I was bummed the other day when I logged into my Chase account and saw that my Ultimate Rewards point total had dropped to a meager 100,000 points. In the past, I’ve earned what seemed like an unlimited supply of Ultimate Rewards points through generous signup bonuses, regular introductions of new or altered Chase Ink products, my having multiple businesses (and thus being able to sign up for the same business card multiple times – once for each business), office supply gift card deals and opportunities (in which Ink cards earn 5 points per dollar), and the once very lucrative Ultimate Rewards Mall.

Unfortunately, many of those opportunities have since fallen by the wayside:

- For a few years, the Chase Ink cards changed in fundamental ways several times. First, they changed the rewards structure of the Ink cards to include 5X and 2X categories. Then, they introduced Ink Plus. Then they changed the cards from MasterCard to Visa. With each change, the altered products were considered new products and it was therefore possible to qualify for new signup bonuses even without cancelling the older cards. More recently, though, the product lineup appears to have settled down, and Chase has reduced the number of Ink card options from four to two (they no longer offer Ink Bold or Ink Classic cards – we are now left with only Ink Plus and Ink Cash as options).

- Office supply gift card opportunities are only mostly dead: you can still buy gift cards at office supply stores to earn 5 points per dollar, but the most lucrative options are gone. You can no longer buy Vanilla Reload cards or variable load Visa cards at Office Depot with a credit card. And, Staples has shut down most opportunities to earn portal rewards when buying $200 Visa gift cards online. Fortunately, OfficeMax, Office Depot, and Staples continue to offer occasional deals on Visa or MasterCard gift cards, but these are limited by supply on hand and often restricted in other ways (such as “limit 1 per household”).

- The Ultimate Rewards Mall used to be my go to option for nearly all online purchases. They used to offer 10 bonus points per dollar everyday at Kohls (and it was easy to double dip back then by buying and using gift cards in order to get an effective rate of 20X). They also offered deals almost every month such as 10X at Sears, Office Depot, or even the Apple Store (although, if memory serves, the latter was just a one day deal). And, they used to offer bonus points for a number of travel related options: Expedia, Travelocity, Hotels.com, etc. That was a great way to earn 2X to 5X in addition to the 2X points offered by the Sapphire Preferred card itself for travel bookings. Unfortunately, over time, the best of these opportunities have dropped away. And, as if to underscore the fact that this is no longer the “ultimate” portal, Chase changed its name to “Shop through Chase”.

The reason I was troubled by a 100K balance was that I find that I use Ultimate Rewards points often, and 100K points won’t last long at the rate I’ve been spending them. I use the points most often for Hyatt awards and Amtrak trips. (Note: As of 12/8/15 Ultimate Rewards can no longer be transferred to Amtrak.) Before the United devaluation, I used my points for international first class Star Alliance awards. I’ve also used points to top off my Southwest account when needed.

I don’t use all of the transfer partners… For transfers to Singapore or Virgin Atlantic, if needed, I would use other transferable points. Most likely I would use Citi ThankYou points since I have an extremely healthy balance there. And, I still have plenty of British Airways points from a long ago 36X deal on their shopping portal, but if needed I’d probably pull from my Amex Membership Rewards stash, especially when Amex offers a bonus for transfers to BA (as they did recently). I’ve never used the ability to transfer points to Korean Air, but they do have fantastic award availability so I’d at least like to have that option if the opportunity arises. I’m also intrigued by some great deals on their partner award chart such as 45,000 miles round trip first class to Hawaii.

I also do not plan to ever transfer points to IHG. If needed, IHG points can be bought for less than a penny each simply by booking and then cancelling points & cash stays. Since Ultimate Rewards points are worth a penny each, at a minimum, it would be a waste to transfer them to IHG. Similarly, Marriott and Ritz points (which are really the same thing) are rarely worth much more than a penny each so I don’t expect to transfer points to those programs.

Plan for replenishing

It turns out that I’m not nearly as poor in Ultimate Rewards points as I suggested at the start of this post. Its true that I have only 100,000 points, but my wife has about 315,000. And, I believe she’s willing to share. Still, that’s not enough for comfort for me. One big trip can easily wipe out our entire Ultimate Rewards stash.

Here are my plans for earning more…

Signup Bonuses

The Ink Plus and Sapphire Preferred signup bonuses have similar language on their offer details pages:

Ink Plus:

This new cardmember bonus offer is not available to either (i) current cardmembers of this business credit card, or (ii) previous cardmembers of this business credit card who received a new cardmember bonus for this business credit card within the last 24 months.

Sapphire Preferred:

This new cardmember bonus offer is not available to either (i) current cardmembers of this consumer credit card, or (ii) previous cardmembers of this consumer credit card who received a new cardmember bonus for this consumer credit card within the last 24 months.

The way I read these statements is that I can earn signup bonuses in the future for the same card I’ve already had as long as I first cancel the existing card and wait two years from the time I earned the bonus to signup again. So, it should be possible to get the signup bonuses every two and a quarter years. Between my wife and I, I can stagger the process so that we always have at least one premium card open (for transfers to loyalty programs) and we can average approximately 100,000 points per year in signup bonuses. I could do even more if I continue to signup for Ink cards through multiple businesses.

5X Category Bonuses

Chase Ink cards offer 5 points per dollar for office supply, cellular, landline, and cable purchases. I’ll continue to put all such purchases on an Ink card. Specifically, I plan to signup for the Ink Cash card, which has no annual fee, and use that for all such purchases. While I’ll open and close Ink Plus cards, I’ll keep the Ink Cash card open indefinitely. That way, I can keep my cable and phone bills on autopay without having to update the credit card on file every year.

Between paying regular bills and buying things (such as discounted gift cards, when available) from office supply stores, I will probably generate between $10,000 and $20,000 worth of 5X spend per year. At only $10K, that’s 50,000 points per year. Not bad!

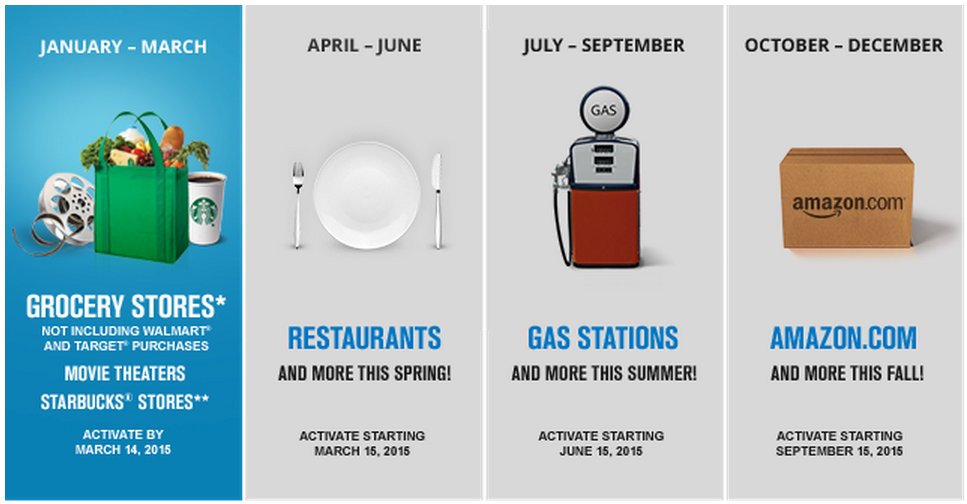

The no annual fee Chase Freedom card also offers 5X categories. With this card, Chase offers different 5X categories every quarter. The 2015 5X calendar is as follows:

Each Freedom card is limited to $1,500 per quarter of 5X spend. So, at most, one Freedom card could generate 30,000 points per year. In reality, though, some categories, like restaurants, would be hard to max out. So, let’s conservatively assume that I would earn half of the maximum: 15,000 points per year.

The way to scale this up is to get more cards. My wife and I each already have one Freedom card each, but we can get more. The trick is that rather than cancelling our Sapphire Preferred cards when we’re done with them, we’ll downgrade to Freedom cards instead. In the near term, that means that we can have a total of four Freedom cards. At 15,000 points earned per year for each card, that comes to 60,000 points per year. And, if we get even more Freedom cards in the future, we’ll be able to do even better.

Summary

The above approach of maximizing sign up bonuses and category bonuses should result in earning at least 210,000 Ultimate Rewards points per year. I was pretty conservative with many of the estimates though, so I think it would be fair to assume that I would do quite a bit better than that. Will it be enough for my travel needs? Yeah, I think so.

[…] Note that it is always possible to earn more points through credit card signup offers. This post is not about that. This post is for those who prefer to get a few cards and stick with them over time. If you’d like to read about how I plan to replenish my Ultimate Rewards stockpile, please see: Chasing Ultimate Rewards. […]

[…] year, I detailed my plan for increasing my Chase Ultimate Rewards point balance. The reason for focusing on Ultimate Rewards? I’m a huge fan of transferable points programs, […]

[…] the March 2015 post “Chasing Ultimate Rewards,” I detailed plans to earn approximately 210,000 Ultimate Rewards points per year without paying […]

[…] The three transferable points programs have a huge amount of overlap, but they’re each strong in different ways. If I had to pick one, I’d say that Chase Ultimate Rewards is the best overall program. This conclusion is partly drawn from the analysis above, and partly from my own experience: even though I have points in all three programs, I find myself using Ultimate Rewards most often (see: Chasing Ultimate Rewards). […]

I just applied for the CSP. I’ve had the Chase Sapphire card for many years and have no intentions of closing it (no annual fee). Can I convert the points from the CSP to CS when I am looking to close this account and reapply?

Yes. Just keep in mind that you have to wait 2 years after the CSP bonus points are earned.

When you say Staples closed the portal rewards, that just means the bonuses through the UR site, right? You’ll still earn the usual 5X points when buying on staples.com using an Ink card, correct?

That’s correct. You’ll still earn 5X when buying stuff (including gift cards) at office supply stores with the Ink cards regardless of whether you go through a portal or not.

[…] Chasing Ultimate Rewards – A strategy for rebuilding a depleted stockpile of Chase Ultimate Rewards points. […]

I was excited to move my cable, cellphone, and landline bills to and Ink Cash card with no annual fee. Unfortunately, they must have changed the rewards recently. They now offer Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on cellular phone, landline, internet and cable TV services each account anniversary year*. This is instead of the 5X points. I’m more interested in Ultimate Rewards points right now.

https://creditcards.chase.com/ink-business-credit-cards/compare-cards?CELL=63WS&IM4R=VK0WN8&jp_ltg=card_topnav

No, they didn’t change anything. The card still earns Ultimate Rewards points. Each point can be redeemed for 1 cent cash back. They just choose to advertise it (and the Freedom card) as a cash back card.

Two questions: when I closed my last Chase Ink Plus account, I let the rep talk me into a downgrade to the cash by mistake. Obviously that means that I didn’t get the 20k sign up bonus. If I cancel it and reapply at some point within the next year, would I still be eligible for the bonus since the language seems to be tied to the date of bonus awarded and I never received one? The second question is about the chase sapphire. I downgraded to a regular sapphire when the fee hit. That should count as a closed account when I reapply for it right? I.E. having a CS open doesn’t affect eligibility for a CSP bonus?

Ink Cash: I think you’re right that you can qualify for the signup bonus as you said, but I don’t have any experience with that so I can’t say for sure.

Sapphire: Yes, I believe that you should qualify for a new Sapphire Preferred since you don’t currently have one open. If you have any doubt, try switching the Sapphire to a Freedom card first.

I am curious about your plan to hold both an Ink Cash and an Ink Plus. You say that you can legitimately claim more than one business. But both my wife and I really only have one business each. Won’t it look a bit odd to Chase if one of us tries to simultaneously hold both an Ink Cash and an Ink Plus if we only have one legit business? How can I justify this to a Chase rep if they ask me on the phone why in the world I want both an Ink Cash and an Ink Plus?

I value my credit relationship with Chase, and I don’t want to bite the hand that feeds me points, so I am usually pretty honest with them. If you only had one legit business, what would you plan to say to them?

In the past, with the same business, I’ve signed up for multiple varieties of Ink cards and was never asked why. That said, if asked, I would simply say that I don’t plan to renew the Ink Plus another year (due to the $95 fee) so I want a fee free version to keep forever.

With all of the above being said, if you downgrade CSP to CF, would you lose the 7% annual dividend accrued since January 1? I’m doubtful it would return with the new CSP.

Yes, I’m sure you’re right that you would lose out on the final year of the 7% annual dividend (for those who got their Sapphire Preferred while that perk was still offered), but unless you earn a huge number of points within that account in 2015, its unlikely to amount to a large number of points. In my case, I have cards that offer better category bonuses than 2X for restaurants and travel, so I haven’t earned many points in that account this year.

Maybe I missed a beat …If restaurants would be hard to max out on one card and you are assuming half the yearly max to compensate for “max out difficulties”…how would four cards provide similar returns.

With categories like grocery stores and gas stations, one can buy Visa gift cards that can be liquidated through a variety of means so I don’t see any practical limit within those categories to how much I can spend to max out the 5X bonus.

any tips for liquidating please?

seems only vanilla GCs are readily available..and cant be used at WM.

thanks

I recently converted my CSP to CS Visa but I’d now like to convert that to a Freedom. I already have a Freedom MC. Does it seem likely Chase will let me make that conversion?

I would guess so, but they might require you to wait for a while first (maybe 12 months)

Are we still able to downgrade the CSP to CF? I tried doing this 3 times over the last 2 weeks without any success. Was told i could only switch to CS. Got a similar feedback from another reader in one of the forums. Would love to know if anyone was successful in downgrading to CF from CSP in the past month. I already have 1 CF but dont think that was the reason for the denial.

I held one CF and one CSP. I was told that once my anniversary hit on the CSP that I could move it to a CF. I did this, was not charged the AMF on the CSP, and now have two CF accounts. Repeated the same pattern successfully for my wife. I handled all of this via secure message online. It was clear that I could not make this switch until at least 12 months from the account open date.

Thanks for the info. Thats probably why i was declined. I still have 2 months to go for the anniversary but wanted to get it now to utilize the Q1 grocery bonus with CF. At least there’s still hope to get the CF come anniversary.

between my wife and I we have 4 freedoms, 2 Inks, and 1 Bold. I have hit the anniversary of the Bold and need to decide if the $95 AMF is worth keeping it (no retention offered). Are there pros/cons to consider here beyond the extension of the 5x cap to another 50K in spend via the Bold card? I do expect to churn Ink on the 2 year mark and via multiple businesses, so I am leaning to canceling, replacing with Cash and freeing up an account with Chase. Thoughts appreciated.

In that situation, I can’t think of any good reason to keep the Ink Bold.