NOTICE: This post references card features that have changed, expired, or are not currently available

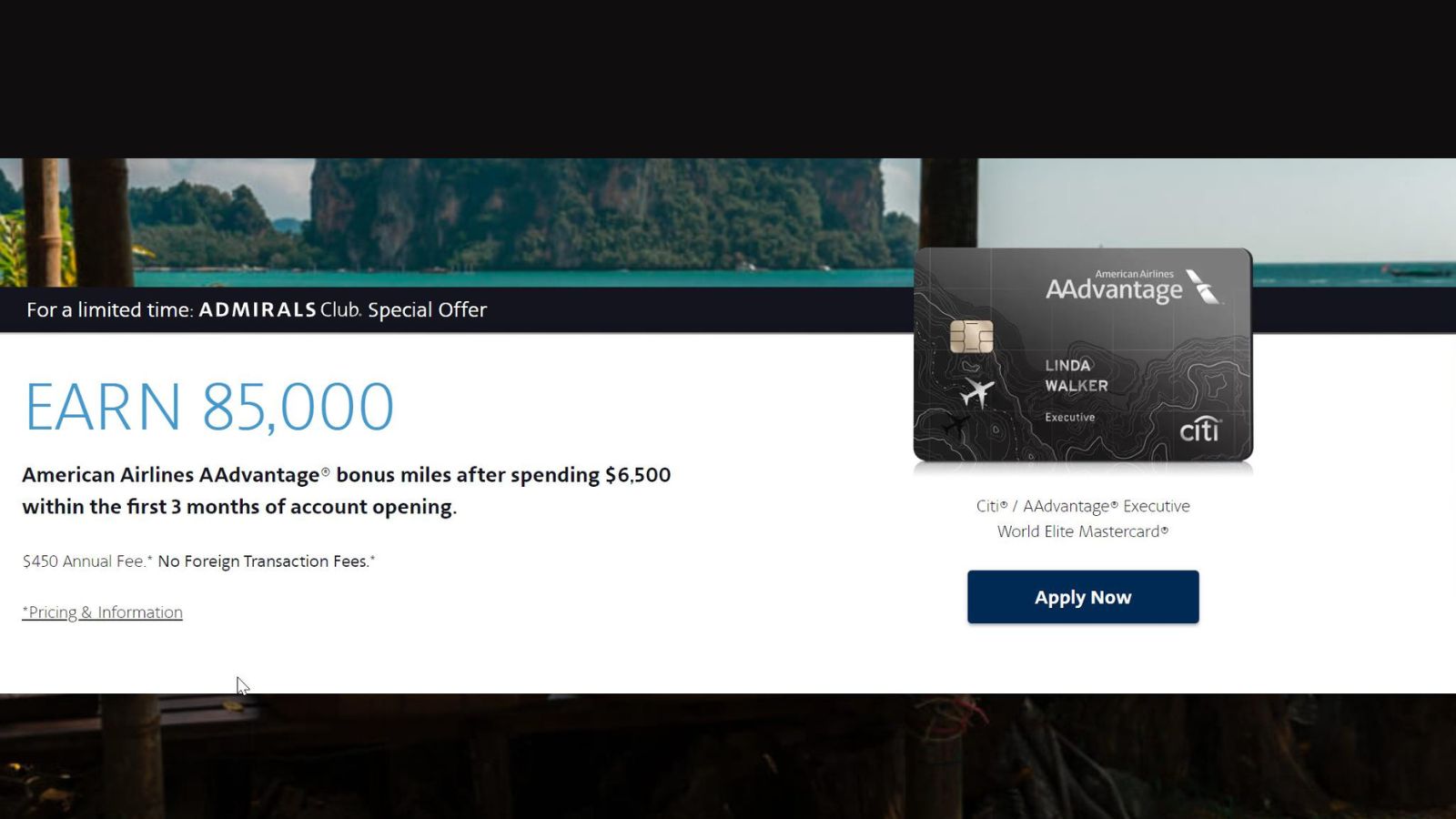

Citi has increased the welcome offer on the AAdvantage Executive Mastercard to 85,000 AAdvantage miles after spending $6,500 within the first 3 months. This is actually a pretty good bonus for this card, as it’s been hovering in the 60K range for some time.

There is another affiliate-linked offer for 80,000 miles after $5,500 in spend (that I’ve seen mentioned a lot in the blogosphere today). We like the direct offer better, so that’s what’s linked on our best offers page.

The Offers & Key Card Details

| Card Offer and Details |

|---|

ⓘ $635 1st Yr Value EstimateClick to learn about first year value estimates 100K miles 100K miles after $10,000 spend in first 3 months$595 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Good choice for those who need Admirals Club® access and those who value the Loyalty Points boosts at 50K and 90K Loyalty Points earned. Plus, it offers the usual collection of perks for flying AA (free checked bag, priority boarding, etc.) and some handy credits for Avis or Budget rentals and GrubHub. Earning rate: 4X AA ✦ 10X hotels booked through AA.com/Hotels ✦ 10X car rentals booked through AA.com/Cars ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: ✦ First Checked Bag Free ✦ Admirals Club® access for both primary and authorized users ✦ Up to $120 per 12 monthly billing cycles for GrubHub purchases (up to $10 per monthly billing cycle) ✦ Up to $120 back on eligible Avis or Budget prepaid car rentals every calendar year ✦ $10 monthly Lyft credit after you take 3 Lyft rides that calendar month ✦ 10K bonus Loyaty Points after earning 50K Loyalty points through all channels and another 10K bonus Loyalty Points after earning 90K Loyalty Points through all channels ✦ 25% savings on eligible in-flight purchases on American Airlines flights ✦ Up to $120 Global Entry or TSA PreCheck application fee credit every 4 years |

Quick Thoughts

First off, if you’re just looking for AA miles, this probably isn’t the card for you. Check out the increased offer on the Aviator Business card that has an 80K welcome bonus with a $95 statement credit in the first year and less than a third of the required minimum spend of this one. That’s a much better value.

But for those folks that are looking at Admiral’s Club membership, it’s worth taking a gander at this card. The $450 annual fee is cheaper than paying for club membership directly, but real kicker is that you can add up to 10 authorized users for free…and they get Admiral’s Club access as well. That’s obviously an incredible deal for folks who have the ability/inclination to use it and makes it the preferred alternative to paying for Admiral’s Club access directly.

The increased bonus makes this a good time to get it if you want it. We saw a 100k bonus years ago, but who knows if we’ll ever see it again. 85,000 is the best we’ve seen for some time.

The affiliate offer that’s been making its way around the interwebs has $1,000 lower minimum spend for 5,000 less miles. Our assumption is that, if you find this card desireable in the first place, getting 5x on that extra $1,000 in spend is probably going to be worth it for you, which is why we have the non-affiliate offer listed as the best one. If you’d prefer the affiliate version with the lower minimum spend, we’ve listed it as an alternate offer. Both versions also offer 4x on AA purchases until the end of the year.

The offer expired. 🙁

FYI if u click through on this it requires a referral code

If you click the? In the referral code box, it will tell you just to enter 99999 if you don’t have a referral code. The bonus doesn’t change if you don’t have a referral code.

Kudos to FM for always telling us the best offer even if it’s not an affiliate link!

I didn’t like how Citi put longtime cardholders to the test and forced me to close my card rather than offer an annual fee credit to compensate for the fact that so many lounges were closed for so long. I think in total, all they offered me was a $225 fee credit to partially offset the $450 fee in 2020 and they offered nothing at all for 2021.

Couldn’t you have just downgraded?

Probably, but at that point I didn’t want anything to do with them anymore.