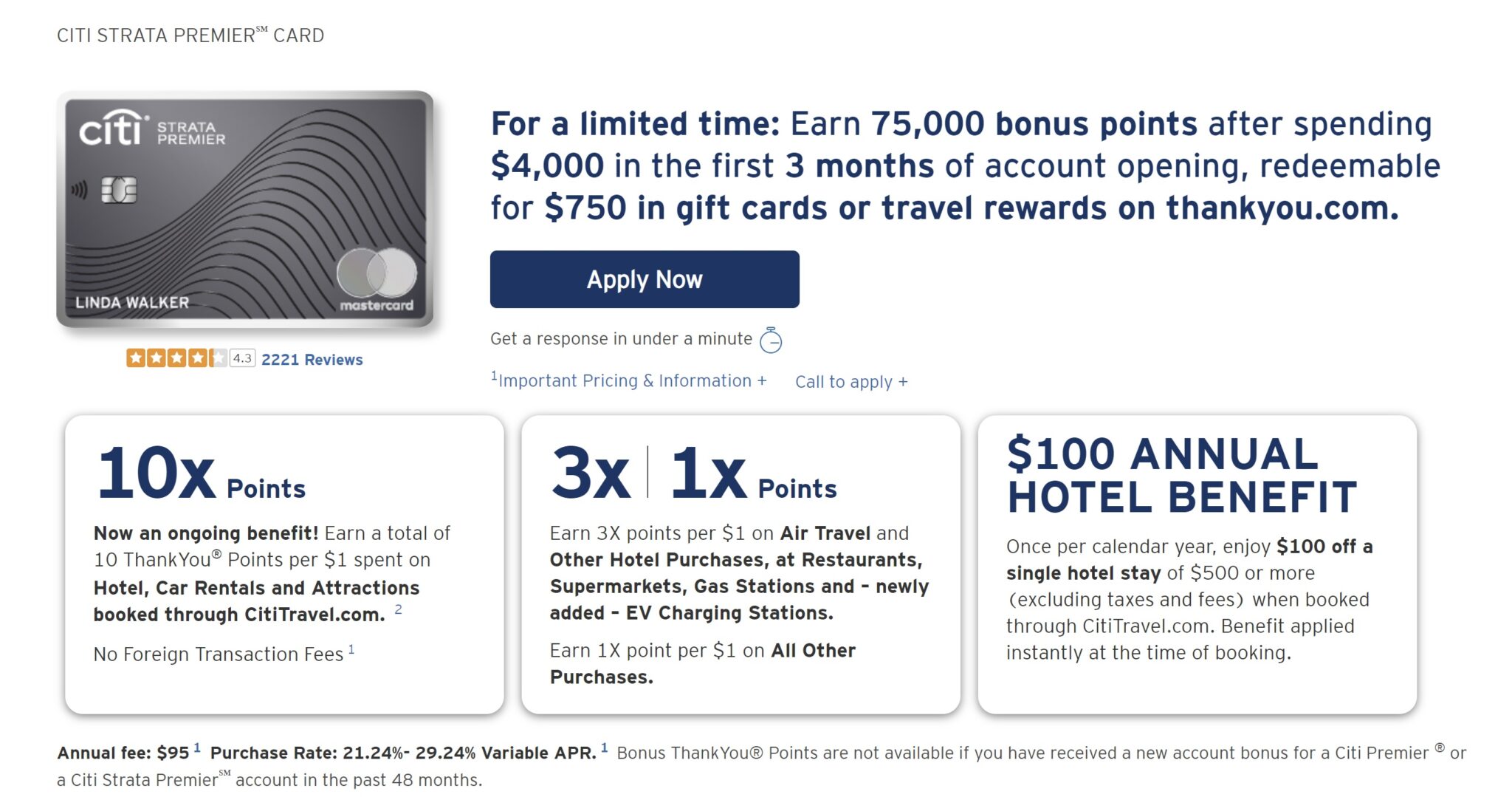

The Citi Strata Premier has launched earlier than initially expected, with an introductory bonus of 75,000 Citi ThankYou points after $4,000 in purchases in the first 3 months. This bonus won’t be available to you if you have received a welcome bonus on a Citi ThankYou Premier card in the last 48 months, but if you haven’t earned a new welcome bonus on the Premier card within that window, you should be eligible for this card.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $741 1st Yr Value EstimateClick to learn about first year value estimates 60K Points 60,000 points after $4,000 spend in the first 3 months$95 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75k after $6 spend in the first 3 months (ended 4/8/25) FM Mini Review: Very strong earnings for spend. Excellent bonus categories. Points transferable to select airlines. Recommend pairing this card with Citi Double Cash Click here for our complete card review Earning rate: 10X hotels, car rentals, and attractions booked through Citi Travel℠ ✦ 3X grocery ✦ 3X dining ✦ 3X gas stations & EV charging ✦ 3X flights, hotels, travel agencies ✦ 1x everywhere else Base: 1X (1.5%) Flights: 3X (4.5%) Hotels: 3X (4.5%) Portal Hotels: 10X (15%) Grocery: 3X (4.5%) Dine: 3X (4.5%) Gas: 3X (4.5%) Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline and hotel partners ✦ $100 Annual Hotel Savings Benefit ($100 off a $500+ hotel stay, excluding taxes and fees, when booked through Citi Travel) ✦ Travel protections See also: Citi ThankYou Rewards Complete Guide |

Quick Thoughts

If the new Citi Strata Premier looks pretty familiar, that’s because the card is essentially a mostly unchanged reboot of the Citi Premier card, though the Strata Premier add a couple of key items of interest:

- 3x at EV charging stations

- 10x on hotels, car rentals, and attractions booked at Citi Travel (now as an ongoing benefit rather than a limited-time promotion)

- Travel protections including Trip Delay Protection, Common Carrier Trip Cancellation and Interruption Protection, Lost or Damaged Luggage, and MasterRental Coverage (car rental insurance).

It’s great to see travel protections back on a Citi card. It never made sense to me that their premium travel card was missing those travel protections that are common on competitor cards. That makes the Strata Premier a card potentially worth using for its 3x air travel and hotel bonus categories (and it continues to be a solid card for grocery and restaurants).

It’s worth noting that existing Premier cardholders have seen their cards updated with the new “Strata Premier” name in their online accounts. Again, I don’t expect that will affect the ability to get approved for the Strata Premier but rather than the 48-month clock since you last earned the welcome bonus is what will determine whether you are eligible.

Overall, there are no major surprises here, but rather a good reboot and a solid new welcome bonus. Many have been curious about a rumored “elite” version of this card, but there has been no official word on that. Personally, I think it is unlikely that we’ll see such a card in 2024; I’d put my money on something like that launching in 2025 if at all.

Is there a way to refer friends for a bonus with this one?

If I got the Premier with the 60K offer a couple of weeks before the Strata became available with the 75K offer, can I get Citi to match the bonus? I’m about $200 away from meeting the spend.

Do we know if giftcard purchases towards minimum spend is safe with Citi?

You should note that the CDW car rental coverage is secondary (not primary like the Venture X, Alt Reserve, or Sapphire Reserve–not sure about Preferred).

I’ll actually add a positive DP here. 4/24 new cards, 2 or 3/6 + 4/12 on inquiries. Some utilization on existing cards but paid off monthly. Pulled EX (Midwest). Instant approval. Trying to pick up TYP for either the 1:2 Choice or 5:1 LHW. Maybe 1:1 EVA.

No Bonus Points for Automatic Upgrade? What’s your opinion – Should I close out this card and apply at a later time? As in wait 48 months? Or just keep this in my wallet? What would you do? I cannot apply with Citi now, I just got the AAdvantage Business – that makes me ineligible for another Citi bonus right?

Essentially this is a name change, so no points. How old is your Premier CC? If you earned the SUB over 48 months ago, you can apply for another Strata Premier. After that applying for the new Strata Premier, product change your old Premier to a Citi Custom Cash CC. The AAvantage Business has no bearing on getting another Strata Premier. But, Citi’s rules on applying are: no more than 1 application in 8 days, and 2 in 65 days.

I have a Premier I got 8+ yrs ago, so well over the 48 month limit. I’m seriously considering this path to get a 2nd Custom Cash. Are these application rules for all issuers or just Citi apps?

If I’m not working on two subs now, I’ll get the this card unfortunately need to wait until Q3 or Q4 of this year.

Ok thanks for letting us know.

800+ credit score, balances paid in full each month, great income. Citi turned me down for not enough credit utilization. Makes me afraid to try again.

Regarding “Citi turned me down for not enough credit utilization” — I always warn people that the reason given in the letter you receive is generally pretty meaningless. I always refer to the story of a reader whose letter said “too many new accounts” — and she hadn’t opened any accounts at all in the previous 2 years. Those letters are just something the computer spits out to save themselves from people calling to ask why. I always recommend that you call the reconsideration line to ask them to reconsider. They won’t always approve on recon, but I ignore the letter reasons entirely.

Not only are there plenty of instances where the reason in the letter makes no sense at all, there is also the fact that if it were so easy to sum up the reason why you were declined, then Experian, Equifax, and Transunion wouldn’t be able to charge banks millions of dollars for access to their algorithms. The reasons for approval or denial are so complex that it’s unlikely to be possible to boil down to a very simple reason like that.

Anyway, I’ll step off my soapbox, but the moral of the story is that I don’t put stock in those reasons. I’d take another swing when I wanted to swing again without much regard to that.

Appreciate the insight, you guys are awesome. I actually did call recon a couple of times after denial and reps said that not enough credit utilization is the one thing they won’t change despite my grovelling. I figure I’ll try again eventually, but have been happy with juicier offers elsewhere.

Not using cards that people already have is getting to be common turn down for Citi and Cap1. Amex is doing the same. If you never carry a balance and/or always sock drawer the card after earning the SUB, your only choice is to start using a card you already have from that bank. That works for Amex.

“Those letters are just something the computer spits out to save themselves from people calling to ask why.”

It’s not just that, it’s a legal requirement to give a reason, since the Equal Credit Opportunity Act. It’s still meaningless though.

Could the “elite” version of this card be the apparent ability to PC to the Prestige card?

rejected

4/24

Don’t have any citi card for 4 years

820+

I am wondering why they would be bothering with rebranding and minor changes if this wasn’t part of a broader product plan, i.e., included additional and presumably more expensive card(s). And why, then, do this now and wait until 2025 for a “Strata Prestige“ card. I would think/hope there is more coming, and rather sooner than later.

All banks do a refresh of their card products. Citi is just dragging their feet a bit…