NOTICE: This post references card features that have changed, expired, or are not currently available

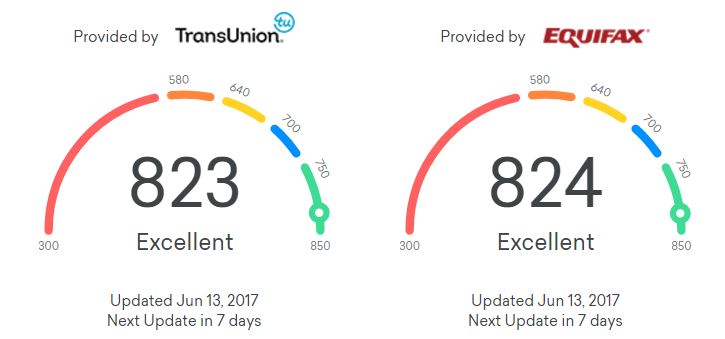

A single retiree named Ben recently asked me for advice. Has has read about the advantages of signing up for credit cards for signup bonuses and wants to get started. He seems to really understand the game — he just hasn’t played it yet. He owns rental property, but primarily lives off his pension and savings. The last time he signed up for a credit card was more than 2 years ago. He can spend $5,000 per month on credit cards through regular use and by using a service like Plastiq to pay his bills. His Experian credit score is 789 and his TransUnion and Equifax scores (provided by Credit Karma) are over 820. He always pays his credit card bills in full and on time.

My reaction? This is nearly the perfect storm of awesome opportunities! Thanks to his rental property, he can apply for business cards as well as personal cards. And $5K spend per month should be more than enough to meet minimum spend requirements.

Hoarding and Cherry Picking

I usually recommend cards based on a person’s goals. Those who want to use points to stay in B&B’s will do best with pay with points cards. Those who want to fly international first class will do best with airline miles. In this case, he wants to keep his options open and likes the idea of hoarding points and cherry picking awards. To me that means focusing first on transferable points like Amex Membership Rewards, Chase Ultimate Rewards, Citi ThankYou Rewards, and SPG (Starwood Preferred Guest).

Starting with Chase

When someone starts completely fresh like this, I think it is essential to start with Chase cards that fall under the 5/24 Rule (where they will not approve your application if you’ve opened 5 or more accounts in the past 24 months).

Since Ben has opened zero accounts in the past 24 months, he can open up to 5 Chase cards that fall under the 5/24 Rule before getting locked out. The cards that currently offer signup bonuses and earn Ultimate Rewards points are:

- Chase Ink Business Preferred — 80K after $5K spend in 3 months

- Chase Sapphire Preferred — 55K: 50K after $4K spend in 3 months + 5K for adding authorized user

- Chase Sapphire Reserve — 50K after $4K spend in 3 months

- Chase Ink Cash — 30K after $3K spend in 3 months

- Chase Freedom Unlimited — 17.5K: 15K after $500 spend in 3 months + 2.5K for adding authorized user

- Chase Freedom — 17.5K: 15K after $500 spend in 3 months + 2.5K for adding authorized user

I think that the first four cards in the list above are great choices. They have excellent signup bonuses ranging from 30K to 80K. The Freedom cards are both worthwhile too, but their signup bonuses aren’t great. He may be better off getting a different fifth card and later downgrading the Sapphire Preferred to the Freedom Unlimited in order to get 1.5X everywhere from the Freedom Unlimited card..

Note that two of the top 4 cards in the above list are business cards. We’ve received mixed information from readers about whether or not Chase business cards contribute to the 5/24 count. They don’t show up on credit reports (which Chase uses to count a person’s 5/24 status, at least with other banks), but Chase Business cards obviously can be counted by Chase. If he’s willing, Ben can attempt to sign up for a Chase card as his sixth card in order to find out definitively whether or not Chase business cards count towards 5/24. If the sixth card is approved, then we’ll know that the Chase business cards he signed up for did not count towards 5/24.

For his fifth card, he can pick from one of these other Chase cards that fall under 5/24:

- Southwest: All 3 varieties currently offer 60K points after $2K or $3K spend. 50K offers are more common.

- United MileagePlus personal or business: 50K after $3K spend

- Marriott personal: 80K after $3K spend

Ben is not particularly interested in flying Southwest, so the United offer would be his best bet. Hopefully he will be targeted for an even better 75K offer once he’s ready to apply for this card. If not, he can make the United business card his fifth card instead. That way, if it turns out that business cards do not contribute to his 5/24 status, he’ll still be able to get the United MileagePlus personal card later. This will give him extra time to find a good targeted offer.

The Chase Plan

To keep things simple, I suggest that he sign up for one card at a time: Sign up for a card, meet spend requirements, apply for the next card about a month later, and repeat.

There could be a small benefit to signing up for two cards on the same day in order to limit the number of inquiries on his account, but same-day Chase inquiries do not always get combined into one.

So, here’s the plan:

Month 1: Chase Ink Business Preferred; 80K after $5K spend in 3 months; $95 annual fee

Ben should sign up first for the Chase Ink Business Preferred (click for details). He doesn’t have a business name or EIN for his rental property business, but he should be able to use his own name as the business name and his SSN as the business Tax ID.

Given that he can spend $5K per month, he can knock out this card’s spend requirement in one month. He may want to cancel this card (or downgrade to a no fee card) after a year when the next annual fee comes due unless he finds that he makes good use of the card’s 3X categories (details here).

Month 2: Chase Sapphire Preferred; 55K after $4K spend in 3 months + add an authorized user; $95 annual fee waived the first year

Next, Ben will sign up for the Sapphire Preferred (click for details) and add an authorized user in order to get the extra 5,000 points. He should make sure to add someone who doesn’t plan to sign up for Chase cards in the next two years so that the authorized user card won’t count against their 5/24 status.

Once he signs up for the next card (the Sapphire Reserve card), this one won’t do him much good anymore (since the Sapphire Reserve is a better card in many ways). He can then downgrade (in multiple steps) to the no fee Freedom Unlimited.

Month 3: Chase Sapphire Reserve 50K after $4K spend in 3 months; $300 in annual travel credits; $450 annual fee

Ben’s third card will be the Sapphire Reserve (click for details). Once the card arrives he should follow these steps to get the most value from it: Your Sapphire Reserve Card arrived. Here’s what to do next…

Ben should also make sure to spend at least $300 on the card on travel in the first year, in order to get full value from the card’s $300 in travel credits.

After a year, Ben can evaluate how much he spent on the card on travel and dining. With the right spending patterns, the card’s 3X rewards for travel and dining and $300 in annual travel credits can more than make up for the $450 annual fee. If he finds that he spent at least $300 on travel, and at least $15,000 on travel & dining combined, then keeping the card is a no-brainer (assuming similar use going forward). If he finds that he spent substantially less on these 3X categories, then he may want to cancel or downgrade the card after a year in order to avoid the second year annual fee. He should always make sure to have a premium card, though, so that he can preserve the ability to transfer points to airline and hotel programs. See: Ultimate Rewards Questions Answered.

Month 4: Chase Ink Cash; 30K after $3K spend in 3 months; No annual fee

The fourth card I recommend is the no-fee Chase Ink Cash (click for details). Since this card offers 5X Ultimate Rewards points for office supply purchases, phone, TV, and internet, it’s a great card to keep long term. Ben should make sure to setup his phone, cable, and internet accounts (Netflix too) to charge to this card so that he’ll automatically earn 5X points for each of these monthly expenses.

Months 1 through 4 totals

If all goes to plan, Ben will have earned 215,000 Ultimate Rewards points from signup bonuses after four months. That doesn’t even count the additional points he’ll have earned from spend. He can move those points into his Sapphire Reserve account so that they are worth 1.5 cents each towards travel. More than 215,000 points at 1.5 cents each, results in well over $3,000 worth of travel.

Next Steps

Four months out is as far as I’m willing to spell out the plan at this point since things tend to change rapidly. I’d like to touch base with Ben after he gets the Ink Cash and then re-evaluate the plan based on current card signup bonuses, new application rules (if any), any changes to his situation, etc.

In the unlikely event that things were to remain exactly as they are today, I may recommend that he next sign up for:

5. United MileagePlus Business Card: 50K

and (to test whether or not business cards count):

6. United MileagePlus consumer card: 50K

and (depending upon whether or not business cards count)

7. Marriott Premier Rewards: 80K

and (depending upon whether or not business cards count)

8. Freedom 17.5K

If all goes well, the above plan may definitively answer whether Chase business cards count towards 5/24. If he is rejected for card #6 due to 5/24, then we’ll know for certain that Chase business cards are counted. If he gets approved for card #6, then at least one of his 3 business cards wasn’t counted. If he goes further and gets approved for card #7, then we’ll know that at least two of his 3 business cards weren’t counted. And then if he’s approved for card #8, we’ll know that none of the business cards were counted.

What can go wrong?

There are many issues that Ben needs to watch out for. Here are a handful:

- Ben may have overestimated how much credit card spend he can handle. If so, he can simply draw out this plan further. Spend two or three months meeting the spend requirements for each card, rather than just one.

- Plastiq may not work the way Ben had hoped. I don’t know if Ben was planning to pay his mortgage with Plastiq, but if so, he may have a problem. Plastiq recently stopped allowing Visa credit cards to be used to pay mortgages. And all of these Chase cards are Visa cards.

- Rules may change. Chase may introduce new rules that prevent Ben from getting so many cards even if he stays within 5/24.

- Ben may forget to pay his credit card bill on time. When signing up for new cards, I find that it is easy to miss the initial payments since I usually setup autopay. If I forget to setup autopay with a new card, then you can bet I’ll forget to pay the bill. Hopefully Bill will be better prepared than that. If not, most banks will waive the fees for a first offense if you just call and ask.

- Offers may drop before Ben signs up for a planned card. If that happens we may need to re-adjust the plan.

Won’t Ben’s credit score drop?

I don’t think so. I big portion of current credit scores used by credit card companies is a person’s credit utilization ratio. As Ben signs up for more cards, he’ll be given more and more available credit. And, if his credit card spend doesn’t change much, his utilization ratio will go down. That’s a good thing. My bet is that his score will dip initially, but then go up after a few months. Hopefully Ben will share his new scores in few months so that we can see for sure.

Note that if Ben was about to seek a new mortgage or seek new car insurance, I wouldn’t recommend as many new cards. Mortgage companies and insurers are known to be more sensitive to many accounts than most credit card companies.

Stay Tuned

Ben has promised to keep me up to date as he signs up for cards. I hope to post updates every couple of months. I’m especially interested to see what happens with the business card 5/24 question.

[…] time to check in again with our informed newbie Ben. Previously, we helped him form a credit card plan. Next, he successfully signed up for three cards at once. Intentionally, all three were […]

[…] time to check in again with our informed newbie named Ben. Previously, we helped him form a credit card plan. Next, he successfully signed up for three cards at once. Intentionally, all three were […]

[…] you remember our informed newbie, Ben? First, we helped him form a credit card plan. Next, he successfully signed up for three cards at once. Intentionally, all three were […]

[…] bit over a week ago I published “A credit card plan for a well informed newbie.” There I detailed a plan for this retiree to quickly rack up huge numbers of points […]

Hey Greg, I’m at 4/24 so I applied for ink business as staggered but I have 4 businesses. When I finish 5k spend on 1 biz, should I apply again for another biz to get 80k points. Will I keep getting 80k

My mistake. I meant that I am at 1/24

The answer is: probably. I’ve done exactly this successfully in the past. For example, I once signed up for two Ink Plus cards — each under a different business, and I got the signup bonus for each.

I can’t promise that this still works, but I expect that it does.

Thanks. FYI, can’t seem to find where I posted this but I applied for 2 spg business cards – 2 different businesses and got different results than you. On one card I got 35k, on the other 25k. So I still got bonuses. Strange though that when I complained about only getting 25k they said because you have a different card but didn’t (so far) claw back the 25k

That’s awesome. Glad to hear that it still works for some

>Those who want to use points to stay in B&B’s will do best with pay with points cards.

Airbnb sells GCs at supermarkets.

I’m new to this whole thing and shocked to find out that an authorized user is seen on a credit report. How is that possible if I didn’t give them my authorized user social security number?

If my husband already has maxed out his 5/24 this year, is there a reason why I wouldn’t get my 5/24 and add him as an authorized user (to get extra points) on everything? Technically then he’ll have received 10 cards this year, but does it matter?

They match up names and addresses when SSN isn’t provided. Luckily it’s very easy to get the Chase AU card removed. The authorized user can simply secure message Chase and ask for it to be removed from their credit report.

No reason not to add your husband as an AU to your cards

Question about Chase’s 5/24. Let’s say I’ve opened 5 cards in the past two years, the oldest one being opened on 6/15/2015. When should I be good to apply for a Chase card? 6/16/2017, 7/1/2017, 7/16/2017, or something entirely?

Thanks everyone. Based on your input, I’ll recommend these changes to Ben:

1. Sign up for Ink Biz Pref and Ink Cash same day in order to combine inquiries.

2. Sign up for the Delta Biz Plat card while the historic best 70K offer is still available. Amex business cards aren’t counted towards 5/24.

3. future applications: try to combine 2 Chase personal or 2 Chase business cards same day.

If he’s going to be grouping apps together like this, then it makes sense for him to wait 91 days between applications so that the impact of the hard pulls will drop down. That won’t matter in the first few application cycles, but it can become important once he has 5 or more recent inquiries.

A couple of readers suggested that he wait to apply for the CSR offer to go up above 50K. Personally, I don’t think that’s at all likely to happen anytime soon, but I don’t have a crystal ball. One approach is to delay applying for CSR until Ben is at 4/24. When he’s at 4/24 and ready to apply for another card, I’d argue that CSR should be it.

So, his apps may look like this (with multi-month gaps in-between):

1. Ink Biz Preferred + Ink Cash + Delta Plat Biz

2. Sapphire Preferred + United 70K (If available) + Any biz card w/ historic high offer that doesn’t show on credit reports

3. Sapphire Reserve (in case the Ink cards did count towards 5/24) + TBD

In general, I recommend grouping up to 2 Chase biz apps or personal card apps for the same day–so long as they can meet the spend (at $5k per month, should not be hard). That way you get the benefit of one credit hit, and can address any issues with reconsideration (e.g. moving credit between cards) all at once if not instantly approved for either card.

Thanks for the reminder. I mentioned in the post that Chase doesn’t always combine pulls, but I forgot that that’s when mixing personal and business cards.

Data point showing that Chase business cards do not count toward 5/24.

-When CSR came out, I was at 5/24 with personal cards, 6/24 counting Chase biz. Application declined.

-A few months later, I dropped to 4/24 with personal cards, 5/24 counting Chase biz. CSR application approved.

Thank you! Great to have specific data like this. Which specific biz card did you have?

I’ve received similar proof from others that the biz cards are counted, so now I’m wondering if the type of business card matters. e.g. maybe they count Ink cards, but not co-branded cards such as United.

Airline cards.Concentrate on which airlines provide the most service where you are. For example, American and Southwest have hubs in Dallas/Fort Worth. United and Delta provide little service and you have to change planes to go almost anywhere. Atlanta, clearly, is a Delta hub.

Can you now transfer UR points to travel partners using Ink cash? I heard mixed responses from chase agents…

I’ve not heard of this. You can, of course, transfer first to a premium card (CSP, CSR, Ink Plus) and then transfer to partners. I’ve not heard of a change that makes it possible to transfer from from Ink Cash directly to partners. That would be interesting.

That’s what I thought…otherwise the only diff between Ink cash and Ink plus/preferred is $95, no foreign transaction fee and some 3x categories. My AF is due on Ink plus. If UR points are transferable with Ink Cash, then I can PC to Ink cash. Looks like that’s incorrect.

The main reason to keep INK Plus and not PC to INK Cash is you have a 50k x5 office supply limit as oppose to 25k x5 limit. That’s for each individual to decide if it’s worth the $95 a year for an additional possible 125k UR points.

No, you can’t transfer directly from Ink Cash to travel partners, but you can move points first to a premium card and then transfer those points.

Yes, that’s my understanding as well. Maybe I got a poor agent. Are you guys keeping Ink plus with AF? I can’t find any promotions to offset the fee. We used to have that before.

I also have CSR, which will hit AF in August. And I have 300k in each. So deciding which one to keep/downgrade or cancel. Thoughts??

It does not make sense to apply for cards which have offers well below their historical peak (CSR 100K, UA 70K, Marriott 100K) since it’s fairly certain they will be higher at some point than they are today.

I agree with Stannis. I would stay below 5/24 and wait for an increased offer on CSR. In the meantime, I would apply for the AMEX Delta Business cards while the bonus is increased. There likely won’t be a better offer on these cards, and the business version won’t count against 5/24.

Going for the Ink Preferred, Sapphire Preferred, and Ink Cash early on is a sound strategy. Not sure why Ben isn’t interested in Southwest, but earning a companion pass would be my number one priority.

That’s a good point about the Delta Biz card. This is a great opportunity for Ben to get in on the historic best offer for that card without hurting his 5/24 standing.

This really depends on your spending patterns. If you regularly spend a lot on a card’s bonus categories, you have to consider the opportunity cost of not being able to use that card for said purchases while you wait for an increase that may or may not happen. In the case of UA, many people currently have a targeted 70K offer (plus 5K for an AU). In the case of the CSR, I expect we’ll see an increase again at some point, but I doubt it’ll be 100K — more likely would be 60-80K. If that happens within 90 days of application, Chase is usually good about matching it. If it takes more than 90 days for the bonus to increase, your opportunity cost of waiting increases — both in terms of lost opportunity for more points on category bonuses and in terms of waiting longer on other card bonus opportunities (to remain under 5/24 so you can take advantage of the increased offer). It’s smart to consider historical offers (and why we keep previous better offers in the data on our Best Offers page), but I’d disagree with a blanket statement that it doesn’t make sense to apply for a card that is below it’s historical peak. Whether or not it makes sense depends on your spending patterns and long-term goals.

I agree in theory, but I think that advice is better applied to Amex cards than to Chase.

With Chase, there’s a trade-off: should he delay going over 5/24 just in hopes of earning more points on those offers? Or should he grab what he can while under 5/24? If he delays going over 5/24, he may miss fantastic limited time offers from other banks.

I’m actually betting that we won’t see a higher CSR offer for a very long time. Obviously I could be wrong, but that’s my prediction. With UA and Marriott 70K and 100K aren’t too rare, so there’s a chance that the stars will align for him.

Yep a few months ago Plastiq and Chase would have been the perfect combination for Ben, all those choices of VISA cards with great initial bonuses and with his rental properties spend would have been easy. Now his situation isn’t as clear, that $5000 a month spend he has for rental properties I assume are mortgage payments. With the new NO VISA rule at Plastiq he could go more with AMEX and lose a little money to meet his spend requirements and make it up with the bonuses. Just not like paying 2.5% and getting 3% with the CSR. Things have really changed in the last 3 days.