Yesterday, Greg published a post about how he is warming on the Citi Strata Elite card. A big factor for him has been the usefulness of the Strata Elite card’s hotel credit. He was clear that not everyone should value that credit as highly as he does. Spoiler alert: I don’t. In fact, as we near the end of the year, I find myself cooling considerably on credit card hotel credits. In part, that’s because I suddenly have so many hotel and travel credits with which to contend, but it is also in part because I looked back at my year in travel and realized that these hotel credits might not be a great fit for my travel patterns.

My 2025 hotel bookings

If I counted correctly, by the end of 2025, I will have spent 105 nights in hotels. That is an above-average year for me, fueled in part by JetBlue’s 25 for 25 promotion.

Out of those 105 nights, 18 nights will have been paid nights (the other 87 have been with points or hotel free night certificates).

While paid nights make up a relatively small proportion of my stays, one might think that with 18 paid nights in 2025, I would have had ample opportunity to use credit card travel credits and/or hotel credits. However, consider that:

- 4 nights are reserved at a non-chain hotel that could only be booked directly on the hotel website during my peak dates, so credit card hotel credits were of no use

- 4 nights were at a Hilton Garden Inn, where I had a targeted Capital One shopping offer for 30% back, and I also earned Hilton points, so credit card hotel credits were not useful

- 4 nights were at a mid-tier Hyatt property that isn’t on luxury booking platforms and where my elite benefits, specifically free breakfast and free parking, saved more than a credit card travel credit would have covered, so credit card hotel credits were of no use

- 6 nights were or will be one-night stays, where credits that require a two-night minimum would be of no use. Of these six nights:

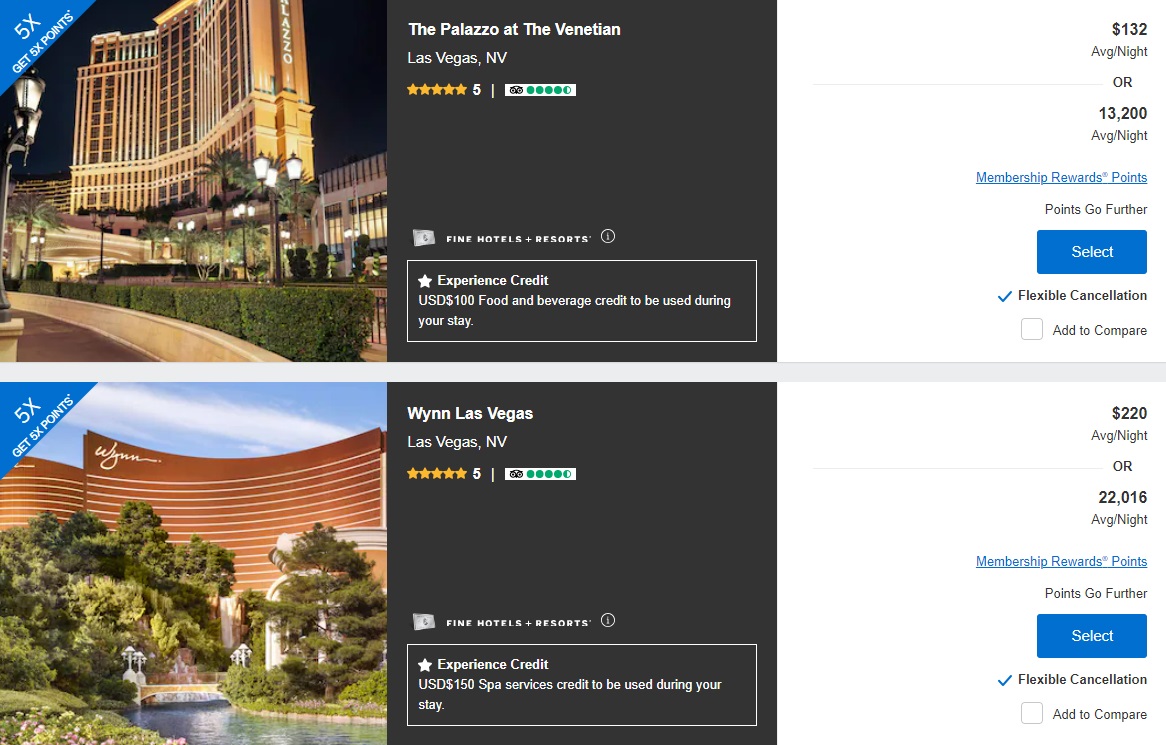

- 3 are booked through Fine Hotels + Resorts® to use American Express Platinum Card® credits. One of those three FHR nights seemed unnecessary, since there was a low-category Hyatt that would have met our needs for the night.

- 2 of the non-FHR one-night stays were in places where there were no FHR options

- 1 night was spent at a Hyatt Place in New York City (Chelsea) since the cash rate was so good (just under $200 per night).

Again, out of 18 paid nights, only 3 made sense to book through a credit card travel portal, and all three of those were one-night stays (where things like the Citi Strata Elite card’s credit or a credit through The Edit by Chase Travel wouldn’t have worked).

That’s pretty rough, given that I’ll have spent nearly a third of the year in hotels. In fairness, in a couple of situations where I ultimately used hotel points, I probably could have gone out of my way to use a hotel credit. However, more often than not, I used points because I wouldn’t have wanted to pay the cash rate.

Cooling considerably on hotel credits

Ironically, Greg wrote pretty recently about dumping his hotel credit cards in favor of using credit card hotel credits, but I think I am in a different boat.

Part of that is situational and unique to 2025. It was only in September that Amex revamped the Platinum Card® to add additional Fine Hotels + Resorts® credit and finally expanded that credit to Business Platinum cards as well. The Strata Elite launched in the summertime, but my wife’s account was caught in the snafu that required additional documentation. Although that didn’t turn out so badly, it only recently became possible for us to use that credit. And the new Chase Sapphire Reserve® “The Edit” credit only became available to pre-June 23rd cardholders this past week. That has left me with an inordinate number of calendar-year credit card hotel credits to put to use before December 31st.

While that sounds like a good problem to have, prepping to use these credits has become a challenge.

Citi’s Strata Elite hotel coupon feels less flexible than I’d like

On the one hand, Citi’s Strata Elite hotel credit is arguably the easiest and most flexible hotel coupon to use since it can be used to book any hotel on the Citi Travel booking platform. On the other hand, this functions as a discount rather than a statement credit. That makes it slightly more challenging for me to use this.

Here’s what I mean: The rest of my 2025 travel is already booked. That means that I’d likely need to use this coupon credit to book a trip for next year.

However, since the Strata Elite hotel credit functions as a discount, I need to commit to a specific booking; I can’t proactively make a backup reservation. With Amex’s credit for Fine Hotels + Resorts®, I can make several prepaid reservations for travel next year. If I later cancel a couple of them, as long as one qualifying reservation remains, Amex won’t claw back the credit. With Citi, that strategy is not possible since the $300 is applied as a discount at the time of booking. If I book a hotel for a stay next year, I’ll save the $300 now, but if plans change and I need to cancel the reservation next year, the discount disappears; it can’t be retroactively applied to another reservation (if you cancel during the same year in which you made the reservation, you do get the coupon back to apply to another reservation).

That puts me in the awkward spot of having to make plans far in advance and fully commit. That isn’t my preference. I have often said that one of the things I love about miles and points is flexibility. I rarely book advance purchase rates that require full prepayment without the ability to change or cancel. Citi’s hotel credit is less flexible than I’d like. While I can presumably cancel (depending on individual hotel policies), if I use my 2025 coupon for a 2026 stay that ultimately gets cancelled, I’ll lose out on the credit. That effectively makes it feel like a non-refundable reservation to me in the sense that even if I can get my cash back, I can’t recapture that $300 in value. Hopefully, this will be less of a pain point in 2026 with most of the year to use the credit, but it still isn’t necessarily simple: if I use this coupon in January for a stay scheduled near the end of the year, I run the risk of being back in this spot next year if plans for that trip change. Ideally, I’ll use this coupon for a near-term stay where I’m pretty sure plans won’t change.

I also hate the fact that a two-night stay is required to use this coupon. It is rare that I stay two or more nights at a hotel where I don’t care about elite benefits (booking through a third party usually means not getting hotel elite benefits for the stay, though your mileage may vary). Similarly, I don’t want to dig deep into my pocket to cover the difference between the coupon and the cash cost of a hotel.

Hedging Amex’s prepaid hotel credits can get expensive

Amex’s prepaid hotel credits appeal far more to me, though I am nonetheless cooling on those, too.

Platinum Cards® (both business and consumer) now offer up to $300 back in credits for bookings through Fine Hotels + Resorts or The Hotel Collection from January to June and again from July to December. In my household, we have a handful of these to use before the end of the year.

I love that these can be used for one-night stays through Fine Hotels + Resorts. We have single-night stays (between flights) coming up in Los Angeles, Seattle, and Frankfurt over the next two months where these credits have been useful (some of these were booked with the prepaid hotel benefit that existed before new benefits launched in September 2025, so we still have a few “new” 2025 credits to use). I was happy to use FHR credits to save the points I would have otherwise used while still getting free breakfast and additionally getting a chunk off the cost of dinner thanks to the $100 hotel credits.

On the flip side, I have been disappointed by the absence of FHR or The Hotel Collection options in a couple of popular places we are visiting before the end of this year. The usefulness of these credits heavily relies on your travel patterns. Again, I’m not willing to dig deep into my pocketbook to cover the difference between the credit and the cost of a luxury hotel, so that further limits the options I’d consider. The good news is that I have found MaxFHR to be invaluable for identifying places where Amex’s prepaid hotel credit can be useful. While I was disappointed not to find FHR/THC properties in places I plan to visit this year, MaxFHR makes it really easy to identify places that I might want to consider visiting, thanks to great FHR/THC deals. And since I can prepay a few backup reservations, I can decrease the odds of losing the 2025 credit even if I don’t use it for a stay this year.

The downside to the ability to book backup reservations is the need to prepay for multiple $300+ reservations. I’ll get up to $300 in statement credits for the first such reservation with each Platinum card, but if I make multiple 2026 reservations in order to ensure that I’ll keep my 2025 prepaid hotel credit, I’ll need to front the money for the backup prepaid reservations. While that will help ensure that the credit doesn’t get clawed back if I need to cancel the initial booking, with multiple household Platinum cards, that can get expensive. And with the credits each having a six-month booking window, I could see this piling up. For instance, if I were unlikely to travel during the first six months of 2026, I might be using my remaining 2025 credits to book travel for late 2026. Then, if I also use my January-to-June 2026 credits to book travel for late 2026 and make backup reservations, it could tie up more money than I’d like. Making backup reservations with multiple Platinum cards and from multiple 6-month windows would quickly cool me further still on these credits. Again, I am hopeful that MaxFHR will help me identify good uses of these credits, but I don’t want my trip planning to entirely focus on finding cheap Fine Hotels + Resorts and The Hotel Collection bookings.

Chase’s The Edit credit would be more exciting if I had more points

Chase’s The Edit credit is the one that currently excites me the least of the bunch, though I think my perspective would change if I had more Ultimate Rewards points (and hopefully I’ll get there over the coming months).

As is the case with Citi, I hate that this credit requires a 2-night stay, though in this case, for a different reason. Since this credit can only be used to book “The Edit” hotels, which tend to be “luxury” type properties, it is very unlikely that the credit could fully cover the cost of a hotel stay. Instead, this would more likely function as a discount. Since I don’t tend to book cash rates at many luxury hotels (except in cases where they are fully or almost-fully rebated by Amex credits!), this Edit credit has not yet become very interesting for me.

However, I think that my perspective on this might change as my Ultimate Rewards points balance increases. I’ve really depleted our Ultimate Rewards points in recent years, so I have far fewer Ultimate Rewards points than I’d like. Since The Edit bookings are currently all Points Boosted to $0.02 per point, I think that if I had a higher balance of Ultimate Rewards points, I would be more likely to get use from this credit by using a combination of $250 charged to the Sapphire Reserve card while using points to cover the balance at $0.02 per point. For instance, if a 2-night booking would cost a total of $750, I wouldn’t be excited about using my Edit credit, since I’d still need to pay $500 out of pocket. However, the ability to use $250 credit + 25,000 points makes me far more interested in using this credit. I will be under 5/24 in December, and as I increase our Ultimate Rewards points balance, I think that I will find this credit more useful since I’ll be happier to combine the credit with points than I am to combine the credit with cash out of pocket.

Hotel free night certificates are more flexible

By contrast to the number of The Edit credits I have left, I am sitting on very few credit card hotel free night certificates. In fact, I’ve found myself in multiple situations recently where I wished I had more certificates to use! Just a few weeks ago, we spent a night in Springfield, MA where the Sheraton cost about $325 all-in or was available for 39,000 points. That wasn’t a great use of points, but I’d have been happy to use a 35K free night certificate + 4,000 points. I constantly find situations like that where I could get excellent value out of free night certificates.

And while those free night certificates are tied to specific chains and typically have a ceiling in terms of point value, I find them far more flexible than credits, which can only be used for a specific collection of hotels and/or require multi-night stays. I’m sure that I’ll enjoy my coming FHR bookings, but I had to seek out opportunities to use those, whereas opportunities to use my hotel free night certificates tend to happen naturally. It is rare that I have a free night certificate nearing expiration unused.

The flip side of this is the struggle with whether to use a free night certificate. It is common to struggle with whether to use a free night certificate now or hold it for a better use later, which inevitably runs the risk of the certificate expiring before “later” happens. That is less likely to be an issue with hotel credits since credits don’t provide an opportunity for outsized value in the same way. I don’t need to worry about holding on to a hotel credit for a “better” use in the future.

Still, I find that hotel free night certificates often save us a bundle on quick one-night stays on road trips during high season, when we want to attend events, and even at airport hotels (particularly around New York-JFK, where prices have risen substantially in recent years). Given the general trend of increasing hotel prices, I think I’m getting more value out of hotel free night certificates in 2025 than in previous years, despite hotel program devaluations.

And given the difference in cost between the average hotel credit card and the cards like the Citi Strata Elite or American Express Platinum Card®, the investment both in terms of the annual fee and the time spent figuring out a use case for the benefits, hotel cards are starting to look like a far easier win.

Does that mean I am going to dump my ultra-premium credit cards in favor of more hotel credit cards? Absolutely not. I’m a blogger. I need to be able to write about these cards and their various benefits, so I’ll continue to carry a number of ultra-premium credit cards. However, despite the big numbers associated with the hotel coupon credits, I am growing less excited about the pressure and time suck of using up all of the associated credits.

All that said, I am still enthusiastic about the ability to double or triple dip credits in the first year of card membership. For instance, the main reason we got the Citi Strata Elite (apart from the 100K intro bonus) was because of the ability to use calendar year credits in both 2025 and 2026 for the cost of the first year’s annual fee (and we effectively got that fee rebated thanks to the application snafu). I’ll still gladly take advantage of coupons like that and consider them part of the welcome offer on a new card. But over the long term, the time spent figuring out how to use these credits, combined with my typical travel pattern being heavily weighted toward award travel, is really starting to make me prefer hotel free night certificates.

I got great value with my Strata Elite $300 credit recently for game 6 of the World Series in Toronto. Booked the Fairmont right across from Union Station for ~$275/night for 2 nights. Then I got upgraded several room tiers due to having Silver status with Accor, which I had forgotten about until I was checking in. While I (unsurprisingly) haven’t seen any points or night credits post to my Accor account, it was interesting my status showed at check-in and was usable for upgrade priority on one of the busiest nights of the year given the World Series.

A friendly reminder –

Chase does claw back edit credit when the booking is canceled, often even requires calling to reset the tracker back to 0 – that is, if you truly intend to stay at an edit hotel out of organic need. To preserve the clawed back (unearned) you need to make sure the tracker returns to unused stage. It does not do so automatically each time when a clawed back happens.

that means even you are not trying to game the system but simply have a legitimate need to cancel / rebook, such the rate has gone down or your itinerary changes, your $250 will be clawed back with just a couple days delay from the time of cancellation. If you truly intend to use the credit you better make sure the edit tracker is reset back to unused state. Else a call to CS is required to get this fixed.

The Edit hotels are a joke. Meanwhile Amex is adding 100s daily to their program. As far as having multiple Platinum credits to use. It really isn’t most of us readers. I would venture most readers have 2 Platinum cards. Either both players having personals or individuals having a personal and business versions. Having to juggle multiple reservations would mean changing your plans less.

But comparing The Edit to either Amex program is not valid. Amex has thousands of properties in their 2 programs versus Chase has at most 10 Edit hotels per city. But usually 5 for those, I have checked. Meanwhile I have been checking Amex every day and they are adding properties constantly. I can easily justify our Platinum AFs because of the $600 hotel credits.

Reading this article I could not agree more on how I feel that the hotel credit of high end cards do not fit our travel pattern / need.

My valuation order comes

1) Statement credit that is broadly applicable to a chain or even a brand.

2) Earning extra points while keeping elite benefits.

3) FN which due to expiration date, is less favorable than having points even with less equivalent theoretical value.

4) The least favorable is hotel credit that has to book thru card issuer’s portal!

I’m finding the Edit credit to basically be useless (I’m not sitting on a stack of Chase points). It’s a non starter here in NYC, and even in a place like Washington DC (which is accessible enough from here), the options are limited (and I would have to kick in $200-$300+ to even make it work). I did a search for Hong Kong/Thailand and didn’t find many options either (have a trip there at the start of 2026). If someone can prove me wrong here, I would love to hear it.

ITT: People who don’t seem to realize that the “FHR credit” is actually available to use on The Hotel Collection bookings, where prices are often pretty reasonable, even though 2 nights are required.

Speaking as someone who has no hotel status, I haven’t found it an issue at all to use the previous $200 credit and adding another $400 on top of that annually is even better for the occasional perks like room upgrade, property credit and early check-in/late check-out.

The Edit is just a 25% off or less coupon at hotels I’d never pay cash for. I found a few where it would be a 50% off coupon, but that’s it.

However, wouldn’t it make sense to pay the remainder in cash? You’re getting 8x on that with CSR, no? I’d rather earn at 8x than burn at 2cpp.

Nick, I agree. With the increase in fees and trying to utilize the credits, it’s becoming tedious

2-night min isn’t great for the Citi Strata Elite credit.

A few thoughts:

The Citi Strata Elite is the most flexible and useable hotel credit by far. It also helps that Citi Travel portal has competitive pricing (sometimes better than other platforms). I travel with family and prefer a slower pace of travel and so staying for 2 or more nights isn’t a problem, it’s usually preferred. It has been even more useful since I find myself staying at independent hotels and apartments (Citi Travel has apartments too) now that I have a family of 5. I’ve also found good value from the Citi Prestige 4th night free discount as well.Amex FHR forces me to change my travel behavior and consider high end luxurious hotels that I wouldn’t otherwise consider. When I use these credits, I tend to try to find places that have reasonable prices that are almost fully covered by the credits. The only places I can find are in Las Vegas on a weekday and some places in Asia where hotels are not expensive. Very limiting.I downgraded the Chase Sapphire Reserve due to the increase in annual fee and I didn’t think the refresh was worth the cost of keeping the card. Therefore, I can’t comment on The Edit, but it seems to be even less useful than Amex FHR.

The Amex Hotel Collection is for 2 night stays. They are much more reasonably priced.

Yes and now that MaxFHR can see these properties they become an easier option. Benefits are more limited than FHR and stays may not grant status perks (seems more property dependent) but you can actually cover two nights at a decent property off peak with THC. I’ve seen some fall weekends at the Canopy or Omni in Tempe that would total around $300. Vegas mid week at an MGM property might work too.

I’m not applying for the Amx Platinum this year solely because I don’t want more hotel credits to deal with while I have Citi Strata and CSR.

I’m also debating whether to take a trip next week, or defer it until Feb knowing that this trip would be perfect for using this year’s Strata hotel credit. But Feb then opens the risk that the trip gets rescheduled and I completely lose the credit. The hotel credit and the Blacklane credit are really reducing the cost of the trip, so its becoming more and more likely that I’ll go.

I think Edit credits don’t get clawed back if you cancel the reservation, but I guess there is always the risk you get your Chase account shut down for bad behavior. Someone correct me if I have that wrong.

There are MANY DPs in Chinese forum the credit get clawed back AND within just 3 days after cancellation.

Chinese forum?

American Chinese who also play the CC games have their forum in Chinese. Lots of info on the discussion forum but of course you need to be able to read Chinese.

You might be also able to find similar info on Reddit related discussion thru googling.

Or you can be your own DP.

I wasn’t actually asking for a DP.

and from Reddit it appears that the credit isn’t clawed back.

The clawback DPs were reported starting end of end of Oct.

Sure if you dont need DPs you can just do what you “believe” then see what happens.

I am just being kind to tell you the DPs I have seen the last few days. Sorta to warn those who do not know any better.

If you dont need such, then please go ahead and do what you believe, then report back to this place so others can be benefited from your contribution.

Great article. I have been wrestling with a lot of the same issues and finding a reasonable use for the Edit credits are the most challenging.

As far as the use of points for Edit stays, I have found that Chase is not consistently providing 2 cents value from point boost.

For example, the Hyatt Regency Incline Village is only providing 1.65 cpp through points boost. That diminishes the use of chase points and the credit when compared to transferring to Hyatt and booking directly.

Others seeing less than 2 cents for their Edit point boost redemptions?

Nick – Great post. Couldn’t agree more. Those of us with multiple Amex Platinum’s are starting to realize the caring costs are getting higher.. Could you expand further on how your back up bookings work? Is it just a way to give yourself another date option as apposed to a way to keep credits you wouldn’t otherwise use?

Just my opinion,

Citi Strata Elite > FHR > United Renowned > Edit

Come 1/1, it’ll be CSR IHG credit ahead of all of those.

Even though the strata elite is a coupon that might disappear, it’s usable at a much wider array of hotels. I like that better than a small number of very expensive properties, such as FHR/Renowned/Edit.

Actually let me amend this. Delta Stays > CSR IHG > the rest as above. Delta Stays is easily the most flexible and closest to cash.

Great post Nick. I really like how you break things down and go into depth. Especially like how you explain your thinking and strategy. It really uncovers a lot of food for thought for me.