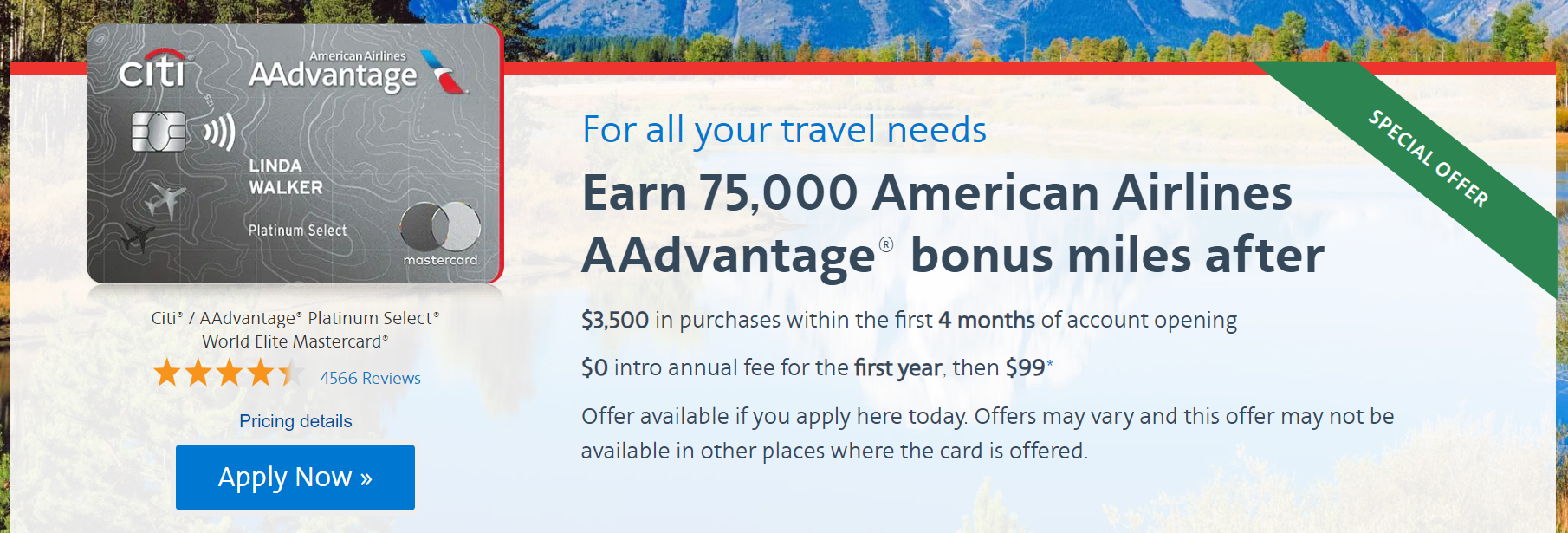

There is a new welcome offer out for the Citi American Airlines AAdvantage Platinum Select card: earn 75,000 miles after $3,500 in purchases within the first 4 months. This is a 15K increase from the previous offer and matches the best that we’ve seen on this card.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $1103 1st Yr Value EstimateClick to learn about first year value estimates 80K Miles Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 80K miles after $1K spend in first 3 months. Ask flight attendant for a code or enter 000000$0 introductory annual fee for the first year, then $99 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: This is the best we've seen in recent times FM Mini Review: Excellent choice for a great intro bonus. Plus it offers the usual collection of perks for flying AA (free checked bag, priority boarding, etc.) Earning rate: 2X restaurants ✦ 2X gas ✦ 2X AA Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: $125 AA Flight Discount with $20K membership year spend Noteworthy perks: ✦ First checked bag free ✦ Priority Boarding ✦ Save 25% on inflight food and beverage purchases ✦ Earn up to $30 in statement credits for each eligible Turo trip completed from October 19, 2025 to October 18, 2026, up to $180 statement credits in total |

Citi Application Tips

- 48 Month Rule: With most Citi cards, you can only receive a welcome offer every 48 months. This applies to the same exact card, not families of cards and is counted from the date that you receive the welcome offer, not from when you're approved.

- Velocity Limits: Citi allows a maximum of one card per 8 days and a maximum of two cards per 65 days (includes both business and personal).

- Inquiries: Citi is thought to be more credit inquiry-sensitive than other issuers. We've heard reports that it's difficult to be approved for a new Citi card if you've had more than 6 hard inquiries within the last 6 months. That said, data points abound of people being approved despite being above that, so it's certainly not a hard and fast rule.

- Card Limits: Citi doesn't have a strict limit on the amount of cards that you can have, but it does place limits on the total amount of credit that they will issue you across all cards. Unfortunately, unlike most banks, Citi does not allow you to move credit from one existing card to the another card.

- Application Status: Call (866) 606-2787 or go here to check your application status. For Costco cards, call (877) 343-4118.

- Reconsideration: If denied, call (800) 695-5171 for personal cards or (866) 541-7657 for business cards.

Quick Thoughts

In the midst of the incredibly strong credit card offers that we’ve seen these past couple of years, welcome offers of 100K+ have become commonplace…sometimes making smaller cobranded card offers looks skimpy by comparison.

In this case, things are a bit different. Since Bilt and Marriott Rewards are the only points programs that transfer to American Airlines, AA credit cards are the primary, meaningful way to quickly accumulate a large sum of AAdvantage miles. The good news is that both Barclays and Citi issue American Airlines credit cards, so there are several possible offers to collect.

Keep in mind that the Barclays-issued Aviator Red card offers a decent amount of miles after the first purchase whereas the Citi card currently requires $3,500 in purchases in the first 4 months. That might make the Barclays card more appealing for some. On the other hand, if your goal is to accumulate as many American Airlines miles as possible and/or you aren’t eligible for an Aviator bonus, this is be a better deal.

If I downgrade the Citi AAdvantage Platinum Select to the MileUp card, will I be eligible for the Platinum Select card in 48 months, or do I need to close the card completely?

Anyone ever have any luck with recon with Citi? I had one attempt before, and it went nowhere. Got denied on this, and hate to just accept a denial without a little fight, but I’m curious if anyone knows the magic to get Citi to sway their decision.

How long does this offer usually last? Am I safe waiting till the last day of March 2024?

Does Citi match? I just opened this on 2/22/24.

I’m almost certain the I haven’t gotten a welcome bonus on this card in 48+ months. If I apply, will it warn me (like Amex) if I have? Or I could be approved but denied for the bonus?

I believe you would need to downgrade or cancel and then reapply but still might need a few weeks in between

Is Citi AA business card considered a different product? or I still need to wait 4 years?

It is considered a different product, so are the Barclays personal and business cards as well.

Any guess as to how long this will last? So many good offers now.

I just got this card last week. Would they match me to this new offer? How do I request for it?

Same situation for me.

A few years back they used to match. Recently it seems much more difficult. I tried calling and emailing with the Custom Cash card a couple years ago and was denied twice. They told me their new policy is only to match when you have a targeted mailer with a specific code.

Though, of course, Nick often says that you get 0% of the things you do not ask for.

If I have this card and it’s over 2 years old, can I apply for another one? Do I need to cancel my current card first and then am I eligible for the bonus?

Unfortunately, you’re only eligible for a welcome bonus every 48 months.

Can I open another account to take advantage of this promo? I already have an Aadvantage card

Yes, as long as you haven’t received a welcome bonus for this specific card within the last 48 months.

QUICK THOUGHT ON AMERICAN THEY SUCK.

HAD 1.1 MILLION MILES STOLEN OUT OF MY ACCOUNT, THEY DID NOTHING, WOULDN’T FLY THEM AGAIN, WOULD RATHER WALK.

Ironically as an airline travel card, the Citi cards do not have any travel protection benefits vs Barclay’s. The trip delay/cancellation/baggage delay benefits could be very valuable when paying for travel.

dont use it for paying for flights. just having the card gives you the free bag, priority boarding etc

I’ve used my Aviator CC for to pay award fees to get free checked bag, etc. but you’re saying I would get those benefits even if I don’t charge anything on an AA card? TIA for clarification…

Correct. You having that cc, which is linked to your AA frequent flyer number, qualifies you for the benefits.

Does this card get you free checked bags on AA flights to the Caribbean and/or Central America (ie Dominican Republic and Belize) or only domestic flights?

Only domestic flights.

That sucks. American is terribly stingy with their bag fees. Amazing that even with their co-branded card they are still hitting you up for bag fees on international flights. Know any way to get around this?

not that I’m aware of (other than having status). even the $595 AA executive card doesn’t waive bag fees internationally

Any level of status works though – even lowly Gold will get a free international bag on AA flights (plus the business/first check-in lane).

No credit card shortcut, have to play the loyalty points game or match from another carrier.

You can put spend on an Aadvantage credit card and earn points, though. Hitting gold isn’t too terrible difficult with all the different ways to earn (flying, online shopping, credit card spen).

Yeah, the only time I check luggage is when I go to a beach place in Mexico with snorkeling gear so I get no benefit from this card except the early boarding.