NOTICE: This post references card features that have changed, expired, or are not currently available

Almost four weeks ago, I wrote about my recent batch of Chase credit card applications. My wife and I applied for a number of Chase cards with the hope of securing 395,000 bonus points. You can read the full details here: Chasing 395,000 points. I don’t have final results yet (still waiting!) but I do have info about application response times, credit inquiry merging, and more…

Applications

I applied for the following card offers:

- Chase Ink Plus: 60,000 bonus points after $5K spend

- Marriott Rewards Premier: 87.5K bonus points after $3K spend plus adding an authorized user

- Marriott Rewards Premier Business: 80K bonus points after $3K spend

And my wife applied for these offers:

- Marriott Rewards Premier: 87.5K bonus points after $3K spend plus adding an authorized user

- Marriott Rewards Premier Business: 80K bonus points after $3K spend

App Status

Here is the current status of each offer:

- My Chase Ink Plus: Still waiting!

- Marriott Rewards Premier: Approved after phone call (as described in previous post), but I still have not received the card. I finally received an email saying that the card is on its way on March 29th. I had applied on March 9th, so it took nearly 3 full weeks for Chase to process the application and get the card in the mail.

- Marriott Rewards Premier Business: 80K bonus points after $3K spend. Approved after phone call (as described in previous post). I received an email on March 11 (just 2 days after applying) saying that the card was on its way. It arrived about 5 days later.

And my wife applied for these offers:

- Marriott Rewards Premier: Approved instantly. 87.5K bonus points after $3K spend plus adding an authorized user. This card arrived just a few days after applying. Apparently instant decisions also mean quick delivery!

- Marriott Rewards Premier Business: Still waiting!

It’s hard to believe, but 4 weeks after applying for these cards, I don’t really know much more than I did initially. I had made a decision to wait out the results of two of the applications: my Ink card and my wife’s Marriott business card. Both are still pending a decision.

Check app status online, but not really

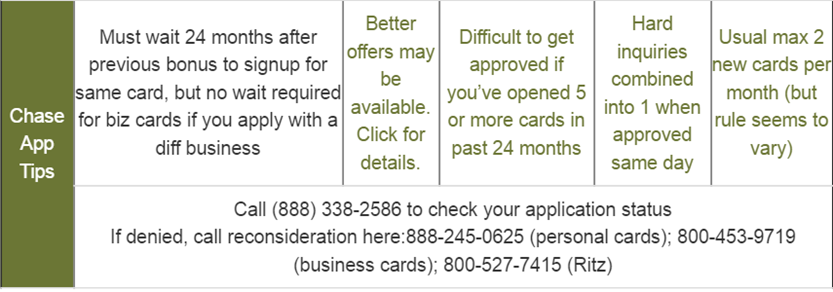

Last year, Julian published a great “Bet You Didn’t Know” post listing how to check your application status with each bank: Bet You Didn’t Know: Online Credit Card Application Status For All Banks. I liked this so much that I incorporated the info directly into my Best Offers page where I list App Tips for each bank.

While most credit card issuers let you check your application status online, Chase makes you call in: 888-338-2586.

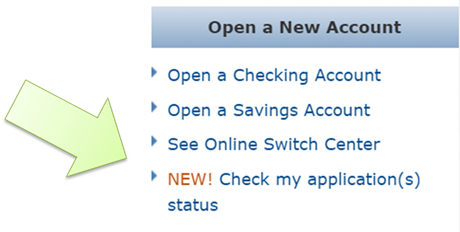

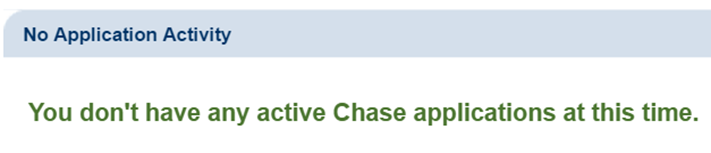

I hate having to call, so I was excited when Dem Flyers published “Check Your Chase Application Status Online!!!” They had noticed that when you log into your Chase account and go to the Customer Center, you may now see a link to check your status, like this:

That’s great! Right? It would be great, except that clicking the link brings you to a message saying that you have no application activity:

I was concerned that Chase had lost my applications so I called to see what was up. The phone rep was able to see my pending applications (at the time: both the Marriott personal card and the Ink Plus card were pending). She told me that they were still processing.

Conclusion: The new option to check application status online only works when you don’t have any applications to check. It’s like a broken clock that is correct twice each day.

Check this broken clock at 4:05 each day

Yes, inquiries combined

After I published “Chasing 395,000 points,” a few people contacted me to ask if my credit inquiries were really combined into one as I expected (since I had applied for multiple Chase cards in one day). They had heard that Chase personal and business application inquiries do not get combined.

I can’t promise that this will hold true for everyone, but in my case (and my wife’s), the answer is yes. The inquiries were combined. However, Chase did pull from two separate credit bureaus: TransUnion and Experian.

Maybe Chase pulled from TransUnion for my personal card application and Experian for my business apps (or vice versa)? That’s possible, but consider this: In January I successfully applied for just one card, Chase Sapphire Preferred, and Chase still pulled from both TransUnion and Experian. And, looking back over my history, I see that Chase has been pulling from both bureaus for at least the past two years. And, each time, no matter how many Chase cards I signed up for in one day, I ended up with just one inquiry on each of the credit bureau reports (TransUnion and Experian).

Please note that credit issuers do not necessarily follow the same process for different people in different locations. Your experience may not match mine.

[…] when Greg the Frequent Miler himself gave it a try, he found the link didn’t report any of his recent Chase credit card applications. As Greg […]

[…] Mixing business and personal applications will result in separate pulls (e.g if you apply for two business cards and one personal, they will pull your credit twice). Update: Recently, a couple reports indicate that business and personal may be combined, including this Freqentmiler report. […]

Where can you see your experian inquiries for free….I think credit karma and sesame both use Trans and Equifax. What are the options to see your Experian besides your one free report per year?

Credit.com, this one uses experian!

Yep, credit.com. See this post for more details: https://frequentmiler.com/2016/03/15/monitor-credit-inquiries-for-free-from-all-three-bureaus/

Please help… I have applied for, and received, almost every card. Now that I have a stack of cards (26 open 36 closed), what is the best strategy for getting more cards. Do I 1) cancel more cards and wait a certain number of months (my average age is 3 years) or 2) apply for more (duplicate) cards and explain that I just needed more cards (that I never use anyway), or 3) some in-between method that I’m not thinking of. I’ve accumulated 3 million points so far, but that seems low compared to what I read.

Thanks for any advice.

Wife and I have earned and redeemed millions of points over the years, but at no time did we have millions of points stashed. We keep using them. I hope you’ve been able to redeem some of those millions and have some fun. Time to enjoy. 🙂

Averaging 1 million points per year isn’t low at all!

If you don’t need a lot more points, then I’d recommend slowing down. Wait for the truly great offers that you might qualify for and sign up for those. If you do need more points, make sure to pay attention to each bank’s rules (such as waiting 24 months after getting a bonus with Chase before applying again).

It’s been a while, but I think it took 6-7 weeks for my SO to get his Ink card when he applied. We followed the do not call rule, and it was ev-en-tu-a-lly approved.

I think these companies are getting better at detecting these kinds of efforts to rack up points like this. If they detect multiple new accounts on your credit report they are less likely to issue their rewards cards. This would explain why one went right away for each of you, but subsequent ones didn’t.

Have faith, I applied for CSP and was denied for 5/24 then I applied for Marriott business and personal, and after a few phone calls was approved for both. My wife also got the Marriott business and personal and had to make a few phone calls to get approved…I too noticed the worthless check app link on their site, I also had to call to get the business card added to my online profile. The personal cards seem to get added automatically, but not the business. We wanted to get another pair of IHG cards also, but with 2 recent approvals and April’s rumored restrictions I decided to wait a month and see if they really apply the 5/24 rule to co-branded cards…who started that rumor anyway?

First world problems…. 🙂

I applied for a Hyatt card for me and an IHG card for my husband; both cards went into pending and were eventually approved 3 weeks after the application. It then took Chase another 2 weeks to mail us the cards. By the time we received both of our cards, the first month’s statement had already closed on both cards. The effect of this delay means that we only have 2 months to meet the minimum spend.

Meeting the minimum spend on the card won’t be a problem for us, since it’s only $1K for each card but I just wanted to put the word out there that people need to be mindful of when the clock on the 3-month period actually starts. Don’t make the wrong assumption that the 3-month period starts when you receive the card!

That’s a really good point!

Chase has always pulled 2 bureaus for me….I think it is their normal procedure.

Chase has only pulled from Experian for my wife and me.

Same here. Experian only. Like FM said, it depends on your geographic location (and the type of card).