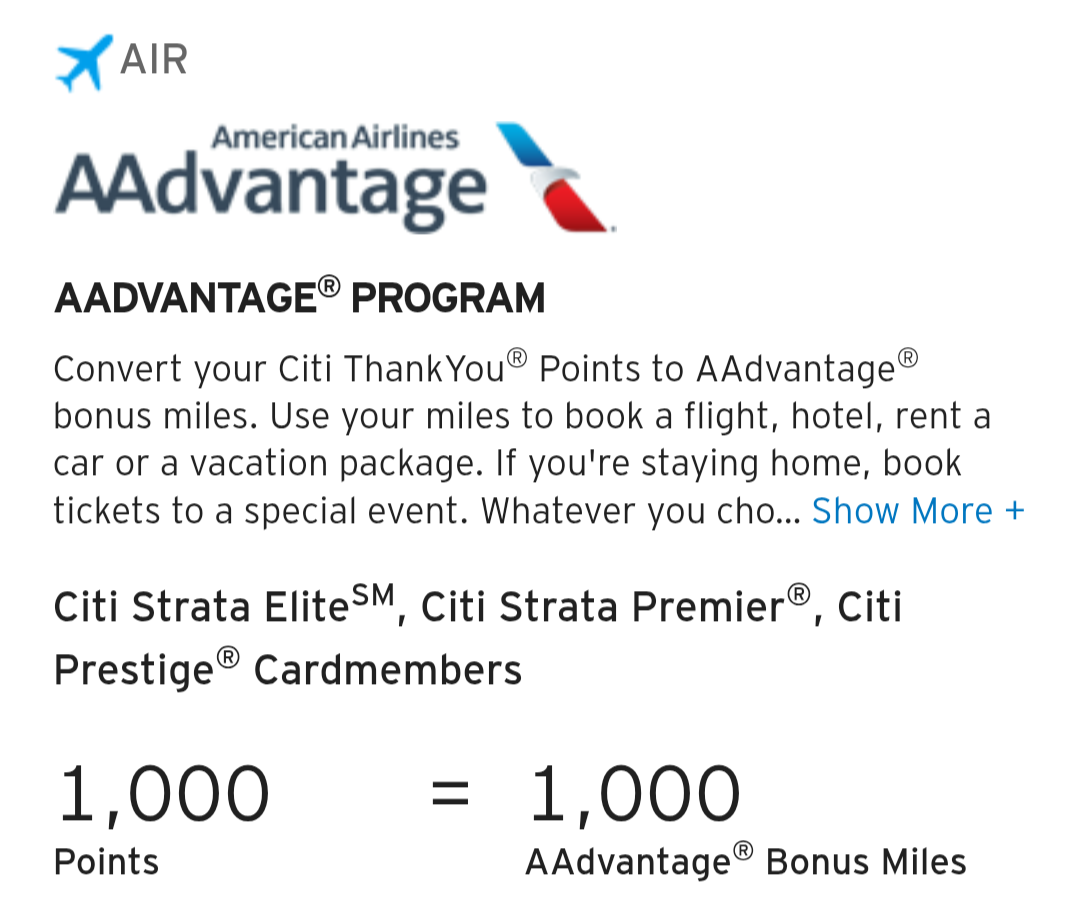

Following the online launch of the new Strata Elite card, Citi has started offering the ability to transfer points from the ThankYou program to American Airlines AAdvantage.

This was initially only showing for new Strata Elite cardholders, but there’s great news on that front as it’s also been rolled out for Citi Prestige and Strata Premier cardholders.

This is massive news. We already pretty much knew (based on rumors and a previously leaked landing page) that Strata Elite cardholders would have the ability to transfer to American Airlines.

What we didn’t know was whether other cardholders would be able to also transfer to American Airlines. When this first appeared earlier on today, it was seemingly only available for people applying for the new Strata Elite card which was a shame. However, it in fact seems like there was simply a slight delay in the rollout because Citi’s transfer page now shows the following three cards as being eligible for transfers to American Airlines:

- Citi Strata Elite

- Citi Strata Premier

- Citi Prestige

This is a huge development for the Citi ThankYou ecosystem as American Airlines can be a very valuable award booking option. In the past, it wasn’t particularly easy for your average person to rack up American Airlines AAdvantage miles outside of credit card welcome offers due to their absence as a partner of the main transferable points programs (not counting Marriott Bonvoy’s ability to transfer). It was soon due to get harder to earn AAdvantage miles through welcome offers seeing as Citi will be becoming the sole issuer of American Airlines credit cards, so earning welcome offers via Barclays will no longer be possible. Now with the ability to earn welcome offers from Citi Strata Elite and Premier cards and also through everyday spend on other ThankYou-earning cards, it’ll be much easier to rack up a healthy stash of AAdvantage miles.

Something worth noting is that at present, it’s only these three premium cards that offer the ability to transfer to American Airlines. With Citi’s other transfer partners, AT&T Access More cardholders have the ability to transfer at the same ratio as Strata Elite, Strata Premier and Prestige cardholders, but that’s not the case with the AAdvantage program.

Also, for all of Citi’s other transfer partners, you can transfer to them even if you don’t have one of those premium cards, just at a lesser rate. For example, if you only have a Custom Cash or Double Cash card, you can transfer to, say, Air France/KLM Flying Blue, just at a lesser ratio of 1,000:700 rather than 1,000:1,000. At the time of publishing this though, there seems to be no option to transfer to American Airlines at a similar lower ratio. It would be nice if that ability is added in the future, but I wouldn’t count on it happening as this is one way for Citi to entice you into applying for – or upgrading to – one of their premium cards.

Question

What are your thoughts on this development? Does this make you more likely to apply for premium Citi cards? Let us know in the comments below.

[…] Yes! You can now transfer Citi ThankYou Points to American Airlines (link)! […]

[…] Citi now offers transfers to American Airlines from Strata Elite, Prestige & Strata Premier – Frequent Miler […]

Is citi/TY the most flexible (most options to derive value) ecosystem now?

Wondering if someone can test the 10% rebate from former Rewards+ cards with the AA transfer? So for 1 year, former Rewards+ card holders can get 1.1x to AA???

I inadvertently did this test, but won’t know the results until my ex-Rewards+ statement closes in August.

Edit: to be clear, I made a transfer (but not to AA) a few days ago; the Rewards+ 10% back has always shown up on the date of the following statement close.

I used to always get an email within 24 hours saying I was getting the 10% bonus points.

The 10% rebate ended 7/20. You will get nothing.

The 10% rebate should be active through July 19, 2026, per the email from Citi regarding this product change.

Sorry I didn’t realize cards about <1 year old still get this. Mine is very old and it ended 7/20/25

The $0 AF card being open to all x-fer partners (except AA) is new info. It used to just be the junior varsity partners of Choice, Wyndham, and JetBlue all at bad rates.

Still bad rates, but now you have all of them! (Except AA)

Cool, now make a Strata business card

Transfers are not instant yet. Be careful if your transferring for a waiting redemption.

Interesting. I transferred first thing this morning and they showed up within 30 sec.

Been 5 hours for me

Wonder if they’re just getting inundated with transfers. Citi probably had to spend a lot of money today on points that have been dormant for a while.

I bet your right

Points moved but it took 24 hours. Im sure it will get better.

AA let’s you hold a reservation for free for some amount of time (can’t remember how long). You can la your reservation while waiting for the transfer to clear.

[…] Full reading at Frequent Miler 2235 ♥️ […]

Anybody else having difficulty getting approved for Citi cards? We have 830-850 credit score but don’t carry a balance. P1 and P3 were both denied for the Citi AA 100k + lounge access

Don’t get any new cards or hard pulls for 6 months and your chances will be better. And spend some on current Citi cards if you have them.

I guess it’s time to ONCE AGAIN review the Citi Byzantine transfer rules.

I was planning to get the upcoming Alaska Premium card specifically because of the great value when booking AA awards but now I might need to rethink my strategy. I wonder what the FM team thinks about this development and the implications for the value of AA miles as well as partner awards going forward.

Yes, this was exactly my thoughts. I heavily bet on speculative transfer to Alaska, and was also considering the Alaska premium card, partially due to the Alaska-AA partner booking on short hop domestic. There’s still great value outside AA partner bookings, but more dilution of those partners awards would be a blow to Alaska. I’m also curious about the FM team’s assessment of this news impacting both AA value and Alaska value.

Custom Cash can only transfer to SYW, and nothing else.

For a good review of this card, see today’s Doctor of Credit article

When we tried to complete your Points Transfer, we encountered a system error. Please try again or contact Customer Service for help.

I just got the same error message. Did yours eventually resolve?

So now, you can earn two AAdvantage points per dollar for everyday spend with DC and a premium Citi card, vs. 1.5 United points per dollar with CFU and a premium Chase card vs. 1 SkyMile per dollar on Amex personal cards (2 SkyMiles per dollar with an Amex business card but there is a fee to transfer). So the best earnings on a US domestic program using credit card spend is now Citi with AA. That is certainly a change!

Also, the Citi Strata Premier has a plethora of strong 3X categories (groceries, airfare, hotels, dining, gas) that Amex and Chase do not offer in a single card.

True—I have it!

But low bonuses. I don’t think you can discount the influence of bonuses (especially for business cards) in the Chase and Amex systems. The spend multiples matter much less than the volume of SUBs, I would think.