NOTICE: This post references card features that have changed, expired, or are not currently available

During this past year Citi changed their card bonus rules to limit how often applicants can get a bonus. Currently you can only get a bonus on a card if you have not opened or closed a card within the same product family within the past 24 months. Right now an application has surfaced on Citi’s website without that language.

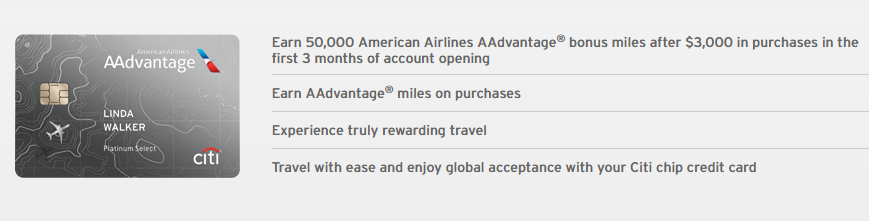

The Offer

Earn 50,000 American Airlines AAdvantage® bonus miles after $3,000 in purchases in the first 3 months of account opening

Key Terms

$95 annual fee is waived the first year.

Need to Know

- In the past, people who have applied through links without the 24 month language have been successful in getting their bonuses.

- You can find more info about this offer along with the application link in this Reddit thread.

HT: Doctor of Credit

Does this card come with the 10% AAdvantage miles rebate? Thanks!

Wife just got the letter in the mail confirming the 3K spend/50K bonus. Looks like this works!

Screenshots + CFPB complaint if necessary = should be fine.

What is CFPB?

Good luck with that! I applied for a similar card (also without the 24 month restriction) back in August and still never got the bonus. After numerous calls, a lot of wasted time, and being transferred to “reservAAtions” a half dozen times I finally got a supervisor who told me their computer said I wasn’t eligible and there was no way to override it. Got 5k as a “courtesy”.

HI Shawn,

Thanks for the info… I am wondering.. I saw that Plastique is coding as a small business. Would it be safe to use Plastique to make your churn on this card for 3K spend required — or the A/E Platinum card with a 15 k spend?