For quite a few years now, I’ve been manufacturing Delta Diamond elite status through credit card spend. That has required a huge amount of spend ($250,000 per year), but the rewards have been huge too. Each year prior to the pandemic, for example, I’ve bought cheap international economy tickets and used the Global Upgrade certificates available to Diamond elites to upgrade to lie-flat Delta One. This year, though, Delta has made those certs less valuable (for details, see: Delta Downgrades Upgrades) and so I’m rethinking my elite status plans…

Earlier this week I updated my estimates regarding Delta Elite status. If elite status could be bought, how much would one reasonably pay? The result was $500 less for Delta’s top tier Diamond status than before. My new estimate came to $2,500 (vs. the old $3,000). But that’s the estimated amount worth paying to move from no status all the way to Diamond status. I’m in a situation now where Platinum status is practically automatic (more on that in a bit) and so the meaningful estimate for me is the value of moving from Platinum to Diamond. In my earlier post, I estimated that it is worth paying $1,500 to move from Platinum to Diamond. This gives me a metric by which I can compare the cost of manufacturing $250K spend (which is the amount required for Diamond status). Is the net cost to me less than $1,500? If so, I probably should keep manufacturing Diamond status. If the cost is more, I should stop.

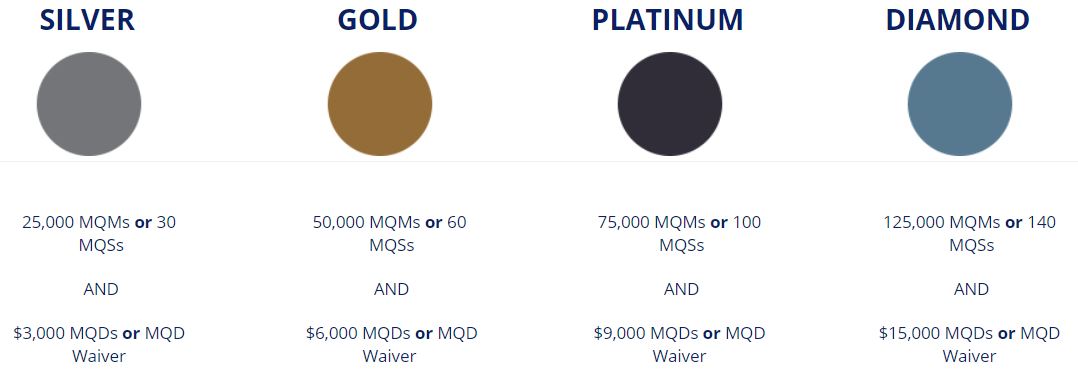

Throughout the pandemic, Delta has rolled over elite status and Medallion Qualifying Miles (MQMs) each year. But I kept manufacturing Diamond status anyway and so I have a huge number of rolled-over MQMs: over 300,000. This means that if I spend $25K on a Delta Platinum or Delta Reserve card in order to earn a Medallion Qualifying Dollar (MQD) waiver, Delta will take 75,000 of those MQMs and give me Platinum status. I could do that for four years without earning any more MQMs. In reality though, I will earn MQMs (both from the credit card spend and from flying) and so I could realistically get Platinum status each year with hardly any fuss for many years. With 300K+ banked MQMs, I don’t have much need to earn more MQMs. So while in the past I’ve highly valued earning MQMs, I don’t highly value earning more today.

In addition to having lots of MQMs rolling over, I also have lots of redeemable miles at my disposal. I have about half a million in my account, and my wife has 1.3 million. I’m mentioning that here not to brag, but to explain another reason to question whether it makes sense to manufacture Diamond elite status through spend. One of the results of spending $250,000 on Delta credit cards each year is that I earn a huge number of redeemable miles in the process. In the past I’ve valued those miles at least at 1 cent each and sometimes as high as 1.3 cents each. But with so many miles in reserve, I don’t value earning more miles as highly. Would I pay 1 cent per mile to get 250,000 more miles? No, I wouldn’t. I don’t know if we’ll ever use up the miles we already have let alone need more. So, how cheap would miles need to be for me to want more? I’d say .8 cents per mile. If you consider that miles can be used for a penny each towards airfare, then buying those miles at .8 cents each is like locking in a 20% discount (or better for times when you find good award deals).

OK, with the above rambling out of the way, we can get into the math. Let’s assume that I can very easily manufacture spend (i.e. put spend on credit cards and get the money back) at a 2% cost. With that assumption, it’s easy to calculate my net cost of earning Diamond status:

- Need $250K spend – $30K = $220K spend. Assume that I’ll put $30,000 spend on a Delta Reserve card each year just to keep Platinum status. In that case, the incremental cost to earn Diamond status is the extra spend needed to get to $250,000

- $220,000 spend at 2% cost = $4,400. This is the incremental cost of spending my way to Diamond status.

- $250K spend on the Delta Reserve Business card = 300,000 redeemable miles. The Delta Reserve Business card has this feature: After you spend $150K in a calendar year, you will earn 1.5X miles per dollar on eligible purchases for the rest of the year. So the first $150K spend will earn 150K miles and the remaining $100K spend will earn another 150K miles. There are other arguably better ways to play this that would result in more MQMs, such as spending $120K on the Delta Reserve and then downgrading to the Delta Platinum to do another $130K spend (ideally with purchases of $5K or more in order to earn 1.5x for most of that); or by spending across multiple cards (personal and business) in order to earn even more MQMs; but let’s keep this simple and assume just one card without any upgrade/downgrade shenanigans.

- I’d pay $2,400 for 300,000 redeemable miles. As discussed earlier in this post, even though Delta miles are worth at least 1 cent each, I don’t need more and so I’d have to get a good discount to want to buy them. At the purchase price of .8 cents per mile, 300K miles would cost $2,400.

- $250K spend on the Delta Reserve Business card = 60K MQMs. One could do even better by putting spend across two Delta Reserve cards or by maxing out the MQMs on the Delta Reserve, then downgrading to Platinum and maxing out the MQMs that can be earned there. But, as discussed earlier, I have tons of rolled over MQMs and so I’m not going to assign a value here toward earning more.

- My net cost for Diamond status = $2,000 ($4,400 – $2,400).

- $2,000 net cost > $1,500: Don’t do it. At the beginning of this post I wrote that I’d be willing to pay up to $1,500 for the incremental benefit of Diamond status over Platinum status. But, as you can see here, my estimated net cost is $2,000.

The numbers tell me not to do it. And so, this year, I won’t do it — at least, not for myself. My wife is already about half way through the needed spend to re-up her Diamond status and so we’ll go ahead and finish that spend for her this year. Then, next year, we’ll see how things go. The good news is that we’ll still have her Global Upgrade certificates to use. Plus, when we fly together domestically, we’ll be upgraded based on her status.

One thing I’ll be watching closely is what happens after January 31 2023. Delta probably won’t roll over everyone’s elite status again. And so, I predict that there will be far fewer top tier elites competing for complementary upgrades. Plus, if Delta lets old upgrade certificates finally expire on January 31st, there should be less competition to use those certificates. If this all turns out to be true, then the subjective value of Delta Diamond status should increase. If we find that my wife’s Diamond elite status gets us more upgrades than before, we might then reevaluate my approach. Conversely, if we find that her Diamond benefits don’t prove to be significantly more valuable than my Platinum benefits, we’ll decide whether she too should stop manufacturing Diamond status.

Stay tuned.

See also:

- How to earn Delta elite status through credit card spend

- What is Delta elite status worth?

- Delta Downgrades Upgrades (but there’s good news too)

[…] who started blogging on BoardingArea about the same time as me, has been using some little-known, crafty techniques to earn the $250,000 Medallion MQD spend waiver. I have not been willing to do this and can earn so much more by putting my monthly spending on […]

Nice article! I think the MQD waiver amount is $25k for Platinum?!? You have it in there as $30k. It’s too bad delta miles stink for international awards. I know you would cringe at the thought, but you could burn through your wife’s whole stash by booking one international round trip in D1 for the two of you!

Telling like it is. Before COVID had two booked D1 across the pond for less than one today and even pocket 100K on top of that. It’s trying how to burn my longtime DL miles and no more. Give me transferable miles period!

I have a friend who transferred ~1 million MR to delta without talking to me about it first because he “trusts” delta more than amex. We were eating dinner at the time, and I almost spit out my food.

You are right that the waiver is $25K, but I’d put $30K on the Delta Reserve because it then gives me 15K MQMs for hitting $30K spend. If I was using a Delta Platinum card I would stop at $25K

Seems like “status” hotel/airline etc.

Loyalty isn’t what it used to be, same with customer service, or egads even service.

Seems like it’s remained on the altar of COVID cost cutting……that which was hanging by a thread before COVID.

The end of an era . What crazy thing are you planning to replace this with?

Ha! Maybe I should try booking all flights into domestic first or international business class for a year and keep track of the incremental cost (in points or cash) to see how much that would cost me compared to getting status and hoping for upgrades.

That would be interesting, but even the thought experiment is telling with respect to some of the fundamental issues at hand…

The reason it is so hard to put “true” values on points and miles and “loyalty” and so on is that our demand for travel is not well bounded. To a first approximation, we can distinguish between required and discretionary travel.

With required travel, it is easier to see the value of points. To take the starkest example, if you have to go to a funeral and plane fares and hotel costs are high in dollars, but less so with miles and points, then one really may be getting high value for the miles and points since in the alternative, you would be paying cash.

From there, the distinction between required and discretionary gets squishy. I am having a hard time buying into some of the re-valuations of hotel points, because hotel prices, in dollar terms, are starting to get to places I don’t see myself going (in the figurative sense), unless I really have to go (in the literal sense).

Which brings me back to loyalty and status … a good loyalty program, at least from our consumers point of view is one that is highly non-linear — that gives a lot of desirable stuff in function of participation. From that standpoint, Hyatt is maybe the best (only?) such program these days: There is a sense in which the more you stay at Hyatt, the cheaper a lot of stuff gets, and the more willing one is to redefine trips from the discretionary to the required category. Most of the rest, from dynamic pricing in hotels to pegging airline status to spending, not miles traveled, effectively linearizes things, so there is no real incentive to travel any more than you have to (where having to can include leisure travel that you feel is “required”)

I write all of this as someone who just fell from Executive Platinum on AA to a holder of an AA-affiliated credit card. It is irking me to think of having to pay for MCE seats, and I’m not having that much fun with wine clubs and dog food, just to work my way back to Gold status. I have no doubt, though, that the additional costs I will incur for whatever AA flights I take in the future will be far below the costs of manufacturing status. But it’s a chicken and egg thing, because one of the reasons I will have fewer costs is that I will be flying less, because in the absence of the benefits I got before AA so linearized its “rewards” program, my incentive for moving discretionary toward required has been drastically reduced, at least as concerns AA.

Nothing you haven’t said/intimated many times before — your discussion of the value of Delta Skymiles when you have a lot of them gets to some of the same issues in a different way. Just a reminder (if only to myself) that the calculations we make are more complicated than that implied by the arithmetic at hand.

Great points!

When you consider the opportunity cost of that spend, which is much higher than 2% since you could apply that spend towards many signup bonuses, the decision becomes even easier.

He’s manufacturing spend on a business card. There is no trade off between doing this and pursuing signup bonuses

You’re ridiculously wrong, but I’m not going to waste my time explaining basic economics to you.

Or, as is the case for some of us, our ability to manufacture spend is nearly unlimited, with time and issuer tolerance of credit limit cycling being the only real throttles.

So you are saying other business cards that pay say cash back which could then be invested in the business to pay employees is not worth as much as delta miles then?

Spending to Platinum for P2 this year. I have AA Plat Pro & DL Platinum. I have only missed an upgrade 1 time on DL since matching my status & I live in a hub. Not bad so far. We will see if I get the premier upgrade next week with AM. P2 has the Reserve card so she wiil trump my status – which has been great – once we meet the spend. I value MR’s but don’t see the spend here as an opportunity loss if the status yields Delta One results.

Not sure I followed it all! you spend $250,000 to get the waiver?? Is that correcto?? That is over the top a lot!

Yes, that’s correct

@Greg- Happy New Year! According to both my Delta Reserve cards POSTED transactions, I hit over $250,000 in 2022. Yet, I am still showing Platinum for 2023. I have plenty of MQM’s. Is there a delay at year end from Amex and Delta since now we can’t see the Spend Tracker for 2022? I know for sure I hit over the $250,000 and all transactions are posted by Dec 31st, 2022. Thanks!

It does take some time for the systems to sync up. If it doesn’t show as Diamond within a few weeks you should definitely call.

Hey Greg

Can you do another article on how you’re doing the manufacturing spent? It’s been awhile maybe there’s something new we can all share

I really wish I could detail it, but the technique I use was shared in strict confidence and would end quickly if it was made public.

Are you able to share what your cost is on this manufacturing technique? 1%, 2%, 2.5%? Just curious to know how much you have been willingly to pay if you indeed had to manufacture all $250,000 spend each year in the past. Thanks!

I reported it in the body of the post: 2%

Thanks. Sorry I missed it.

Greg, what about the opportunity cost of putting that spend on your Delta-specific cards versus (say) MR-earning cards?

Let’s say you put all of that spend on the Everyday Preferred Card and earned 1.5 points per dollar. Using your $220k number x 1.5 PPD = 330k points. (Instead of 300k Delta points.)

Next, while I know you don’t like portals, let’s say you have the Amex Business Platinum and can get 35 percent of your points back on airfare bookings. The effect works out to 1.54 cents per point. (Higher value per point.)

THE MATH

300k Delta points x 1.3 CCP = $3900 of airfare

330k MR points x 1.54 CCP = $5082 of airfare

AND you’ll earn Delta points on the MR redemption

you are also earning $5082 x 9 miles per dollar = 45,738 miles

45,738 miles x 1.3 CCP = $595 of airfare

NET EFFECT

$5082 + $595 – $2900 = $1777 opportunity cost

From this dollar number subtract the Platinum – Diamond differential that you forego:

1.3 CPP x 2 points per dollar x your actual cash spend on tickets = ???

GINSU KNIVES

But wait, you’ll earn MQM and MQD on the MR redemption.

WHAT ABOUT THE SERVICE DIFFERENTIAL?

In an offline conversation, you mentioned Delta’s service level to me. In spite of the numbers, is the quality of service that Diamond commands worth the effort? Is it “something one simply can’t buy?” Or, can one buy (with cash or points) Diamond-like services in the same way one can buy Five Star Services on American?

Momma never said it would be easy, huh?

My thoughts exactly on MR points vs DL. Also how about Platinum Business? I figure a ticket cost in MR points @ 1.71 cents (usually 90% of cash price sometimes more, then 35% rebate). Plus you get DL points for the flight as a cash ticket. When redemption rates are off the charts, a lot of times the airlines have decent cash prices. Great card for that.

Alternatively, what would the value be if one transfers those 330k MR points to Virgin Atlantic or Flying Blue during a transfer bonus period at (say) 1.25X? One would have about 412k points. Then do a partner redemption on Delta . . . or simply redeem them on those airlines. IF one is looking towards Europe, those points might be worth north of $8000 (depending). That’s a more substantial opportunity cost to overcome.

I love this line of thinking. I don’t really need to choose between them though. If spending a lot with a 2% fee makes sense on other cards, I can (and do) do that as well. I don’t do Amex MR at 1.5x because the rebate value is 1.5 x 1.54 = 2.31% back and so that’s a small reward (2.31% – 2% fee = 0.31%). Instead I could spend with my BOA card to earn 2.62% cash back and net 0.62% on the transaction. Better yet, when Amex has referral offers that give me +3 (or whatever) on all spend, then I do really well. Same with welcome bonuses that require high spend.

Regarding service differential: I don’t think there’s any way to buy that. With Diamond, when I have issues, the call center reps often make exceptions to whatever rule I’m hitting up against. It’s really hard to know how to quantify that and it will be sorely missed (especially since my wife hates calling)

I’d estimate that using your BofA card instead of your Amex Delta cards would yield a net incremental value of about $3800. What if you took this amount and applied it to domestic upgrades? What is the value of the certainty of having the seat versus the uncertainty of getting the seat (upgrade)? What’s your peace of mind worth? Bo say Just Do It.

How would I handle international upgrades in that scenario?

If you can use cash back to buy the business class ticket outright, you have certainty. If you are willing to chance an upgrade, upgrade with points. I haven’t priced it on Delta but on AA it’s 25k points for one cabin up (per direction). As long as there’s the equivalent of I inventory. I hope this helps.

I have a lot of biz spend so Diamond is easy to attain, but the new GUC policy makes it so much harder and more expensive to use. And can they figure out how to book these online already??!

“No one is Elite if everyone is”. Dumped Diamond three years ago. Platinum now and last two flights I couldn’t get an upgrade to Comfort+. I am Platinum Pro at American as well and I am not going to do a thing to maintain status. Airline status is of diminishing value. I am just planning on buying extra legroom economy or cheap First Class tickets and enjoy lounge access from credit cards or promotions to get foreign airline status to get in lounges (Singapore and Finnair). Just a bit of an adjustment to board the plane closer to the end!

To me, the value of Diamond has been so diminished by the new GUC certificate policy (a policy that was bad anyway as using GUCs wasn’t easy even if booking a10+ months out) that I’m being actively careful with flights and spend to ensure that I don’t hit Diamond, even though I could.

Yeah it means lower priority for upgrades, but based on my experience so far this year, I’ve been upgraded every time as a Platinum to Comfort+, and the incremental benefit to me in having “almost guaranteed” First for domestic flights is not worth it.

And, as I’ll be able to roll over about 50k MQMs, I value that more as it will guarantee that I can earn Platinum in 2023 with little effort flying. I say flying, as I value other card spend (e.g. Venture X 2x) significantly more than Delta card manufactured spend.

Interested in feedback on my strategy.

Makes sense to me!

A few years ago my family was going skiing in Montana over President’s weekend. Our Friday morning flight from Florida was canceled. I called the Delta Diamond line and they put all four of us on a sold out afternoon flight that day. When we arrived at the gate they were, of course, overbooked, and no one wanted to give up their seats on the Friday of a long weekend. $200, $400 and $600 were being offered, but no one bit. Finally, in desperation, they offered $1,500 and there was a mad rush to the counter. All four of us took the bump and we got in the next morning to our ski destination while pocketing $6,000 total in Visa giftcards. This may just be a lucky anomaly for us that others will have a low chance of replicating, but do you think we would have been put on that sold out flight if I was Platinum instead of Diamond? If not, then there is probably some sort of intangible benefit for being Diamond.

I have no idea what would have happened if you were Platinum, but yes there’s no doubt in my mind that they often treat Diamond members exceptionally well, especially when there are problematic situations. It is tough to give up those intangible and unpredictable benefits!

Delta phone reps have been saying an unannounced policy change on April 14 prohibits the use of global upgrade certificates on Air France/KLM.

Interesting. I can’t understand why they went from making the certs more valuable on Air France a couple of years ago to making them less valuable and then now (apparently) not useable at all. Crazy.

I redeemed on KLM 4 days ago

Shouldn’t one include the cost of the Amex Delta Reserve cards annual fee unless you feel that the companion certificate offsets the annual fee on those cards?

Yep. If the decision was tighter then I would have looked into that factor. For many I think that the combo of SkyClub access and annual companion ticket easily offset the annual fee. But for those (like me) who get SkyClub access also from a Platinum card, not so much.