airlines; 3X restaurants worldwide, 6X Marriott; 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Annual Choice Award with $60K calendar year spend Noteworthy perks: ✦ 85K Free Night Award each year upon renewal ✦ $300 dining credit per membership year ($25/mo) ✦ Platinum Elite status ✦ 25 elite nights credit ✦ Priority Pass membership (Lounges only) with 2 guests ✦ Global Entry fee credit ✦ Free premium internet at Marriott properties Note: Enrollment required for some benefits. See also: Marriott Bonvoy Complete Guide |

In order to get accepted to any of the Amex cards, you must not only satisfy the Marriott specific rules shown in the chart near the top of this post, but you must also have fewer than 5 or 6 Amex credit cards:

Real World Example

Let’s take a real world example to show how to use the eligibility matrix above. A reader wrote the following:

My husband and I both have the Marriott Bonvoy boundless cards and got them February 2020 and April 2020. I want to upgrade both of us to the Ritz and it seems like waiting until our anniversary date would be best. I swear I read somewhere that we should get the Marriott amex cards first because we won’t ever be able to get them after that. Is that correct?

Now take a look at the eligibility matrix. If the couple upgrades to the Ritz card, they would suddenly be subject to the 30! warning:

By looking at the eligibility key, you can see what that 30! warning means:

Once the couple has the Ritz card, they won’t be eligible for the two consumer Amex cards. The only way they would become eligible is to cancel or downgrade the Ritz card and wait 30 days.

So, should they sign up for one of the Amex cards first, like the Bonvoy Brilliant? Are they eligible? By looking at Bonvoy Brilliant column under “Card You Want” and then scanning down to the card they have (Bonvoy Boundless), you see the “90 24!!” warning. This couple would not be eligible for the Bonvoy Brilliant card if they were approved in the past 90 days or if they’ve received a welcome bonus in the past 24 months for the Boundless card. They’re probably just past the 24 months, so they’re safe on both scores but it is worth checking their Marriott account history to see when their welcome bonuses posted.

So, short answer: yes this couple could get the welcome bonus for the Bonvoy Brilliant, but only if they sign up for it before upgrading to the Ritz card.

Product Eligibility and Bonus Eligibility Terms

The following terms are copied directly from each Marriott card’s signup page…

Chase Bonvoy Bold

This credit card is not available to you if (1) you currently have any of the following cards or (2) you received a new cardmember bonus for any of the following cards within the last 24 months: Marriott Bonvoy® Premier credit card, Marriott Rewards® Premier credit card, Marriott Bonvoy Boundless® credit card, Marriott Rewards® Premier Plus credit card, Marriott Bonvoy Bold® credit card.

The new cardmember bonus is not available to you if (1) you currently have or had any of the following cards within the last 30 days: Marriott Bonvoy® American Express® Card, The Starwood Preferred Guest® Credit Card from American Express; or if (2) you applied and were approved for any of the following cards within the last 90 days or (3) received a new cardmember bonus or upgrade bonus for any of the following cards within the last 24 months: Marriott Bonvoy Business® American Express® Card, Starwood Preferred Guest® Business Credit Card from American Express, Marriott Bonvoy Brilliant® American Express® Card, Starwood Preferred Guest® American Express Luxury Card, Marriott Bonvoy Bevy™ American Express® Card.

Chase Bonvoy Boundless

This credit card is not available to you if (1) you currently have any of the following cards or (2) you received a new cardmember bonus for any of the following cards within the last 24 months: Marriott Bonvoy® Premier credit card, Marriott Rewards® Premier credit card, Marriott Bonvoy Boundless® credit card, Marriott Rewards® Premier Plus credit card, Marriott Bonvoy Bold® credit card.

The new cardmember bonus is not available to you if (1) you currently have or had any of the following cards within the last 30 days: Marriott Bonvoy® American Express® Card, The Starwood Preferred Guest® Credit Card from American Express; or if (2) you applied and were approved for any of the following cards within the last 90 days or (3) received a new cardmember bonus or upgrade bonus for any of the following cards within the last 24 months: Marriott Bonvoy Business® American Express® Card, Starwood Preferred Guest® Business Credit Card from American Express, Marriott Bonvoy Brilliant® American Express® Card, Starwood Preferred Guest® American Express Luxury Card, Marriott Bonvoy Bevy™ American Express® Card.

Chase Bonvoy Bountiful

This credit card is not available to you if (1) you currently have this card or (2) you received a new Cardmember bonus for this card within the last 24 months.

The new cardmember bonus is not available to you if (1) you currently have or had any of the following cards within the last 30 days, (2) you applied and were approved for any of the following cards within the last 90 days, or (3) you received a new cardmember bonus or upgrade bonus for any of the following cards within the last 24 months: Marriott Bonvoy® American Express® Card, Starwood Preferred Guest® Credit Card from American Express, Marriott Bonvoy Business® American Express® Card, Starwood Preferred Guest® Business Credit Card from American Express, Marriott Bonvoy Brilliant® American Express® Card, Starwood Preferred Guest® American Express Luxury Card, Marriott Bonvoy Bevy™ American Express® Card.

Amex Bonvoy Business

You may not be eligible to receive a welcome offer if you have or have had this Card or the Starwood Preferred Guest® Business Credit Card from American Express or previous versions of these Cards. You also may not be eligible to receive a welcome offer based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for a welcome offer, we will notify you prior to processing your application so you have the option to withdraw your application.

Welcome offer not available to applicants who (i) have or have had the Marriott Bonvoy® Premier Plus Business Credit Card from Chase, the Marriott Rewards® Premier Plus Business Credit Card from Chase, the Marriott Bonvoy Business® Credit Card from Chase, or the Marriott Rewards® Business Credit Card from Chase in the last 30 days, (ii) have acquired the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, the Marriott Bonvoy Bold® Credit Card from Chase, in the last 90 days, or (iii) received a new Card Member bonus offer in the last 24 months on the Marriott Bonvoy Bountiful™ Credit Card from Chase, Marriott Bonvoy Boundless® Credit Card from Chase, or the Marriott Bonvoy Bold® Credit Card from Chase.

Amex Bonvoy Brilliant

You may not be eligible to receive a welcome offer if you have or have had this Card or the Starwood Preferred Guest® American Express Luxury Card or previous versions of these Cards. You also may not be eligible to receive a welcome offer based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for a welcome offer, we will notify you prior to processing your application so you have the option to withdraw your application.

Welcome offer not available to applicants who (i) have or have had The Ritz-Carlton® Credit Card from JPMorgan or the J.P. Morgan Ritz-Carlton Rewards® Credit Card in the last 30 days, (ii) have acquired the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, or the Marriott Bonvoy Bold® Credit Card from Chase in the last 90 days, or (iii) received a new Card Member bonus or upgrade offer for the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, or the Marriott Bonvoy Bold® Credit Card from Chase in the last 24 months.

Amex Bonvoy Bevy

(new language in bold)

You may not be eligible to receive a welcome offer if you have or have had this Card, the Marriott Bonvoy Brilliant® American Express® Card or previous versions of these Cards. You also may not be eligible to receive a welcome offer based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for a welcome offer, we will notify you prior to processing your application so you have the option to withdraw your application.

Welcome offer not available to applicants who (i) have or have had The Ritz-Carlton® Credit Card from J.P. Morgan, the J.P. Morgan Ritz-Carlton Rewards® Credit Card, the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, the Marriott Rewards® Premier Plus Credit Card from Chase, the Marriott Bonvoy® Premier Credit Card from Chase, the Marriott Rewards® Premier Credit Card from Chase, the Marriott Bonvoy® Credit Card from Chase, the Marriott Rewards® Credit Card from Chase, the Marriott Bonvoy Bold® Credit Card from Chase, the Marriott Bonvoy® Premier Plus Business Credit Card from Chase, the Marriott Rewards® Premier Plus Business Credit Card from Chase, the Marriott Bonvoy Business® Credit Card from Chase, or the Marriott Rewards Business® Credit Card from Chase in the last 30 days, (ii) have acquired the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, the Marriott Bonvoy Bold® Credit Card from Chase in the last 90 days, or (iii) received a new Card Member bonus or upgrade offer for the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, or the Marriott Bonvoy Bold® Credit Card from Chase in the last 24 months.

[…] of each other. Just piling on to the never-ending points and miles rules to learn – this article is […]

I have the Chase Bonvoy Boundless opened June 5th 2022, met SUB requirements first statement closing July 4th 2022. I want the Amex Bonvoy Business next month at the 24 month mark, but am unclear from the chart more precisely when I would be eligible?

[…] cards are available from both Amex and Chase. There are a maze of rules associated with Marriott cards that you need to follow to maximize how you qualify. In general, […]

I am pretty sure I qualify for the bonus and bonvoy boundless since. I have the brilliant but the bonus came over 24 months ago. Am I correct in this?

Looking for data points from more than one person regarding reapplying for the Chase Marriott Bonvoy recently closed but more than 3 years since bonus, the 5 night offer ends March 27, closed on March 9 th but credit report doesn’t show as closed , only on my Chase account.

Does a retention bonus count as a welcome bonus ?? I got an Amex marriott business card retention bonus less than 24 months ago and wondering if that will bar me from getting a Chase marriott card.

Has anyone figured out how many bonus elite nights you can accumulate? is it 30 or 45?

For ex I have the amex bonvoy classic, the amex business so 30 nights.

If I get the bevy, will I get 45 nights total?

Thanks!

40 total is max

Bonvoy Brilliant: 25 +

Bonvoy Business: 15

If I downgrade RC to Boundless, wait for 30 days, will I be eligible for the Brilliant? The part of the chart that’s unclear is if the Boundless is considered “approved in the last 90 days.” I don’t have any other bonvoy card and never had the Brilliant. Thanks!

[…] Frequent Miler has an extremely useful table to help determine if you are eligible for a certain card based on your past/current cards. You can find that here: Are You Eligible for a New Marriott Card? […]

[…] is available HERE if you decide to apply, thank you. Hopefully, you are eligible for it, here is a link that explains the ridiculous restrictions imposed on us credit card applicants free loaders staying […]

[…] down/ShowMoreCards, voila. Hopefully, you are eligible for it, here is a link that explains the ridiculous restrictions imposed on us credit card applicants free loaders staying […]

Has anybody applied for both the Chase and the Amex Marriott cards and received the bonus for both ?

Today I called the Chase Ritz-Carlton number, (855) 896-2222, and they confirmed I can product change my second Marriott Bonvoy Boundless card so I can have 2 R-C cards. I share this in hopes points and miles gurus share information like this, that I have never read on any blog or heard on any Youtube channel. I depend mainly on calling the lender and find too many guru sites just repeat the same information. My wife will be doing the same. I have heard of having 4 AX Hilton Aspire cards but never 4 Chase R-C cards. I prefer R-C.

Am I correct in assuming that the only way to get 2 bonuses within 24 months (assuming no popup or other bonus within 24 months) is with the amex business and one of the personal amex cards?

I think so

Gentle correction: “but you must also have fewer than 5 or 6 Amex credit cards:” should be “Amex personal credit cards”.

Until recently I had 9 different AX business credit cards. 7 different AX phone reps have reconfirmed: AX has no set limit on the number of business credit cards they will issue to an individual. AX has offered me a 2nd and sometimes 3rd SUB on the open BIZ cards I already have (Hilton, Marriott, BBC, BBP, etc.). All of these were Sole Prop with my SSN.

That’s not correct. Amex counts all of your credit cards together: business and consumer, but for the 5 or 6 card limit they don’t count charge cards like the Platinum and Gold personal and business cards. So, my bet is that the Amex business cards you’ve been able to get have all been charge cards (also known as “pay over time” cards).

Call AX Business (800) 492-3344 instead of betting me. “5 or 6 card limit” is misinformation repeated by those “points and miles gurus” who copy and paste from each other instead of contacting the lender. I have 2 BBP, 2 BBC, 2 Hilton Business, 2 Marriott Business, for a total of 8 non-hybrid (what you called “charge”) cards. The Business Green is my only Business card matching your description. I did not count Platinum or Gold cards, whether personal or business. Again: “7 different AX phone reps have reconfirmed: AX has no set limit on the number of business credit cards they will issue to an individual.”

Are all of these business cards for the same business or different businesses? (I see you mentioned sole prop with SSN)

These are all sole prop under 1 SSN.

Well that doesn’t jive with my experience. I currently hold 3 personal amex cards and 2 business credit cards from amex under their respective business EIN’s and they have told me on 4 recent applications over the last 2 years that I have the maximum number of credit card products offered. None of these cards are charge cards.

So not sure how to reconcile your post with personal experience or the numerous other people on flyertalk who have also reported being declined after holding a total of 5 personal and business cards.

Call AX Business (800) 492-3344

Why do people settle for copying and pasting from others instead of directly contacting the lender?

I opened my first BBP on 8/8/2022 and was offered a second BBP on 10/11/2022. I take the offers I like. I did similarly with my other AX Biz cards.

Please, feel free to limit yourself out of fear of “Once in a Lifetime”, 5/24, “pop-up jail”, etc.

Travel gurus, bloggers, content creators, etc. want referrals, clicks, likes, subscriptions, Patreon, etc. so they have no reason to verify or update information as long as they are reaping benefits.

“flyertalk”, like reddit, is full of the self-impressed, who profess to have mystical insider knowledge.